Wisconsin Form Corp-es

Description

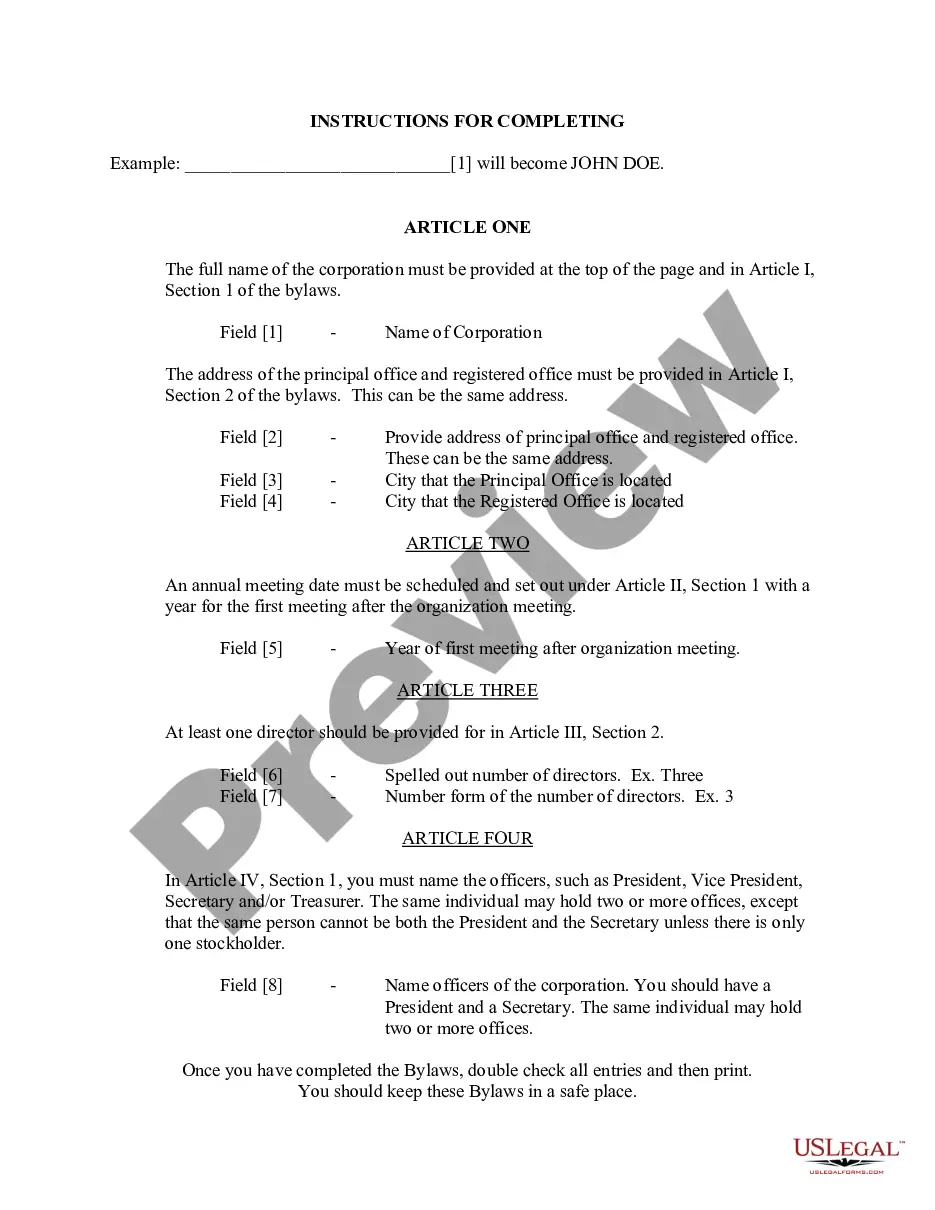

How to fill out Wisconsin Bylaws For Corporation?

Legal papers management can be overwhelming, even for knowledgeable experts. When you are searching for a Wisconsin Form Corp-es and don’t have the time to spend searching for the appropriate and updated version, the procedures may be stressful. A robust web form catalogue might be a gamechanger for anyone who wants to handle these situations successfully. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms available anytime.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any requirements you could have, from personal to business paperwork, in one place.

- Utilize advanced resources to finish and manage your Wisconsin Form Corp-es

- Gain access to a useful resource base of articles, guides and handbooks and resources related to your situation and needs

Save time and effort searching for the paperwork you will need, and utilize US Legal Forms’ advanced search and Review tool to get Wisconsin Form Corp-es and acquire it. If you have a subscription, log in in your US Legal Forms profile, look for the form, and acquire it. Take a look at My Forms tab to find out the paperwork you previously downloaded as well as to manage your folders as you see fit.

Should it be your first time with US Legal Forms, create an account and acquire limitless access to all advantages of the library. Listed below are the steps to take after getting the form you want:

- Validate it is the proper form by previewing it and reading through its description.

- Ensure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are all set.

- Select a monthly subscription plan.

- Find the formatting you want, and Download, complete, eSign, print out and send out your papers.

Enjoy the US Legal Forms web catalogue, supported with 25 years of expertise and stability. Change your day-to-day papers administration into a smooth and easy-to-use process today.

Form popularity

FAQ

Corporations generally pay quarterly estimated tax payments if they expect to owe $500 or more in estimated tax when they file their tax return. Find how to figure and pay estimated tax.

To form a Wisconsin S corp, you'll need to ensure your company has a Wisconsin formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

The answer is NO. Because the U.S. tax system is pay as you go, you need to pay and file on a quarterly basis by the estimated tax due date or you'll be charged a penalty.

There are several options available for making estimated payments. Payments can be made via Quick Pay or in My Tax Account. Complete and print the interactive Form 1-ES Voucher. Call the department at (608) 266-2486 to request vouchers.

Pay your estimated taxes online for free through the IRS EFTPS: The Electronic Federal Tax Payment System webpage, or arrange for payment through a financial institution, payroll service, or other trusted third party.