Satisfaction, Release or Cancellation of Deed of Trust by Corporation

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

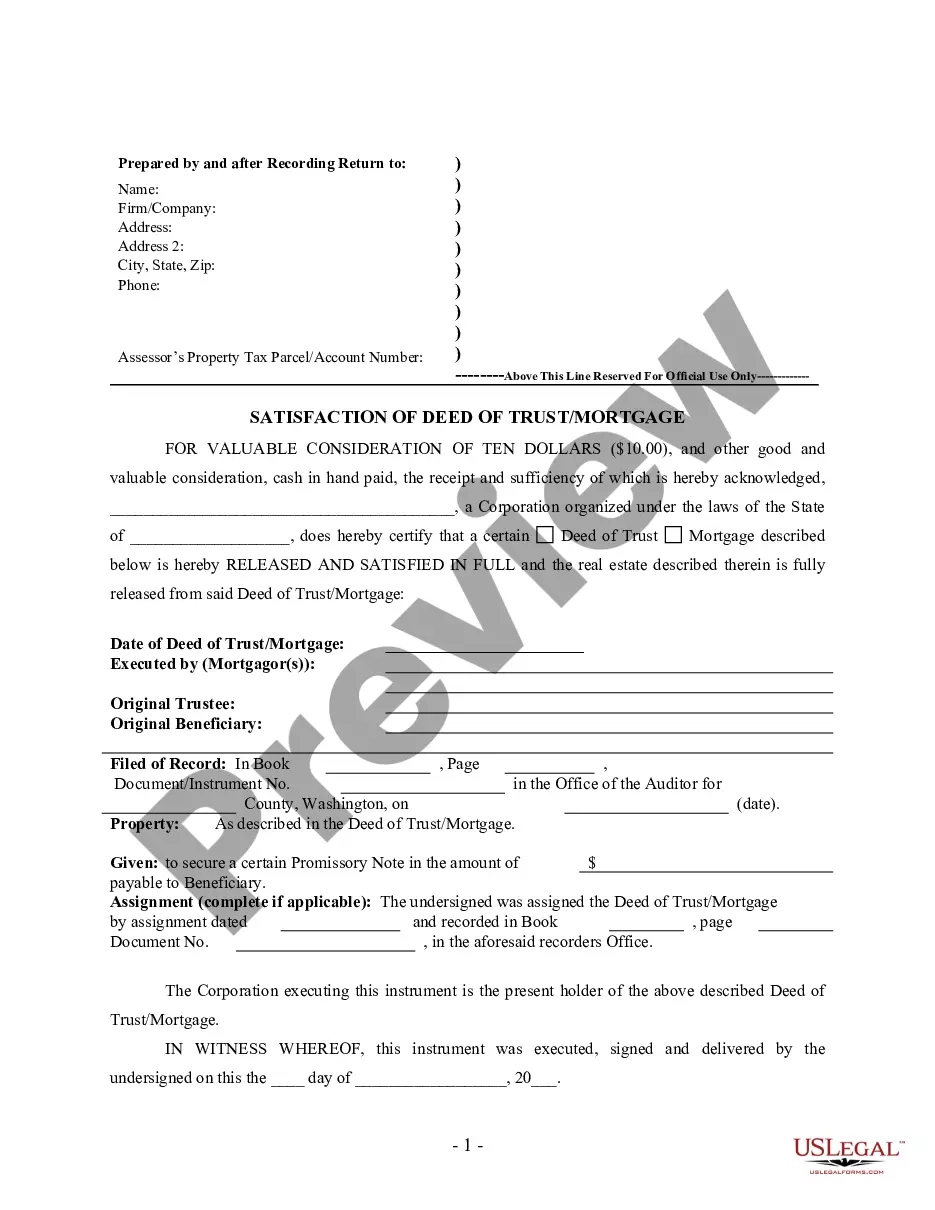

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Washington Law

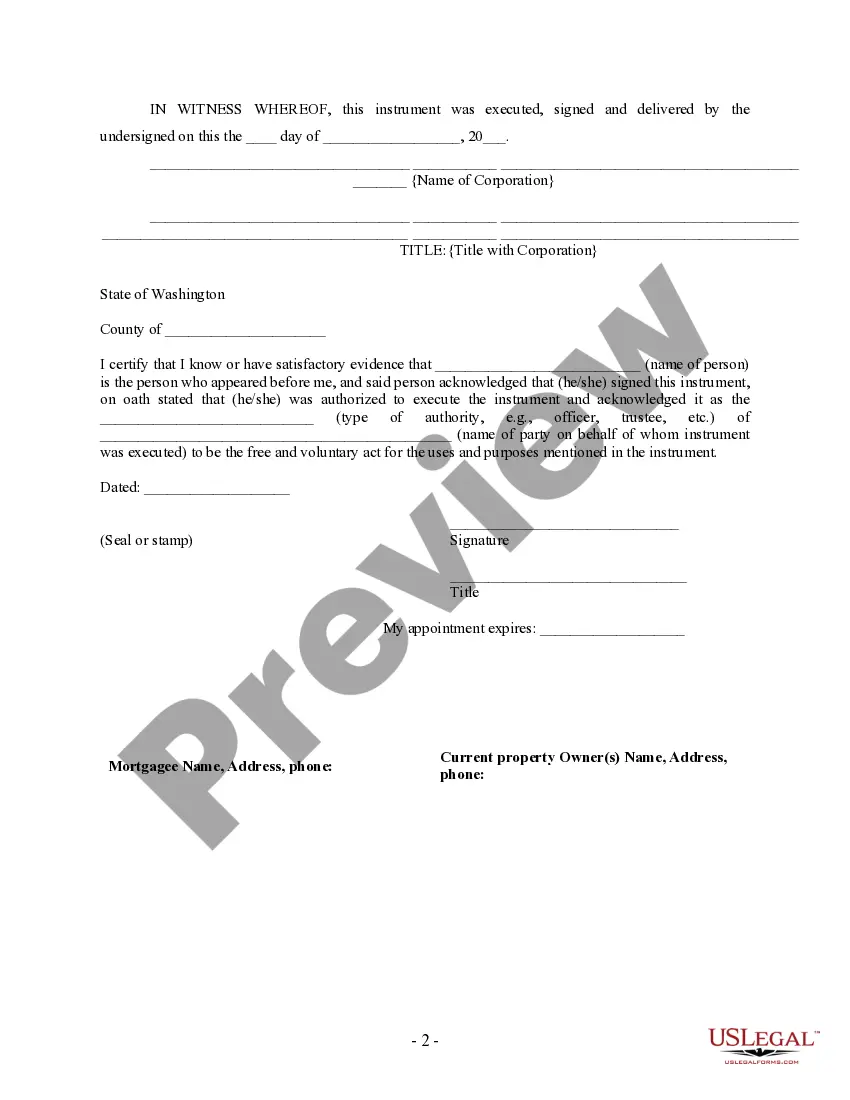

Execution of Assignment or Satisfaction: Whenever the amount due on any mortgage is paid, the mortgagee or the mortgagee's legal representatives or assigns shall, at the request of any person interested in the property mortgaged, execute an instrument in writing referring to the mortgage by the volume and page of the record or otherwise sufficiently describing it and acknowledging satisfaction in full thereof. Said instrument shall be duly acknowledged. An Assignment must be executed by the mortgage holder.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Whenever the amount due on any mortgage is paid, the mortgagee shall, within sixty days of receipt of the request of any person interested in the property mortgaged, execute an instrument referring to the mortgage by the volume and page of the record and acknowledging satisfaction in full thereof.

Recording Satisfaction: An instrument acknowledging satisfaction shall be, upon request, recorded in the county wherein the property is situated. ... Trustee shall record the reconveyance of the property to the person entitled thereto upon receipt of the written request.

Penalty: If the mortgagee fails to acknowledge satisfaction of the mortgage sixty days from the date of such request or demand, the mortgagee shall forfeit and pay to the mortgagor damages and a reasonable attorneys' fee.

Acknowledgment: An assignment or satisfaction must contain a proper Washington acknowledgment, or other acknowledgment approved by Statute.

Washington Statutes

RCW 61.24.020 - Deeds subject to all mortgage laws--Foreclosure--Recording and indexing--Trustee and beneficiary, separate entities, exception.

Except as provided in this chapter, a deed of trust is subject to all laws relating to mortgages on real property. A deed conveying real property to a trustee in trust to secure the performance of an obligation of the grantor or another to the beneficiary may be foreclosed by trustee's sale. The county auditor shall record the deed as a mortgage and shall index the name of the grantor as mortgagor and the names of the trustee and beneficiary as mortgagee. No person, corporation or association may be both trustee and beneficiary under the same deed of trust: PROVIDED, That any agency of the United States government may be both trustee and beneficiary under the same deed of trust. A deed of trust conveying real property that is used principally for agricultural purposes may be foreclosed as a mortgage. Pursuant to *RCW 62A.9-501(4), when a deed of trust encumbers both real and personal property, the trustee is authorized to sell all or any portion of the grantor's interest in that real and personal property at a trustee's sale.

RCW 61.24.110 - Reconveyance by trustee.

(1) The trustee of record shall reconvey all or any part of the property encumbered by the deed of trust to the person entitled thereto on written request of the beneficiary, or upon satisfaction of the obligation secured and written request for reconveyance made by the beneficiary or the person entitled thereto.

(2) If the beneficiary fails to request reconveyance within the sixty-day period specified under RCW 61.16.030 and has received payment as specified by the beneficiary's demand statement, a title insurance company or title insurance agent as licensed and qualified under chapter 48.29 RCW, a licensed escrow agent as defined in RCW 18.44.011, or an attorney admitted to practice law in this state, who has paid the demand in full from escrow, upon receipt of notice of the beneficiary's failure to request reconveyance, may, as agent for the person entitled to receive reconveyance, in writing, submit proof of satisfaction and request the trustee of record to reconvey the deed of trust.

(3)(a) If the trustee of record is unable or unwilling to reconvey the deed of trust within one hundred twenty days following payment to the beneficiary as prescribed in the beneficiary's demand statement, a title insurance company or title insurance agent as licensed and qualified under chapter 48.29 RCW, a licensed escrow agent as defined in RCW 18.44.011, or an attorney admitted to practice law in this state may record with each county auditor where the original deed of trust was recorded a notarized declaration of payment. The notarized declaration must: (i) Identify the deed of trust, including original grantor, beneficiary, trustee, loan number if available, and the auditor's recording number and recording date; (ii) state the amount, date, and name of the beneficiary and means of payment; (iii) include a declaration that the payment tendered was sufficient to meet the beneficiary's demand and that no written objections have been received; and (iv) be titled "declaration of payment."

(b) A copy of the recorded declaration of payment must be sent by certified mail to the last known address of the beneficiary and the trustee of record not later than two business days following the date of recording of the notarized declaration. The beneficiary or trustee of record has sixty days from the date of recording of the notarized declaration to record an objection. The objection must: (i) Include reference to the recording number of the declaration and original deed of trust, in the records where the notarized declaration was recorded; and (ii) be titled “objection to declaration of payment.” If no objection is recorded within sixty days following recording of the notarized declaration, any lien of the deed of trust against the real property encumbered must cease to exist.<br />

<br />

RCW 61.16.010 – Assignments, how made–Satisfaction by assignee.<br />

<br />

Any person to whom any real estate mortgage is given, or the assignee of any such mortgage, may, by an instrument in writing, signed and acknowledged in the manner provided by law entitling mortgages to be recorded, assign the same to the person therein named as assignee, and any person to whom any such mortgage has been so assigned, may, after the assignment has been recorded in the office of the auditor of the county wherein such mortgage is of record, acknowledge satisfaction of the mortgage, and discharge the same of record.<br />

<br />

RCW 61.16.020 – Mortgages, how satisfied of record.<br />

<br />

Whenever the amount due on any mortgage is paid, the mortgagee or the mortgagee’s legal representatives or assigns shall, at the request of any person interested in the property mortgaged, execute an instrument in writing referring to the mortgage by the volume and page of the record or otherwise sufficiently describing it and acknowledging satisfaction in full thereof. Said instrument shall be duly acknowledged, and upon request shall be recorded in the county wherein the mortgaged property is situated. Every instrument of writing heretofore recorded and purporting to be a satisfaction of mortgage, which sufficiently describes the mortgage which it purports to satisfy so that the same may be readily identified, and which has been duly acknowledged before an officer authorized by law to take acknowledgments or oaths, is hereby declared legal and valid, and a certified copy of the record thereof is hereby constituted prima facie evidence of such satisfaction.<br />

<br />

RCW 61.16.030 – Failure to acknowledge satisfaction of mortgage–Damages–Order.<br />

<br />

If the mortgagee fails to acknowledge satisfaction of the mortgage as provided in RCW 61.16.020 sixty days from the date of such request or demand, the mortgagee shall forfeit and pay to the mortgagor damages and a reasonable attorneys’ fee, to be recovered in any court having competent jurisdiction, and said court, when convinced that said mortgage has been fully satisfied, shall issue an order in writing, directing the auditor to immediately record the order.