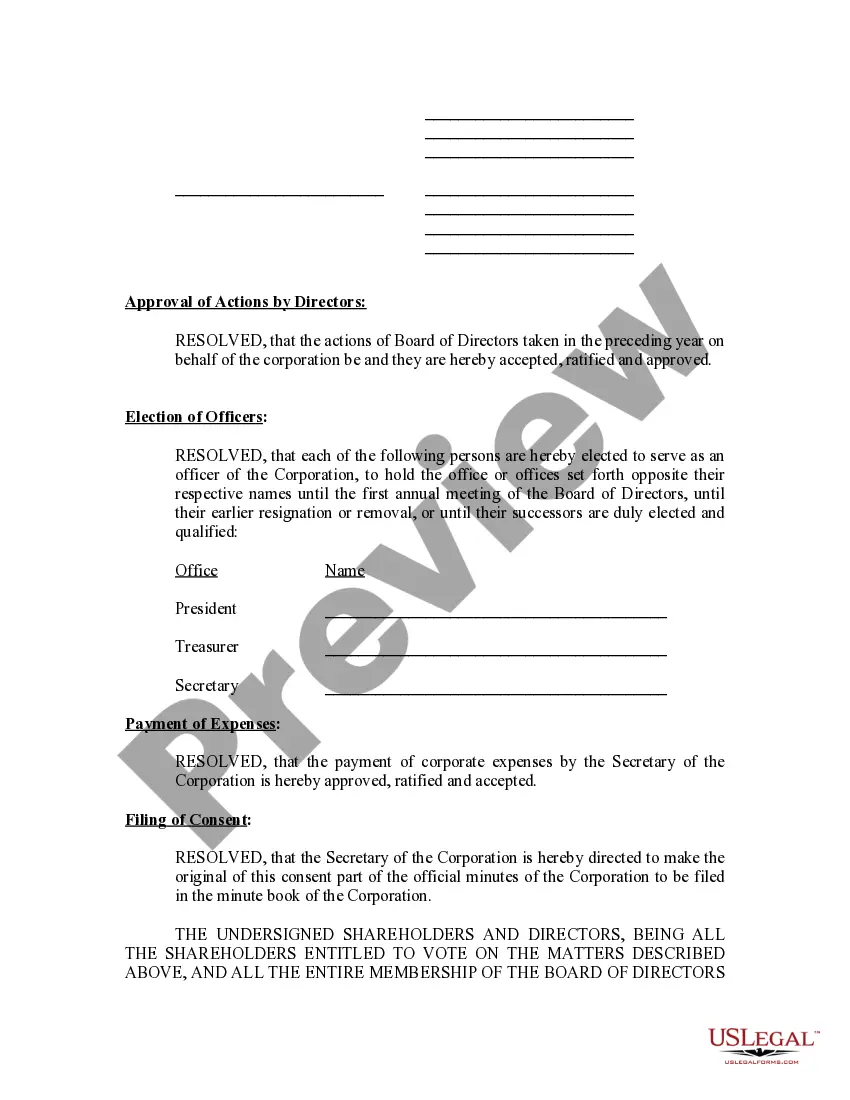

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Efile Your Annual Washington Meeting Minutes With Irs

Description

How to fill out Washington Annual Minutes?

Drafting legal documents from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of creating Efile Your Annual Washington Meeting Minutes With Irs or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your disposal.

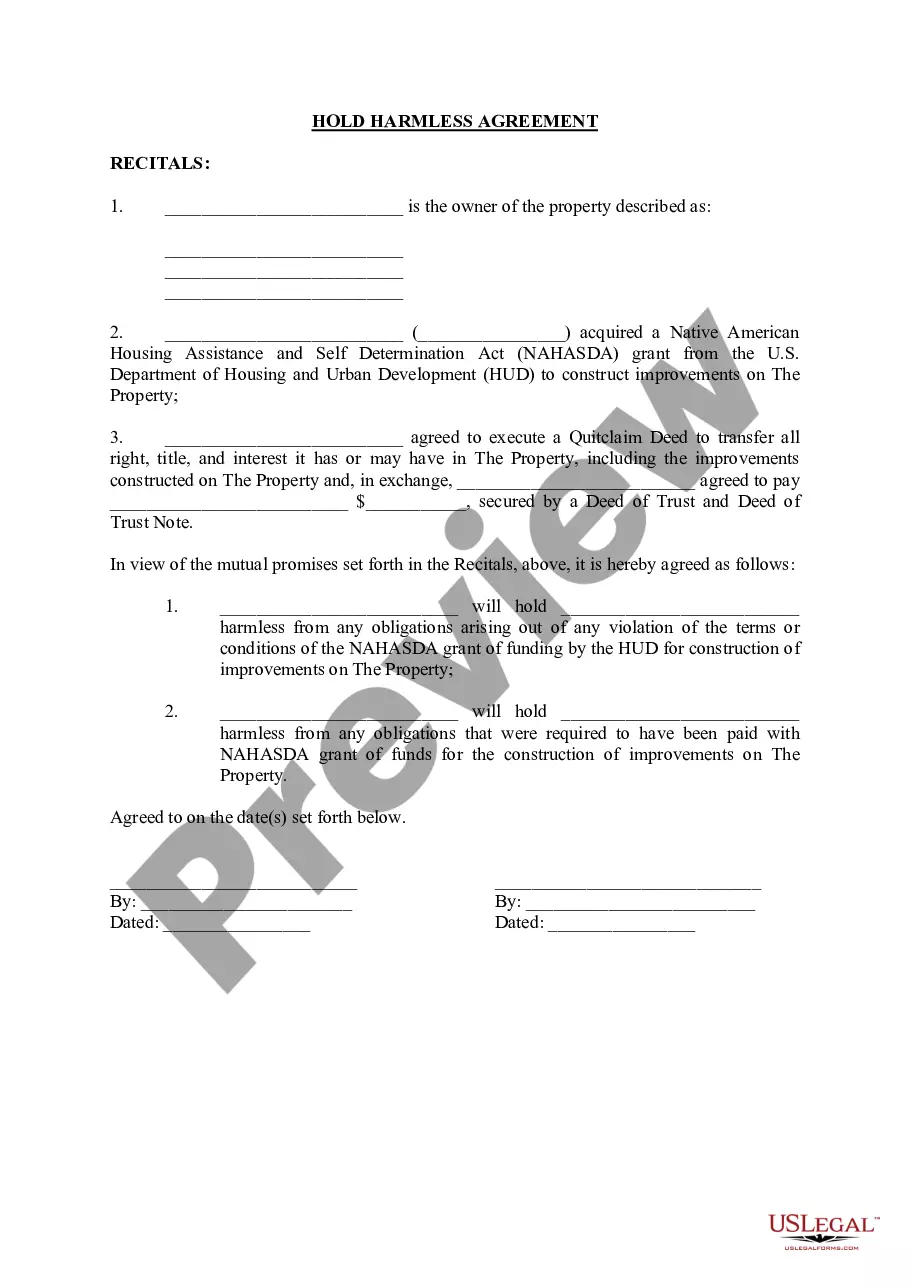

Our virtual catalog of over 85,000 up-to-date legal forms addresses virtually every element of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-compliant forms diligently put together for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can quickly locate and download the Efile Your Annual Washington Meeting Minutes With Irs. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes minutes to register it and explore the catalog. But before jumping straight to downloading Efile Your Annual Washington Meeting Minutes With Irs, follow these tips:

- Review the document preview and descriptions to make sure you have found the form you are looking for.

- Check if template you choose complies with the requirements of your state and county.

- Choose the right subscription option to buy the Efile Your Annual Washington Meeting Minutes With Irs.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and turn document execution into something simple and streamlined!

Form popularity

FAQ

How to file an amended tax return Download Form 1040-X from the IRS website. Gather the necessary documents. ... Complete Form 1040-X: Add your personal information, details of what's changed, and your explanation for the changes. ... Submit your completed amended return: You can send it by mail or e-file.

The state of Washington requires all corporations, nonprofits, LLCs, PLLCs, LPs, LLPs, and LLLPs to file a Washington Annual Report. These reports must be filed with the Washington Secretary of State, Corporations & Charities Division each year.

While you will get more time to file your return, an extension does not grant you more time to pay your taxes. To avoid possible penalties, you should estimate and pay your federal taxes by the due date. You can request an extension: Online using IRS' Free File program.

Once you find your local office, see what services are available. Or, on the IRS2Go app, under the Stay Connected tab, choose the Contact Us option and click on ?Local Offices.? Then, call 844-545-5640 to schedule an appointment. IRS offices are closed on federal holidays.

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).