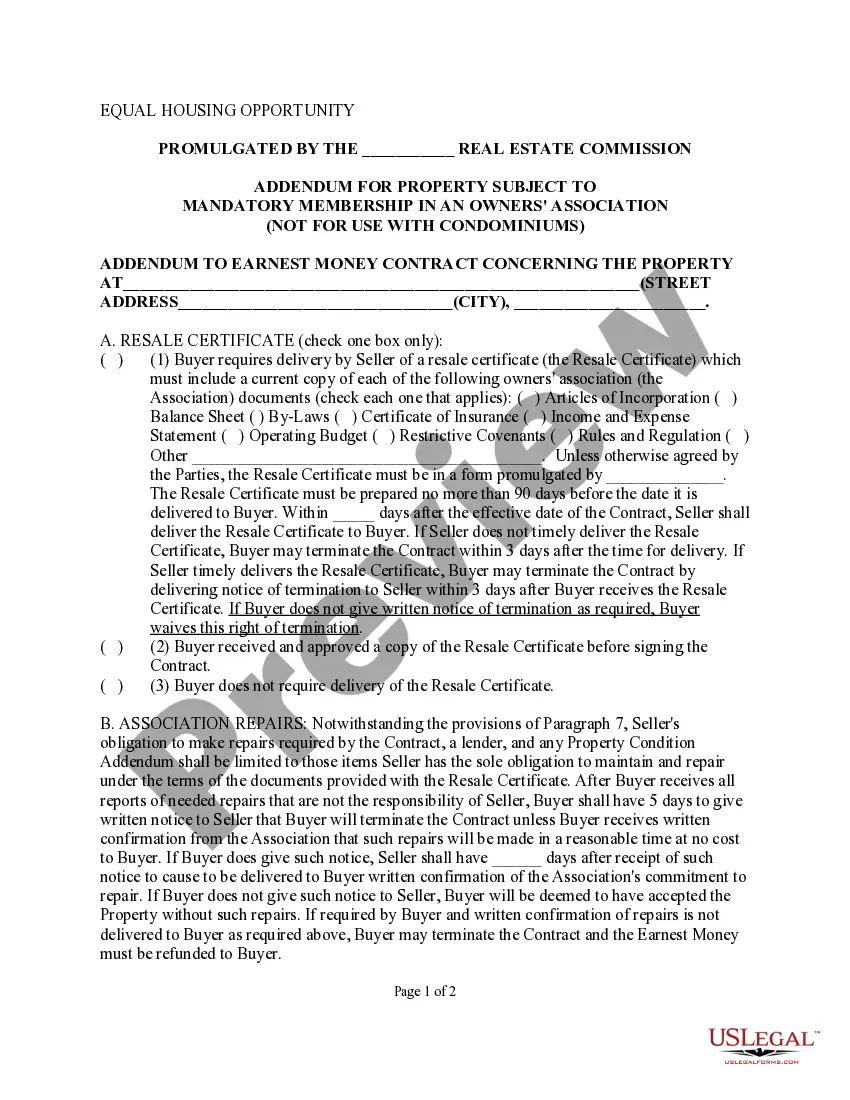

This detailed sample Resale Certificate for Property Subject to Mandatory Membership in an Owners' Associationcomplies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

Texas Resale Certificate for Property Subject to Mandatory Membership in an Owners' Association

Description

How to fill out Texas Resale Certificate For Property Subject To Mandatory Membership In An Owners' Association?

Get access to high quality Texas Resale Certificate for Property Subject to Mandatory Membership in an Owners' Association templates online with US Legal Forms. Steer clear of days of misused time looking the internet and lost money on forms that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find over 85,000 state-specific authorized and tax forms that you could save and fill out in clicks in the Forms library.

To receive the example, log in to your account and click on Download button. The document is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Verify that the Texas Resale Certificate for Property Subject to Mandatory Membership in an Owners' Association you’re looking at is suitable for your state.

- View the form using the Preview option and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to finish creating an account.

- Select a preferred format to save the document (.pdf or .docx).

You can now open the Texas Resale Certificate for Property Subject to Mandatory Membership in an Owners' Association sample and fill it out online or print it out and do it yourself. Take into account mailing the file to your legal counsel to make sure things are filled in appropriately. If you make a error, print and complete application once again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and get access to more samples.

Form popularity

FAQ

In Texas, unlike in other states, resale certificates and sales tax permits are not interchangeable.You can also generally use a Texas resale certificate if you intend to buy items and then resell them across the border in Mexico.

You can apply for a Texas seller's permit online through the Texas Online Tax Registration Application or by filling out the Texas Application for Sales and Use Tax Permit (Form AP-201) and mailing it to the comptroller's office at the address listed on the form.

Why are resale certificates required? A taxable item that is purchased for resale is exempt from sales or use tax if the seller accepts a properly completed Form 01-339, Texas Sales and Use Tax Resale Certificate (PDF), instead of collecting the sales tax due.

4. How much does it cost to apply for a sales tax permit in Texas? It's free to apply for a Texas sales tax permit. A bond may be required but only after the application is filed and reviewed.