Credit Shelter Trust Washington State With Trust

Description

How to fill out Washington Complex Will With Credit Shelter Marital Trust For Large Estates?

It’s clear that you cannot instantly become a legal expert, nor can you discover how to swiftly prepare a Credit Shelter Trust in Washington State without possessing a specialized skill set.

Drafting legal documents is a lengthy process that demands specific training and expertise. So why not entrust the preparation of the Credit Shelter Trust in Washington State to the professionals.

With US Legal Forms, one of the most extensive legal template repositories, you can find anything from court documentation to templates for internal communication.

You can regain access to your documents through the My documents tab at any time. If you’re an existing user, you can simply Log In and find and download the template from the same tab.

Regardless of the reason for your documentation—whether financial, legal, or personal—our website is equipped to assist you. Explore US Legal Forms today!

- Locate the document you require using the search bar at the top of the page.

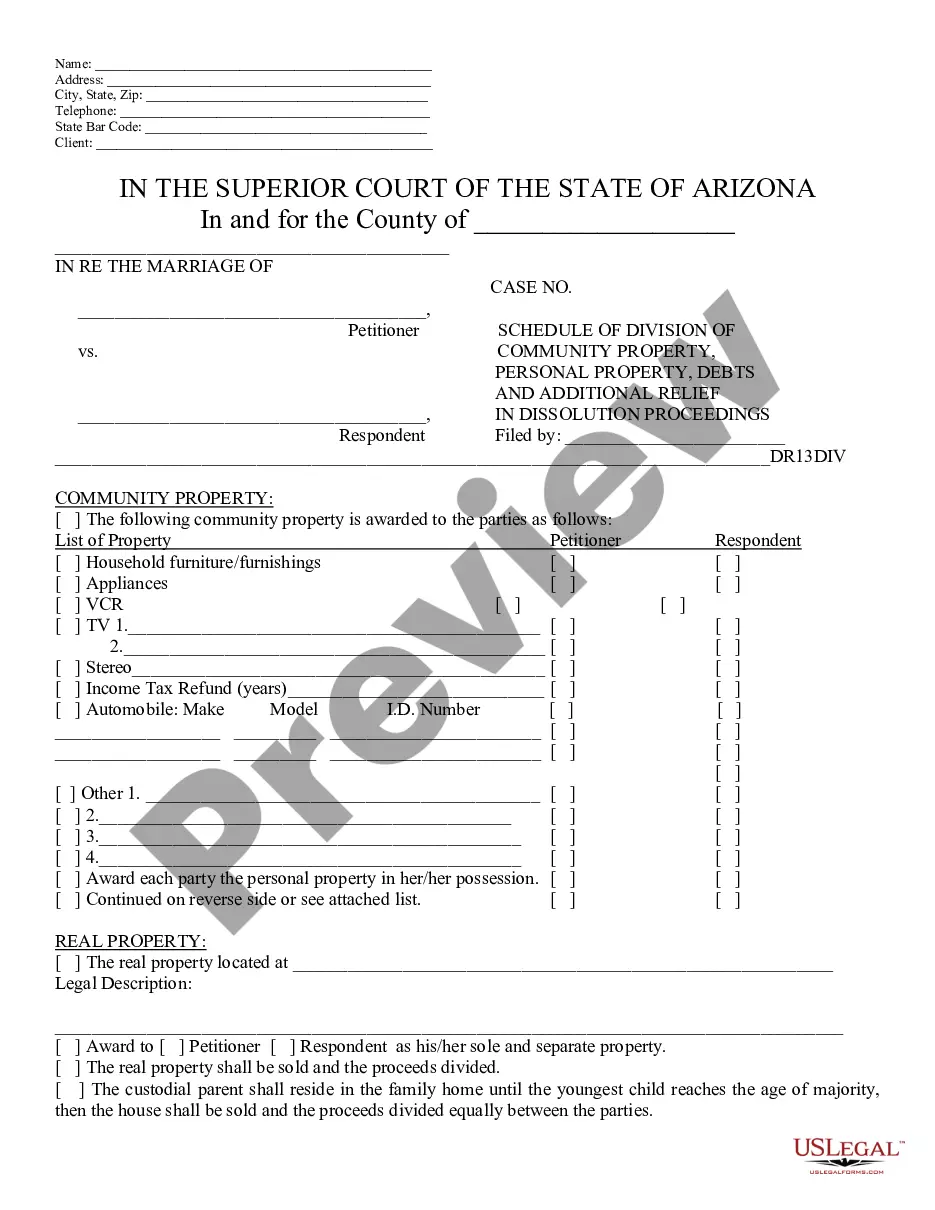

- Preview it (if this option is available) and review the accompanying description to determine if the Credit Shelter Trust in Washington State is what you seek.

- If you need a different form, start your search again.

- Create a free account and select a subscription plan to acquire the template.

- Click Buy now. Once your payment is processed, you can download the Credit Shelter Trust in Washington State, fill it out, print it, and send it to the appropriate people or organizations.

Form popularity

FAQ

A family trust is a legal arrangement where a person places assets to benefit family members. This type of trust can provide flexibility in asset distribution, protect assets from creditors, and, in some cases, lower estate taxes. In Washington State, a credit shelter trust can function as a family trust by preserving wealth across generations while minimizing tax liabilities. Establishing a family trust ensures that your loved ones receive maximum benefit from your estate.

A Credit Shelter Trust (also called a Bypass Trust) is a tax planning tool used by married couples to provide creditor protection and control in addi- tion to preserving the estate tax exemp- tion amount of the first spouse to die.

Understanding a Credit Shelter Trust (CST) CSTs are created upon a married individual's death and funded with that person's entire estate or a portion of it as outlined in the trust agreement. These assets then flow to the surviving spouse.

Credit Shelter Trust Example Spouse A passes away leaving his entire estate to Spouse B. Due to the unlimited marital exemption, Spouse B will pay zero estate tax on this transfer, and as such would not utilize any of Spouse's A's $11.5mm federal exemption or New York's $6mm exemption.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.