Credit Shelter Trust Sample Form

Description

Form popularity

FAQ

A credit shelter trust example typically includes provisions where the trust holds assets up to the exemption limit for estate taxes, benefiting surviving spouses or heirs. These trusts help in effectively managing and distributing assets while minimizing tax burdens. For a structured approach, check out a credit shelter trust sample form on uslegalforms to see real-life applications.

When naming a credit shelter trust, consider including the phrase 'Credit Shelter Trust' along with the grantor's name. This will ensure that the purpose of the trust is clear for legal and tax purposes. If you need practical examples, a credit shelter trust sample form is available on uslegalforms, which can provide valuable insights.

Naming your trust is an important step that often reflects the purpose of the trust or the names of the grantors. A common approach is to include the words 'Trust' and the grantor's last name for clarity. Using a credit shelter trust sample form can offer you templates and ideas for naming your trust effectively.

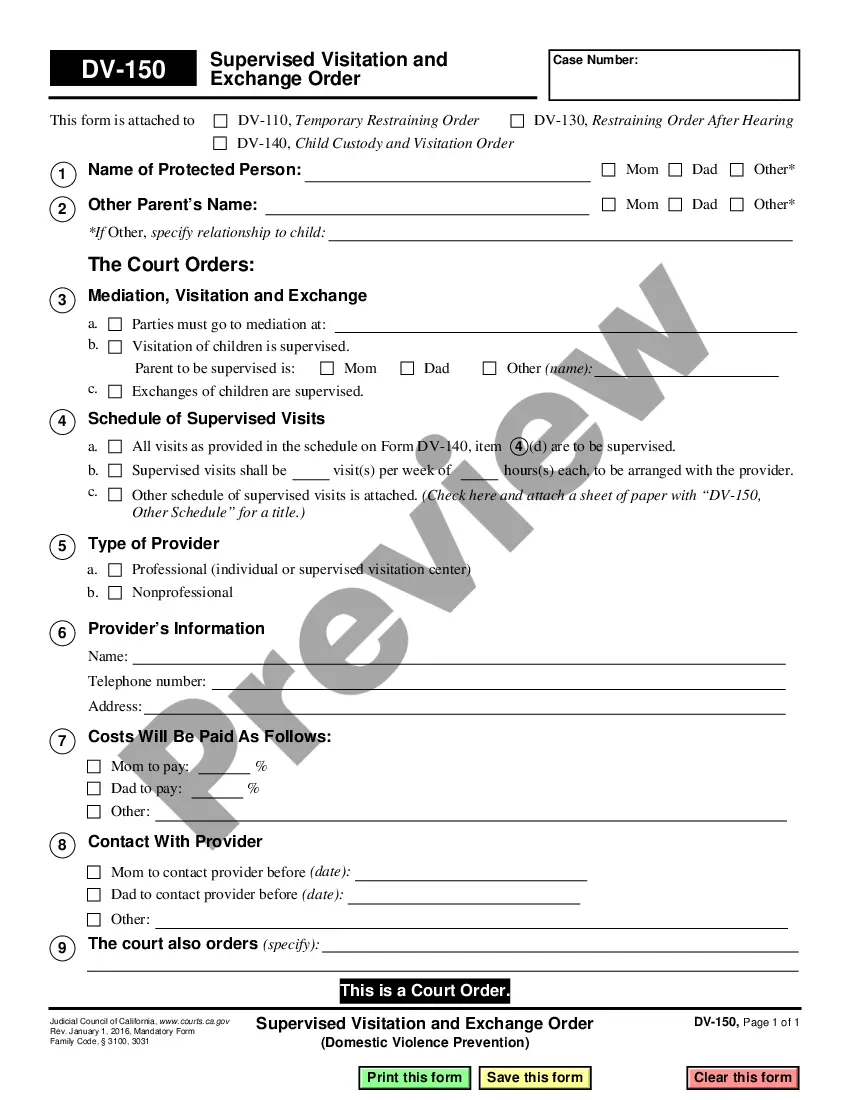

To set up a credit shelter trust, you begin by drafting a trust document with specific instructions regarding the trust's assets and beneficiaries. It's vital to work with an estate planning attorney to ensure all legal requirements are met. You can also access a credit shelter trust sample form through uslegalforms to help guide you in this process.

A credit shelter trust is often referred to as a bypass trust or an A-B trust. This type of trust allows individuals to sidestep estate taxes by sheltering assets from the taxable estate. If you're looking for a reliable credit shelter trust sample form, you can find it easily on platforms like uslegalforms.

While credit shelter trusts offer tax benefits, they come with some disadvantages worth considering. These trusts can complicate your estate plan, requiring more time and effort for administration. Additionally, they often involve initial setup costs and ongoing management fees. Utilizing a credit shelter trust sample form can streamline the process, but understanding these drawbacks is crucial for making an informed decision.

Yes, credit shelter trusts remain relevant in estate planning, especially for married couples who want to minimize estate taxes. They allow one spouse to shelter assets up to the exemption limit while ensuring the surviving spouse retains access to those assets. Using a credit shelter trust sample form can simplify the setup process and help families protect their wealth. It's essential to evaluate your specific situation to determine if this strategy is right for you.

To create a credit shelter trust, you should start by consulting with an estate planning attorney who understands your unique financial situation. You will need a credit shelter trust sample form to guide the creation of the trust document. This form typically outlines the necessary details, such as the names of beneficiaries and trustees. Once the trust is drafted, it must be signed and funded appropriately to be effective.