Lease Property Form For Rent

Description

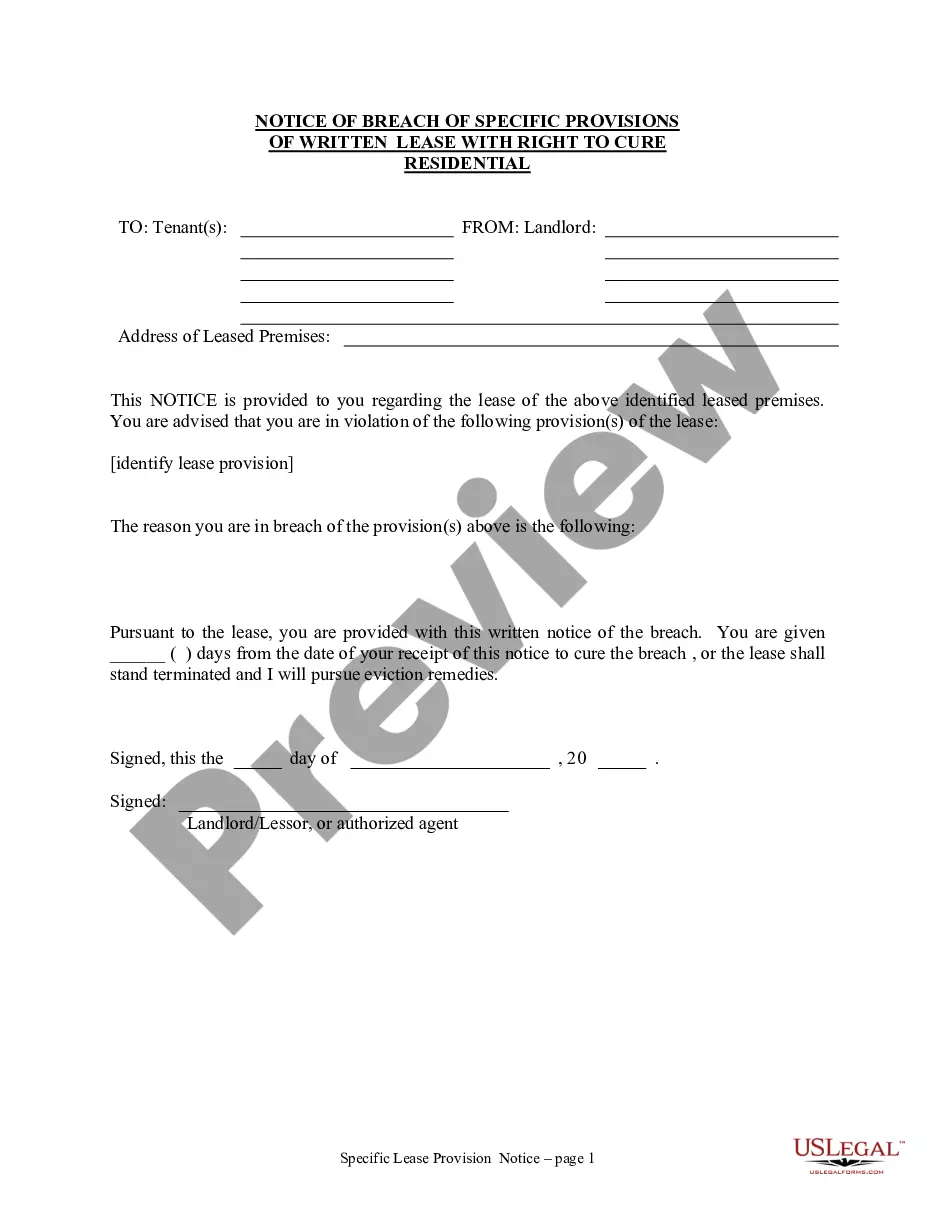

How to fill out Washington Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With Right To Cure For Nonresidential Property From Landlord To Tenant?

- Log into your US Legal Forms account to access your document library if you're a returning user.

- Before downloading, preview the document and read its description to confirm it aligns with your needs and legal requirements.

- If adjustments are necessary, utilize the Search tab to locate other templates that may better suit your requirements.

- Select your document by clicking the 'Buy Now' button and choose a subscription plan that fits your needs.

- Complete the purchase by entering your payment information, either through credit card or PayPal.

- Download your lease property form for rent to your device and access it anytime through the 'My Forms' section.

In conclusion, US Legal Forms enables you to efficiently create and manage your legal documents with a vast array of easily accessible templates. Whether you're a new user or returning, navigating the site is user-friendly.

Don’t wait! Visit US Legal Forms today to get your lease property form for rent and ensure a smooth renting experience.

Form popularity

FAQ

Claiming rent as a deduction on taxes is not straightforward, as it generally does not qualify for standard tax breaks. However, certain circumstances and state programs may allow for partial deductions or credits. Research your state’s specific rules or consult a tax expert to understand what options exist. Keeping your lease property form for rent handy will strengthen your case when seeking any available tax benefits.

Renters typically do not receive a tax return merely for paying rent. However, many may receive a return if they qualify for specific deductions or credits related to housing. It's beneficial to keep track of all relevant rental information, including your lease property form for rent. This documentation can clarify any potential tax-related benefits you might qualify for.

Generally, rent is not a deductible expense on state tax returns. However, some renters may qualify for specified benefits that can alleviate rental costs. It’s wise to consult your state tax guidelines or a tax professional for tailored advice. Remember to maintain your lease property form for rent as proof of your rental payments and to support any claims.

In Pennsylvania, you can claim various deductions, including certain business expenses and property taxes. Renters should check if they qualify for the Property Tax/Rent Rebate Program, which can provide financial relief for those paying rent. Always ensure you have a solid lease property form for rent to support your claims. This form serves as valuable documentation when navigating your state taxes.

In many states, you cannot directly claim your rent when filing state taxes. However, some locations offer tax credits or deductions for a portion of your rent. Understanding your state’s regulations is crucial, as different laws apply. A lease property form for rent can help establish your eligibility for any potential benefits.

When signing a lease, you typically need to provide personal identification, proof of income, and sometimes references. It’s essential to have a lease property form for rent that outlines the terms of the agreement clearly. Make sure to read the lease carefully and ask questions about anything unclear. This way, you ensure both you and your landlord have aligned expectations.

To stand out on a rental application, showcase your reliability by presenting a strong credit score and employment history. Providing references and ensuring your application is complete enhances your chances. A detailed lease property form for rent demonstrates your professionalism and commitment to the rental process.

To rent a property, you typically need to complete a rental application form. This document gathers essential information like employment history, references, and financial details. Using a lease property form for rent allows landlords to capture all necessary information efficiently.

Filling out a rental verification form involves providing accurate personal details, rental history, and contact information for previous landlords. Ensure you follow all instructions carefully to avoid delays. A good lease property form for rent can guide you through the verification process smoothly.

When examining rental applications, look for discrepancies in reported income, gaps in rental history, or lack of references. These may indicate issues that could affect your tenancy. A clear and professional lease property form for rent can lessen confusion and help identify potential problems early.