Lease Property Form For A Trust

Description

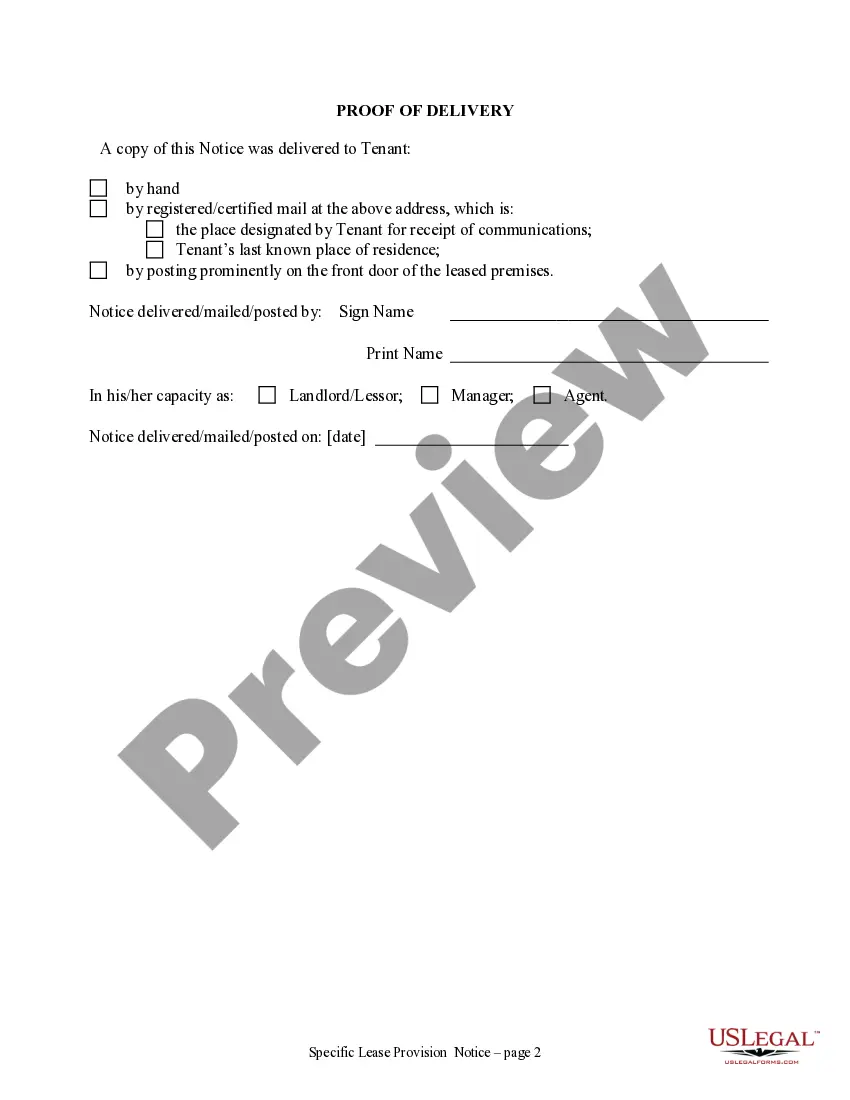

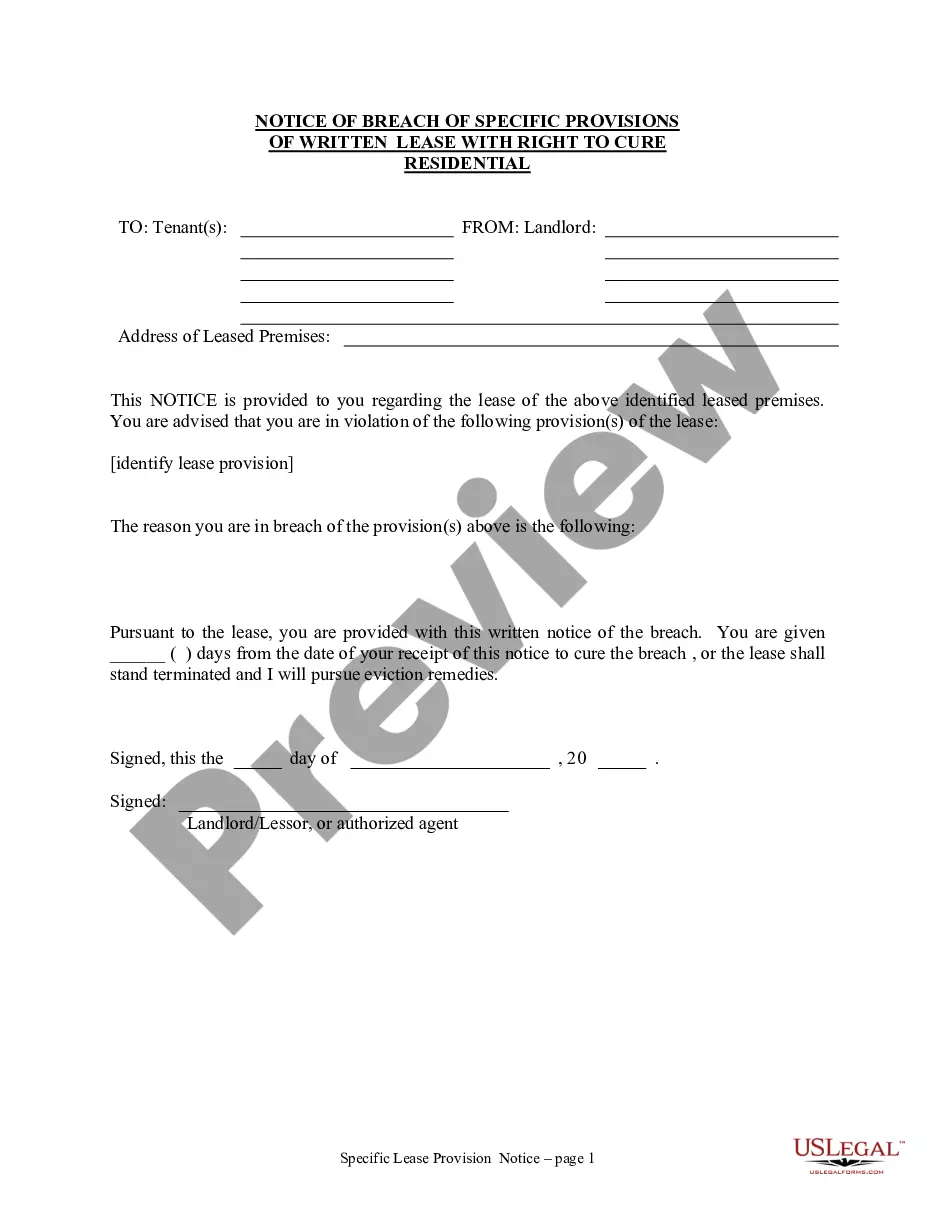

How to fill out Washington Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With Right To Cure For Nonresidential Property From Landlord To Tenant?

- If you have previously used US Legal Forms, simply log in to access your account and download the lease property form directly to your device. Ensure that your subscription is active; if not, renew it according to your payment plan.

- For first-time users, begin by exploring the Preview mode to review the form details. Confirm that the lease property form aligns with your requirements and complies with your local jurisdiction regulations.

- If necessary, utilize the Search tab to find additional templates that may better fit your situation. Once you find a suitable form, proceed to the next step.

- Select your desired document by clicking the 'Buy Now' button and choose a subscription plan that best meets your needs. Registration is required to access the vast library.

- Complete your purchase by entering your payment details via credit card or PayPal for subscription access.

- Download your form. Save it to your device for completion and find it later in the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of obtaining legal documents, such as a lease property form for a trust, by offering a user-friendly platform with vast resources and expert assistance.

Start your journey today by accessing US Legal Forms and ensure your legal documents are accurate and compliant!

Form popularity

FAQ

To manage a trust effectively, you must file specific tax forms. Typically, you will need to file IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. Additionally, if the trust generates income, you may also need to provide beneficiaries with a Schedule K-1. Utilizing a Lease property form for a trust can simplify the management of trust assets, ensuring compliance with tax obligations.

Yes, you can put rental property in a trust, which can help manage and protect your investment. This arrangement simplifies the distribution of rental income to beneficiaries according to your wishes. To set this up effectively, consider using a lease property form for a trust for proper documentation.

A common mistake is failing to fund the trust adequately, leaving it empty or underfunded. Parents should ensure that the trust accounts for all intended assets and liabilities. Utilizing a lease property form for a trust ensures that every aspect is covered, preventing oversights.

Leasing a car through a trust is possible, but it requires careful structuring. The trust must be outlined clearly in the lease agreement to ensure the car's ownership aligns with the trust’s terms. Using a lease property form for a trust helps in ensuring all elements are properly addressed.

Certain assets may not be suitable for a trust, such as retirement accounts with designated beneficiaries or life insurance policies. Additionally, some personal property may complicate trust administration. When considering your assets, remember to focus on those that align well with a lease property form for a trust.

Yes, you can put a lease in a trust. This allows the trust to manage the leasehold interest in the property. If you are considering this, make sure to use a lease property form for a trust for proper documentation and support.

To fill out a trust fund, you must provide detailed information about assets and beneficiaries. You should clearly state how you want your assets distributed, using a lease property form for a trust if applicable. Utilizing a template from online resources like US Legal Forms can simplify this process.

Putting a property in a trust may lead to higher administrative costs and taxes. Additionally, transferring property into a trust often requires legal assistance, which can add to your expenses. It’s crucial to weigh these factors against the benefits, especially if you're considering using a Lease property form for a trust.

Yes, rental income generated from a trust is generally taxable. The trust must report this income using the appropriate forms to ensure compliance with IRS regulations. Utilizing a lease property form for a trust can streamline your rental transactions and ensure all income is properly documented.

Typically, the trustee of the trust prepares the K1 form to report income distributed to beneficiaries. This process can be complex, and using the appropriate lease property form for a trust may simplify your reporting obligations. Additionally, it is wise to consult a tax professional to ensure accuracy in K1 preparation.