Trust Deed For Mortgage

Description

How to fill out Washington Deed Of Trust - Amended Long Form - With Representative Acknowledgment?

- If you have an existing account with US Legal Forms, simply log in and download the trust deed form directly. Ensure that your subscription is active; otherwise, renew it as per your payment plan.

- For first-time users, begin by exploring the Preview mode and reviewing the form descriptions. Make sure to select the appropriate trust deed template that meets your local jurisdiction requirements.

- If you cannot find the correct form, use the Search feature to locate another template that addresses your needs effectively.

- Once you've found the right document, click the Buy Now button and select your preferred subscription plan. You will need to create an account to access the full library.

- Proceed to make your payment by entering your credit card information or using your PayPal account.

- Lastly, download the trust deed template to your device, enabling you to fill it out and access it anytime through the My Forms section.

In conclusion, utilizing US Legal Forms allows you to access a vast collection of over 85,000 legal templates, including trust deeds for mortgages, ensuring you have all the necessary tools to create legally sound documents.

Explore the extensive library today and take the next step in securing your financial future!

Form popularity

FAQ

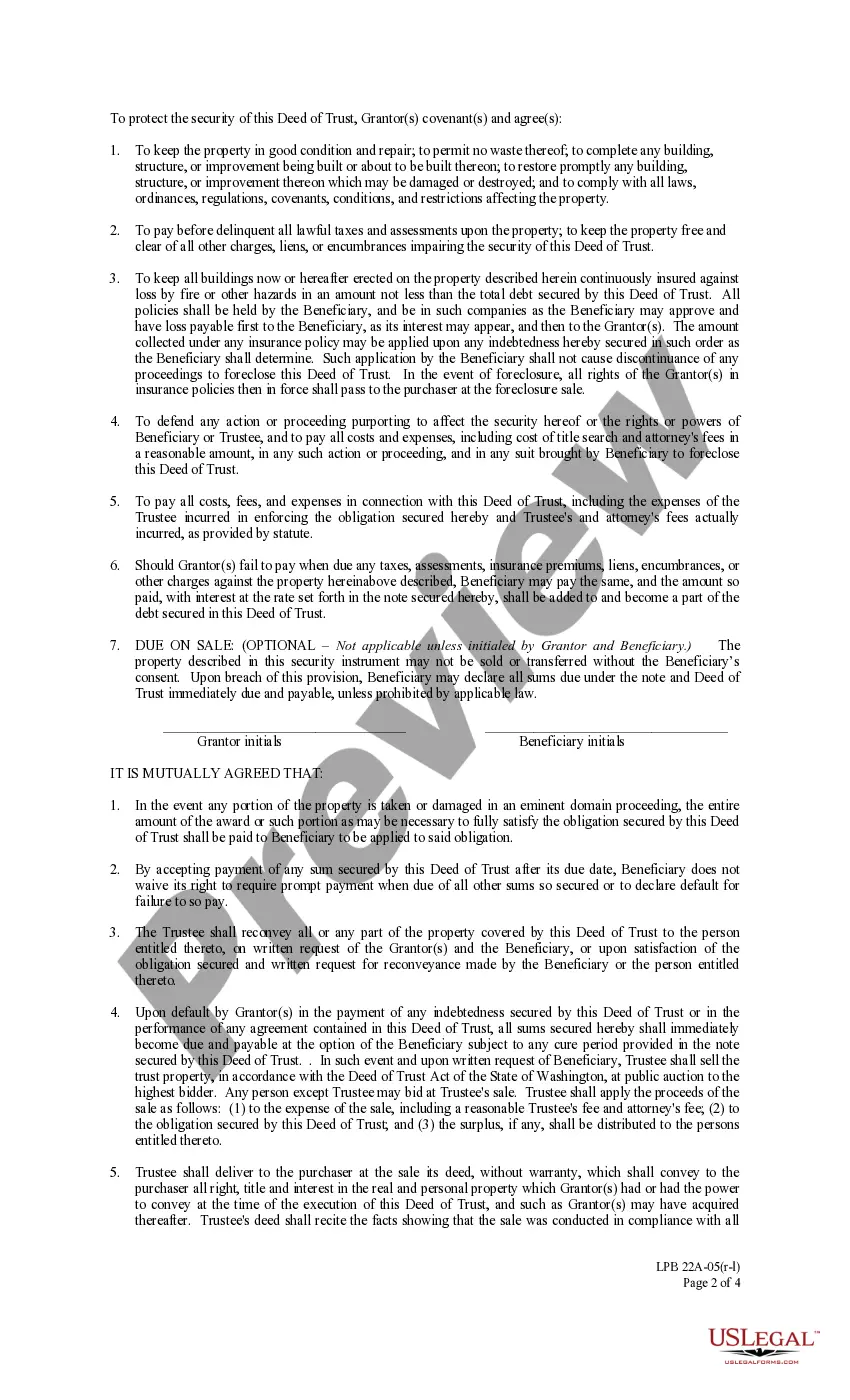

Drafting a trust deed for a mortgage requires careful planning and organization. Start by gathering relevant information about the mortgage agreement, the property, and the involved parties. Next, structure the document clearly, detailing the rights and responsibilities of each party. Using uSlegalforms can simplify this process, providing you with templates and guidance tailored to your needs.

Yes, you can write your own trust deed for a mortgage, but it requires careful attention to detail. It is important to understand the legal requirements in your state to avoid issues later on. For many, utilizing templates available on uSlegalforms can help ensure you include all necessary components without missing critical details.

Writing a trust deed for a mortgage involves several key steps. Start by defining the terms clearly, including the parties involved, the property description, and the obligations of each party. It is vital to ensure that the trust deed complies with state laws, which may vary. For assistance, consider using uSlegalforms, which provides templates and resources to streamline the process.

To obtain a trust deed, start by consulting with a qualified attorney who can draft the necessary documents. They will guide you through the process of creating a trust deed for mortgage and ensure all legal aspects are covered. Once prepared, the trust deed will require signatures from involved parties and must be filed with the appropriate county office. Following these steps will help you secure the trust deed you need.

While trust deeds offer several advantages, they also come with certain drawbacks. One significant con is that if the borrower defaults, the trustee can initiate a non-judicial foreclosure, which may occur faster than traditional foreclosure processes. Additionally, creating a trust deed for mortgage can involve legal fees and complex documentation. It’s important to weigh these factors against the benefits before making a decision.

Typically, a trust deed is drafted by an experienced attorney who specializes in estate planning or real estate law. The attorney will work closely with the property owner to outline the details of the trust deed for mortgage. This professional guidance ensures that all legal requirements are met, preventing potential issues in the future. It's essential to have proper documentation to protect everyone's interests.

One key mistake parents make when establishing a trust fund is failing to communicate their intentions clearly. By not discussing the trust's purpose and how it will be managed, parents can create confusion among heirs. This confusion can lead to disputes, especially if a trust deed for mortgage is involved in managing family property. Transparency is critical to ensuring that everyone understands the goals of the trust.

To place your house in a trust while retaining your mortgage, you'll first need to establish the trust legally. Then, you should inform your mortgage lender, as the new arrangement may require consent or additional documentation. It is crucial to ensure that the trust does not violate the terms of your mortgage agreement. Working with a platform like US Legal Forms can help streamline this transition.

A deed of trust is released once the borrower pays off the mortgage in full. The lender will provide a formal release document, which the trustee then files with the appropriate county office. This process officially frees the property from the deed of trust for mortgage. Using services like US Legal Forms can simplify the necessary paperwork involved.

One potential disadvantage of a trust deed for mortgage is the faster foreclosure process compared to traditional mortgages. If the borrower defaults, the trustee can initiate foreclosure without the need for court intervention, which may leave the borrower with little time to act. This aspect highlights the importance of understanding all terms before committing fully. Consulting with legal experts or platforms like US Legal Forms can provide clarity.