Sell Real Estate

Description

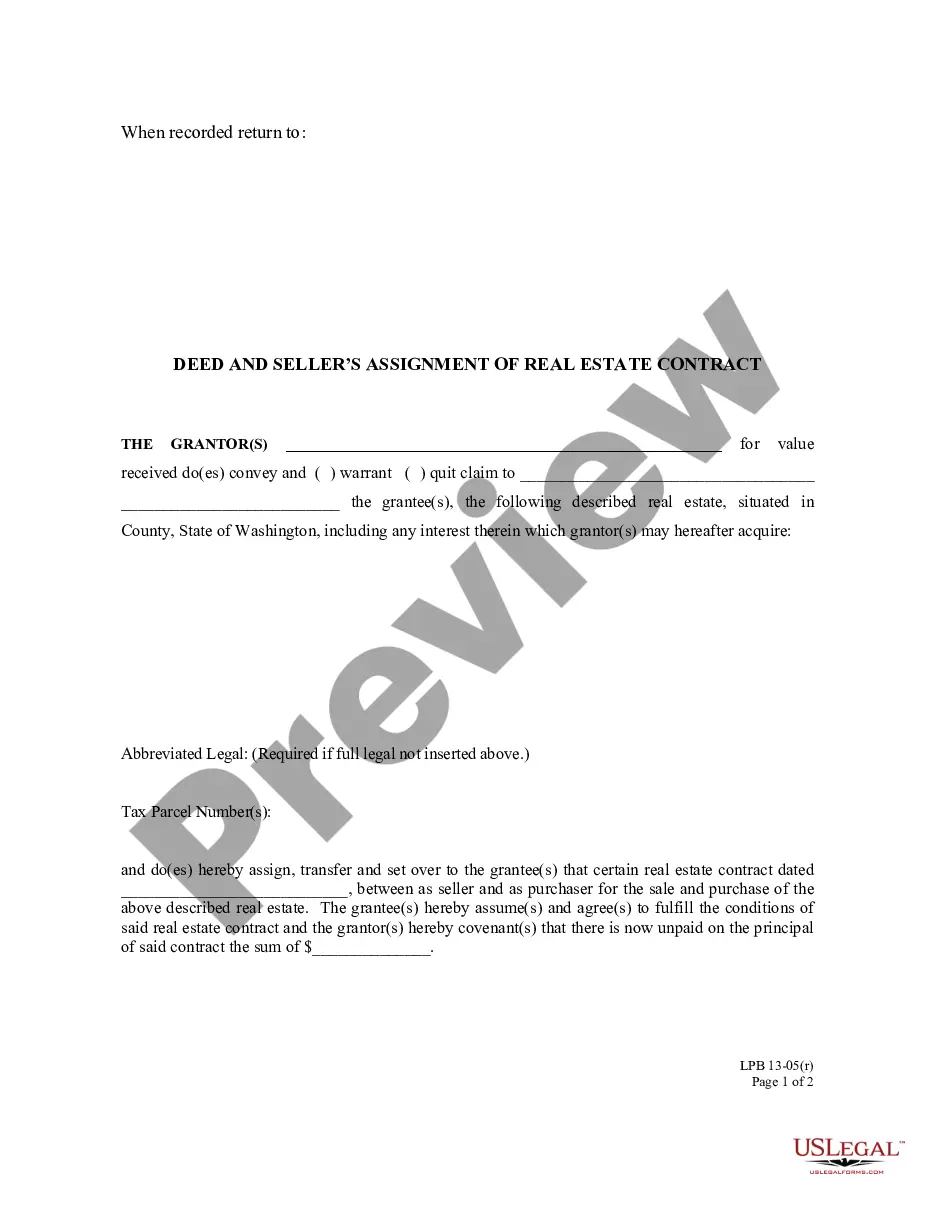

How to fill out Washington Deed And Seller's Assignment Of Real Estate Contract - With Representative Acknowledgment?

- Log in to your account if you're a returning user and confirm your subscription is active. If it’s expired, renew according to your chosen payment plan.

- Explore the Preview mode and detailed form descriptions to select the right document that caters to your specific requirements.

- If the desired form isn’t a perfect match, utilize the Search feature to find a more suitable template.

- After confirming the right form, proceed by clicking the Buy Now button and choose your preferred subscription plan. You'll need to create an account to access the complete library.

- Complete your purchase by entering your credit card information or opting for PayPal payment.

- Download the template directly to your device for easy access, and find your documents anytime in the My Forms section of your profile.

By following these steps, you can enjoy a smooth experience selling real estate. US Legal Forms not only provides a vast repository of legal documents but also gives you access to expert assistance to ensure all forms are accurately completed.

Start simplifying your real estate transactions today with US Legal Forms and unlock the potential for hassle-free sales!

Form popularity

FAQ

Getting into real estate without experience is entirely possible and requires a proactive approach. Begin by immersing yourself in learning about the industry through online resources and local seminars. Consider taking a part-time job in real estate to gain hands-on experience. Furthermore, using USLegalForms can provide you with access to the required documentation, making your transition smoother as you work toward selling real estate.

Beginners can start in real estate by first educating themselves about the market and different investment strategies. Creating a clear plan and setting goals will serve as a guiding framework. It’s wise to connect with experienced agents or mentors who can offer insights. Also, using tools from USLegalForms can help you handle the necessary paperwork effectively as you begin your venture to sell real estate.

To get involved in selling real estate, start by researching your local market and understanding its dynamics. Consider taking a real estate course to gain knowledge about the industry and necessary regulations. Networking with professionals and attending open houses can help you learn the ropes. Lastly, using platforms like USLegalForms can simplify the process by providing essential documents and resources for your journey.

While $5000 may seem limited, it can be a good starting point to sell real estate through various avenues. You can consider joining investment groups or pooling funds with other investors. Additionally, exploring properties in less expensive markets gives you a chance to stretch your budget. With strategic planning, you can find opportunities to gradually increase your investment.

When selling your house, you will likely need to complete Form 1040, Schedule D, and, perhaps, Form 8949, depending on your specific sale details. These forms help you accurately report any capital gains or losses to the IRS. For a smoother process, consider using US Legal Forms to access the right templates and the latest information related to real estate sales.

The IRS 2 out of 5 year rule allows homeowners to exclude certain capital gains from the sale of their primary residence if they satisfy the living requirement. Essentially, if you have owned and lived in your home for at least two years, you may qualify to exclude gains up to $250,000 when you sell real estate. This provision encourages homeownership and supports financial literacy in property transactions.

Filing for sale of real estate involves reporting the sale on your tax return and ensuring all documentation is accurate. You will typically fill out Form 1040 and accompanying schedules to declare any gains or losses. Using platforms like US Legal Forms can simplify this process with templates and guidance tailored for real estate transactions.

An example of the 2 out of 5 year rule could be a homeowner who purchased their house five years ago and lived in it for the last three years. If they decide to sell now, they can exclude capital gains up to $250,000, as they meet the two-year residency requirement. Understanding your own situation can be crucial when preparing to sell real estate.

To calculate your eligibility under the 2 out of 5 year rule, track your residency period in your primary home over the last five years. You must add up the time you have lived in the house to confirm that it meets the two-year residency requirement. This calculation not only helps determine your qualification for tax exclusions but also assists you in making informed decisions about your sale.

The phrase 2 out of 5 years refers to the requirement that homeowners must have lived in their residence for two years within the last five-year period to qualify for capital gains exclusion. This rule is essential when you want to sell real estate, as it impacts your tax liability directly. Understanding this timeline can help you plan better when considering selling.