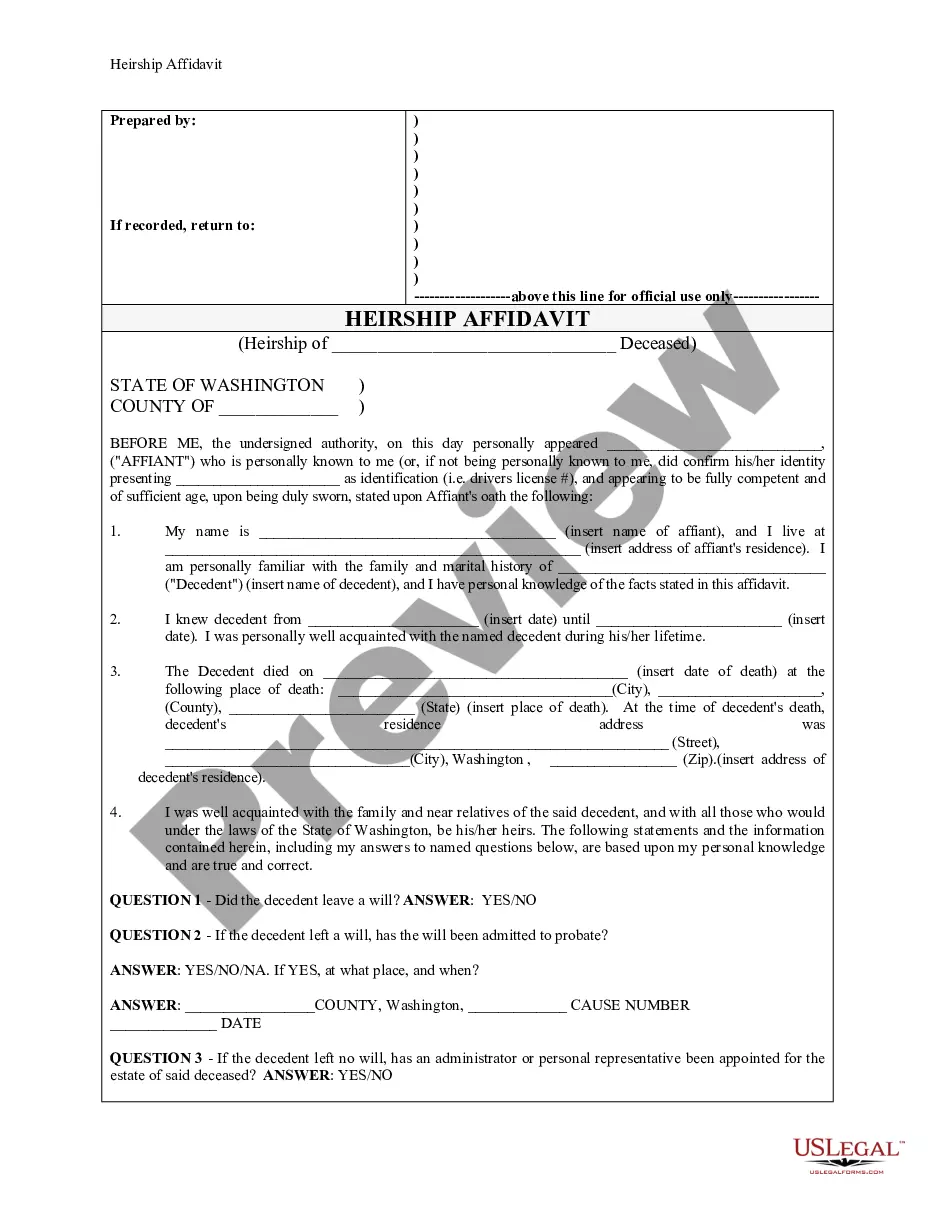

Affidavit Of Inheritance Washington Withholding Tax

Description

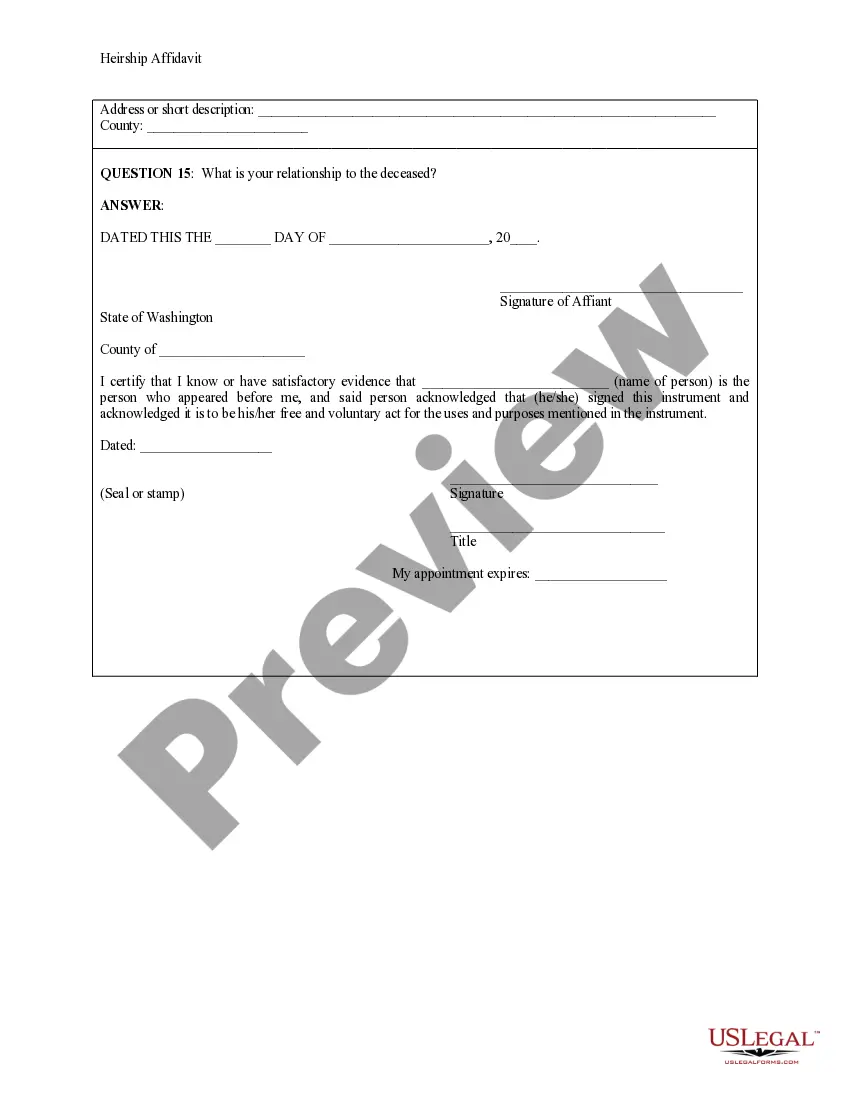

How to fill out Washington Heirship Affidavit - Descent?

What is the most reliable service to obtain the Affidavit Of Inheritance Washington Withholding Tax and other recent versions of legal documents.

US Legal Forms is the answer! It's the largest repository of legal forms for any purpose.

If you do not yet have an account with our library, here are the steps to create one: Form compliance verification. Prior to obtaining any template, confirm that it meets your usage requirements and adheres to your state or county's regulations. Review the form description and use the Preview if available. Alternative document search. In case of any discrepancies, use the search bar at the top of the page to find a different template. Click Buy Now to select the appropriate one. Account registration and subscription purchase. Select the most suitable pricing plan, Log In or create your account, and complete your payment via PayPal or credit card. Downloading the document. Choose the desired format to save the Affidavit Of Inheritance Washington Withholding Tax (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an outstanding choice for anyone dealing with legal documentation. Premium users enjoy additional benefits as they can complete and approve previously saved files electronically at any time using the integrated PDF editing tool. Explore it today!

- Each template is meticulously prepared and validated for adherence to federal and local laws.

- They are categorized by field and state of application, making it simple to locate what you require.

- Experienced users of the site only need to Log In, verify their subscription status, and click the Download button next to the Affidavit Of Inheritance Washington Withholding Tax to retrieve it.

- Once saved, the document is accessible for future use within the My documents section of your profile.

Form popularity

FAQ

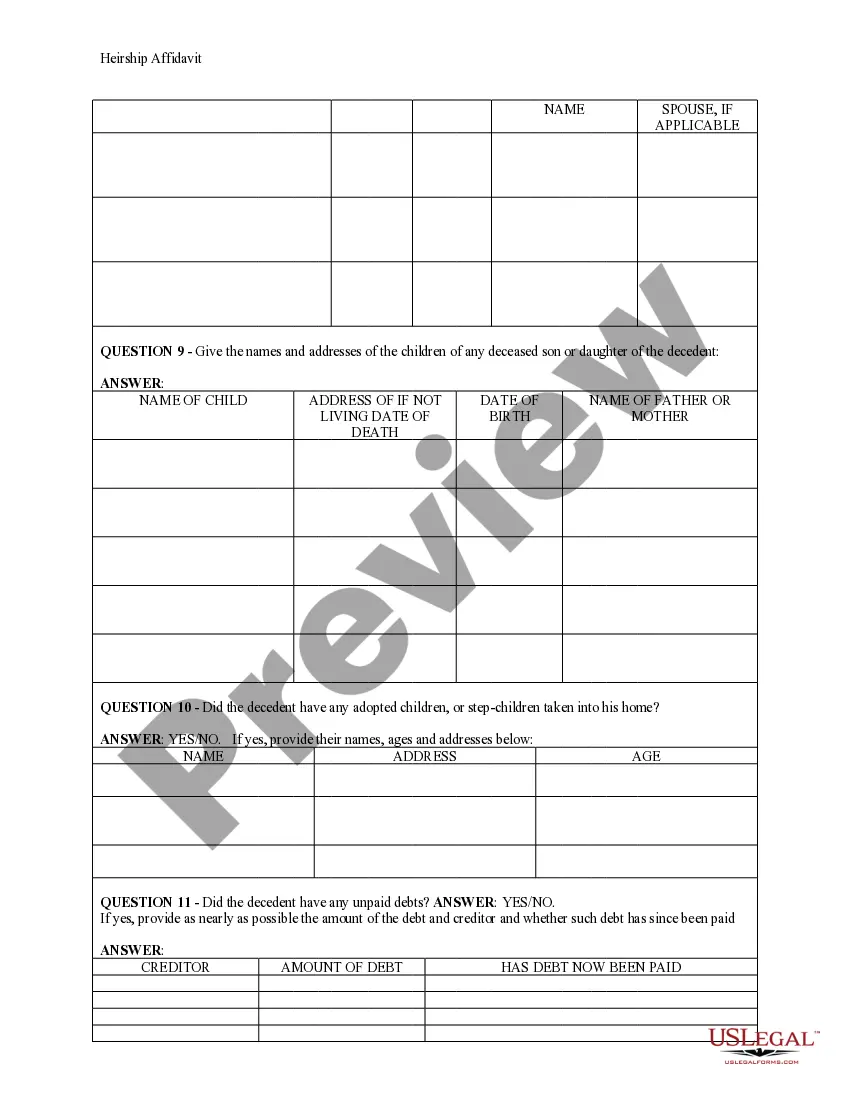

First, you must wait at least 40 days after your loved one has died before submitting the affidavit. Second, you are required to mail a copy of the affidavit, along with the decedent's social security number, to DSHS's Office of Financial Recovery, whose address is currently: P.O. Box 9501, Olympia, WA 98507-9501.

The vehicle may then be titled and licensed in the name of the estate of the deceased pending final settlement of the estate. A copy of the court order appointing or confirming the personal representative must be attached to the application for certificate of ownership.

How to File (7 steps)Step 1 Pay Debts.Step 2 Wait Forty (40) Days.Step 3 Prepare Affidavit.Step 4 Notify Other Successors.Step 5 Get It Notarized.Step 6 Mail Notarized Copy.Step 7 Collect the Assets.

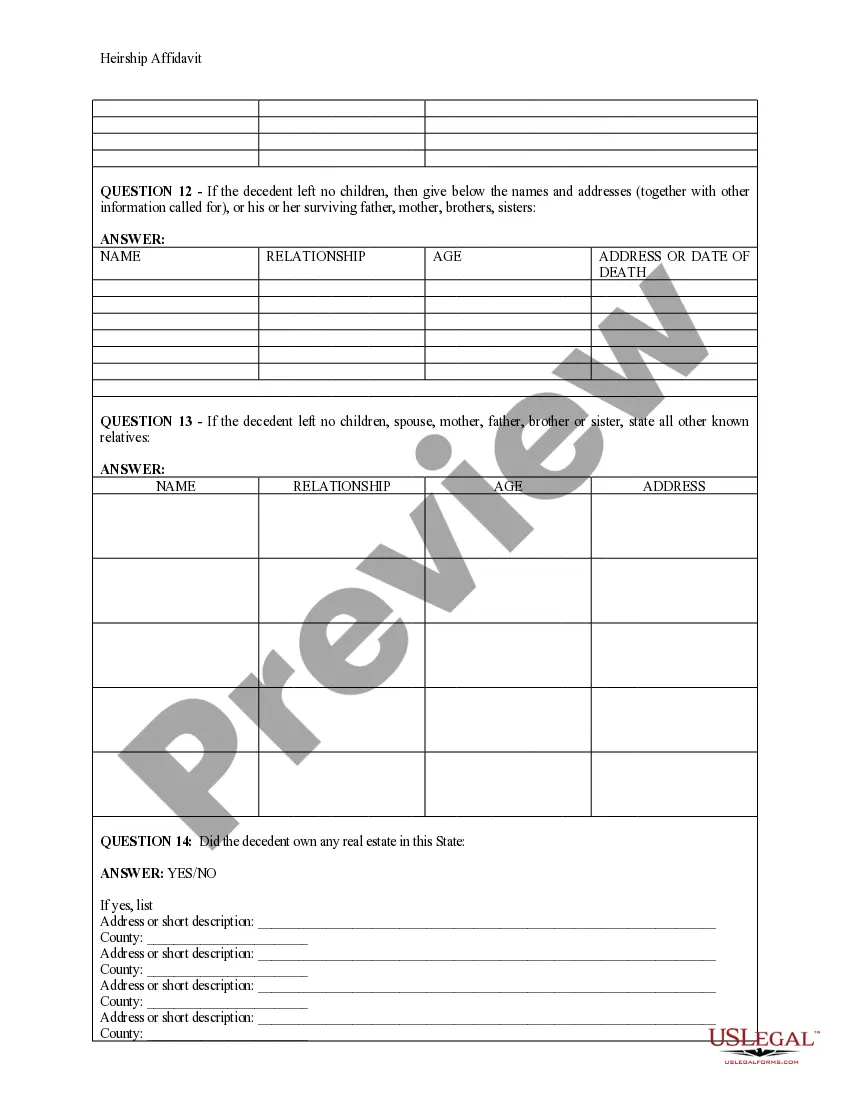

File the Will The will should be filed with the Clerk's Office of the Superior Court in the decedent's resident county at death, generally within 40 days of decedent's death.

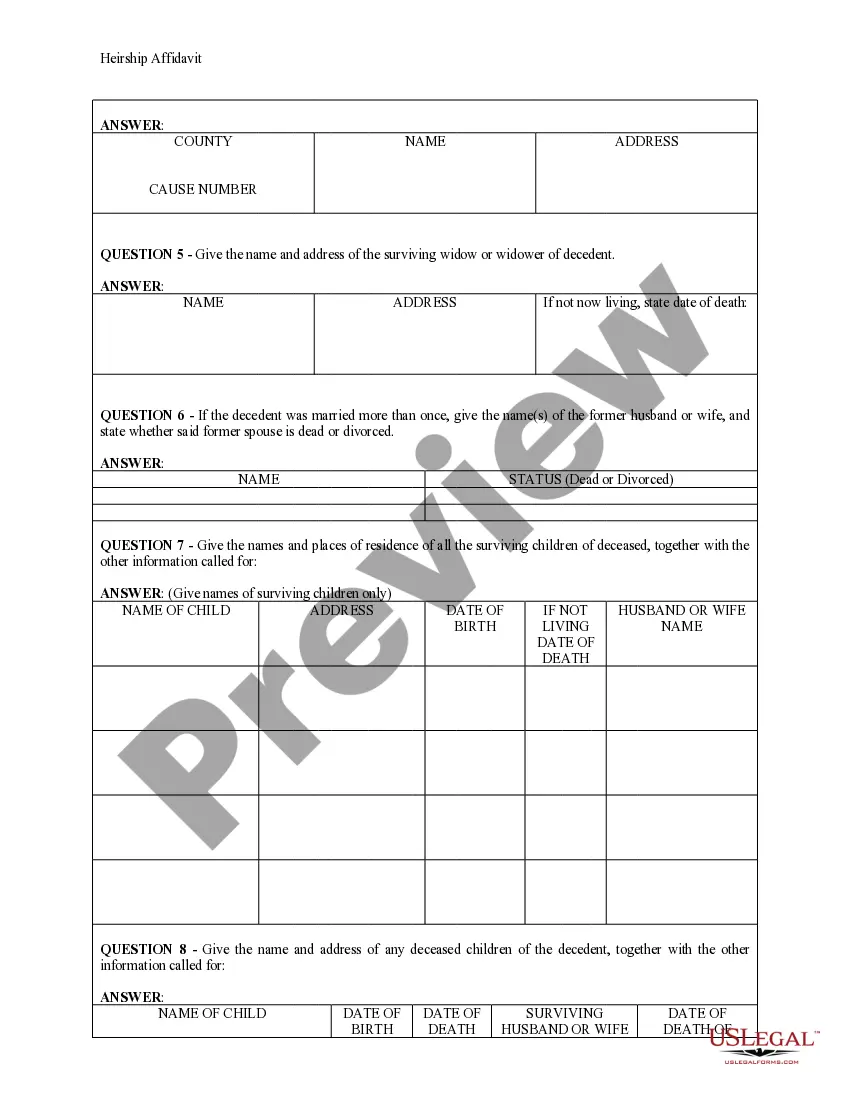

The order is: the surviving spouse, children, parents, siblings, grandchildren and nieces and nephews. RCW 11.28.