Tax Liability For Llc

Description

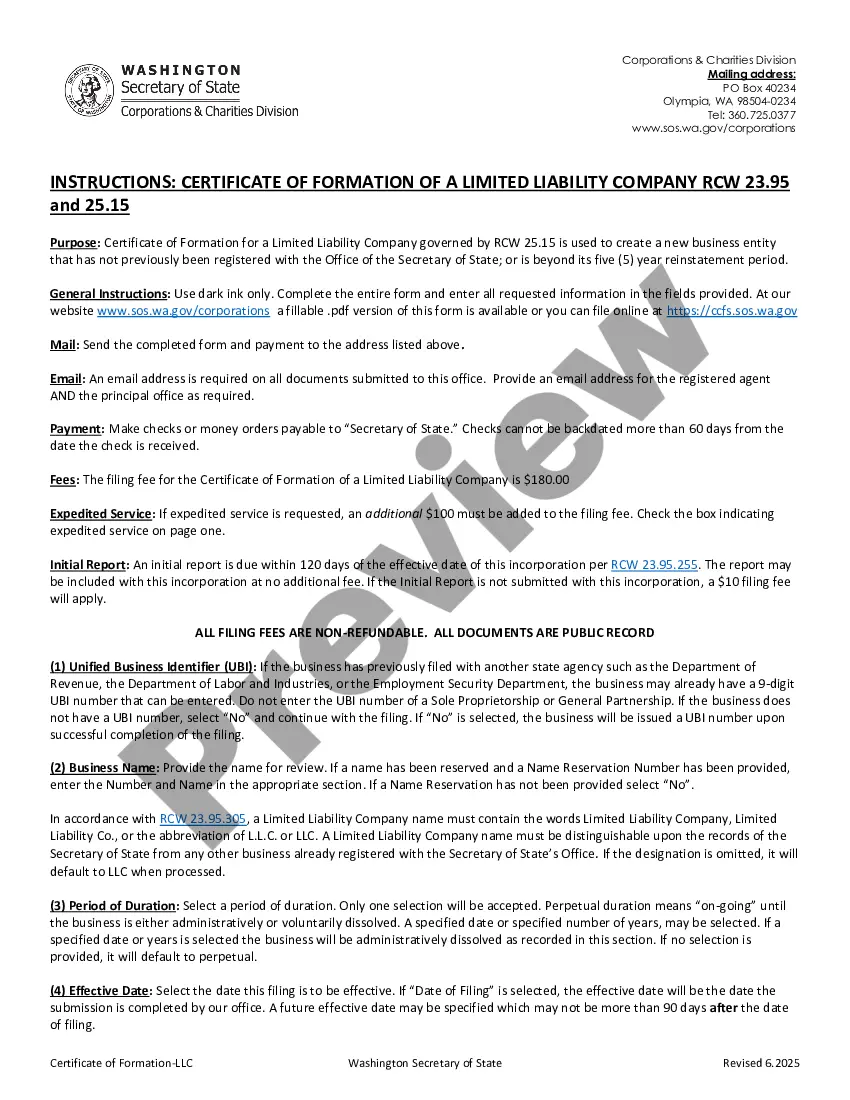

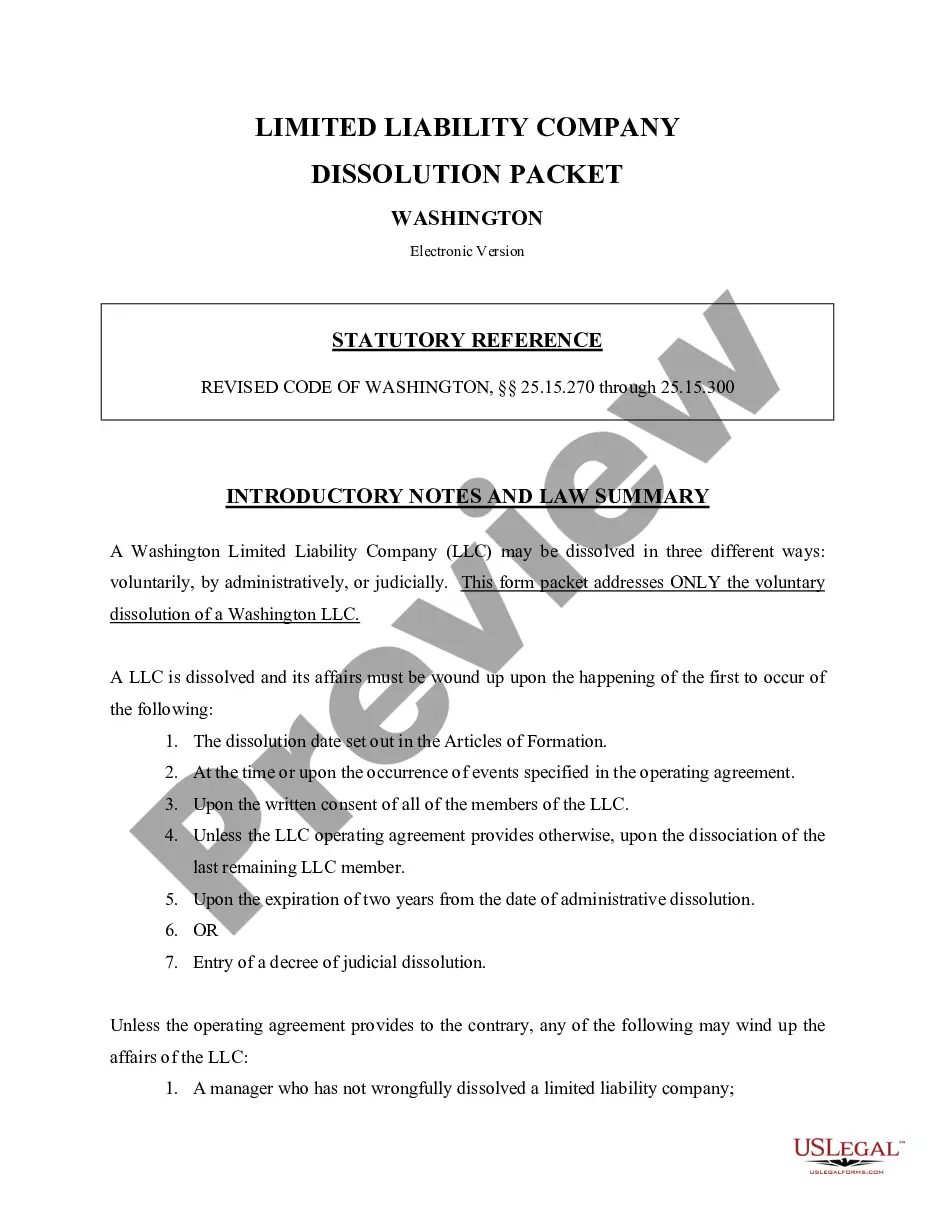

How to fill out Washington Limited Liability Company LLC Formation Package?

- Log in to your US Legal Forms account if you are already a member. Once logged in, locate the desired form template and click the Download button to save it to your device. Ensure your subscription is current; if it has expired, renew it as per your payment plan.

- If you are new to US Legal Forms, begin by browsing the available legal forms. Utilize the Preview mode and read through the form descriptions to guarantee you select a document aligned with your needs and local jurisdiction requirements.

- In case you can't find the right template, use the Search feature to explore more options until you locate the correct form that meets your criteria.

- After settling on the appropriate document, proceed by clicking the Buy Now button. Choose your preferred subscription plan and create an account to gain access to the entire library of resources.

- Complete your purchase by entering your credit card information or opting for your PayPal account to finalize the subscription.

- Finally, download the form you've selected. Save it on your device for completion and easy retrieval through the My Forms section of your account whenever needed.

In conclusion, US Legal Forms provides a robust collection of legal documents, ensuring you can easily access and complete forms necessary for managing your LLC's tax liability. Their extensive resources empower both individuals and legal professionals to create precise and compliant documents.

Take action today to simplify your legal processes and ensure your LLC is set up for success!

Form popularity

FAQ

If you start an LLC and take no action, your business may face several consequences, including potential tax liabilities. Without operating your LLC, you could incur annual fees or taxes that you might not expect. It's essential to stay informed about your obligations, even if your business activities are minimal. Platforms like US Legal Forms can guide you in maintaining compliance and managing your tax liability for LLCs.

In the U.S., the tax liability for LLCs depends on various factors, including income levels and deductions. Generally, a small business can earn a certain amount under the IRS's standard deduction before owing federal taxes. However, it is crucial to consult a tax professional to understand your unique situation. Using resources like US Legal Forms can help you navigate the complexities of tax liability for LLCs.

LLC owners can reduce tax liability for LLCs by taking advantage of various deductions and credits available to businesses. This includes deducting business expenses such as wages, operating costs, and certain capital expenditures. Additionally, LLCs can choose to be taxed as an S corporation, which can help avoid double taxation on profits. Overall, understanding the tax options available is essential for minimizing tax liability for LLCs, and platforms like uslegalforms can provide valuable resources and guidance in navigating these complexities.

Generally, LLC owners must file both personal and business taxes separately unless they elected to be taxed as a corporation. Your tax liability for LLC will be reported on your personal tax return if you are a single-member LLC. Be sure to keep both tax filings organized to avoid confusion when it's time to submit.

Regardless of income, an LLC must file taxes if it has any income or has opted for corporate taxation. Your tax liability for LLC will be calculated based on your income, regardless of the amount. It's important to stay compliant with tax regulations, so consider consulting resources like US Legal Forms to ensure you understand your obligations.

You should set aside approximately 25% to 30% of your income in your LLC for tax purposes. This estimate allows you to handle your tax liability for LLC without facing unexpected financial burdens. Adjust your savings according to your earnings and any specific tax obligations in your state.

An LLC should ideally set aside 25% to 30% of its income to prepare for tax payments. This helps manage your tax liability for LLC effectively and ensures sufficient funds are available when taxes are due. Remember that state taxes may vary, so always stay informed about local regulations.

As a general guideline, aim to save about 25% to 30% of your profit for taxes to cover your tax liability for LLC. This percentage varies based on your income and state tax laws, so consider consulting a tax professional for personalized advice. Regularly setting aside this amount can prevent last-minute financial stress when tax season arrives.

You can write off various business expenses to reduce your tax liability for LLC. Common deductions include operational costs, employee salaries, and equipment purchases. Keep detailed records of all expenses, as these deductions can significantly lower your taxable income. Utilizing a platform like US Legal Forms can help you track and categorize your expenses efficiently.

In most cases, you file LLC and personal taxes separately. The LLC profits pass through to your personal tax return unless you elect corporate taxation. This separation helps you maintain clear financial records and assess your tax liability for LLC. Consulting an accountant can offer guidance tailored to your situation and ensure compliance.