Incorporate In Washington With Hotels

Description

How to fill out Washington Business Incorporation Package To Incorporate Corporation?

No matter if you handle documents regularly or need to present a legal paper occasionally, it's essential to have a resource that features all relevant and current samples.

The first step you must take with an Incorporate In Washington With Hotels is to ensure that you have its latest version, as it determines its eligibility for submission.

If you want to simplify your hunt for the most recent document examples, search for them on US Legal Forms.

To acquire a form without an account, follow these steps: Use the search menu to locate the form you need. Review the preview and description of the Incorporate In Washington With Hotels to ensure it's the exact one you are looking for. After confirming the form, click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit or debit card information or PayPal account to complete the transaction. Choose the file format for download and confirm it. Eliminate confusion when dealing with legal documents. All your templates will be organized and verified with a US Legal Forms account.

- US Legal Forms contains a comprehensive collection of legal forms that features nearly any document sample you might seek.

- Look for the templates you need, verify their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Obtain the Incorporate In Washington With Hotels samples in mere seconds and keep them accessible at any moment in your account.

- A US Legal Forms account permits you to access all the samples you need with convenience and minimal hassle.

- Simply click Log In in the site header and navigate to the My documents section where all the forms you need are readily available.

- You won’t need to spend time searching for the best template or verifying its validity.

Form popularity

FAQ

Incorporating in Washington state comes with various benefits, including a robust legal structure and protections for personal assets. The state offers a welcoming environment for businesses, especially in the hospitality sector. By choosing to incorporate in Washington with hotels, you tap into a diverse market and gain essential resources to enhance your business strategy.

An LLC provides flexibility in management and taxation, while an S Corp offers benefits like potential tax savings and increased credibility. With an LLC, you can have unlimited members, but S Corporations restrict ownership to 100 shareholders. Choosing to incorporate in Washington with hotels requires understanding these distinctions to select the best legal structure for your business needs.

Yes, an LLC operating in Washington state must obtain a business license. This requirement ensures your business complies with state regulations and taxes. You can easily start the process online through the Washington Department of Revenue. When you incorporate in Washington with hotels, securing the right licenses is crucial for a successful operation.

Yes, each city in Washington may have its own licensing requirements for businesses operating within its limits. Therefore, if you plan to incorporate in Washington with hotels that span multiple locations, you must obtain a license for each city. This ensures compliance with local regulations and promotes smooth operations. Staying informed about licensing helps avoid penalties.

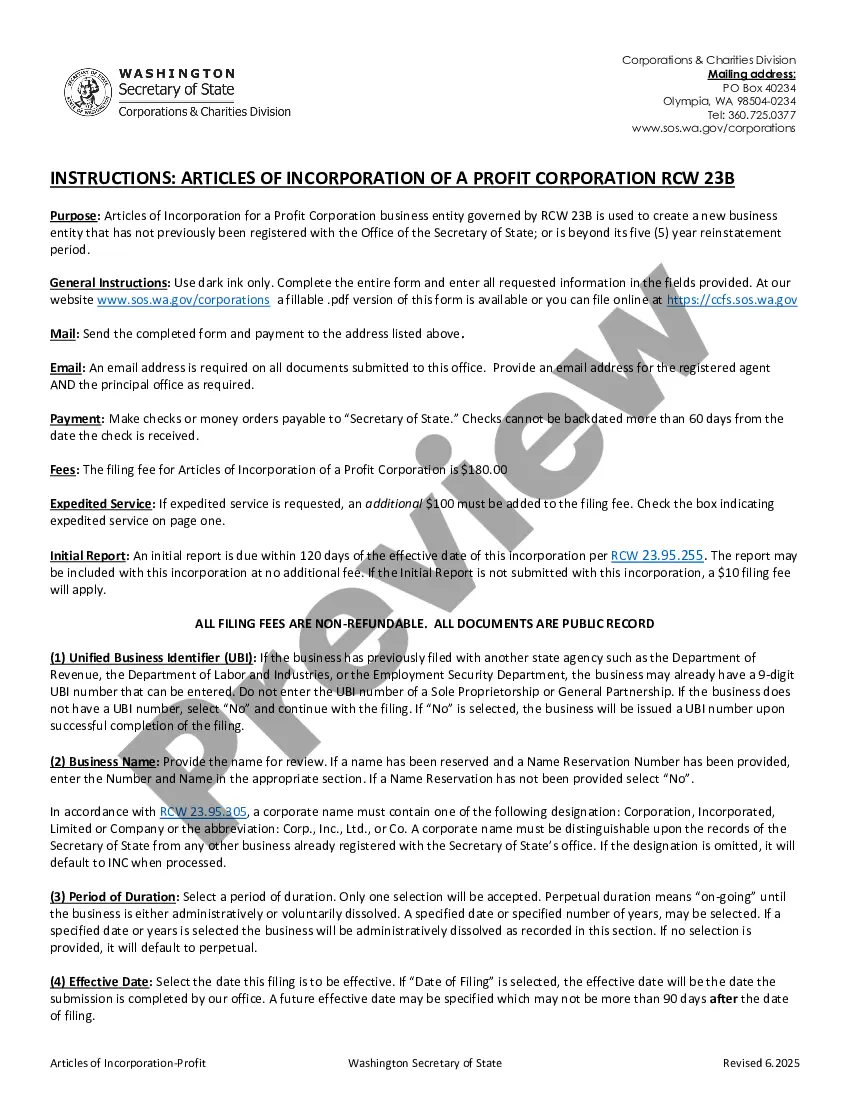

To incorporate in Washington, you need to file articles of incorporation with the Secretary of State's office. Additionally, you must choose a unique business name and designate a registered agent. Tools like US Legal Forms can facilitate this process by providing the necessary templates and guidance. Incorporating properly sets a strong foundation for your hotel business.

The general sales tax rate in Washington state is 6.5%, but local taxes can increase this figure. Depending on the city you are in, the combined state and local rate can be as high as 10% or more. When you incorporate in Washington with hotels, you should factor these rates into your financial planning. Awareness of tax obligations enhances your business's compliance and success.

Hotel taxes and fees in Washington typically range from 10% to 15% of your room rate. This includes state and local taxes, which can vary by city. When you plan to incorporate in Washington with hotels, understanding these costs helps you budget accordingly. These fees contribute to local infrastructure and services, enhancing your stay.

To obtain a UBI (Unified Business Identifier) number in Washington state, you need to register your business with the Washington Secretary of State. If you choose to incorporate in Washington with hotels, you'll complete this registration process online or via mail. This unique identifier helps the state track your business activities and taxes over time. It’s a straightforward process, and you can receive your UBI number quickly once you submit your application.

Yes, you need a business license to operate an LLC in Washington state. This requirement applies regardless of whether you incorporate in Washington with hotels or another type of business. The state requires that you obtain a General Business License from the Washington Secretary of State. Completing this process not only ensures legal compliance but also allows for smoother operations moving forward.

The lodging tax in King County is a combination of state, county, and city taxes that generally totals around 15.6%. When you plan to incorporate in Washington with hotels, it's important to factor in these taxes, as they can affect your overall costs. These taxes contribute to local tourism and community projects, making it essential to understand for budgeting purposes. Be sure to check the latest rates as they can change periodically.