Washington State Purchase And Sale Agreement Form 21 Withholding

Description

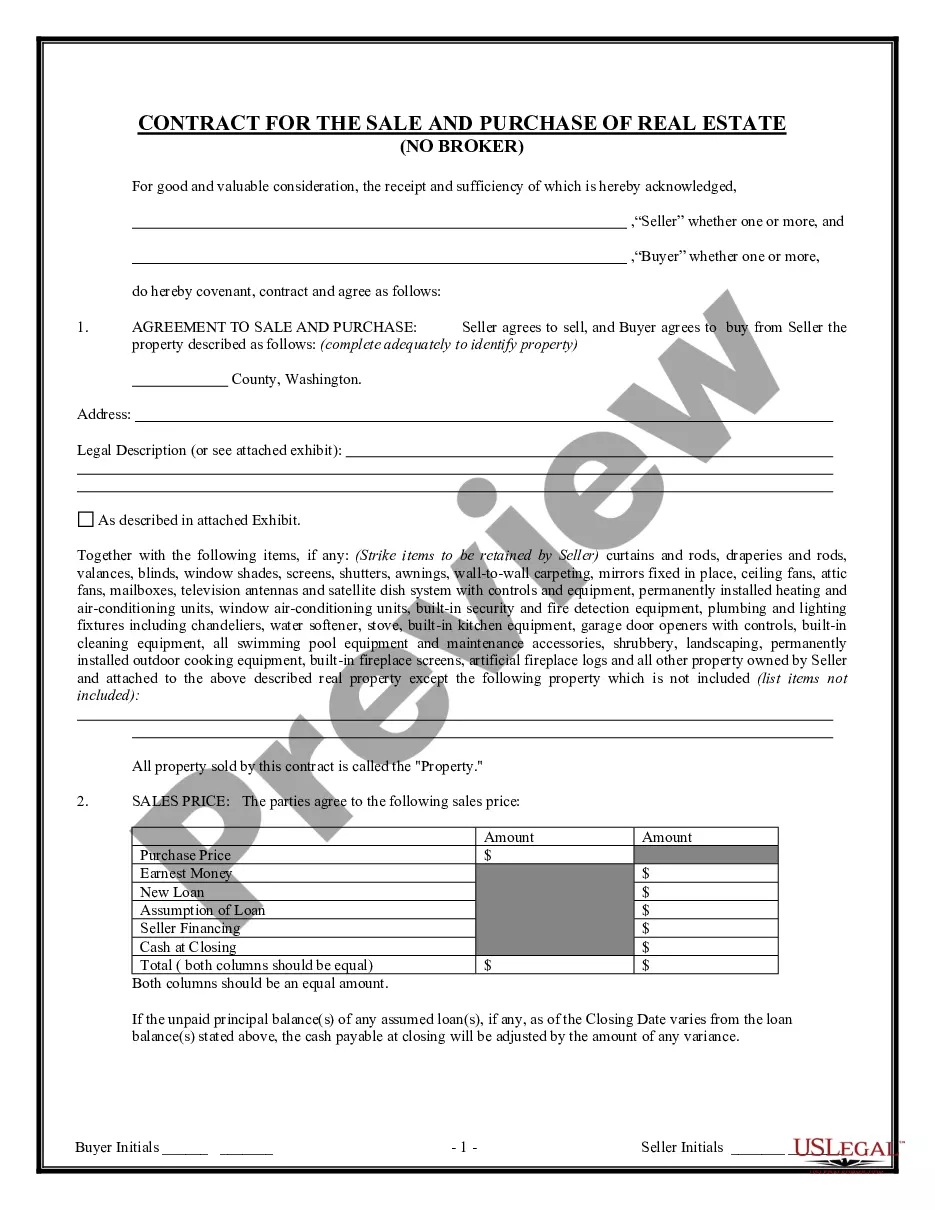

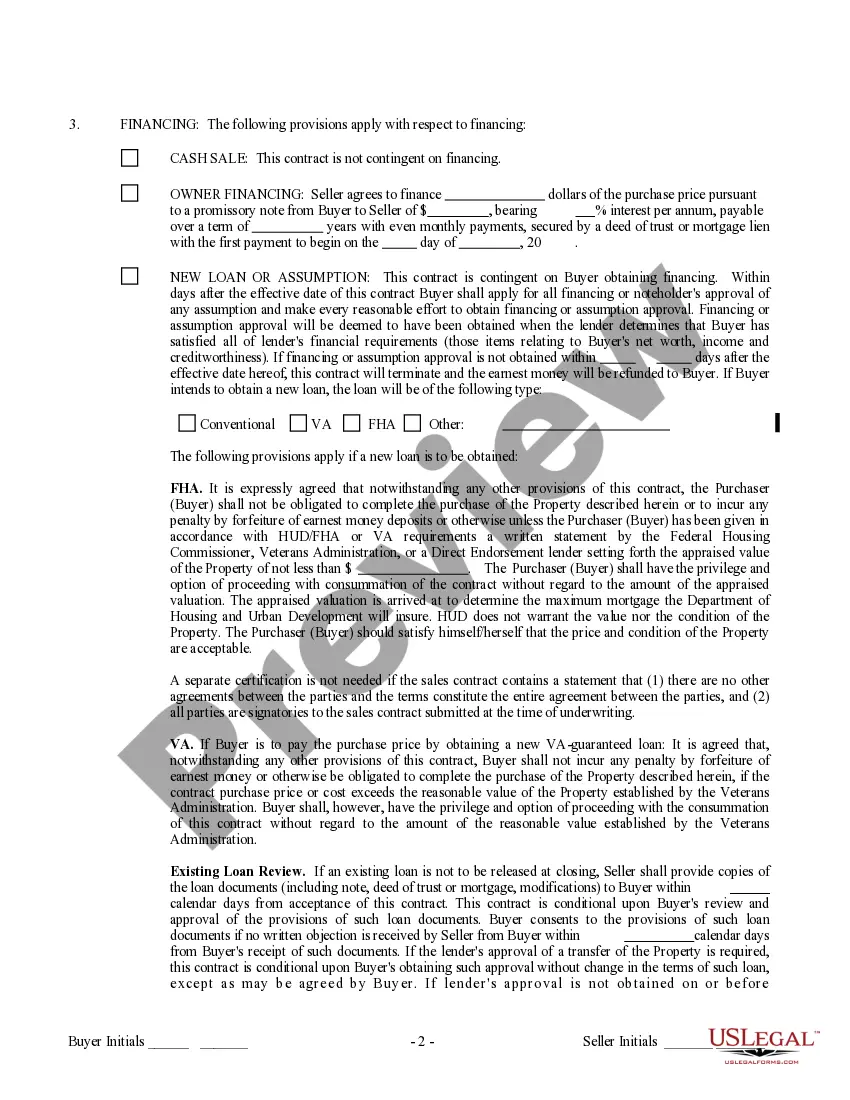

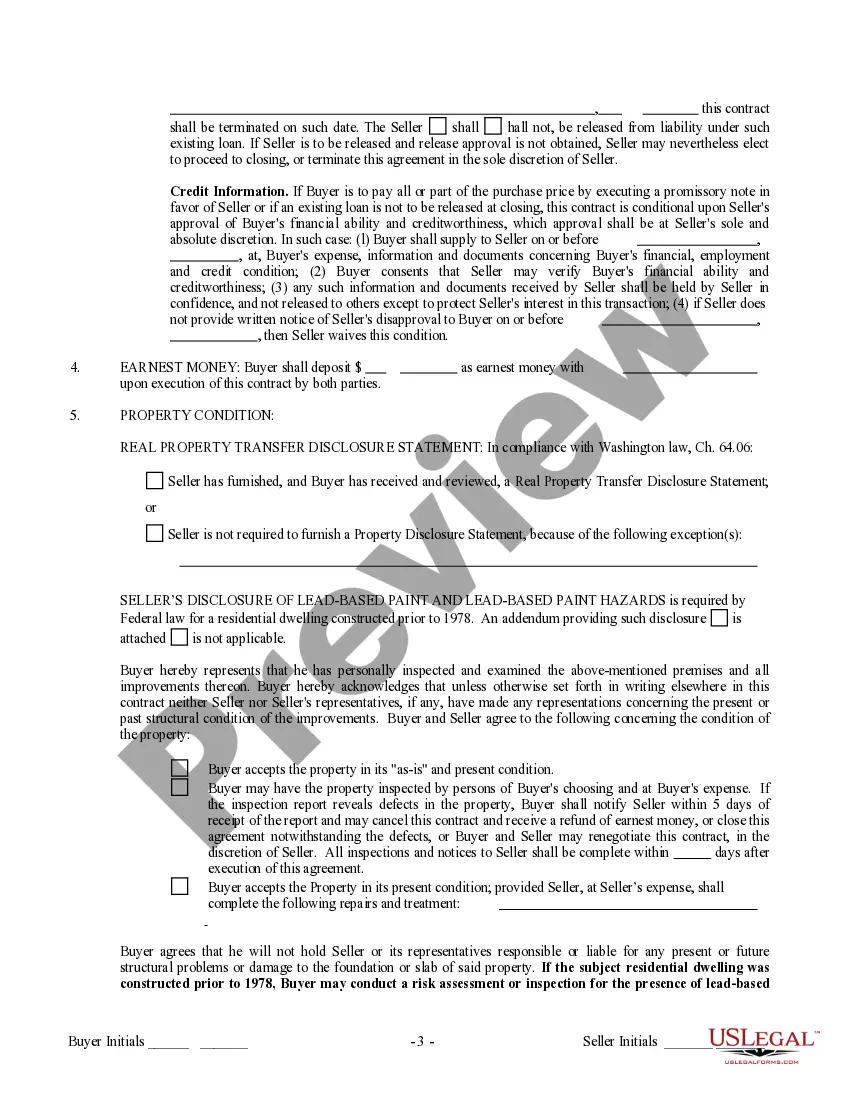

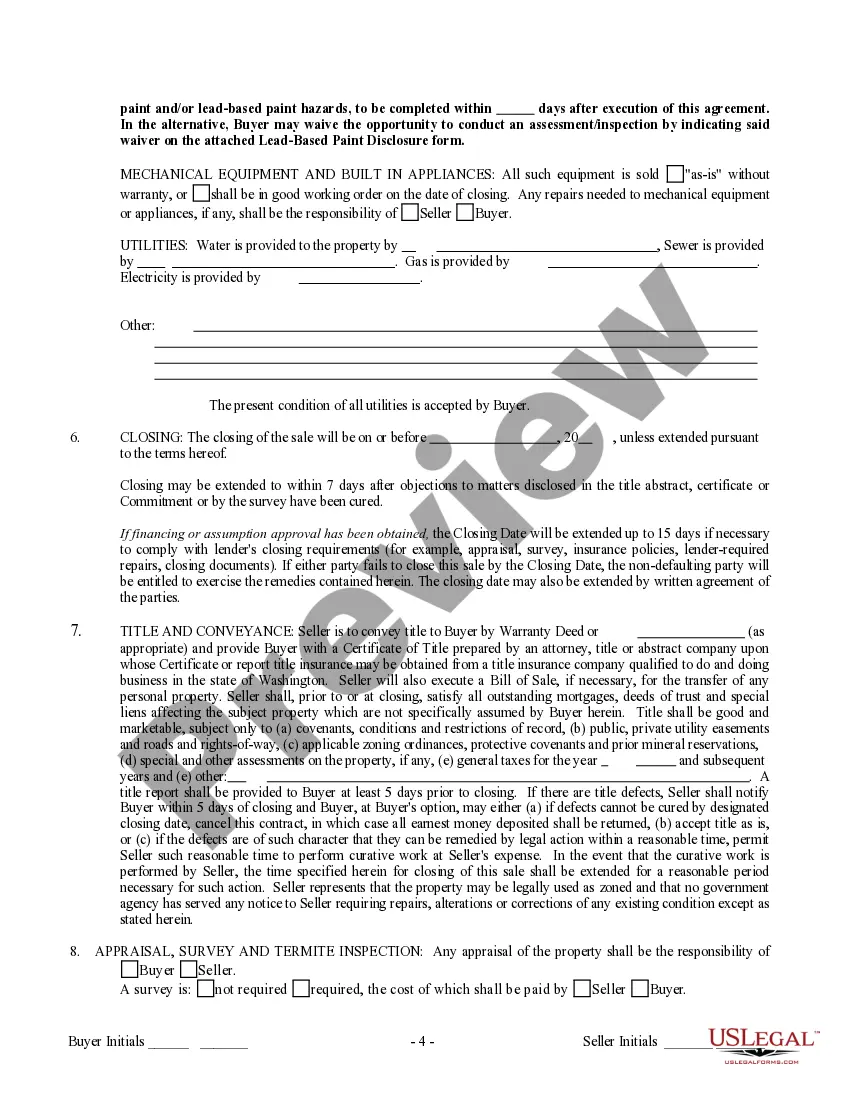

How to fill out Washington Contract For Sale And Purchase Of Real Estate With No Broker For Residential Home Sale Agreement?

It’s widely acknowledged that you cannot transform into a legal expert in a single day, nor can you easily comprehend how to swiftly arrange the Washington State Purchase And Sale Agreement Form 21 Withholding without the necessity of a tailored background.

Crafting legal documents is a lengthy endeavor that demands specific education and expertise. So why not entrust the creation of the Washington State Purchase And Sale Agreement Form 21 Withholding to the specialists.

With US Legal Forms, one of the most comprehensive legal template repositories, you can find a variety of documents from court papers to templates for in-office communication.

You can revisit your documents from the My documents section anytime. If you’re already a customer, you can simply Log In, and find and download the template from the same section.

Regardless of the intent of your documentation—be it financial, legal, or personal—our platform has you covered. Give US Legal Forms a try now!

- Recognize the document you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if Washington State Purchase And Sale Agreement Form 21 Withholding is what you need.

- Initiate your search again if you require a different template.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment processes, you can download the Washington State Purchase And Sale Agreement Form 21 Withholding, fill it out, print it, and deliver it to the necessary parties or organizations.

Form popularity

FAQ

Writing a bill of sale in Washington state involves a few key steps. First, you should include details about the buyer and seller, as well as the vehicle information, and any other pertinent details related to the sale. Using the Washington state purchase and sale agreement form 21 withholding will ensure you meet all legal requirements. After completing the bill, both parties should sign it to confirm the transaction, providing each with a copy for their records.

To privately sell a vehicle in Washington state, you need to gather necessary documents, including the Washington state purchase and sale agreement form 21 withholding. Begin by ensuring the vehicle title is clear and available for transfer. Once you find a buyer, complete the sale by filling out the form accurately, which serves as a legally binding agreement. Remember to submit the required paperwork to the local Department of Licensing to finalize the sale.

For a title transfer in Washington state, both the seller and buyer typically need to be present to sign the title. This process helps ensure that both parties agree on the terms of the sale. However, if one party cannot be present, proper documentation, such as a signed release, may be required. Using a Washington state purchase and sale agreement form 21 withholding can help streamline this process and clarify responsibilities.

In Washington state, a bill of sale alone does not grant you a title. The bill of sale documents the transfer of ownership but does not replace the official title. To obtain a title, you must have the vehicle's current title signed over to you, along with the Washington state purchase and sale agreement form 21 withholding if applicable. This ensures a smooth transition of ownership and meets legal requirements.

To sell a car in Washington state, you need to complete a few essential documents. First, ensure you have the vehicle's title, which proves ownership. Additionally, it's helpful to prepare a Washington state purchase and sale agreement form 21 withholding; this form can clarify the sale terms between you and the buyer. Finally, don't forget to provide a bill of sale, which is necessary for record-keeping.

Writing an agreement between a seller and a buyer involves defining the rights and responsibilities of both parties. Begin with the full names of both individuals and include a detailed description of the item or property in question. Be sure to specify payment methods and timelines for delivery. You can explore options like the Washington state purchase and sale agreement form 21 withholding on US Legal Forms to create a comprehensive agreement.

Yes. It may be illegal for the subcontractor to operate without a license, but that does not mean a project owner can simply keep the value of the work performed without paying for it.

There are also criminal penalties that may be imposed. In Arizona, it is a class 1 misdemeanor for a person not licensed as a contractor to: Act in the capacity of a contractor (even merely bidding on a project) Advertise that they are able to perform any service or contract for compensation.

Contracting without a license in violation of A.R.S. § 32-1151 is a class 1 misdemeanor (A.R.S. § 32-1164). All class 1 misdemeanors carry a maximum term of six months in the county jail and a maximum fine of $2,500 plus an 83% surcharge.

Most Construction contractors (both primes and subs) must be licensed with the Arizona Registrar of Contractors; some exemptions apply. To become a licensed contractor, you must submit an application showing you have passed one or more written exams, met appropriate experience requirements, and have sufficient bonding.