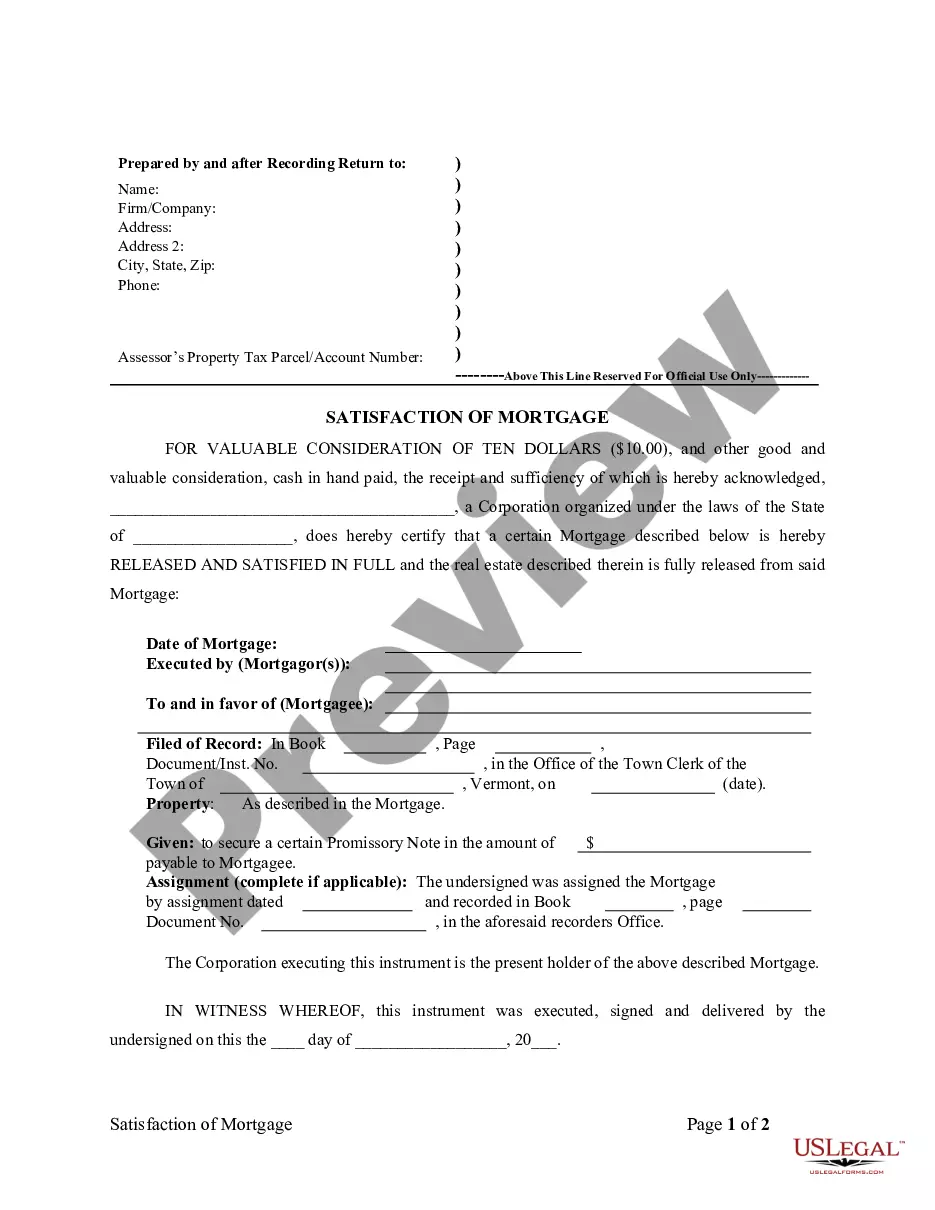

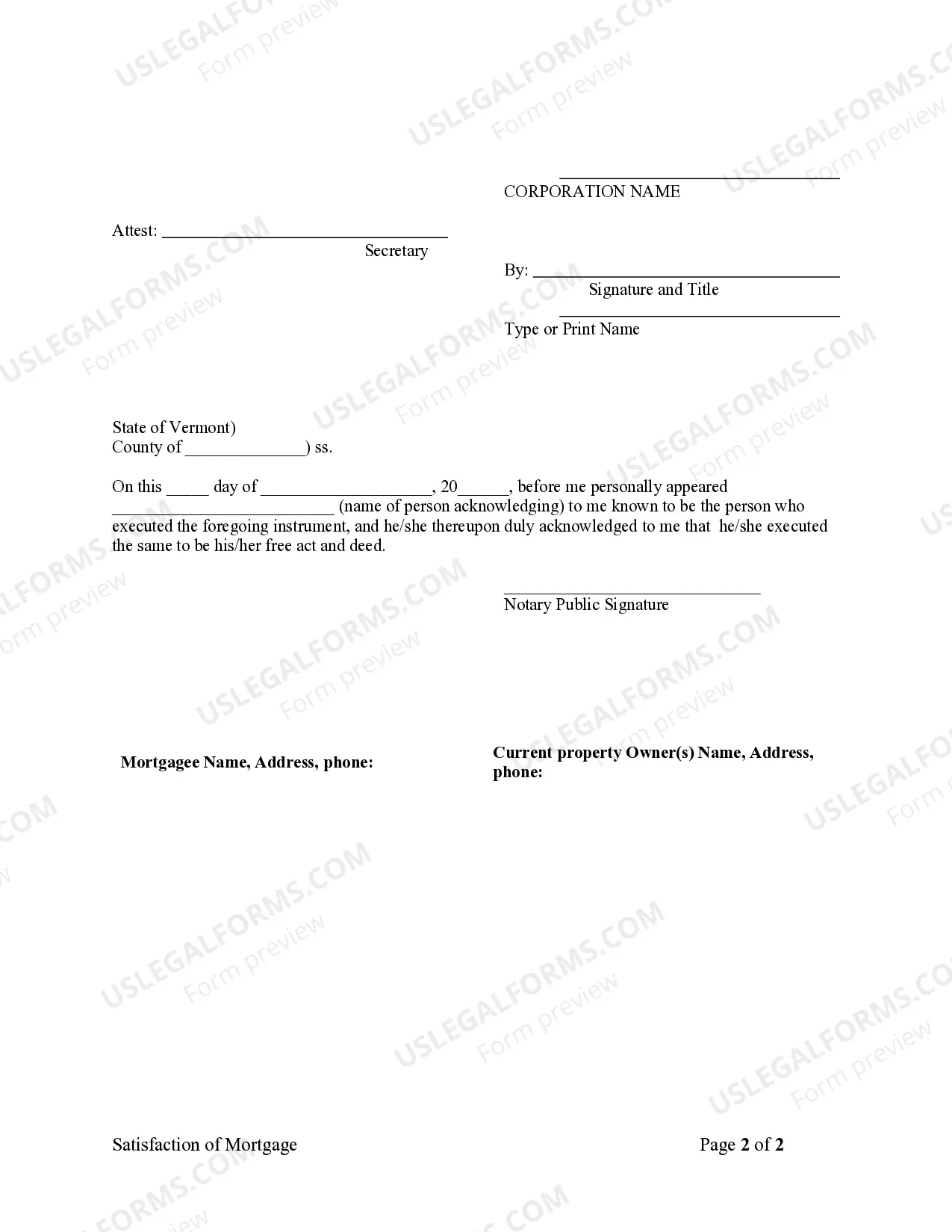

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Vermont by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Online Mortgage Application Vermont For Sale

Description

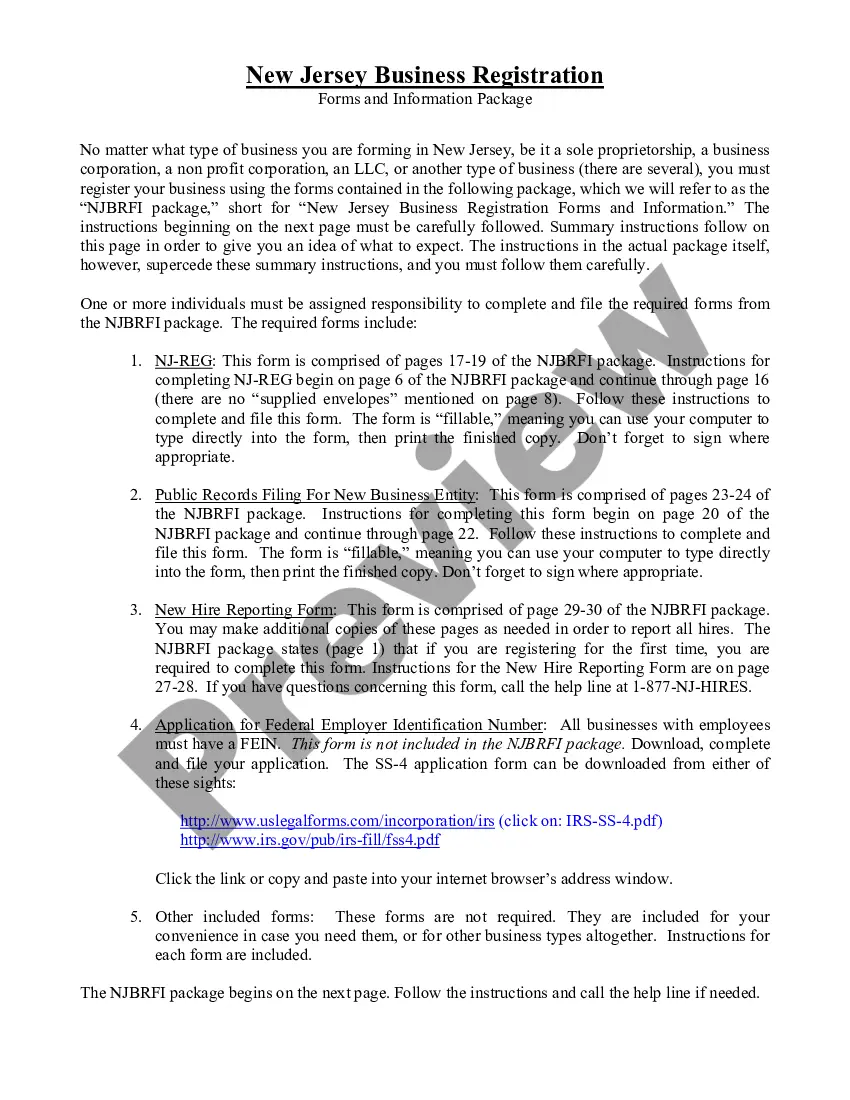

How to fill out Vermont Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

There is no longer a need to spend hours searching for legal documents to fulfill your local jurisdiction requirements. US Legal Forms has gathered all of them in one place and enhanced their accessibility. Our platform provides over 85k templates for various business and personal legal situations categorized by state and area of application. All forms are accurately drafted and verified for legitimacy, so you can be confident in acquiring an up-to-date Online Mortgage Application Vermont For Sale.

If you are acquainted with our service and already possess an account, you must ensure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all obtained documentation at any time by navigating to the My documents section within your profile.

For those who have not utilized our service previously, the procedure will require a few additional steps to finalize. Here’s how new users can locate the Online Mortgage Application Vermont For Sale in our library.

Creating formal documentation in accordance with federal and state laws is quick and easy with our platform. Try US Legal Forms today to keep your paperwork organized!

- Thoroughly read the page content to ensure it includes the template you require.

- To assist with this, utilize the form description and preview options if available.

- Make use of the Search bar above to look for another template if the one currently displayed does not meet your needs.

- Click Buy Now beside the template name upon finding the appropriate one.

- Select the preferred pricing plan and either register for an account or Log In.

- Complete payment for your subscription using a credit card or through PayPal to proceed.

- Choose the file format for your Online Mortgage Application Vermont For Sale and download it to your device.

- Print your document to fill it out manually or upload the template if you wish to complete it using an online editor.

Form popularity

FAQ

The easiest type of mortgage to get approved for typically includes government-backed loans, such as FHA loans. These loans require a lower credit score and a smaller down payment, making them accessible for many buyers. If you're considering an online mortgage application in Vermont for sale, these options can streamline the process and provide you with the financial support you need. Using platforms like US Legal Forms can help simplify your application and guide you towards the best choices.

Yes, applying for a mortgage completely online is not only possible but increasingly common. Many lenders offer robust digital platforms that allow you to manage the entire process from start to finish. Utilizing an online mortgage application Vermont for sale simplifies the experience, providing ease and convenience at your fingertips.

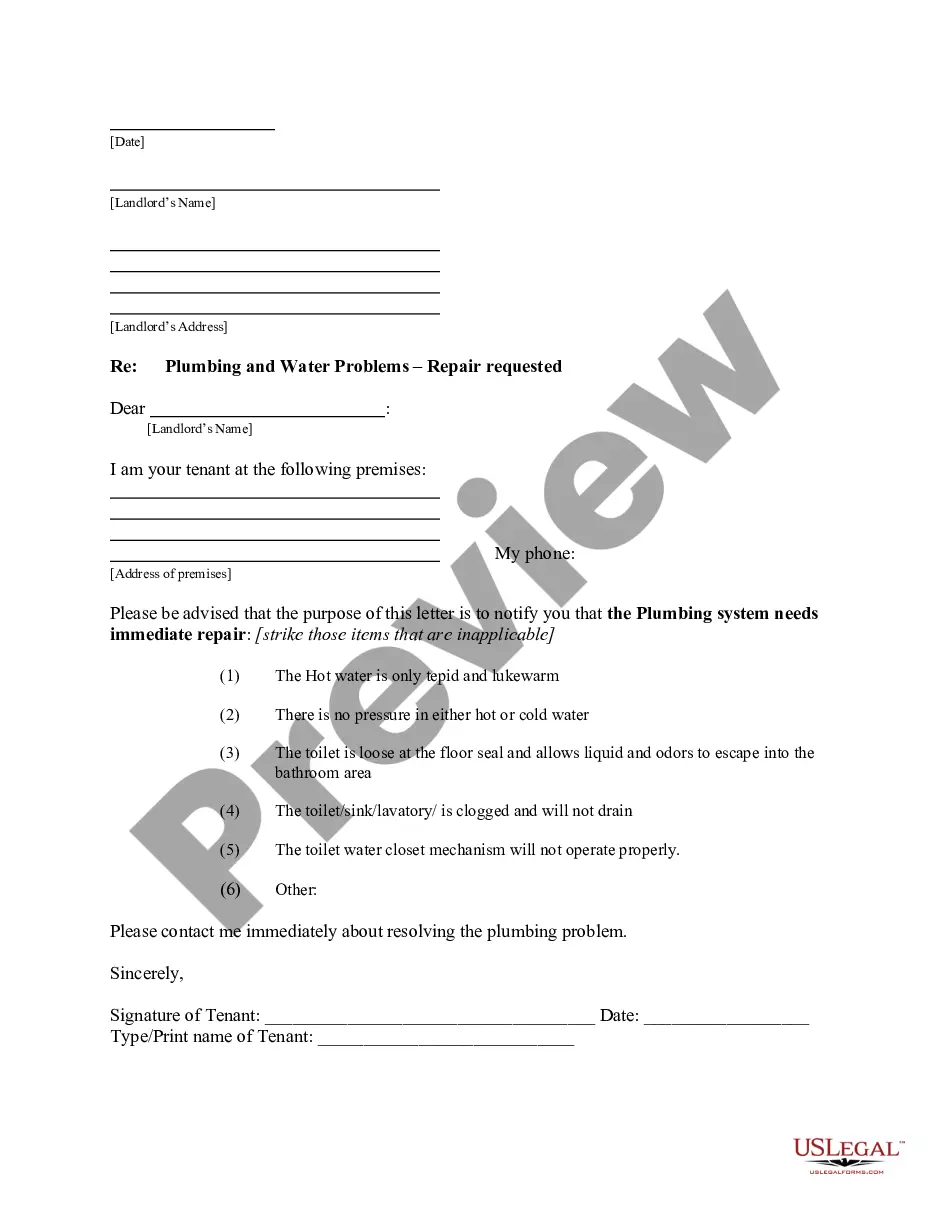

When engaging with your mortgage lender, avoid making absolute statements about your financial situation, such as 'I can afford this much' without context. Steer clear of minimizing your debts or exaggerating your income. Instead, communicate openly and provide accurate, honest information on your online mortgage application Vermont for sale.

Common issues on a mortgage application include inconsistent income, high debt-to-income ratios, and recent large purchases. Lenders take note of any red flags that might suggest financial instability. To enhance your chances, consider a careful review of your online mortgage application Vermont for sale before submission.

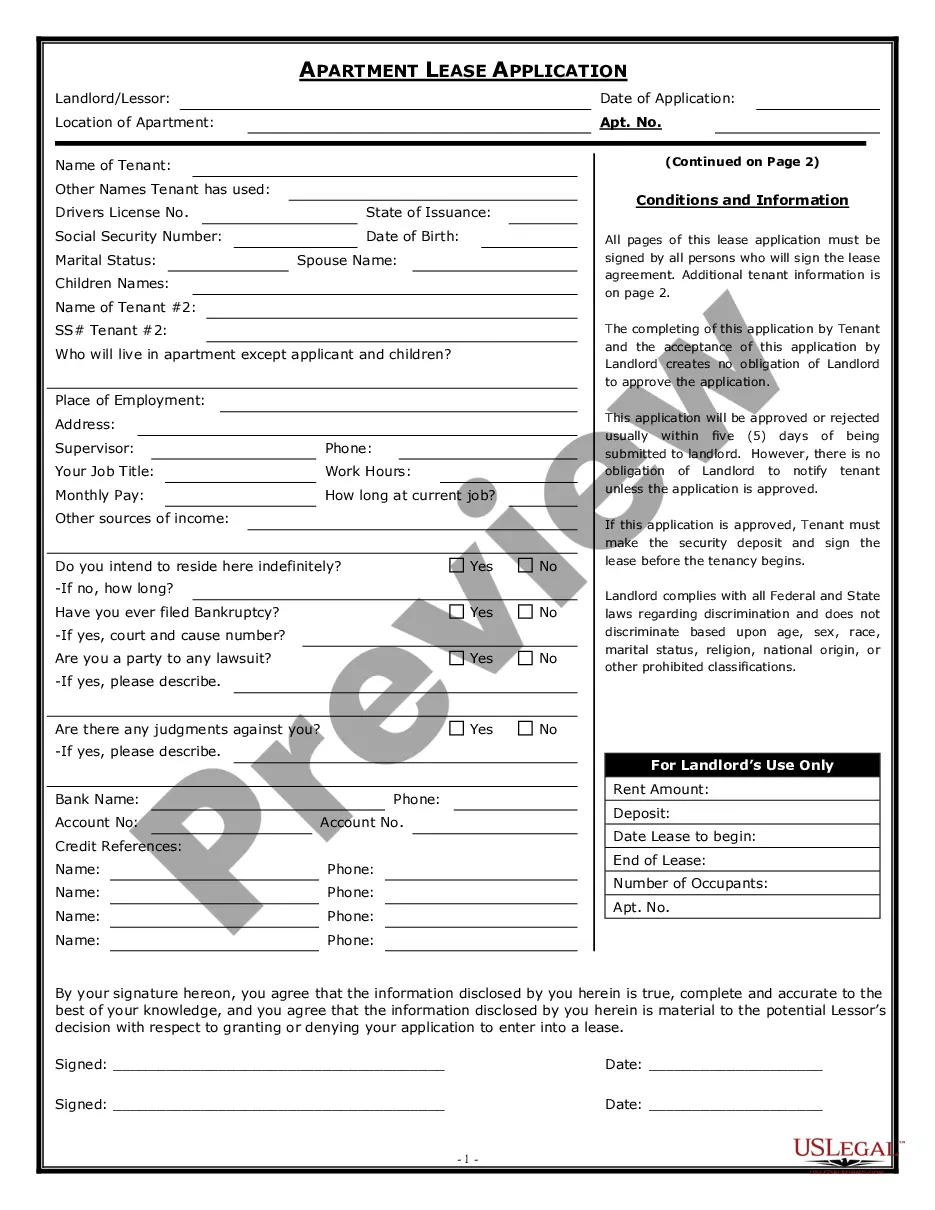

Filling out a mortgage application can be straightforward when you follow essential steps. Begin by gathering your financial documents, including income statements and bank information. Use an online mortgage application Vermont for sale to input your details correctly, ensuring accuracy to expedite the approval process.

In Vermont, a credit score of 620 or higher typically qualifies you for a conventional mortgage. However, some lenders may have alternative options for those with lower scores through government-backed programs. By using an online mortgage application Vermont for sale, you can explore various lending options tailored to your credit profile.

Applying for an online mortgage application in Vermont for sale offers convenience and efficiency. You can submit necessary documents at your own pace without the pressure of a face-to-face meeting. Additionally, online applications often streamline the process, allowing for quicker responses and potentially better rates. With platforms like USLegalForms, you can easily navigate your application and receive expert guidance along the way.

To secure a mortgage without income verification, start by researching lenders that offer this option. Prepare documentation regarding your assets, credit history, and employment status. Building a positive relationship with your chosen lender can also enhance your chances. You can leverage our online mortgage application Vermont for sale to simplify the process and access relevant lenders easily.

For a no-income verification mortgage, lenders often require a down payment of at least 20% to mitigate risk. Some lenders may allow lower down payments, but these options might come with higher interest rates. This requirement aims to protect both you and the lender. Explore various programs through our online mortgage application Vermont for sale to identify the best solutions for your needs.

To qualify for a $400,000 mortgage, your income typically needs to be around $100,000 annually, assuming a standard debt-to-income ratio. This estimate can vary based on factors such as credit score and down payment amounts. It’s crucial to calculate all monthly payments accurately, including property taxes and insurance. Consider our online mortgage application Vermont for sale as a resource to evaluate your options.