Wisconsin FAQs — Farmland Preservation Zoning is an agricultural zoning program designed to preserve Wisconsin’s productive agricultural lands. The program is administered by the Wisconsin Department of Agriculture, Trade and Consumer Protection (MATCH). The program has two primary components — Farmland Preservation Zoning (FPZ) and the Wisconsin Farmland Preservation Program (FPP). The Farmland Preservation Zoning component is a local ordinance that helps protect and preserve agricultural land by limiting non-agricultural land uses. This helps to maintain the productivity of the land and the viability of agricultural operations. The zoning also helps to ensure that agricultural land is not taken out of production for other uses. The Wisconsin Farmland Preservation Program component provides financial assistance to local governments, landowners, and other entities to help them preserve agricultural land. Financial assistance is available for activities such as land acquisition, farmland protection agreements, and land management. Wisconsin FAQs — Farmland Preservation Zoning includes: • Overview • Farmland Preservation Zoning • Wisconsin Farmland Preservation Program • Application Process • Eligibility Criteria • Program Benefits • ResourceFAQs. FAQs

Wisconsin FAQs - Farmland Preservation Zoning

Description

How to fill out Wisconsin FAQs - Farmland Preservation Zoning?

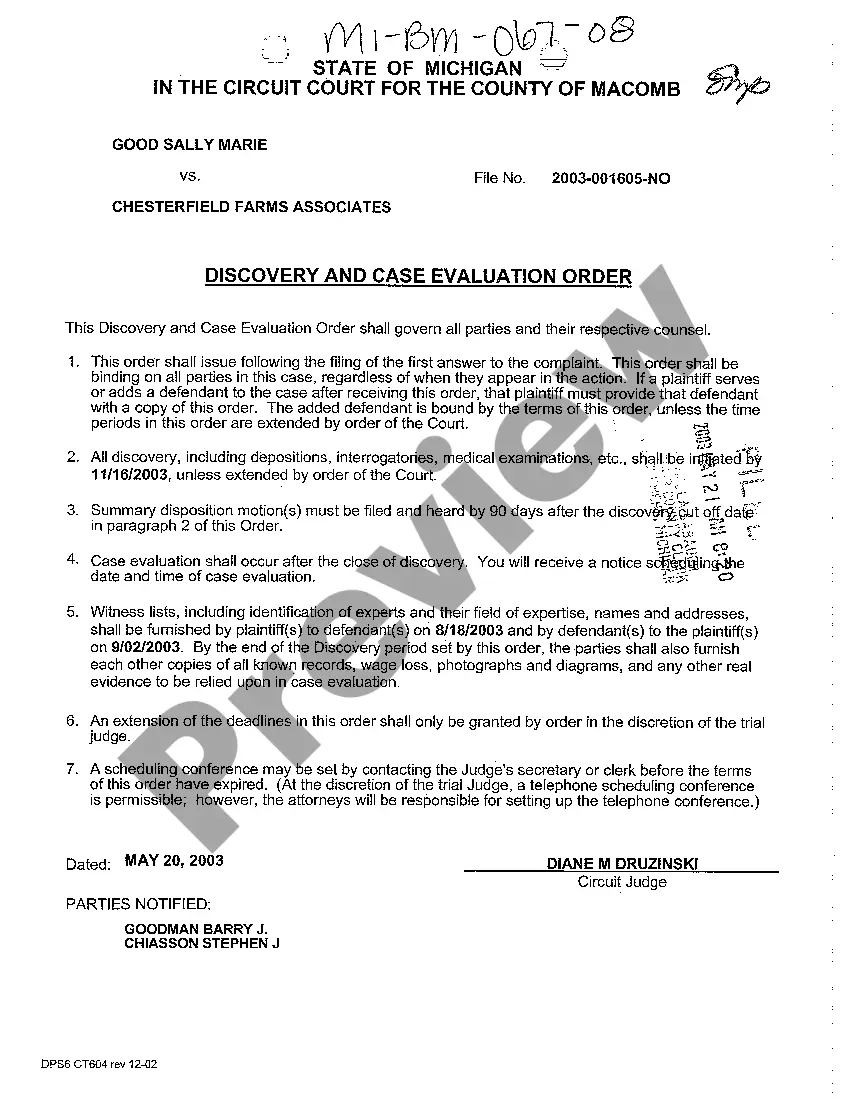

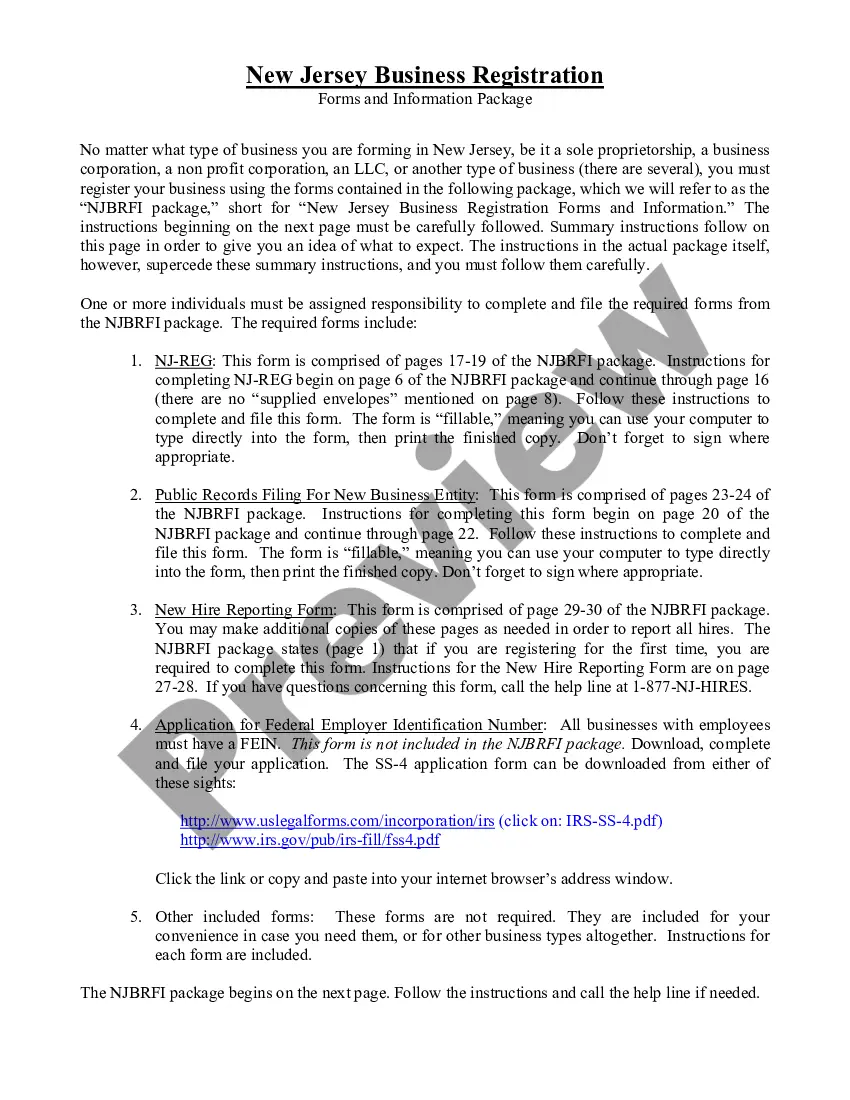

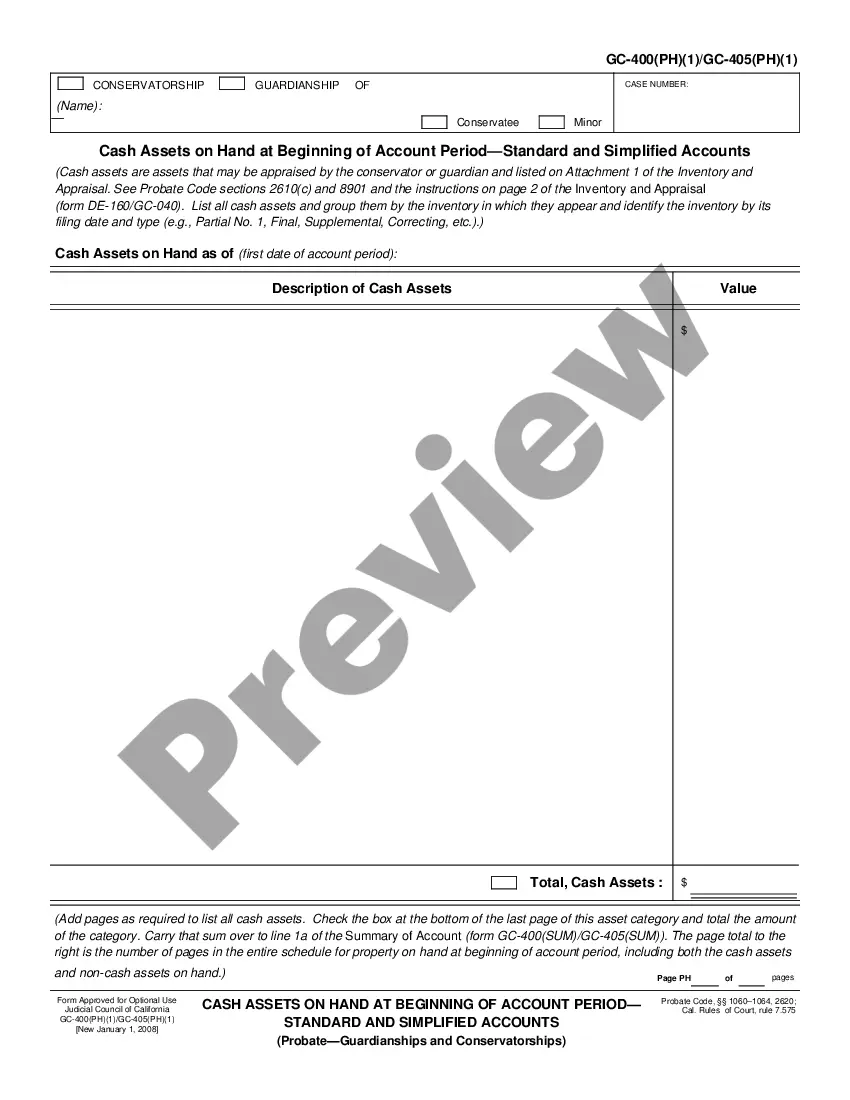

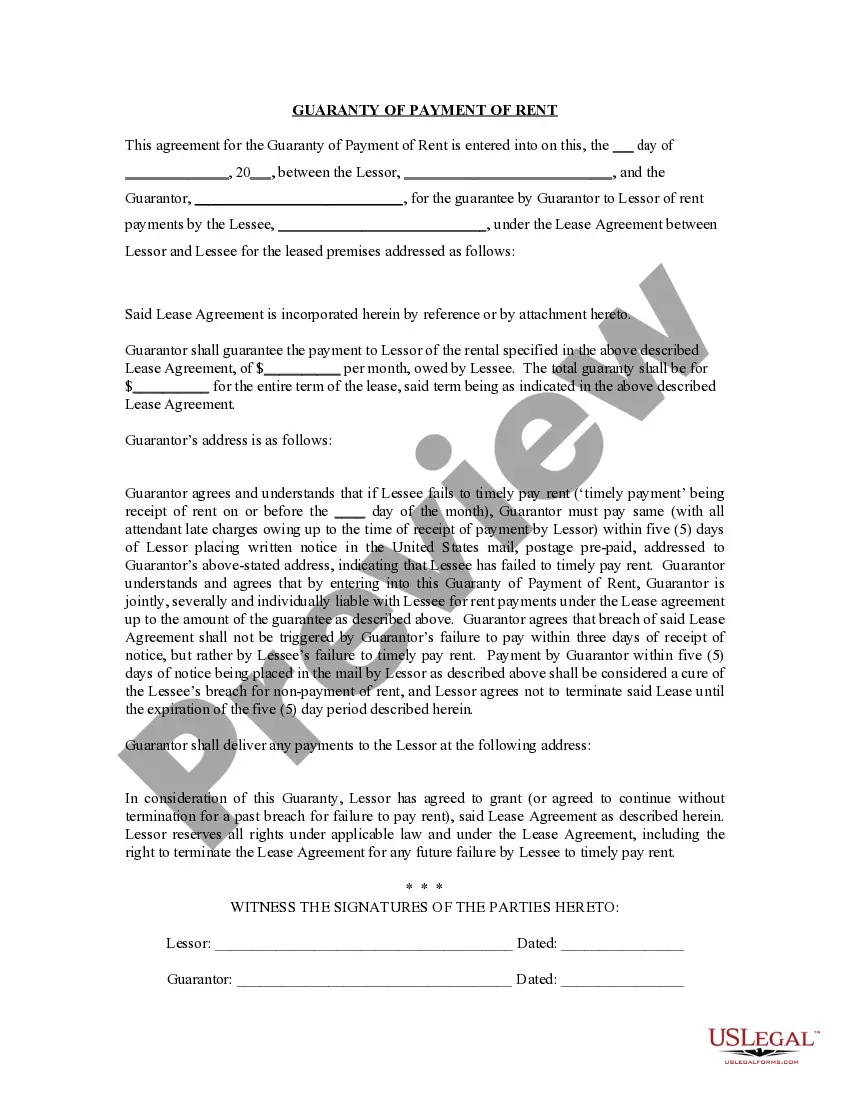

Coping with legal paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Wisconsin FAQs - Farmland Preservation Zoning template from our service, you can be sure it meets federal and state laws.

Dealing with our service is easy and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your Wisconsin FAQs - Farmland Preservation Zoning within minutes:

- Make sure to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Wisconsin FAQs - Farmland Preservation Zoning in the format you prefer. If it’s your first time with our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Wisconsin FAQs - Farmland Preservation Zoning you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Tax Benefits of Turning Your Hobby Into a Business With all the supplies and equipment needed to run your small farm, any potential write-offs are appealing. You can deduct many expenses, including: Farm supplies like feed, fertilizer, seed, and poultry. Labor hired to help out with farm tasks.

????????Wisconsin's Farmland Preservation Program helps farmers and local governments preserve farmland, protect soil and water, and minimize land use conflicts. Through participation in the program: Counties develop farmland preservation plans.

The farmland tax relief credit is also a refundable credit that is provided through the state income tax system. The credit reimbursement rate for net property taxes levied on agricultural land only is established annually by the Department of Revenue (DOR). The maximum allowable credit is $1,500.

Production of the following items qualifies as an agricultural operation: Livestock: Hogs, cattle, sheep, and horses. Dairy. Poultry: A combined total of 20 or more chickens, geese, turkeys or ducks. Fruit: A combined total of 20 or more fruit trees, grapevines, and nut trees.

USDA defines a farm as any place that produced and sold?or normally would have produced and sold?at least $1,000 of agricultural products during a given year. USDA uses acres of crops and head of livestock to determine if a place with sales less than $1,000 could normally produce and sell at least that amount.

You are in the business of farming if you culti- vate, operate, or manage a farm for profit, either as owner or tenant. A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and or- chards and groves.

What does farmland preservation mean? Farms or development easements that are acquired through the Farmland Preservation Program will forever be protected for agricultural use. Landowners who have sold their development rights still can sell their land at any time.

Wisconsin Agricultural Land Wisconsin defines agricultural land as ?land which is devoted primarily to agriculture use? as per Sec. Tax 18, Wis. Adm. Code.