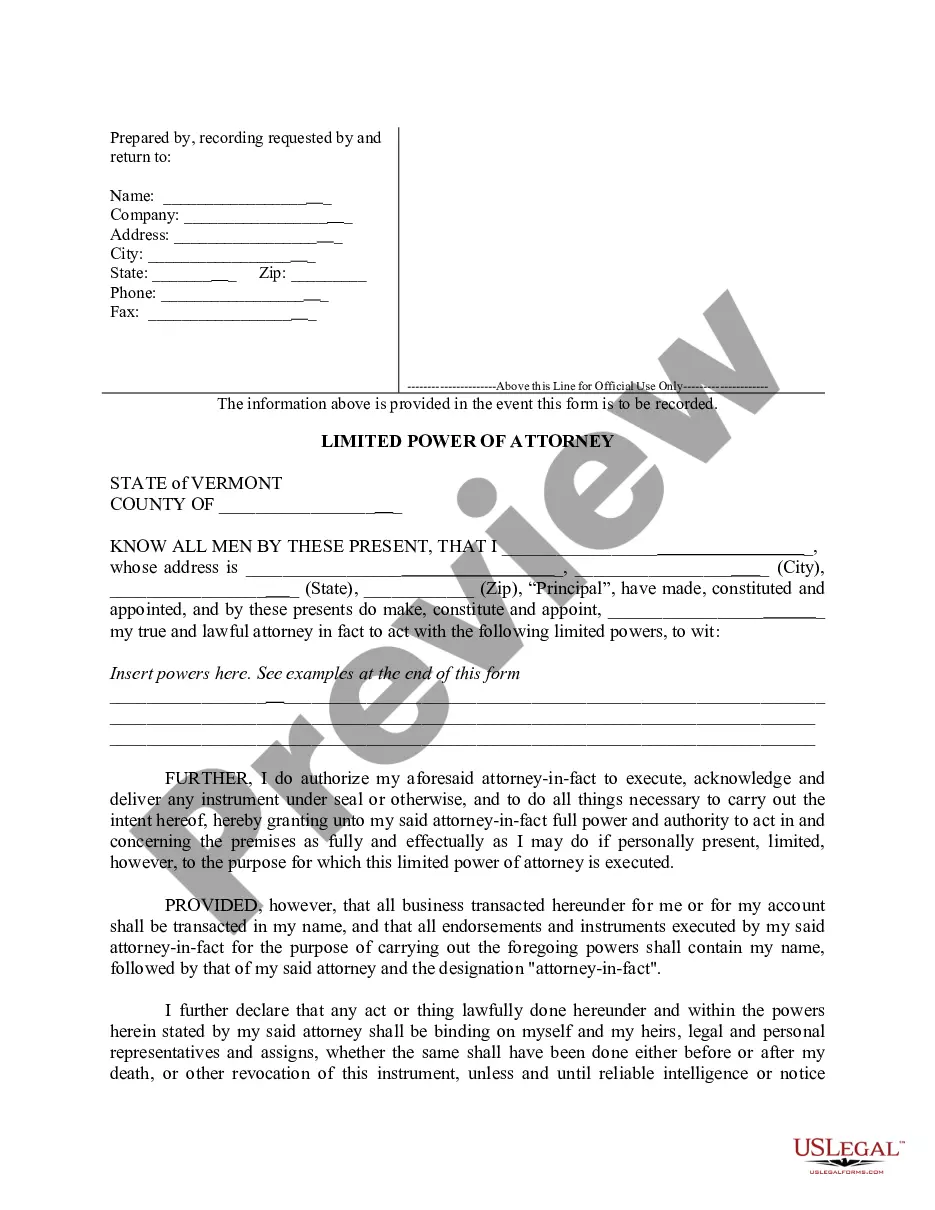

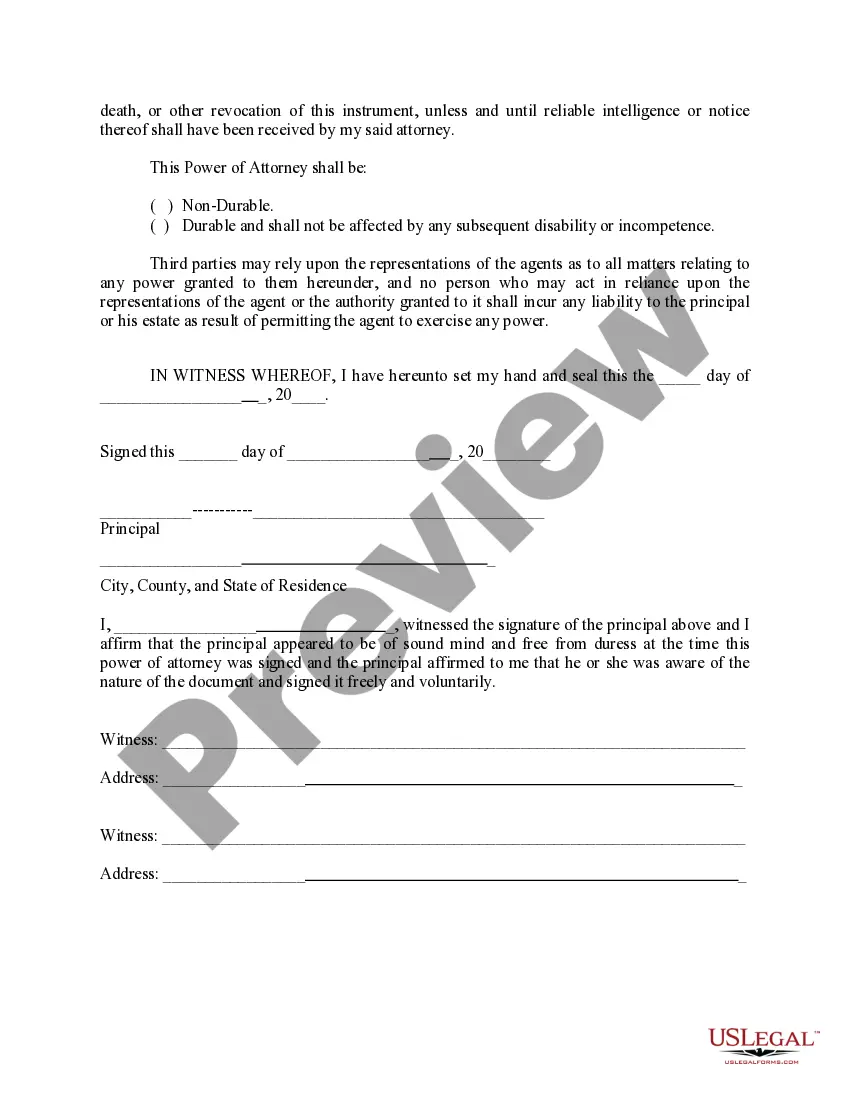

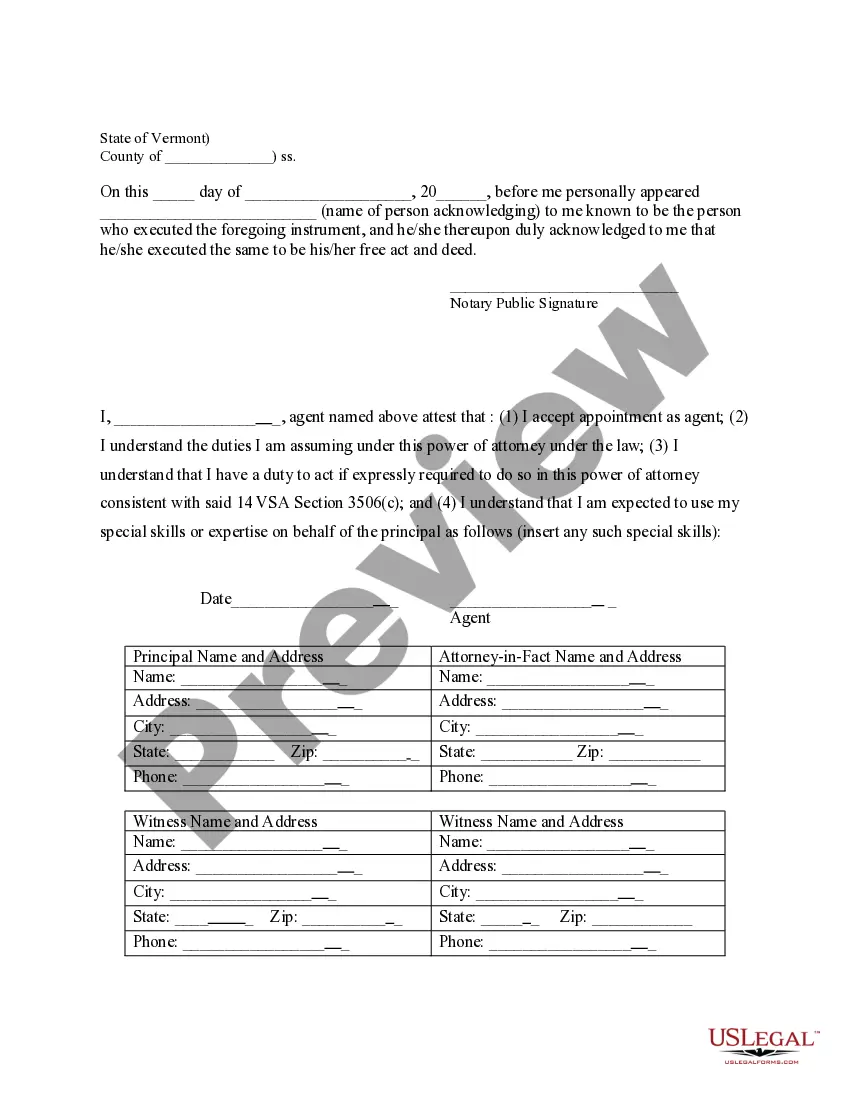

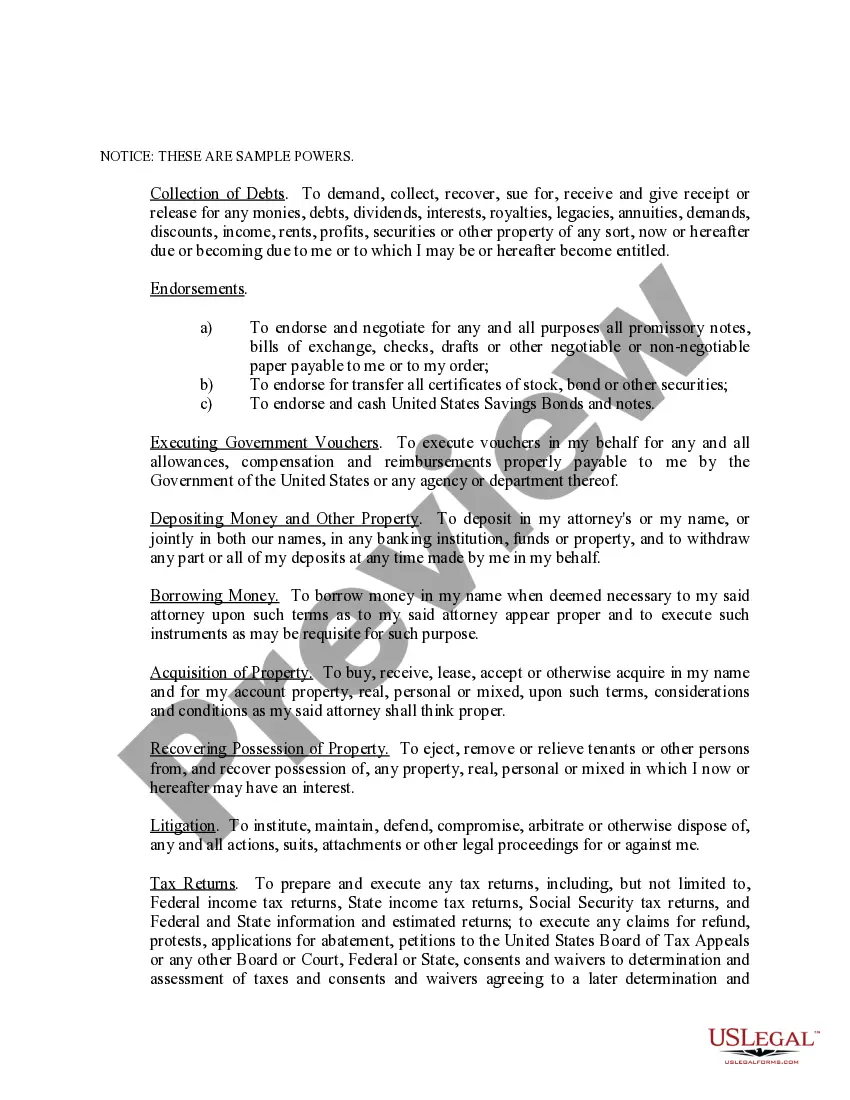

This is a limited power of attorney for the State of Vermont. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

Vermont Power Attorney Form For Taxes

Description

How to fill out Vermont Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

There’s no longer a need to spend hours searching for legal documents to meet your local state obligations. US Legal Forms has gathered all of them in a single location and made them easier to access.

Our platform provides over 85k templates for any business and personal legal matters organized by state and area of application. All forms are well-crafted and validated for authenticity, allowing you to feel confident in acquiring an up-to-date Vermont Power Attorney Form For Taxes.

If you are acquainted with our platform and already possess an account, make sure your subscription is active before accessing any templates. Log In to your account, pick the document, and hit Download. You can also retrieve all previously acquired documents anytime by visiting the My documents section in your profile.

Print your form to complete it by hand or upload the template if you would rather do it in an online editor. Completing official paperwork under federal and state laws and regulations is fast and straightforward with our library. Try US Legal Forms now to maintain your documentation systematized!

- If you’re new to our platform, the process will involve a few more steps to finish.

- Here’s how new users can locate the Vermont Power Attorney Form For Taxes in our collection.

- Review the page content thoroughly to confirm it includes the sample you require.

- Utilize the form description and preview options if available.

- Employ the Search field above to find another sample if the previous one didn’t meet your needs.

- Click Buy Now next to the template title once you discover the right document.

- Choose your desired pricing plan and either register for an account or Log In.

- Complete your subscription payment with a credit card or through PayPal to continue.

- Select the file format for your Vermont Power Attorney Form For Taxes and download it to your device.

Form popularity

FAQ

Form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information. The taxpayer and the tax professional must sign Form 2848. If the tax professional uses the new online option, the signatures on the forms can be handwritten or electronic.

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

If your return is signed by a representative for you, you must have a power of attorney attached that specifically authorizes the representative to sign your return.

As the principal, you must sign the Power of Attorney in the presence of at least one witness and a notary. Most banks and many Vermont town offices have a notary available to sign documents. The Power of Attorney does not go into effect until the agent signs it. The agent's signature does not need to be notarized.

N Assemble any schedules and forms behind your Form 1040/1040A in the order of the "Attachment Sequence No." shown in the upper right hand corner of the schedule or form. For supporting statements, arrange them in the same order as the schedules or forms they support and attach them last.