Power Of Attorney Form Vermont For Car

Description

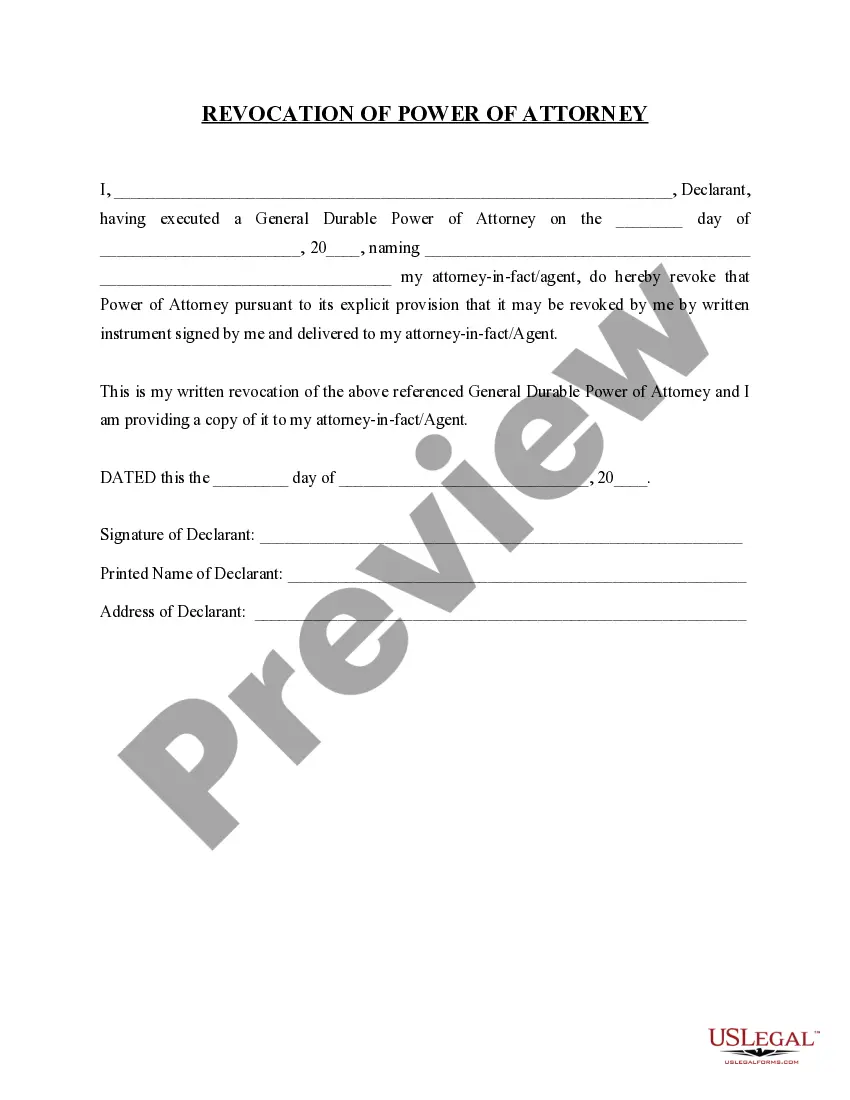

How to fill out Vermont Revocation Of General Durable Power Of Attorney?

Individuals typically link legal documentation with something complex that only a professional can handle.

In a way, it's accurate, as compiling Power Of Attorney Form Vermont For Car requires substantial understanding of topic specifications, including state and municipal laws.

However, with the US Legal Forms, everything has turned more straightforward: readily available legal documents for any personal and business situation tailored to state statutes are gathered in a single online repository and are now accessible to all.

Select a subscription plan that accommodates your needs and budget. Create an account or Log In to proceed to the payment page. Complete your subscription payment via PayPal or with your credit card. Choose the format for your document and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once purchased, they remain stored in your account. You can access them whenever needed through the My documents tab. Experience all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current documents categorized by state and area of use, so searching for Power Of Attorney Form Vermont For Car or any other specific template only takes a few moments.

- Previously registered users with a valid subscription must Log In to their account and select Download to retrieve the form.

- New users will first need to sign up and subscribe before they can download any files.

- Here is the step-by-step guide on how to obtain the Power Of Attorney Form Vermont For Car.

- Review the page content closely to ensure it meets your requirements.

- Examine the form description or view it through the Preview option.

- Search for another template using the Search field above if the previous one doesn't fit your needs.

- Select Buy Now once you locate the correct Power Of Attorney Form Vermont For Car.

Form popularity

FAQ

How to Write1 Download The Vehicle Power Form On This Page.2 Name The Individual Granting This Power.3 Definitively Identify The Vehicle.4 Formally Declare The Agent's Identity.5 Execute With A Notarized Principal Signature.

In the state of Vermont, there are different fees associated with vehicle title transfer. The following are the standard vehicle titling fees and taxes you will owe when you are titling a Vermont vehicle: Original vehicle title: $35. Vehicle title transfer: $35.

Complete the entire Vermont Motor Vehicle Registration, Tax and Title Application (form #VD-119). Be sure to enter the Plate number that you are transferring. You must complete Section 7 of the Vermont Registration Application, or incude your current Vermont Registration with the "Transfer Section" completed.

You need to submit the following documents obtained from the person who is giving you the vehicle (the previous owner):...Registering used vehicle received as a giftProperly assigned titleBill of Sale & Odometer Disclosure Statement (form #VT-005)Gift Tax Exemption (form #VT-013)

A general POA is acceptable for motor vehicle transactions at DMV offices if the POA refers to transactions for all of the "chattels and goods" of the principal. An automobile dealer or employee of any automobile dealer cannot use a general POA to transfer a vehicle.