Loan Participation Agreement Template For Nbfc

Description

How to fill out Participating Or Participation Loan Agreement In Connection With Secured Loan Agreement?

Individuals typically link legal documentation with complexity that only an expert can handle.

In some respects, this is accurate, as creating a Loan Participation Agreement Template For Nbfc requires considerable knowledge of subject matter criteria, including state and county laws.

However, with US Legal Forms, everything has been made more straightforward: pre-prepared legal templates for any personal and business situation specific to state regulations are compiled in a single online repository and are now accessible to all.

All templates in our library are reusable: once obtained, they remain stored in your profile. You can access them whenever needed through the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents categorized by state and area of application, making it quick to search for Loan Participation Agreement Template For Nbfc or any other specific example.

- Existing registered members with an active subscription must sign in to their account and click Download to obtain the document.

- Individuals new to the service will need to create an account and subscribe before they can save any documentation.

- Here’s a comprehensive guide on how to obtain the Loan Participation Agreement Template For Nbfc.

- Examine the content on the page thoroughly to confirm it meets your requirements.

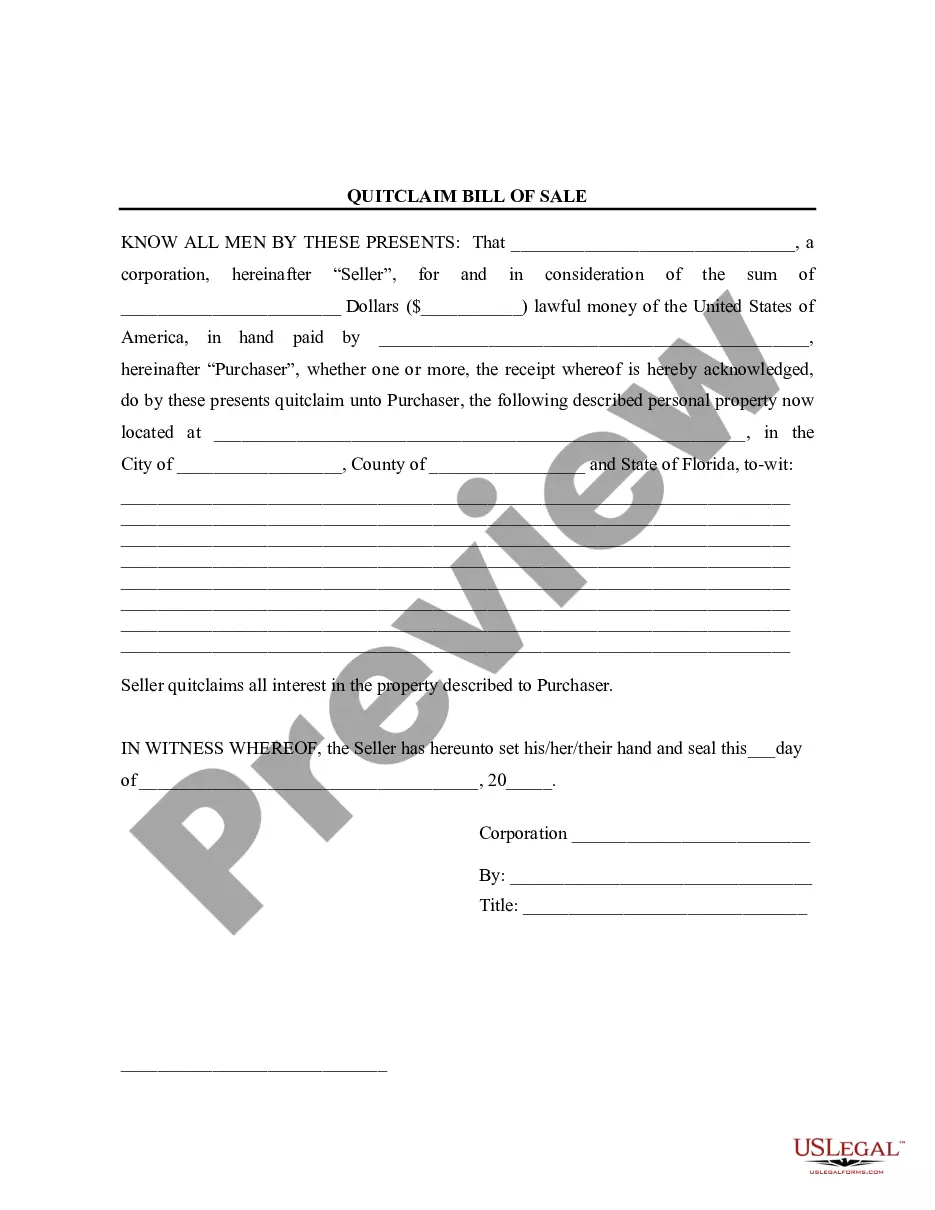

- Review the form description or check it using the Preview function.

- Search for an alternative sample using the Search field above if the previous option does not satisfy your needs.

- Click Buy Now when you locate the suitable Loan Participation Agreement Template For Nbfc.

- Select the subscription plan that fits your needs and budget.

- Create an account or sign in to continue to the payment page.

- Make your subscription payment using PayPal or with your credit card.

- Select the format for your document and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

Generally, participation agreements involve one or more participants who purchase an interest in the underlying loan, but a single lender, the lead lender, retains control over the loan and manages the relationship with the borrower.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

That summary should have two goals:Summarize in as few words as possible all of the future requirements the company must follow, based on potentially likely events, and.For each area summarized, to also note specifically where in the agreement one would go to find out more information when needed.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

Participation mortgages reduce the risk to participants and allow them to increase their purchasing power. Many of these mortgages, therefore, tend to come with lower interest rates, especially when multiple lenders are also involved.