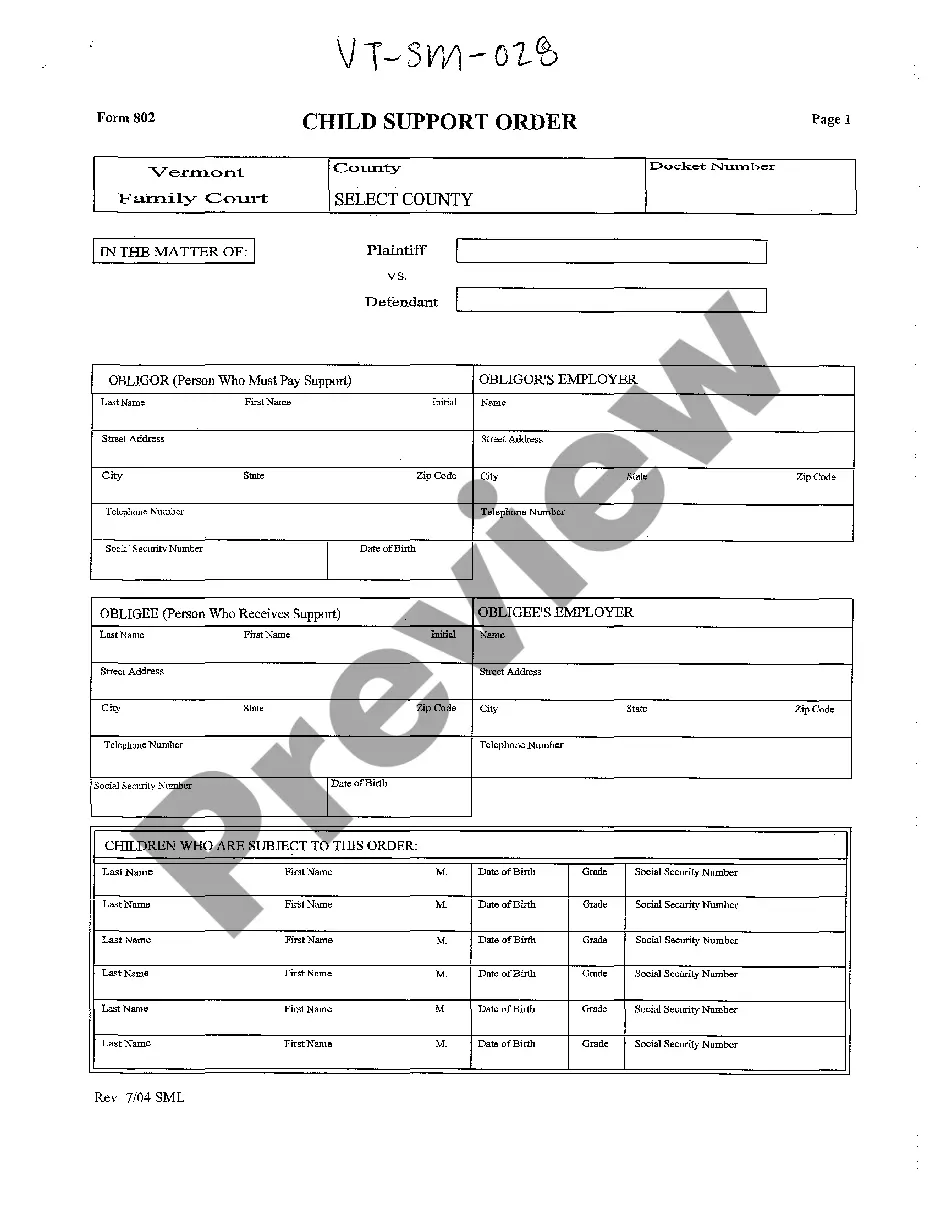

This is a Child Support Order to be used in the State of Vermont. This document is used by the Court to detail the specific findings regarding the amount of child support to be paid and the terms of the award.

Child Support In Vermont Withholding Limits

Description

How to fill out Vermont Child Support Order?

There’s no longer a need to invest time seeking legal documents to meet your local state requirements. US Legal Forms has gathered all of them in one location and made them easily accessible.

Our platform provides over 85,000 templates for any business and personal legal matters categorized by state and area of application. All forms are expertly drafted and validated for authenticity, so you can be confident in obtaining the current Child Support In Vermont Withholding Limits.

If you are accustomed to our platform and already possess an account, you must ensure that your subscription is active prior to acquiring any templates. Log In to your account, choose the document, and click Download. You can also return to all saved documents at any time by accessing the My documents tab in your profile.

Print your form to fill it out manually or upload the template if you prefer to do it in an online editor. Preparing formal documents under federal and state regulations is swift and straightforward with our library. Experience US Legal Forms today to maintain your documentation organized!

- If you have not interacted with our platform before, the procedure will necessitate a few additional steps.

- Examine the page content closely to make sure it contains the sample you need.

- To do this, utilize the form description and preview options if available.

- Employ the search bar above to look for another template if the one currently displayed does not meet your needs.

- Click Buy Now adjacent to the template name when you locate the suitable one.

- Choose the desired pricing plan and either register for an account or Log In.

- Complete the payment for your subscription using a credit card or via PayPal to advance.

- Select the file format for your Child Support In Vermont Withholding Limits and download it onto your device.

Form popularity

FAQ

Child support does not automatically stop after having more children. In Vermont, each child usually has a separate support obligation, which can be affected by family size and individual circumstances. If a parent is facing changes in their financial situation, adjustments may be requested through the court. Understanding child support in Vermont withholding limits will help you ensure proper coverage for all your children.

In Vermont, child support typically ends at 18, but this isn't always the case. If a child is still enrolled in high school or has special circumstances, the obligation may continue. Parents should keep communication open regarding educational needs and court orders to avoid misunderstandings. Knowing the child support in Vermont withholding limits helps in planning your budget effectively.

Child support calculations in Vermont are based on both parents' incomes and the needs of the child. The state uses a formula that considers factors such as healthcare costs, childcare expenses, and parenting time. It’s essential to accurately report all relevant income to ensure a fair calculation. For guidance, using resources like USLegalForms can clarify your rights and responsibilities regarding child support in Vermont withholding limits.

In the United States, child support typically ends when a child reaches the age of 18, but this can vary by state. In Vermont, support obligations may extend beyond 18 if the child is still in high school or has special needs. It's crucial to consult local laws, as these regulations can affect the timing of your payments. Familiarizing yourself with child support in Vermont withholding limits will ensure you stay compliant.

Child support does not automatically stop during the summer. In Vermont, support obligations continue until the court modifies the order or the child becomes emancipated. It's important for parents to stay informed about their obligations throughout the year, including summer months, especially if children have varying needs. Understanding child support in Vermont withholding limits can help you manage your finances.

The lowest amount of child support can differ by state, often established by a state guideline based on the non-custodial parent's income. This amount usually ensures that the essential needs of the child are met. In the context of child support in Vermont withholding limits, it's vital to understand how these minimums impact your overall financial layout. Utilizing services from uSlegalforms can streamline this process and provide clarity.

In Mississippi, the minimum child support varies based on the number of children needing support and the non-custodial parent's income. The court typically applies a formula that considers these factors to determine a fair amount. It's crucial to note how these calculations relate to child support in Vermont withholding limits, as they provide a basis for invoicing and managing payments. For precise calculations or crafting agreements, uSlegalforms can be a helpful platform.

Minnesota law on child support sets clear guidelines for determining payment amounts based on parental income and needs of the child. Generally, courts use a formula that considers the income of both parents and the child's requirements. Thus, understanding these laws is essential, especially if you seek to understand child support in Vermont withholding limits. You can explore relevant resources to ensure compliance and fair support agreements.

To deduct child support from payroll, start by obtaining the necessary withholding order from the court. This document outlines the specific amount to be deducted based on the child support in Vermont withholding limits. Next, communicate with your payroll department to ensure they understand the deduction requirements. With effective payroll management systems, such as those available on USLegalForms, you can streamline the process to ensure compliance and accuracy.

The maximum child support amount in Vermont is determined by a formula based on the non-custodial parent's income and specific state guidelines. Each case is unique, so it's important to consult resources or legal advice to understand how this applies to you. Being aware of the maximum limit can help you better navigate child support in Vermont withholding limits and ensure fair contributions.