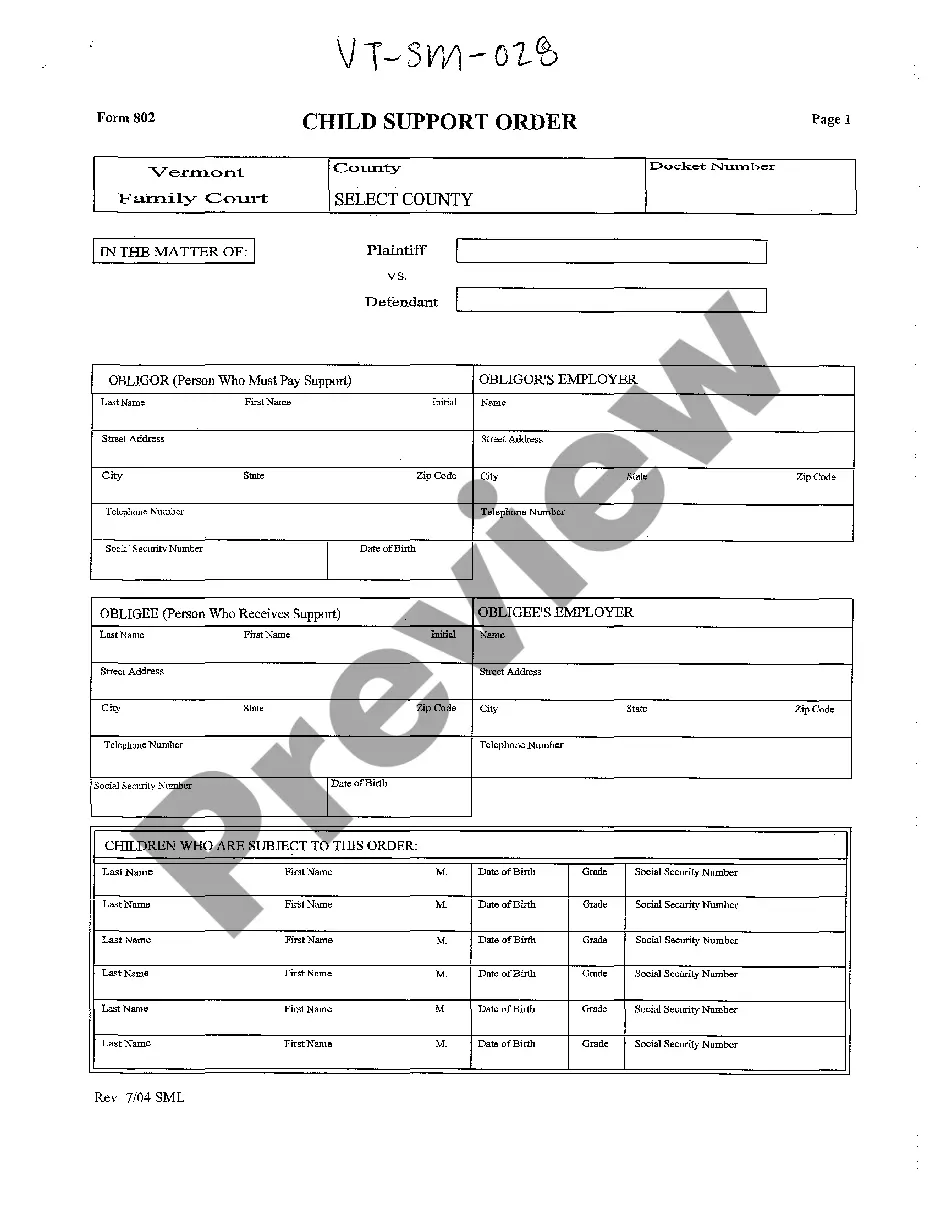

This is a Child Support Order to be used in the State of Vermont. This document is used by the Court to detail the specific findings regarding the amount of child support to be paid and the terms of the award.

Child Support In Vermont Withholding Calculator

Description

How to fill out Vermont Child Support Order?

Individuals typically link legal documents with something intricate that only an expert can manage. In some respect, this is accurate, as creating a Child Support In Vermont Withholding Calculator necessitates significant knowledge of the subject matter, including state and county laws.

However, with US Legal Forms, everything has become more attainable: ready-made legal templates for various life and business situations according to state regulations are gathered in one online library and are now accessible to everyone.

US Legal Forms provides over 85,000 current forms categorized by state and application area, making the search for Child Support In Vermont Withholding Calculator or any specific template quick and easy.

All templates in our collection are reusable: once purchased, they remain stored in your account. You can access them any time needed via the My documents tab. Explore all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- Review the page content carefully to verify it meets your requirements.

- Read the form description or view it through the Preview option.

- Search for another template via the Search bar in the header if the previous one doesn't fulfill your needs.

- Click Buy Now when you locate the appropriate Child Support In Vermont Withholding Calculator.

- Select a pricing plan that aligns with your needs and budget.

- Register for an account or Log In to move forward to the payment page.

- Make your payment via PayPal or with a credit card.

- Choose the format for your file and click Download.

- Print your document or import it to an online editor for quicker completion.

Form popularity

FAQ

To calculate your adjusted gross income, start by summing up all your income sources, including wages, bonuses, and investment earnings. After totaling these amounts, subtract allowable deductions like retirement plan contributions and certain business expenses. This process is essential, especially when you plan to use the child support in Vermont withholding calculator, as it directly affects your child support obligations.

The biggest factor in calculating child support is usually the income of both parents, along with the needs of the child. State guidelines consider various elements, including healthcare costs, education expenses, and the standard of living. By accurately assessing these factors, the child support in Vermont withholding calculator can provide a fair estimate to support your child's needs.

To gross up your child support income, add back any deductions that may have reduced your income for child support calculations. By adjusting your income figure, you can estimate how such factors affect your overall child support obligations. You can use the child support in Vermont withholding calculator to see how these adjustments impact the final amount.

Adjusted gross income for child support is the amount of income calculated after specific deductions are taken into account. It encompasses total earnings minus reductions like retirement contributions, alimony, and certain business expenses. Understanding this figure is essential when using the child support in Vermont withholding calculator, as it directly impacts your support payments.

To file for child support in Vermont, start by obtaining the necessary forms from the court or online. After filling them out, submit your forms along with any required documentation to the family court. A child support in Vermont withholding calculator can assist you in determining the correct support amount to request. Following submission, a hearing will be scheduled to finalize the support order.

Calculating adjusted gross income involves adding all sources of income and then subtracting specific deductions allowed by Vermont law. This figure is crucial as it impacts child support calculations. Using a child support in Vermont withholding calculator can simplify this process by providing clear estimations based on your financial details. Ensure you include all relevant income to get an accurate calculation.

The best way to file for child support is to gather all necessary documents, including proof of income and living expenses. Using a child support in Vermont withholding calculator allows you to calculate the support amount fairly. You can file your petition in person at your local Family Court or online, depending on available options. Always consider seeking legal advice to navigate the process smoothly.

Back child support refers to payments that have not been made in the past. In Vermont, courts may allow you to collect overdue payments through various means, including wage garnishment. Utilizing a child support in Vermont withholding calculator can help estimate the total owed. It's important to stay proactive and work with the court to set up a repayment plan that suits your situation.

To order child support in Vermont, you need to file a motion with the court. You can customize your request by using a child support in Vermont withholding calculator, which helps determine the appropriate amount based on specific factors. Once you submit your motion, a hearing will take place to establish the child support order. It is beneficial to consult with a legal professional to ensure the process meets your needs.

The maximum amount that can be withheld for child support in Vermont is subject to federal and state guidelines, typically around 50-60% of disposable income for families with multiple support orders. This can vary based on individual circumstances, making it essential to use a Child support in Vermont withholding calculator to determine the specific withholding limit applicable to your case.