Vermont Failure Reasonable For Limitations

Description

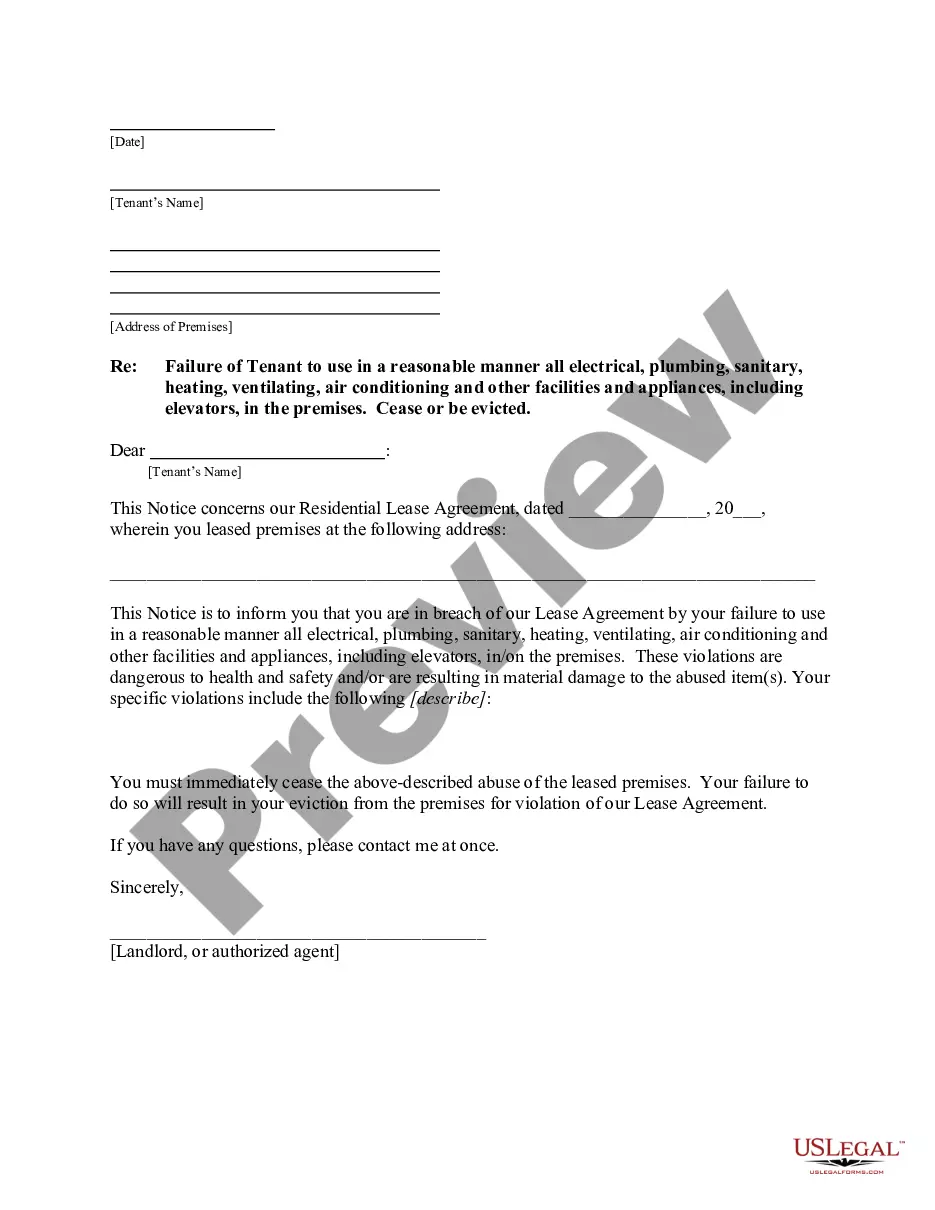

How to fill out Vermont Letter From Landlord To Tenant For Failure To Use Electrical, Plumbing, Sanitary, Heating, Ventilating, Air Conditioning And Other Facilities In A Reasonable Manner?

- For returning users, log in to your account and ensure your subscription is active. Click on the Download button for the required template.

- If you're new to US Legal Forms, start by previewing the form's description to confirm it's suitable for your needs and complies with local jurisdiction.

- Search for alternative templates if necessary using the Search tab if the selected document does not meet your criteria.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You'll need to create an account for full access.

- Complete your payment using your credit card or PayPal, and make sure your transaction is confirmed.

- Finally, download the form to your device for completion, and access it anytime in the My Forms section of your profile.

US Legal Forms provides an invaluable resource for individuals and attorneys, allowing for seamless execution of legal documents. With over 85,000 editable forms, users benefit from an extensive library that surpasses competitors' offerings.

Leverage the expertise of premium professionals for assistance with form completion to ensure compliance and accuracy. Start simplifying your legal process today with US Legal Forms!

Form popularity

FAQ

Crimes such as murder, aggravated murder, and certain sexual assaults have no statute of limitations in Vermont. This allows victims to seek justice at any time, regardless of when the crime occurred. Being informed about these laws can help individuals avoid any Vermont failure reasonable for limitations in seeking legal recourse.

In Vermont, certain serious crimes are exempt from the statute of limitations, including homicide and certain sexual offenses. This means that there is no time limit to bring charges for these crimes. Understanding these exceptions can help prevent a Vermont failure reasonable for limitations when dealing with severe offenses.

The statute of limitations in Vermont varies based on the type of claim. For personal injury, it is generally three years, while for property damage, it’s six years. Being aware of these timelines is crucial to preventing any Vermont failure reasonable for limitations when considering legal action.

In Vermont, the 7 year statute of limitations applies to most civil actions, including contracts and debt collection cases. This means you have seven years from the date of the incident to file a lawsuit. Knowing this timeframe helps individuals avoid any Vermont failure reasonable for limitations that could jeopardize their legal rights.

The 183 day rule in Vermont determines how long a resident must stay in the state to be considered a resident for tax purposes. If you reside in Vermont for more than 183 days within a year, you may face state taxes on your income. Understanding this rule is essential to avoid any Vermont failure reasonable for limitations regarding your tax obligations.

Yes, Vermont has a statute of limitations that applies to various legal actions, including debt collection, which is six years for most debts. This legal framework helps protect consumers, ensuring that old debts cannot be pursued indefinitely — a key point of the Vermont failure reasonable for limitations. Understanding this can help you manage your financial obligations more effectively. For detailed information and assistance, uslegalforms can offer support tailored to your needs.

Generally, a debt becomes uncollectible in Vermont after six years of inactivity, aligning with the Vermont failure reasonable for limitations. After this timeframe, creditors cannot take legal action against you. However, unpaid debts can remain on your credit report, affecting your credit score. If you're unsure about your debts, uslegalforms provides tools and templates to help you assess your situation effectively.

In Vermont, the statute of limitations for most types of debt collection is six years. After this period, creditors lose the legal ability to sue you for unpaid debts, reflecting the concept of Vermont failure reasonable for limitations. It’s important to note that while a debt becomes legally uncollectible, collectors may still attempt to contact you. Utilize resources from uslegalforms to understand your rights and options better.

The 777 rule is a guideline related to how debt collectors should manage communication with you. It typically suggests that collectors can only contact you seven times within a seven-day period before facing potential legal issues. Understanding this can empower you when dealing with debt collectors, especially when considering the Vermont failure reasonable for limitations. Tools like uslegalforms can provide valuable resources to navigate these interactions.

In Vermont, a debt may be considered written off after a certain period, typically six years for most types of unsecured debt, due to the Vermont failure reasonable for limitations. This means creditors cannot legally enforce the collection of the debt via the courts. However, keep in mind that the debt could still exist, and collectors may continue to seek payment unless you formally dispute it. Seeking guidance from uslegalforms can help clarify your situation.