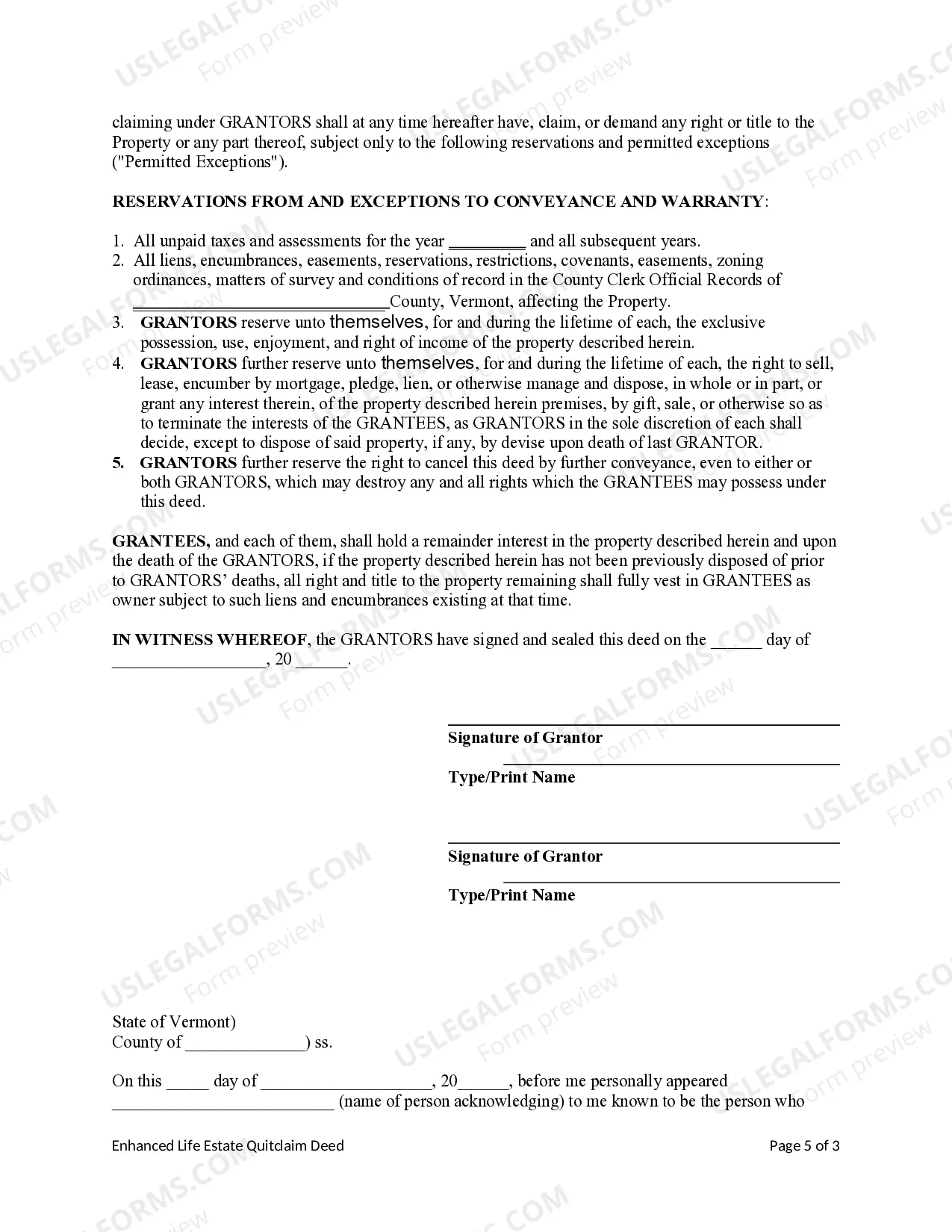

Enhanced Life Estate Deed Example

Description

How to fill out Vermont Enhanced Life Estate Deed (a.k.a. Lady Bird Deed) From Two Individuals / Husband And Wife To Two Individuals / Husband And Wife.?

Creating legal documents from the ground up can frequently be overwhelming.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more affordable method to generate Enhanced Life Estate Deed Example or any other forms without unnecessary hurdles, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms covers nearly every facet of your economic, legal, and personal matters. With just a few clicks, you can swiftly obtain compliant forms tailored for you by our legal experts.

However, before proceeding to download the Enhanced Life Estate Deed Example, adhere to these suggestions: Review the document preview and descriptions to confirm that you are selecting the correct form. Ensure that the template you choose meets the standards of your state and county. Opt for the most suitable subscription plan to purchase the Enhanced Life Estate Deed Example. Download the file, then complete, sign, and print it out. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make document execution a straightforward and efficient process!

- Utilize our website whenever you require a dependable service to easily discover and download the Enhanced Life Estate Deed Example.

- If you’re an existing user and have previously created an account with us, simply Log In to your account, choose the template, and download it, or re-download it later from the My documents section.

- Don’t have an account? No problem.

- Setting it up takes minimal time, allowing you to browse the library.

Form popularity

FAQ

While you can file a transfer on death deed without a lawyer, consulting one can simplify the process. A legal expert can provide valuable insights and ensure that all the requirements for your enhanced life estate deed example are met. They can also help clarify any potential issues that may arise during the filing process. Using US Legal Forms can support you in preparing the necessary documents efficiently.

Drafting an enhanced life estate deed involves clearly stating the grantor's intention to create a life estate. Start with the property description, followed by the names of the beneficiaries who will receive the property after the life tenant passes away. You can use templates available on platforms like US Legal Forms to guide you through proper formatting and legal requirements. This ensures the enhanced life estate deed example meets local regulations.

Typically, the life tenant is responsible for paying property taxes associated with a life estate deed during their lifetime. However, once the life tenant passes away, the responsibility can shift to the remainderman. Understanding these tax obligations is essential as they can affect the overall financial planning of the estate. Using an enhanced life estate deed example can clarify these responsibilities and help ensure compliance with tax regulations.

One significant disadvantage of a life estate deed is the potential for unanticipated tax liabilities for beneficiaries after the property owner passes away. Additionally, the life tenant cannot sell or transfer the property without the remainderman's consent, which can create obstacles in managing the property. Furthermore, any liens placed on the property can affect all parties involved. Evaluating the downsides is crucial when considering an enhanced life estate deed example.

Enhanced life estate deeds are recognized in several states, including Florida, Massachusetts, and North Carolina. Each state may have specific regulations and requirements, so it is essential to verify your local laws. Consulting a legal expert familiar with property deeds can enhance your understanding of these variations. An enhanced life estate deed example serves as a reliable guide when navigating the nuances across different jurisdictions.

People create life estates to ensure their property passes to specific beneficiaries upon their death while retaining control during their lifetime. This arrangement can help avoid extensive probate processes, making it easier and faster for heirs to inherit property. Additionally, an enhanced life estate deed example allows the original owner to potentially reduce estate taxes, making it a strategic choice for many. This configuration balances control and transferability efficiently.

A life estate can create complications for property management, particularly if multiple parties are involved. For example, a beneficiary may have limited control over the property decisions, leading to potential conflicts. Additionally, once the life tenant passes away, the property automatically transfers to the remainderman, which can limit flexibility in estate planning. Understanding these factors can help you navigate an enhanced life estate deed example effectively.

Alabama does not recognize transfer on death deeds; however, it does allow the use of enhanced life estate deeds. An enhanced life estate deed allows property owners to retain control of their property while designating beneficiaries to receive it after their death. This method simplifies the transfer process and avoids the lengthy probate proceedings. To explore an enhanced life estate deed example and understand how it compares to other options, visit the US Legal Forms platform for comprehensive resources and templates.

An example of an enhanced life estate deed includes a property owner designating their home to their children, retaining the right to live there for life, with the property automatically passing to the children after death. This arrangement allows the parent to maintain life use while providing peace of mind regarding property transfer. For individuals seeking to navigate this type of deed, examining an enhanced life estate deed example can provide clarity in structuring such agreements.

While life estate deeds offer advantages, they also have drawbacks. One major issue is that the life tenant cannot sell or mortgage the property without the agreement of the beneficiaries, limiting financial flexibility. Additionally, since ownership automatically transfers to the beneficiaries upon death, this could lead to complications, especially if the beneficiaries are not in harmony. Understanding these issues becomes easier with clear examples of enhanced life estate deeds.