Vehicle Promissory Note Without Interest Tax Implications

Description

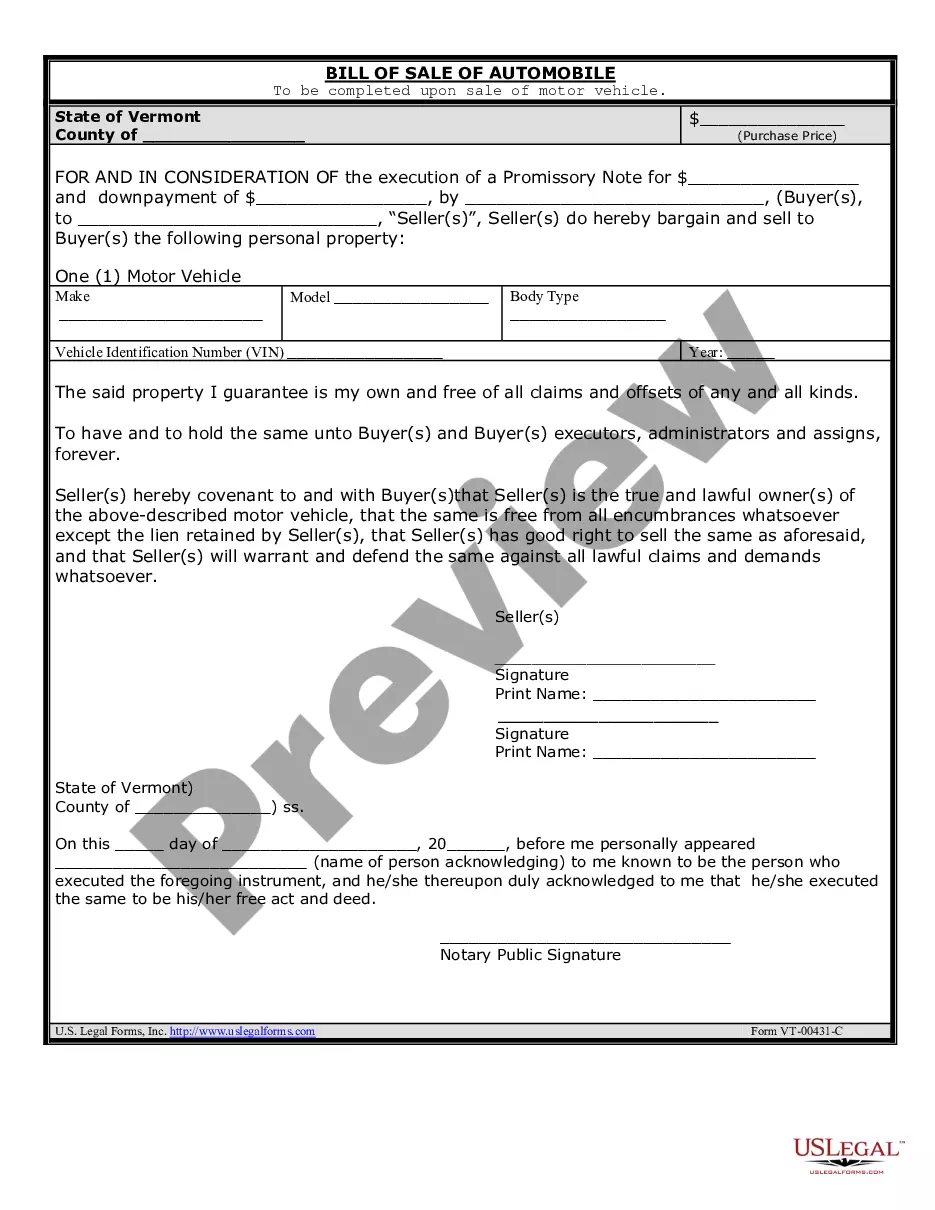

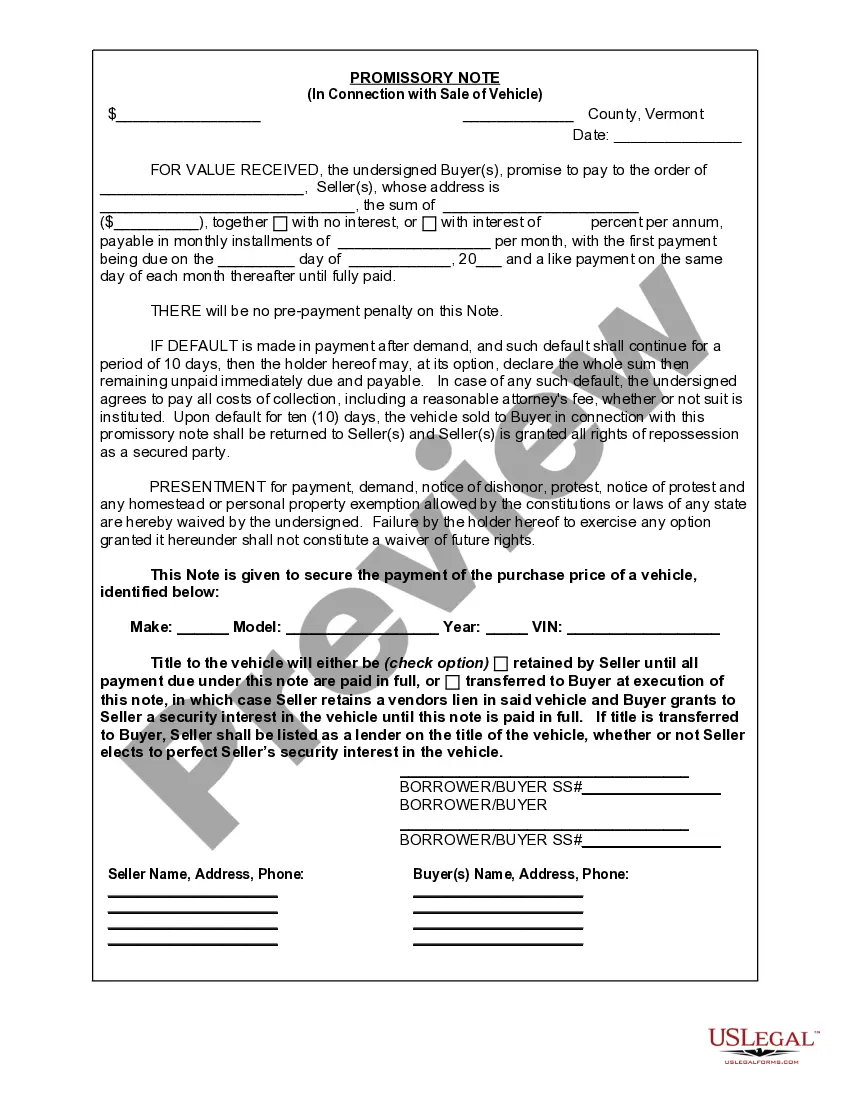

How to fill out Vermont Promissory Note In Connection With Sale Of Vehicle Or Automobile?

There's no longer any need to spend time searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our website offers over 85k templates for various business and personal legal situations categorized by state and usage area.

Completing official paperwork under federal and state regulations is quick and easy with our platform. Try US Legal Forms now to keep your documentation organized!

- All forms are professionally crafted and verified for accuracy, so you can be confident in obtaining an up-to-date Vehicle Promissory Note Without Interest Tax Implications.

- If you are acquainted with our platform and already possess an account, ensure your subscription is valid before acquiring any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documents whenever necessary by accessing the My documents section in your profile.

- If you have never utilized our platform before, the process will require a few additional steps to complete.

- Here's how new users can find the Vehicle Promissory Note Without Interest Tax Implications in our library.

- Examine the page content closely to confirm it includes the sample you require.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

Generally, any income you generate from a promissory note is taxable income and must be reported. The income generated is simply the interest you earned on the note for the tax year in question. If you lent the money personally rather than through your business, report the income on your personal income tax return.

The buyer doesn't want to have to pay interest, and the seller feels funny asking for it, so they agree, no interest. Unfortunately, the IRS may impute interest received to the seller, even if the parties agreed to zero interest or a rate below the IRS' published rates.

If you are paying the promissory interest and this is a personal loan, you can't deduct the interest. According to the IRS, only a few categories of interest payments are tax-deductible: Interest on home loans (including mortgages and home equity loans) Interest on outstanding student loans.

A simple promissory note will state the full amount is due on the stated date; you won't need a payment schedule. You can decide whether to charge interest on the loan amount and include the interest in the document if needed.

If you are receiving the promissory interest, enter it as if you received form 1099-INT. In the Received from box, you may enter Promissory Note Interest Income and the name and any tax ID, if you have it. Only the amount is required however.