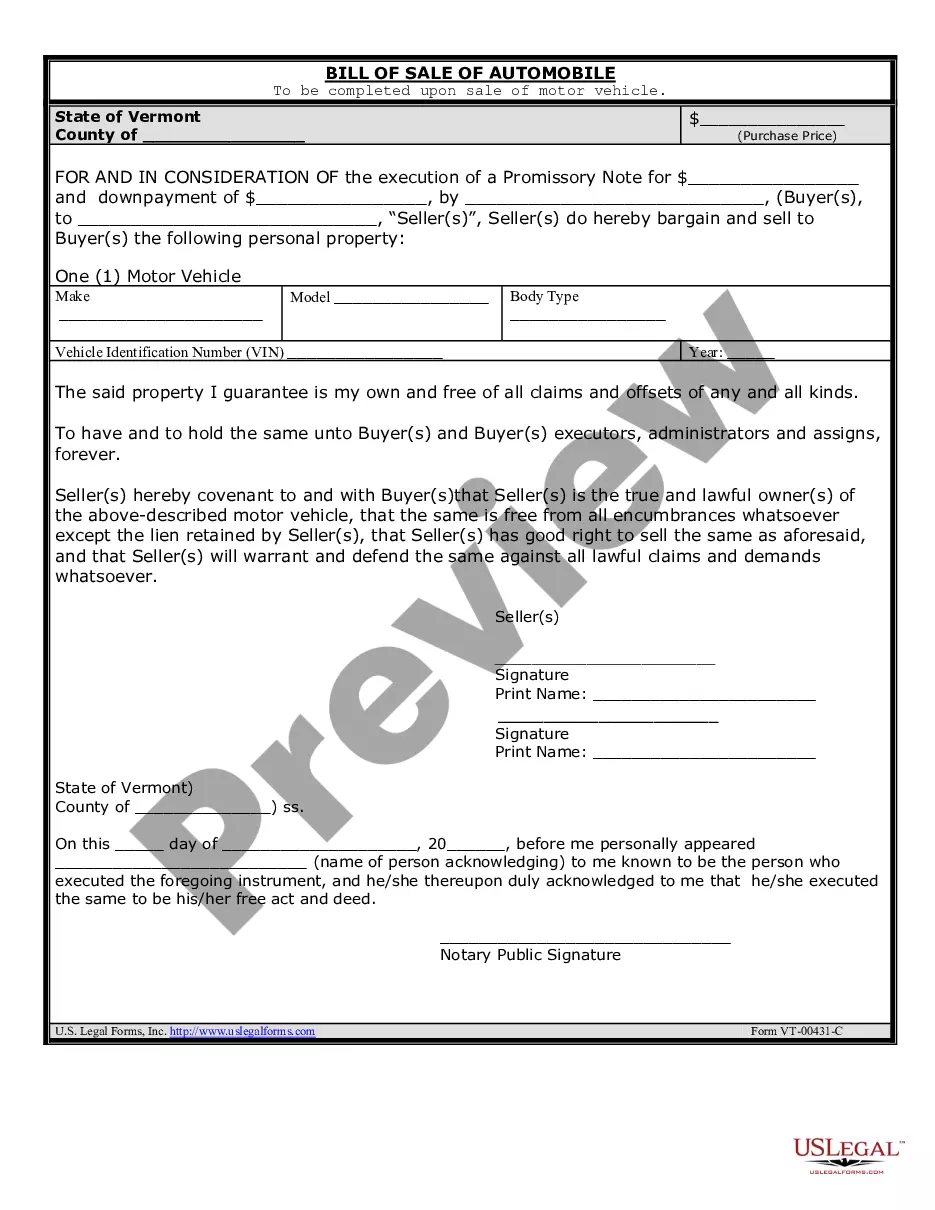

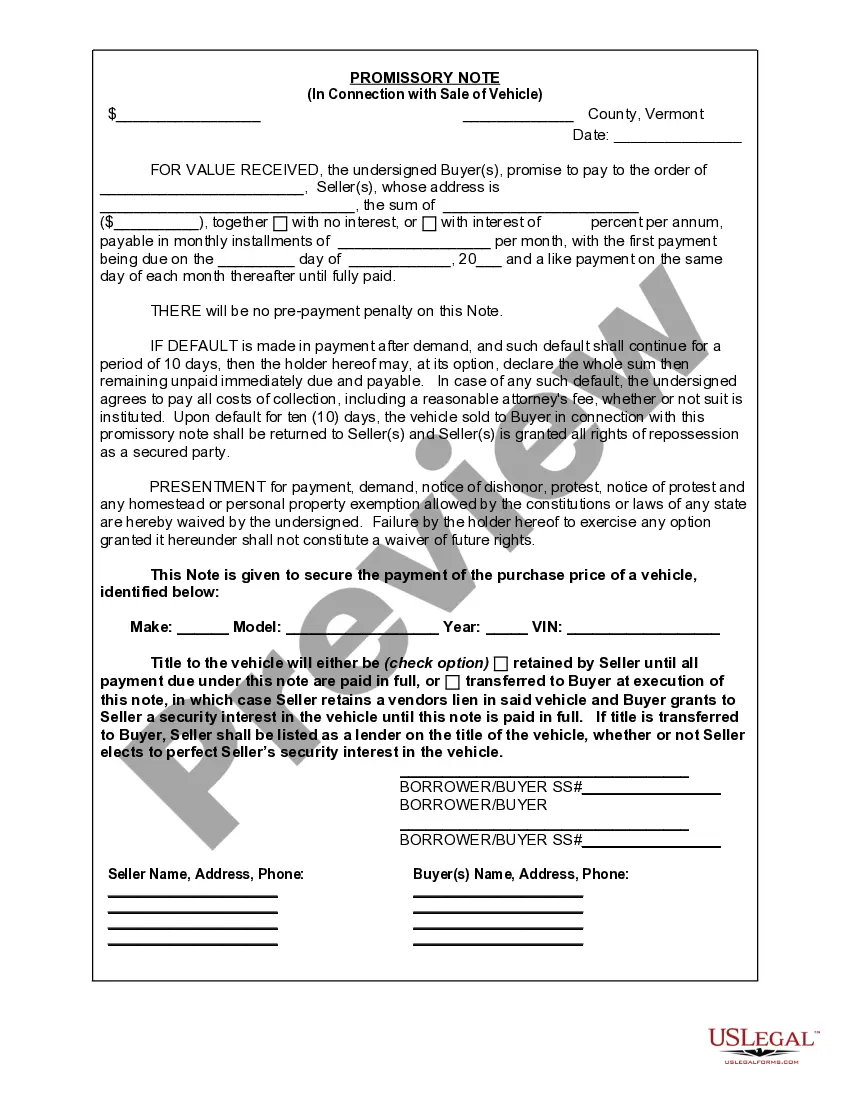

Vehicle Promissory Note With Collateral

Description

How to fill out Vermont Promissory Note In Connection With Sale Of Vehicle Or Automobile?

When you need to finalize a Vehicle Promissory Note With Collateral that adheres to your local state's statutes and guidelines, there can be numerous options to select from.

There's no need to review every document to verify it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

Navigate through the suggested page and verify its alignment with your needs.

- US Legal Forms is the most comprehensive online directory with a compilation of over 85k ready-to-use documents for business and personal legal situations.

- All templates are confirmed to comply with each state's regulations.

- Thus, when downloading a Vehicle Promissory Note With Collateral from our site, you can be assured that you have a valid and up-to-date document.

- Acquiring the necessary sample from our platform is remarkably simple.

- If you already possess an account, just Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can access the My documents section in your profile and retrieve the Vehicle Promissory Note With Collateral whenever needed.

- If it is your first time using our library, please follow the instructions below.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

It is possible to use your car as collateral on a loan. This means you offer up the car as security so if you default on the loan, the lender can take the car to help compensate for its financial loss. To use your car as collateral, you must have equity in the vehicle.

Collateral is something that you pledge as a security when you take a loan from the bank. If you are unable to repay the loan, the bank may take possession of the collateral. The most commonly accepted assets that are used as collateral include property, bonds, gold, savings certificates, deposits and vehicles.

If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts. Retirement accounts are not usually accepted as collateral.

Collateral ensures that the borrower will repay a loan as agreed or, if the borrower defaults, provides the lender with a way to recoup its losses. On a mortgage, for instance, the collateral is the home the mortgage was used to buy; on an auto loan, the collateral is the car the buyer drives home from the dealership.