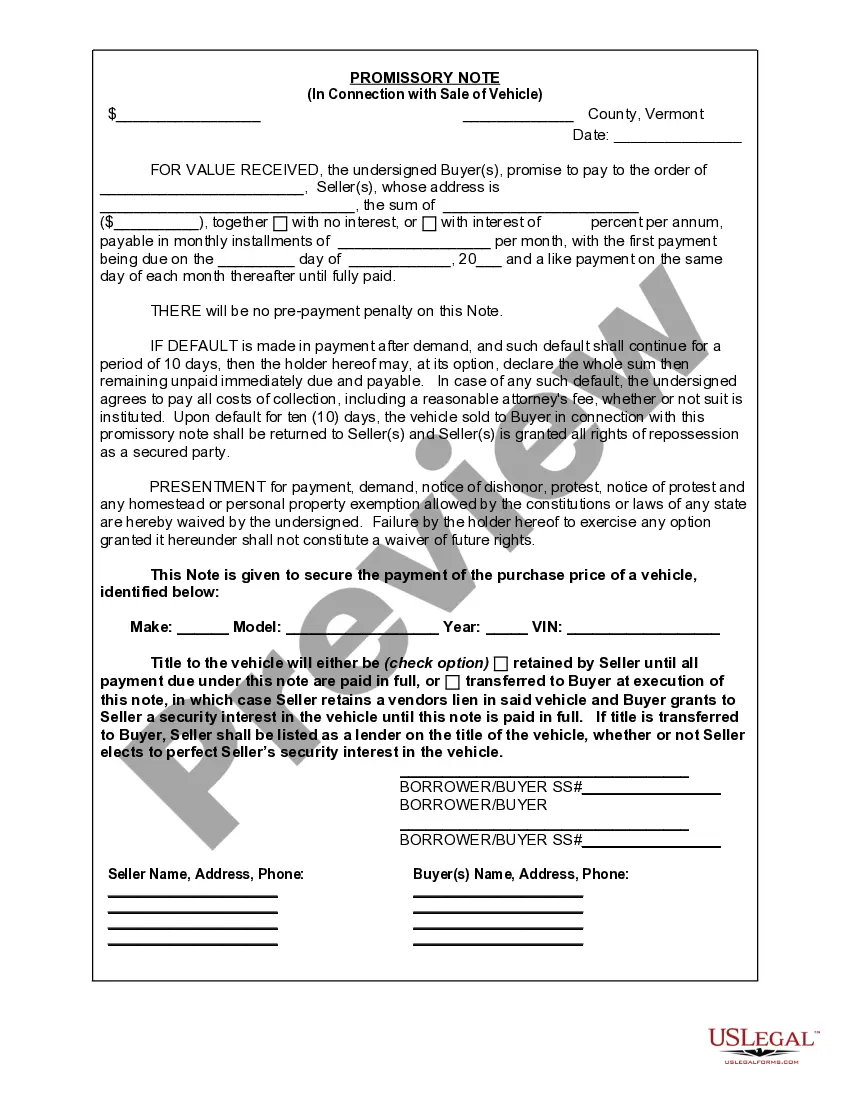

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Vehicle Promissory Note With Chattel Mortgage

Description

How to fill out Vermont Promissory Note In Connection With Sale Of Vehicle Or Automobile?

What is the most reliable service to obtain the Vehicle Promissory Note With Chattel Mortgage and other updated versions of legal documents? US Legal Forms is the solution!

It boasts the largest assortment of legal forms for any situation. Each template is skillfully crafted and certified for adherence to federal and local laws and regulations.

Form compliance review. Prior to acquiring any template, ensure it satisfies your use case requirements and aligns with your state or county regulations. Review the form description and utilize the Preview if available.

- They are categorized by field and state of application, making it simple to find what you require.

- Experienced users of the site just need to sign in to the platform, verify if their subscription is active, and hit the Download button next to the Vehicle Promissory Note With Chattel Mortgage to obtain it.

- Once saved, the template will remain accessible for future utilization within the My documents section of your account.

- If you don't have an account yet, follow these steps to create one.

Form popularity

FAQ

The bookkeeping behind the Chattel Mortgage purchase:Deposit Paid (Current Asset) no tax code.Motor Vehicles at Cost (Non-Current Asset) apply capital expense including GST tax code.Chattel Mortgage (Motor Vehicle) (Non-Current Liability) no tax code.Chattel Mortgage Interest Charges (Expense) no tax code.More items...?

Chattel mortgage fee is what you pay the bank in exchange for getting a secured loan. Most auto loans in the Philippines are secured, meaning that in case you miss a certain number of monthly payments, the bank has the right to repossess your car.

Chattel Mortgage refers to a contract by virtue, which involves recording the personal property in the Chattel Mortgage Register as security for the performance of an obligation. The Chattel Mortgage can either be a formal contract or an accessory contract. It is required if the debtor has to retain the property.

Debit asset/car by the amount cost of the car. Credit cash by the amount of down payment and notes payable-car loan by the amount of any borrowed money for the car. If no money is borrowed, then credit cash for the entire cost of the car. In the example, debit asset/car by $20,000.

A Chattel Mortgage is primarily used to purchase an asset for business use. Structured similarly to a regular mortgage, the lenders provide funds to purchase the asset (known as a Chattel) and register their security interest on the Personal Property Securities Register (PPSR) for the life of the loan.