Agreement Lease Mineral Form

Description

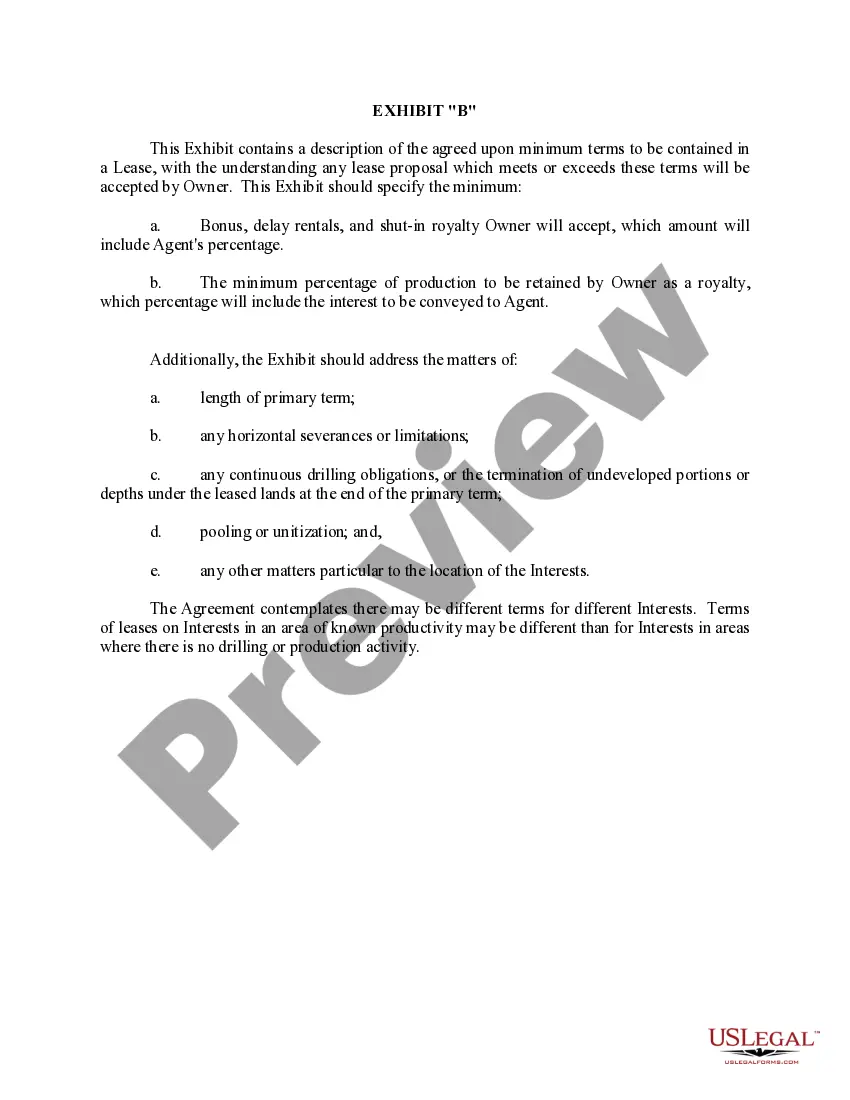

How to fill out Agreement Designating Agent To Lease Mineral Interests?

What is the most reliable service to obtain the Agreement Lease Mineral Form and other current versions of legal documents? US Legal Forms is the solution! It boasts the largest assortment of legal forms suitable for any situation.

Each template is expertly crafted and validated for adherence to federal and local legislation. They are organized by region and state of application, making it simple to find the one you require.

US Legal Forms is an excellent option for anyone handling legal documentation. Premium subscribers can benefit even more by completing and electronically signing previously saved documents at any time using the integrated PDF editing tool. Try it now!

- Veteran users of the platform only need to sign in to the system, verify their subscription status, and click the Download button next to the Agreement Lease Mineral Form to obtain it.

- Once saved, the template will be accessible for future use within the My documents section of your account.

- If you do not yet possess an account, here are the steps you need to follow to create one.

- Form compliance verification. Before acquiring any template, ensure it aligns with your use case and the regulations of your state or county. Review the form description and utilize the Preview feature if available.

Form popularity

FAQ

Mineral rights are conveyed meaning transferred to a new owner through a deed. At the time of the initial conveyance, the property deed will include the separation of the surface and mineral rights.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

The convention is to simply multiply the trailing 12-month cash flow figure generated by the subject property or collection of properties by three (3) and the result presumably represents the market value of such properties.

For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th. Bonus. The bonus is the amount paid to the Lessor as consideration for his/her execution of the lease.

Mineral rights don't come into effect until you begin to dig below the surface of the property. But the bottom line is: if you do not have the mineral rights to a parcel of land, then you do not have the legal ability to explore, extract, or sell the naturally occurring deposits below.