Va Closing Transaction For Creating Receivables Is

Description

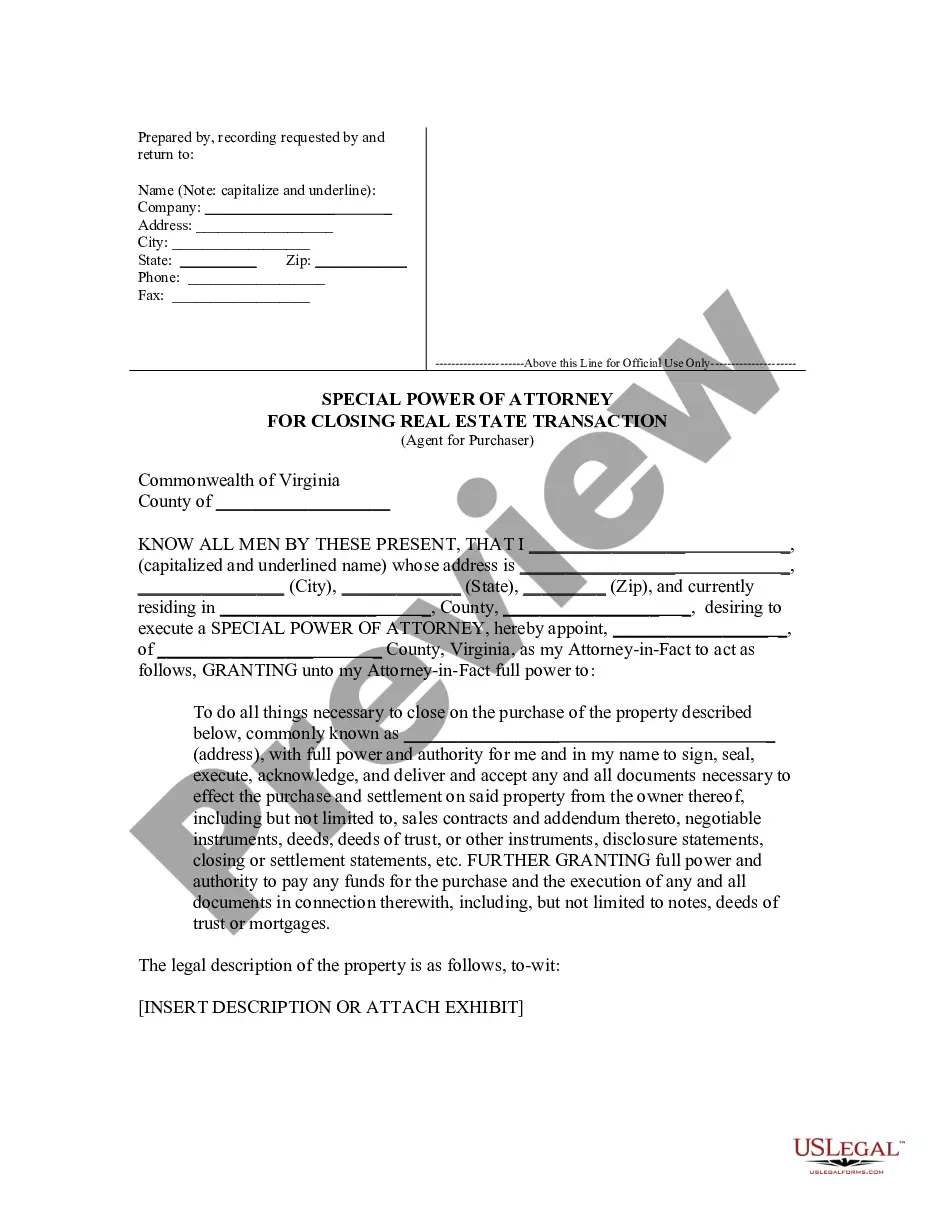

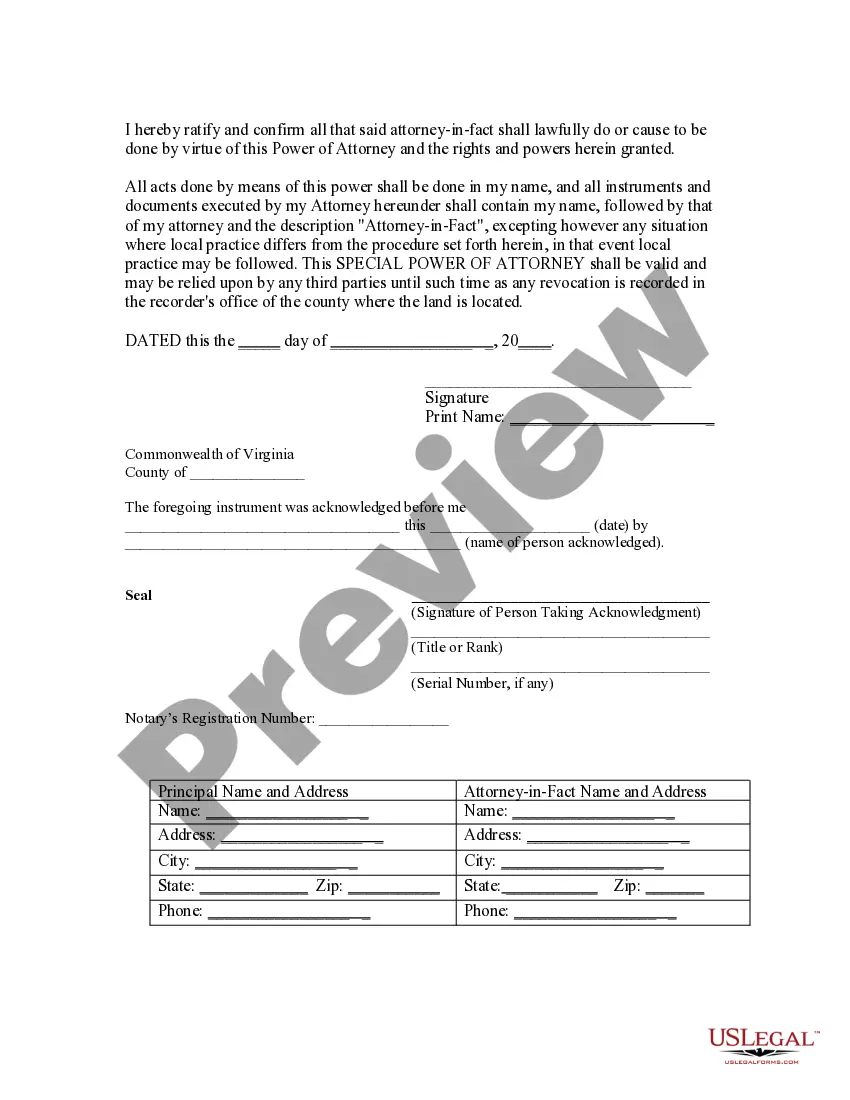

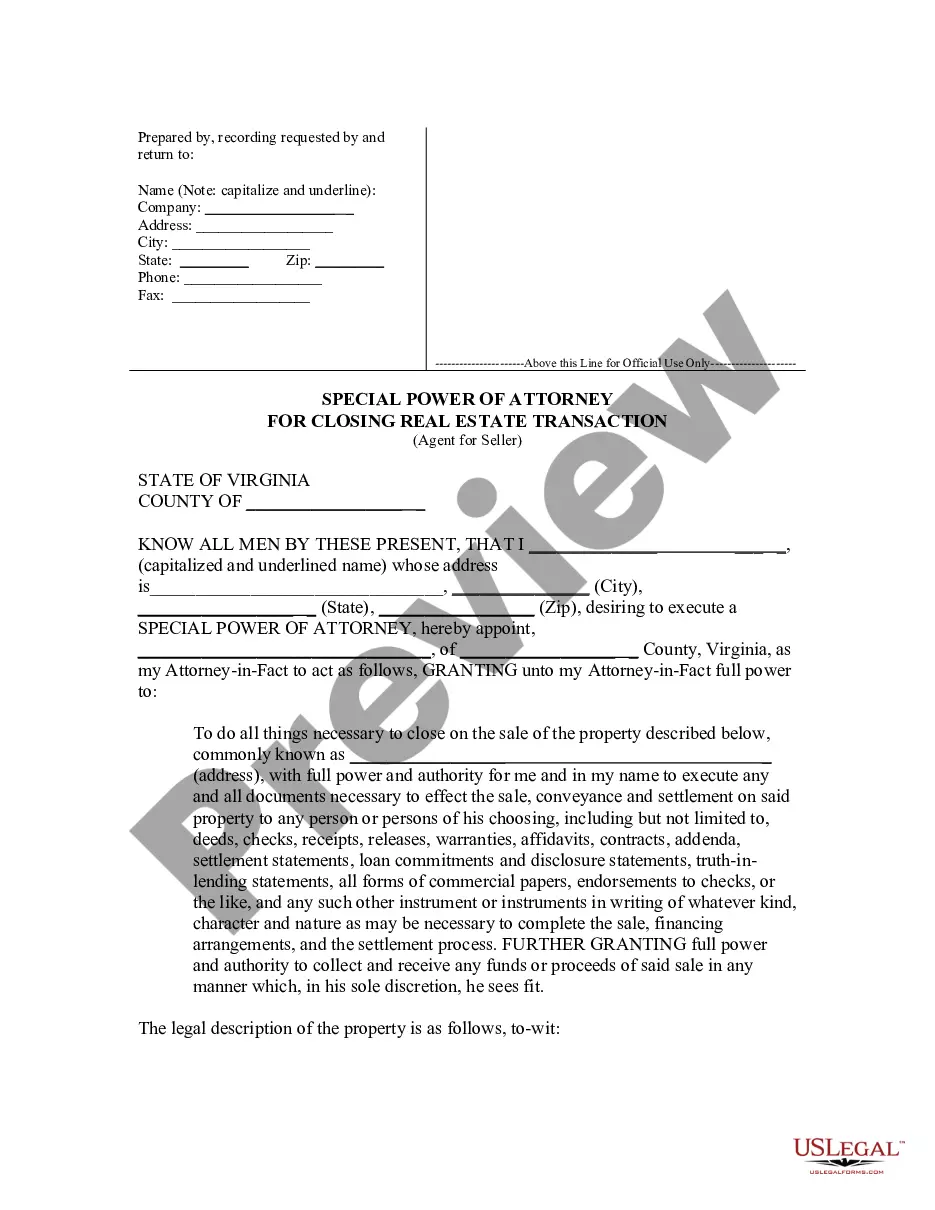

How to fill out Virginia Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Handling legal documentation and procedures can be a lengthy addition to your entire day.

Va Closing Transaction For Creating Receivables Is and similar forms often require you to seek them out and navigate the process to finalize them effectively.

Therefore, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and functional online catalog of forms at your disposal will be immensely beneficial.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific forms and a range of tools to assist you in completing your documents effortlessly.

Is this your first experience with US Legal Forms? Sign up and set up your account in just a few minutes, granting you access to the form catalog and Va Closing Transaction For Creating Receivables Is. Then, follow the steps below to finalize your form: Ensure you have located the correct form by utilizing the Preview feature and reviewing the form description. Select Buy Now as soon as you are prepared and choose the monthly subscription plan that aligns with your needs. Click Download then complete, eSign, and print the form. US Legal Forms has 25 years of experience helping users manage their legal documents. Find the form you need today and streamline any process effortlessly.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms offers you state- and county-specific forms available at any time for download.

- Protect your document management processes using a high-quality service that enables you to assemble any form in minutes without extra or concealed fees.

- Simply Log In to your account, locate Va Closing Transaction For Creating Receivables Is, and download it instantly from the My documents tab.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

Hear this out loud PauseThe Ending Accounts Receivable Formula is a simple equation used by businesses to determine the amount of cash they are owed by customers at the end of an accounting period. It's calculated by taking the beginning Accounts Receivable balance and adding new sales, then subtracting payments made on existing invoices.

This closing balance formula is, however, pretty straightforward. You simply need to take your opening balance at the start of the accounting period, add any earnings, and subtract what you spent in the period.

Hear this out loud PauseTo write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable. The visual below also includes the journal entry necessary to record bad debt expense and establish the allowance for doubtful accounts reserve (aka bad debt reserve or uncollectible AR reserve).

Hear this out loud PauseCompanies use invoices to report accounts receivable transactions. Invoices include information regarding the sale of the products or services, such as a description of the product or service, the total cost and the payment due date. A journal entry may contain: The date of the journal entry.

Hear this out loud PauseClosing Receivables means all accounts receivable and other receivables, whether billed or unbilled, of the Company and its Subsidiaries as of the Closing. Sample 1Sample 2. Closing Receivables means all accounts receivables in the Ordinary Course of Business of the Company as of immediately prior to the Closing Date.