Exemption Va Homestead For Property Tax

Description

How to fill out Virginia Homestead Deed For Single - Home?

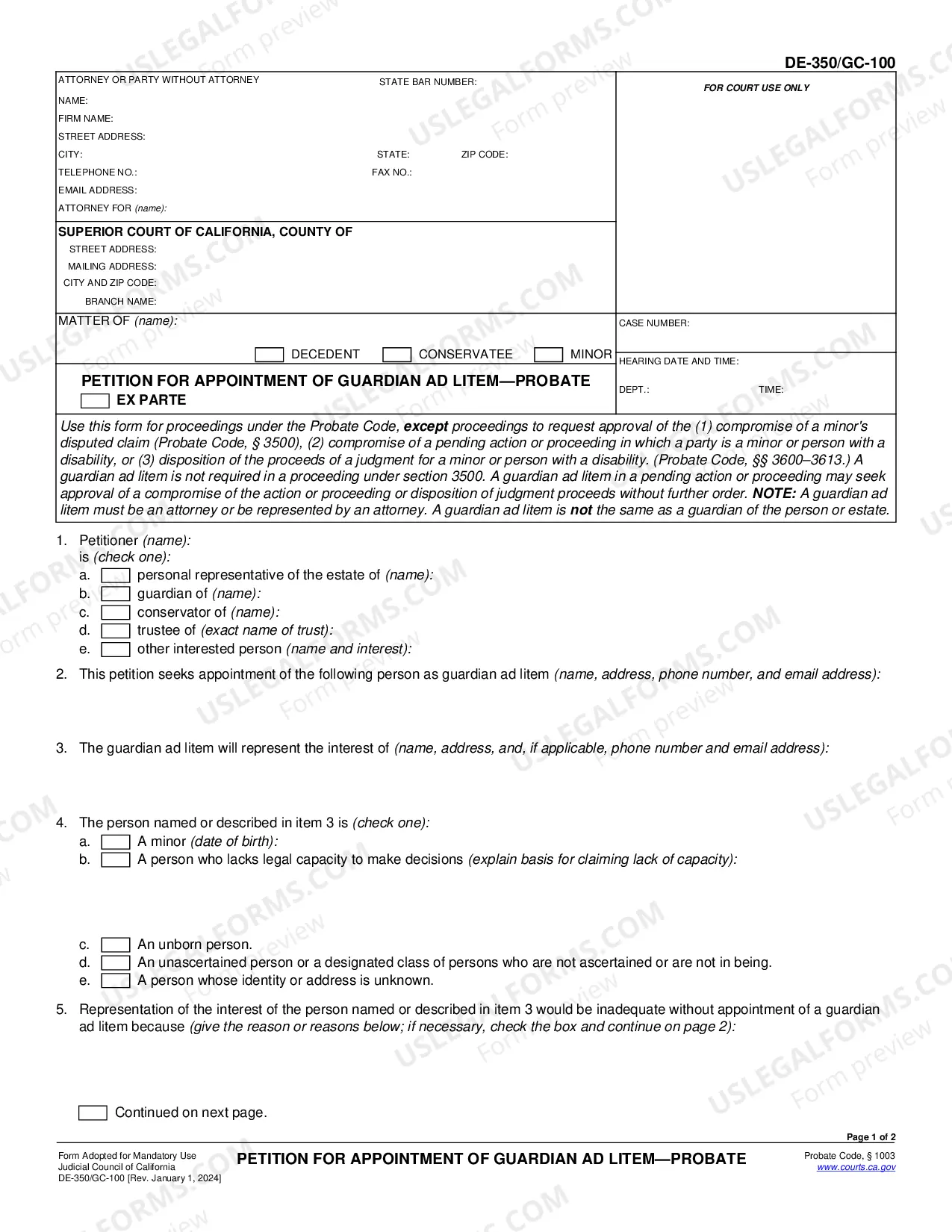

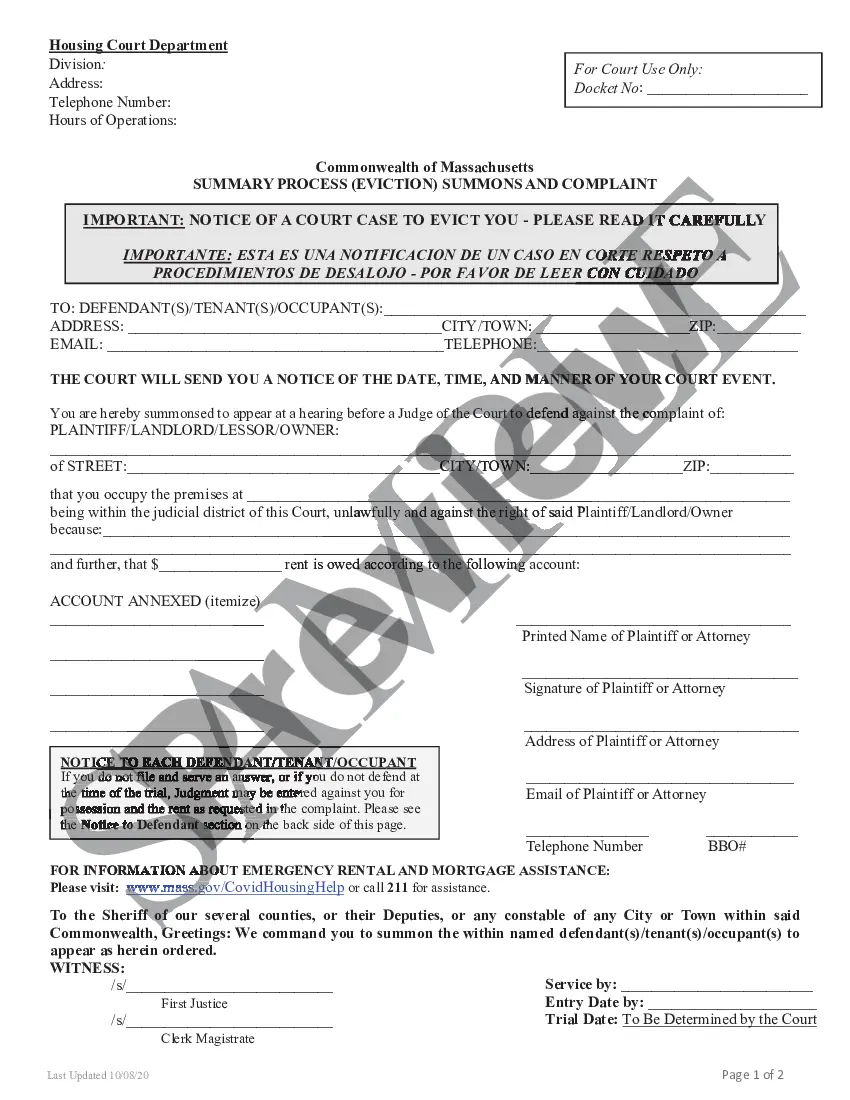

Whether for business purposes or for personal matters, everyone has to manage legal situations at some point in their life. Completing legal papers requires careful attention, beginning from picking the correct form template. For example, when you choose a wrong edition of a Exemption Va Homestead For Property Tax, it will be declined once you send it. It is therefore important to get a reliable source of legal documents like US Legal Forms.

If you have to get a Exemption Va Homestead For Property Tax template, stick to these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Examine the form’s description to make sure it suits your case, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong document, get back to the search function to find the Exemption Va Homestead For Property Tax sample you require.

- Download the file when it meets your requirements.

- If you already have a US Legal Forms profile, click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the profile registration form.

- Select your transaction method: use a bank card or PayPal account.

- Select the document format you want and download the Exemption Va Homestead For Property Tax.

- Once it is downloaded, you are able to fill out the form with the help of editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time searching for the right sample across the web. Utilize the library’s straightforward navigation to get the proper template for any situation.

Form popularity

FAQ

Under the Virginia exemption system, homeowners can exempt up to $25,000 of equity in a home or other property covered by the homestead exemption. The exemption applies to real property, which includes your home or condominium and personal property used as a residence, so your mobile home would also be covered.

Owner/Applicant must be at least 65 or permanently disabled as of December 31 of the previous year. Sworn affidavits from two medical doctors licensed in Virginia or two military officers who practice medicine in the United States Armed Forces - use the Tax Relief Affidavit of Disability (PDF) for their completion.

The Circuit Court Clerk's Land Records Office (Room 300) processes filing of Homestead Deeds/Exemptions.

The Virginia homestead exemption also allows individuals to deduct an additional $5,000 in real or personal property (including cash), or $10,000 if the debtor is 65 or older. This exemption type is often called a "wildcard" exemption.

Virginia homestead laws allow residents to designate up to $5,000 worth of real estate (including mobile homes) as a homestead, plus $500 for each dependent. If a resident is sixty-five years of age or older, or a married couples files for an exemption together, up to $10,000 may be exempted under the homestead laws.