Virginia Trust For Historic Preservation

Description

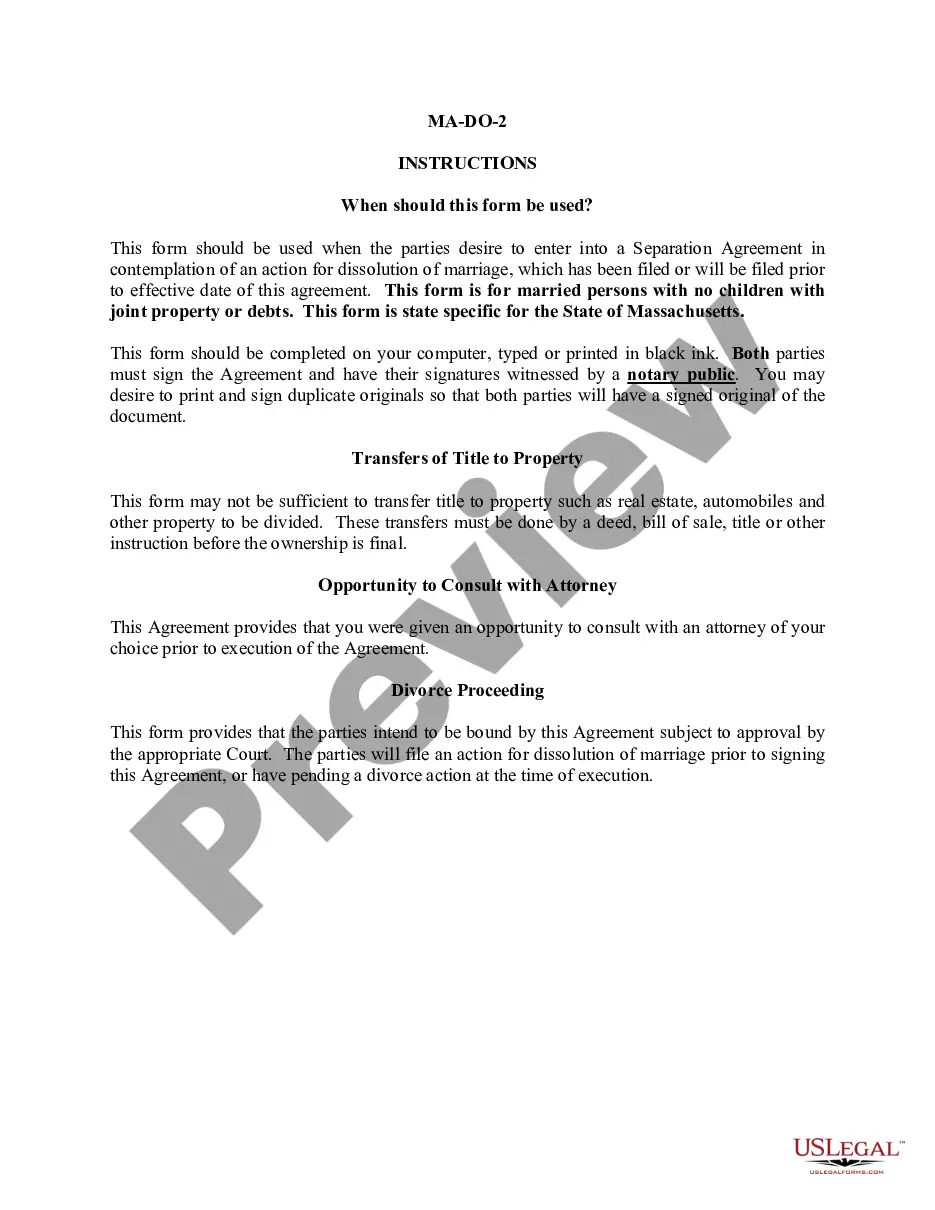

How to fill out Virginia Notice Of Assignment To Living Trust?

Regardless of whether it's for commercial reasons or personal issues, everyone must confront legal matters at some point in their lives.

Completing legal documents demands meticulous focus, starting with selecting the appropriate form template.

Once saved, you can fill out the form using editing tools or print it to complete it by hand. With a vast catalog of US Legal Forms available, you will never need to waste time hunting for the correct sample online. Utilize the library’s simple navigation to find the right template for any circumstance.

- For example, if you select an incorrect edition of a Virginia Trust For Historic Preservation, it will be rejected once submitted.

- Thus, it is essential to have a trustworthy source of legal documents like US Legal Forms.

- If you wish to acquire a Virginia Trust For Historic Preservation template, adhere to these straightforward steps.

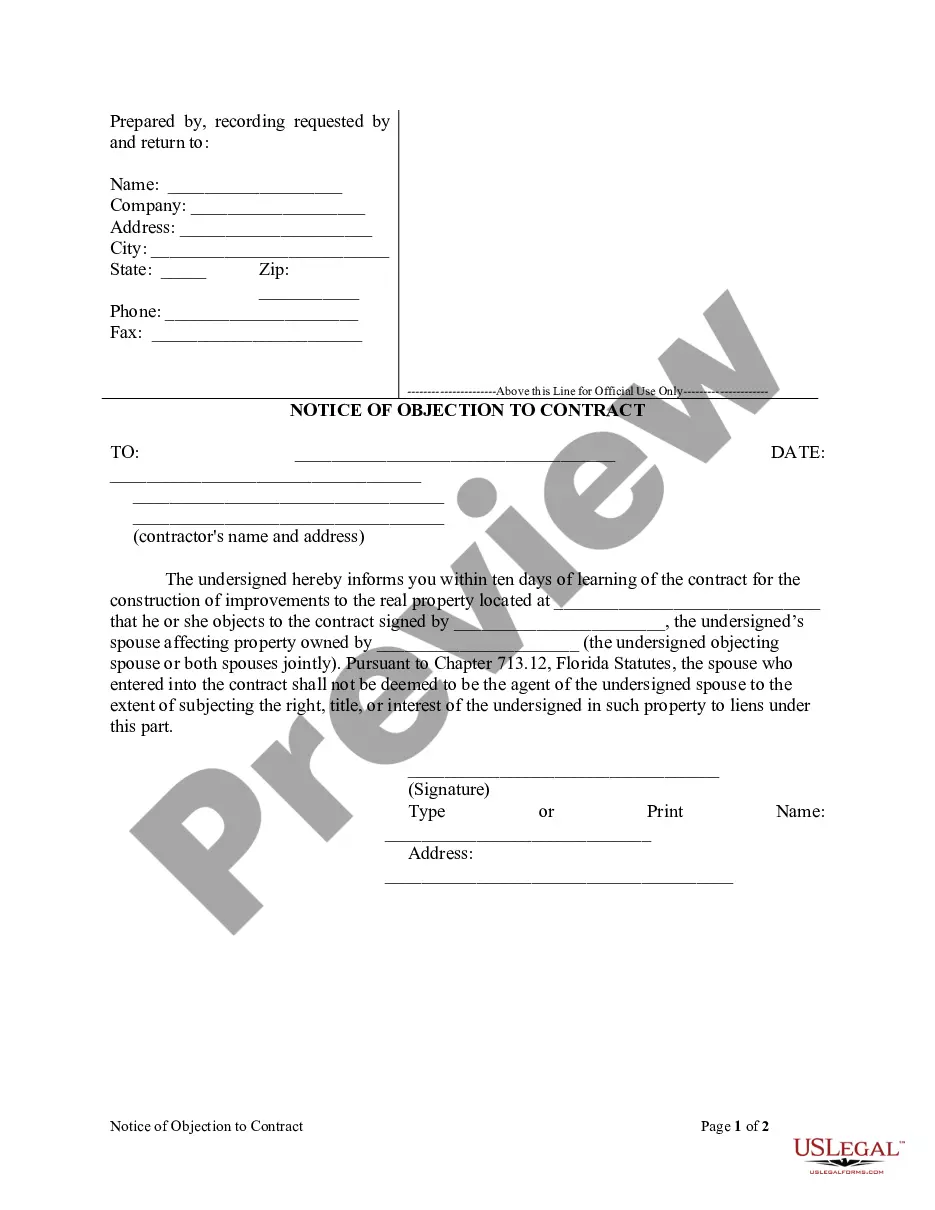

- Locate the sample you require using the search option or catalog browsing.

- Review the details of the form to ensure it fits your circumstances, state, and locality.

- Click on the form’s preview to view it.

- If it's the incorrect document, return to the search feature to find the Virginia Trust For Historic Preservation sample you require.

- Obtain the template if it fulfills your needs.

- If you own a US Legal Forms profile, click Log in to retrieve previously saved documents in My documents.

- If you don't have an account, you can purchase the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Virginia Trust For Historic Preservation.

Form popularity

FAQ

TRUSTS: Trusts must make payments of estimated tax if the income tax liability on Form 770 for the taxable year will exceed $150. ESTATES: Estates are not required to make estimated tax payments until the first taxable year that ends 2 or more years after the decedent's date of death.

All applications must be submitted to the Department of Taxation, Tax Credit Unit, P.O. Box 715, Richmond, VA 23218?0715 90 days prior to the due date of your return. A letter will be sent to certify the credit.

A trust created by will of a decedent who at his death was domiciled in the Commonwealth; or. A trust created by or consisting of property of a person domiciled in the Commonwealth; or. A trust or estate which is being administered in the Commonwealth.

The fiduciary of a resident estate or trust must file a return if the estate or trust is required to file a federal fiduciary income tax return (Form 1041), or if it had any Virginia taxable income.

Anyone can make a trust in Virginia as long as they follow the requirements as listed in the statute. The settlor must have the proper mental capacity and must intend to create the trust. Furthermore, the settlor must name a beneficiary for the trust and a trustee to manage it.