Virginia Revocable Trust Form

Description

Form popularity

FAQ

The primary downside of a revocable trust is that it does not provide protection against creditors or legal judgments. Additionally, since you retain control over the trust assets, it may not offer the same tax benefits as irrevocable trusts. However, the flexibility and ease of management with the Virginia revocable trust form often make it a favorable choice for many.

While placing assets in a trust can offer benefits, one downside is the potential loss of control over those assets. Once assets are transferred, it may be challenging to alter decisions without a proper legal process. It is essential to consider how the Virginia revocable trust form can allow for flexibility while providing a clear structure.

Putting assets in a trust can be beneficial for your parents, especially in managing their estate and avoiding probate. It allows for greater control over asset distribution and can provide tax advantages. Using the Virginia revocable trust form can simplify the process and empower your parents to make informed decisions about their estate.

A significant risk of a trust fund lies in the mismanagement of the trust by the trustee. If the trustee does not act in the best interest of the beneficiaries, it could lead to financial loss or disputes. Utilizing the Virginia revocable trust form can help mitigate these risks by providing clear guidelines for trustee responsibilities and beneficiary rights.

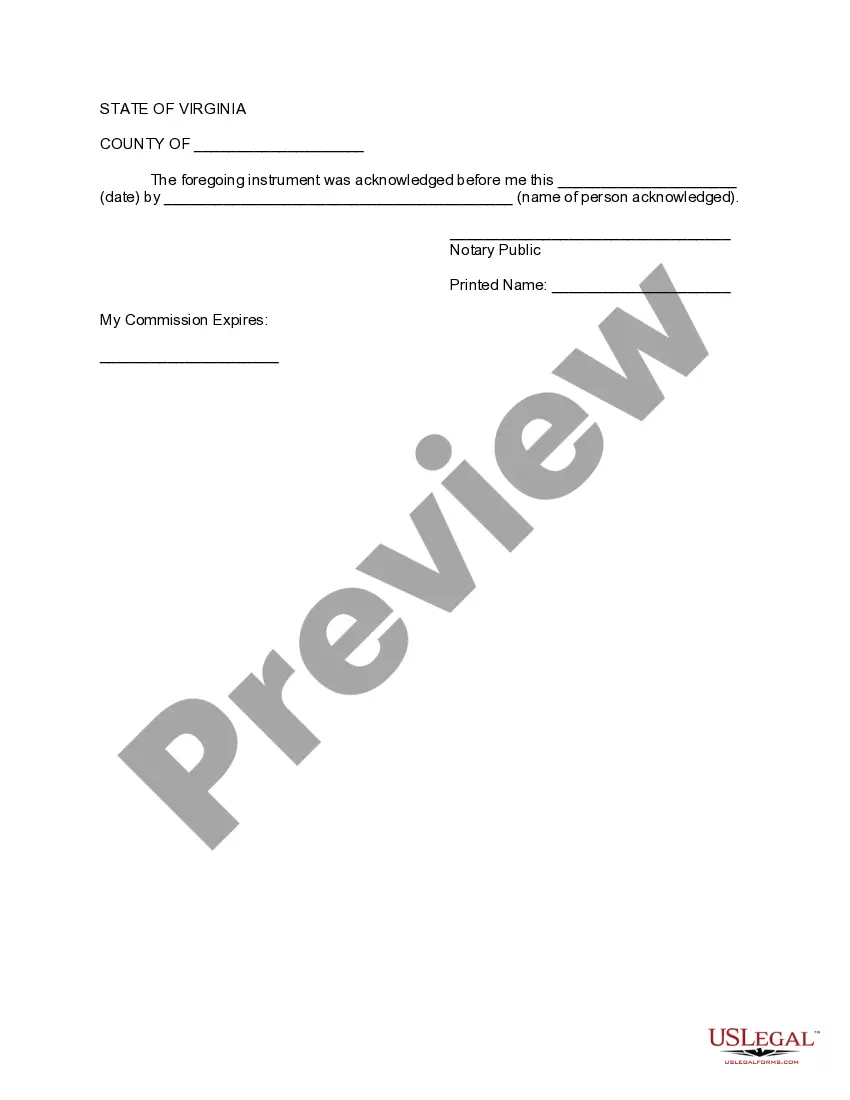

To set up a revocable trust in Virginia, you should first gather necessary information about your assets. Next, complete the Virginia revocable trust form, detailing how you want your assets to be managed and distributed. Consider consulting a legal professional to ensure everything is completed correctly and reflects your intentions.

A common mistake parents make is not clearly defining their wishes for the trust. This lack of clarity can lead to confusion and disputes among beneficiaries. It's crucial to outline specific goals and instructions in the Virginia revocable trust form to avoid potential conflicts and ensure everyone understands the intended purpose of the trust.

Filling out a revocable living trust involves providing specific information about your assets and beneficiaries. First, you will need to complete a Virginia revocable trust form, ensuring you include names, descriptions, and values of the assets you wish to include. Remember to appoint a trustee who will manage the trust and clearly outline their powers. If you need guidance during this process, consider using uslegalforms, which offers resources to help you complete the form accurately.

Creating a revocable trust begins with gathering necessary information about your assets and beneficiaries. Then, you can use a Virginia revocable trust form as a template to outline your wishes clearly and precisely. You will detail how your assets will be managed during your lifetime and distributed after your death. It is advisable to consult with a legal expert to ensure your trust meets all required regulations.

Not all assets should be held in a revocable trust. For instance, retirement accounts like IRAs or 401(k)s typically require designated beneficiaries, so they are usually kept separate from the Virginia revocable trust form. Additionally, assets with joint ownership or those that pass by transfer-on-death designations, like certain accounts or vehicles, should also remain out to maintain their designated transfers.

You can write your own trust in Virginia using a Virginia revocable trust form. It's important to ensure that the trust document meets state laws to be valid and effective. Many individuals find templates helpful, as they provide a clear structure and necessary provisions. Additionally, using a service like US Legal Forms can simplify the process by offering reliable forms and guidance tailored to Virginia's legal requirements.