Trustee Fiduciário

Description

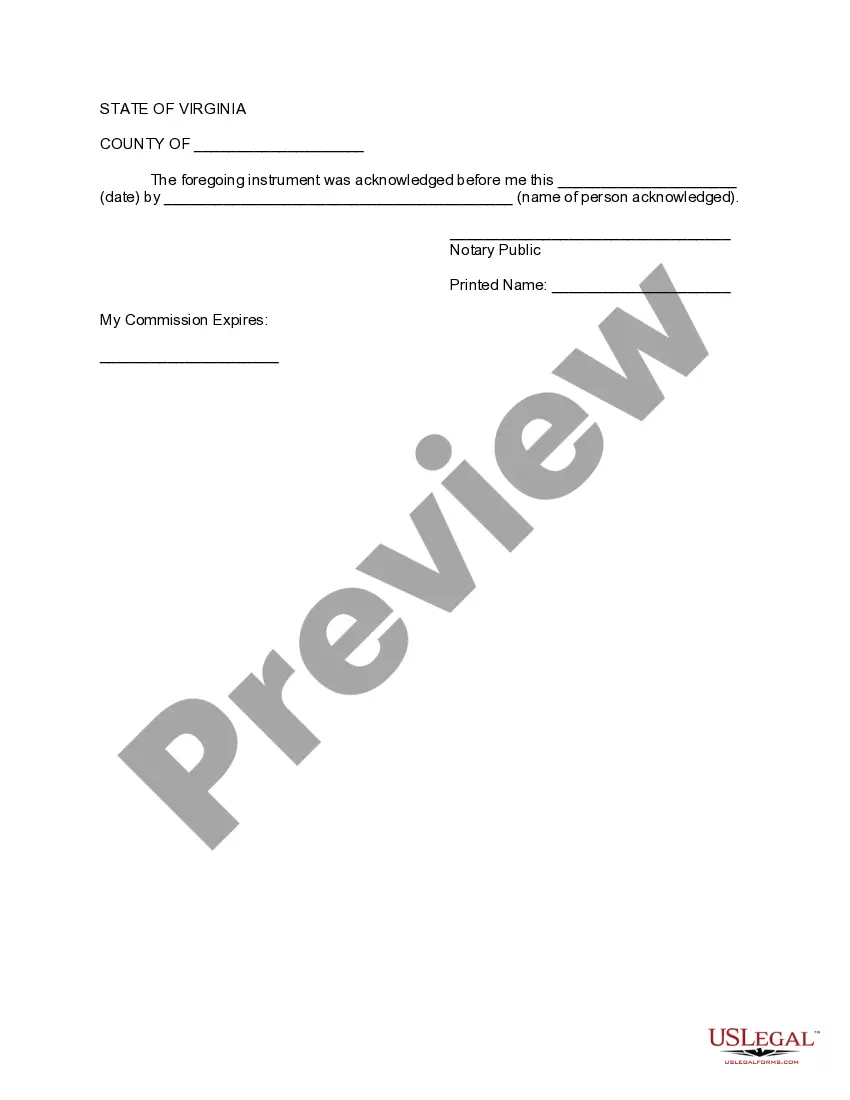

How to fill out Virginia Amendment To Living Trust?

- Log into your account if you’re a returning user and ensure your subscription is active. Click the Download button to acquire your form template.

- For first-time users, begin by checking the Preview mode to review form details, ensuring it matches your needs and complies with your local jurisdiction.

- In case you need a different template after reviewing, utilize the Search feature at the top to find a more suitable option.

- Once you’ve found the correct document, click the Buy Now button and select your preferred subscription plan, requiring you to create an account for access.

- Complete your purchase by entering your credit card information or using your PayPal account for the subscription payment.

- Finally, download the selected form, which will be accessible for future reference in the My Forms section of your profile.

In conclusion, US Legal Forms not only provides an expansive collection of over 85,000 fillable and editable legal forms but also connects users with expert assistance for the precise completion of documents. This empowers you to swiftly execute necessary legal processes with confidence.

Explore US Legal Forms today and simplify your legal documentation needs!

Form popularity

FAQ

Common examples of a trustee fiduciário name include your attorney, a financial advisor, or a trusted family member. Organizations like banks and trust companies can also serve effectively in this capacity. Remember to consider each candidate's qualifications and how well they align with your overall goals for the trust.

The best person to serve as your trustee fiduciário is someone who is not only trustworthy but also knowledgeable in financial matters. They should balance personal connection with professional capability. Evaluating their past decisions, integrity, and understanding of your goals and values can help you identify the right fit.

Choosing a trustee fiduciário requires careful consideration of the candidate's experience, reliability, and willingness to serve. Begin by discussing the role with potential candidates to gauge their interest. Consider engaging professional services or organizations that specialize in trust management to ensure the highest level of expertise.

When naming a trustee fiduciário, you should consider someone who understands your values and can honor your wishes. This person should ideally have experience in managing financial assets or legal matters. Friends or family members may be appropriate, but ensure they are capable and willing to take on the responsibility.

A suitable trustee fiduciário can be an individual or a corporate entity, often someone with a good understanding of financial matters and a trustworthy track record. This person should have the ability to act in the best interest of the beneficiaries and manage the trust assets responsibly. It's important that they possess strong organizational skills and can navigate the complexities of trust administration.

Trust income is reported on Form 1041 for the trust itself, while beneficiaries may receive a Schedule K-1 to report their portions of that income. Each beneficiary must then include this information on their individual tax returns. Accurately reporting trust income helps prevent potential issues with the IRS.

Yes, trustee fees are generally considered taxable income for the trustee fiduciário. These fees may be reported as ordinary income on the trustee's tax return. Proper categorization of these fees is essential to ensure accurate tax reporting.

In New York, a trustee fiduciário must file a trust return if the trust has income over a certain threshold. This requirement includes both resident and non-resident trusts with New York-source income. Filing accurately helps maintain compliance with state tax laws.

Trust income typically appears on Schedule K-1, which you receive from the trust. As a beneficiary, you report this income on your Form 1040. Understanding this process can help ensure you correctly account for all trust distributions.

Irrevocable trust income is reported on IRS Form 1041. As a trustee fiduciário, you must disclose the income earned by the trust and any distributions made to beneficiaries. Trusts must ensure proper reporting to avoid issues with the IRS.