Trust And Trustee Relationship

Description

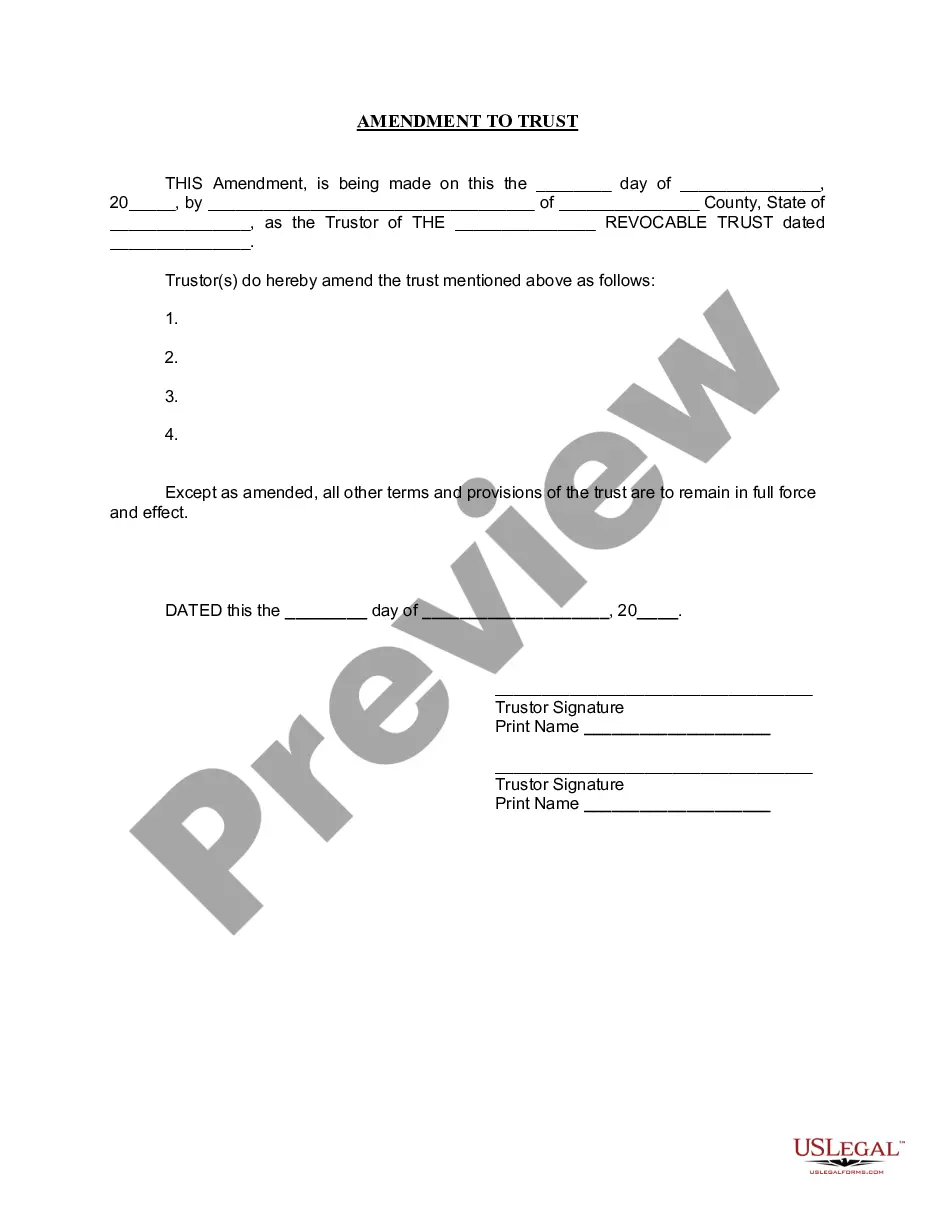

How to fill out Virginia Amendment To Living Trust?

- Log in to your US Legal Forms account. Make sure your subscription is active; renew it if necessary.

- Explore the Preview mode and read the form description to confirm it meets your specific requirements.

- Use the Search feature to find alternative templates if the initial selection does not suit your needs.

- Select your chosen document and click on the Buy Now button, then choose your preferred subscription plan.

- Complete your transaction by providing your payment details, either via credit card or PayPal.

- Download the form to your device, making it accessible through your profile's My Forms section whenever you need it.

US Legal Forms provides a vast selection of over 85,000 legal forms, more than many competitors, ensuring you find exactly what you need. Plus, premium expert assistance is available for form completion, helping you create legally sound documents with ease.

In conclusion, leveraging the US Legal Forms service makes handling trust and trustee relationships significantly easier. Start your journey today by visiting US Legal Forms and streamline your legal documentation tasks!

Form popularity

FAQ

The dynamic between the trustee and beneficiary illustrates a unique balance of power within a trust. While the trustee holds the authority to manage trust assets and make decisions, the beneficiaries possess the ultimate interest in those assets and the right to benefit from them. Thus, in a trust and trustee relationship, both parties play vital roles, with trustees obligated to act in the best interests of beneficiaries. This equilibrium ensures that trust objectives are met while safeguarding beneficiaries' rights.

A trustee has various powers, including managing, investing, and distributing trust assets according to the trust document's stipulations. They are also responsible for maintaining accurate records and providing beneficiaries with relevant updates regarding the trust. In the context of a trust and trustee relationship, these powers are granted to ensure the effective administration of the trust and to uphold the best interests of the beneficiaries. Therefore, a trustee must act with caution and integrity while executing their responsibilities.

No, a trustee and a trust are not the same. A trust is a legal arrangement where assets are held for the benefit of specified individuals, known as beneficiaries, while a trustee is the person or organization responsible for managing those assets. The trust and trustee relationship ensures that the trustee administers the trust according to its terms, fulfilling fiduciary duties and protecting the interests of the beneficiaries. This distinction is crucial when establishing and managing estate planning tools.

A trustee is an individual or entity that holds and manages the assets placed in a trust, acting in accordance with the trust's terms. On the other hand, a trust manager may oversee the day-to-day management of trust assets, but they do not possess the same legal responsibilities as a trustee. In a trust and trustee relationship, the trustee must prioritize the interests of beneficiaries while the trust manager executes specific investment strategies. Understanding these roles helps clarify the dynamics involved in managing a trust effectively.

When selecting a trustee for your trust, consider qualities such as reliability, experience, and a strong understanding of financial matters. You want someone who can navigate the complexities of the trust and trustee relationship with integrity. Conduct thorough interviews and check references, ensuring the person or institution understands your goals for the trust. UsLegalForms provides guidelines for appointing a trustee that aligns with your wishes.

Having co-trustees can be beneficial, as it allows for shared responsibilities and diverse perspectives in managing the trust. However, it can also complicate decision-making processes within the trust and trustee relationship. Carefully consider the compatibility of co-trustees and ensure they can work together harmoniously. UsLegalForms offers resources to help you outline co-trustee roles and responsibilities effectively.

The best trustee for a trust is someone who is reliable, knowledgeable, and impartial. This individual should understand the trust and trustee relationship and be capable of making sound decisions regarding the trust's assets. Evaluate potential trustees based on their experience and ability to serve the beneficiaries effectively. Consider professional trustees or institutions if conflicts of interest may arise.

Typically, the trustee holds the most power in a trust. The trustee has the authority to manage assets, make distributions, and ensure that the trust operates according to the grantor’s wishes. However, the trust and trustee relationship also implies that the trustee must act in the beneficiaries' best interests. Therefore, the balance of power includes both fiduciary responsibility and accountability.

The person who creates a trust is referred to as the grantor. This individual decides how assets should be managed and distributed, defining the trust and trustee relationship. Understanding the role of the grantor is crucial in setting up an effective trust structure. It's important to clarify intentions and desires within the trust to guide the trustees.

If a trust has no trustee, the trust cannot be executed as intended. This situation can lead to delays in distributing assets and might require a court to appoint a trustee. Thus, having a trustee is essential to maintain the trust and trustee relationship. Make sure to outline a successor trustee in your trust document to avoid complications.