Non Affidavit Estate Form

Description

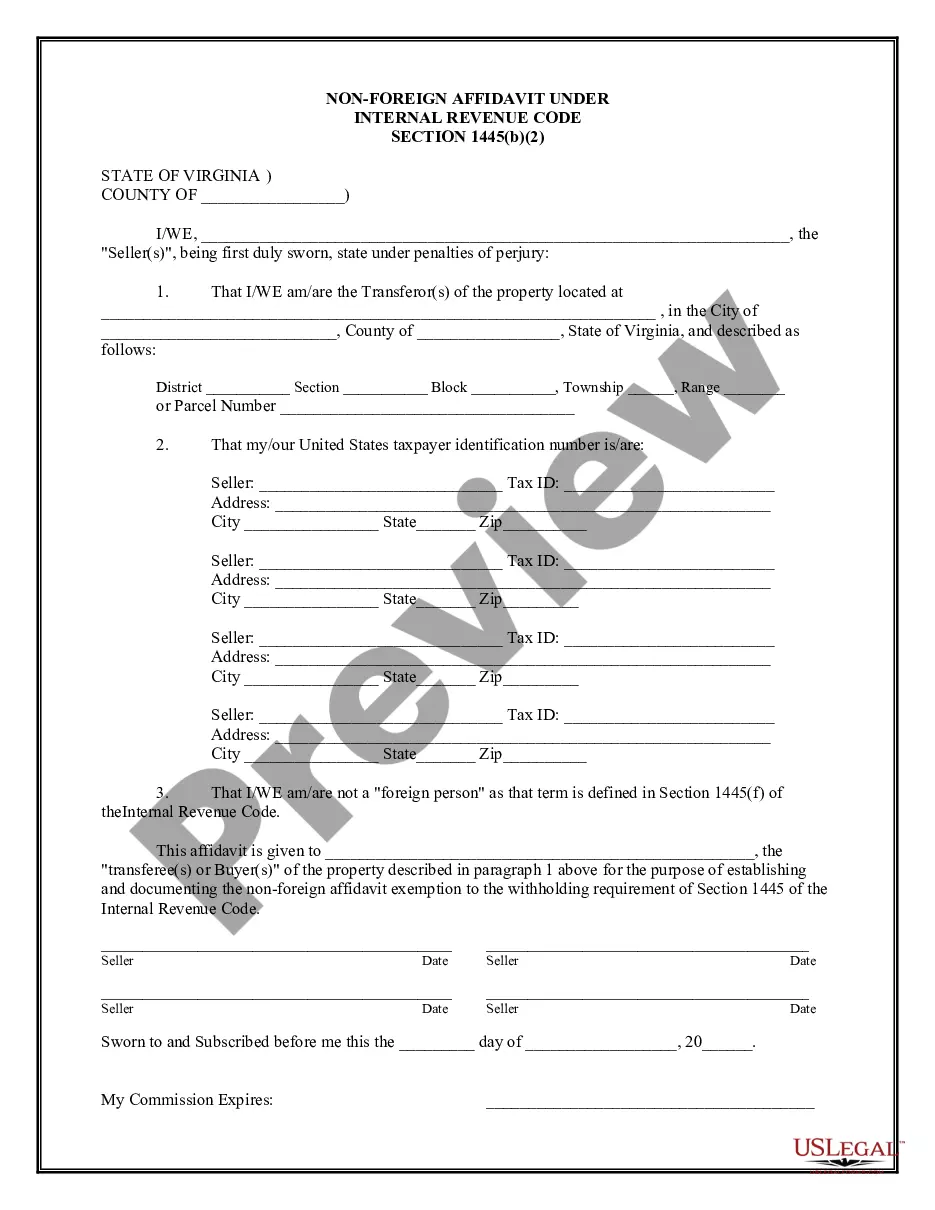

How to fill out Virginia Non-Foreign Affidavit Under IRC 1445?

Navigating through the red tape of official documents and templates can be challenging, particularly if one does not engage in that professionally.

Even selecting the appropriate template for a Non Affidavit Estate Form will be labor-intensive, as it must be accurate and precise to the last numeral.

However, you will need to invest significantly less time finding a suitable template if it originates from a source you can trust.

Obtain the correct form in a few simple steps: Enter the title of the document in the search bar, select the appropriate Non Affidavit Estate Form from the list of results, review the description of the sample or open its preview, and when the template meets your requirements, click Buy Now. Then, select your subscription plan, provide your email, and create a password to establish an account at US Legal Forms. Choose a credit card or PayPal as your payment method and download the template document to your device in the desired format. US Legal Forms can save you time and effort researching if the form you found online is right for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of locating the right forms online.

- US Legal Forms is a single source to find the latest samples of documents, consult their utility, and download these samples to complete them.

- This is a repository with over 85K forms applicable in various professional fields.

- When searching for a Non Affidavit Estate Form, you will not have to doubt its authenticity as all forms are verified.

- Having an account at US Legal Forms will ensure you have all the necessary samples at your fingertips.

- Store them in your history or add them to the My documents catalog.

- You can access your saved forms from any device by clicking Log In at the library site.

- If you still lack an account, you can always search for the template you need.

Form popularity

FAQ

Step 1 Gather Information. The law requires you to wait thirty (30) days before you file a small estate affidavit.Step 2 Prepare Affidavit.Step 3 Identify Witnesses.Step 4 Get Forms Notarized.Step 5 File with Probate Court.Step 6 Distribute Affidavit.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

Kansas Summary: Under Kansas statute, where as estate is valued at less than $40,000, an interested party may issue a small estate affidavit to collect any debts owed to the decedent.

How to Fill Out a Small Estate Affidavit in IllinoisFill in your name and information in #1.Complete the information about the decedent in #2-4.Mark either #7a or #7b depending on what is true.Complete #9a to indicate the names of the spouse and children if any.More items...?26-Jun-2019

Small Estate Affidavit Process in TexasName and address of decedent.Date of death.Description of assets.Description of debts.Names and addresses of distributes.Signatures of distributees.27-Jun-2019