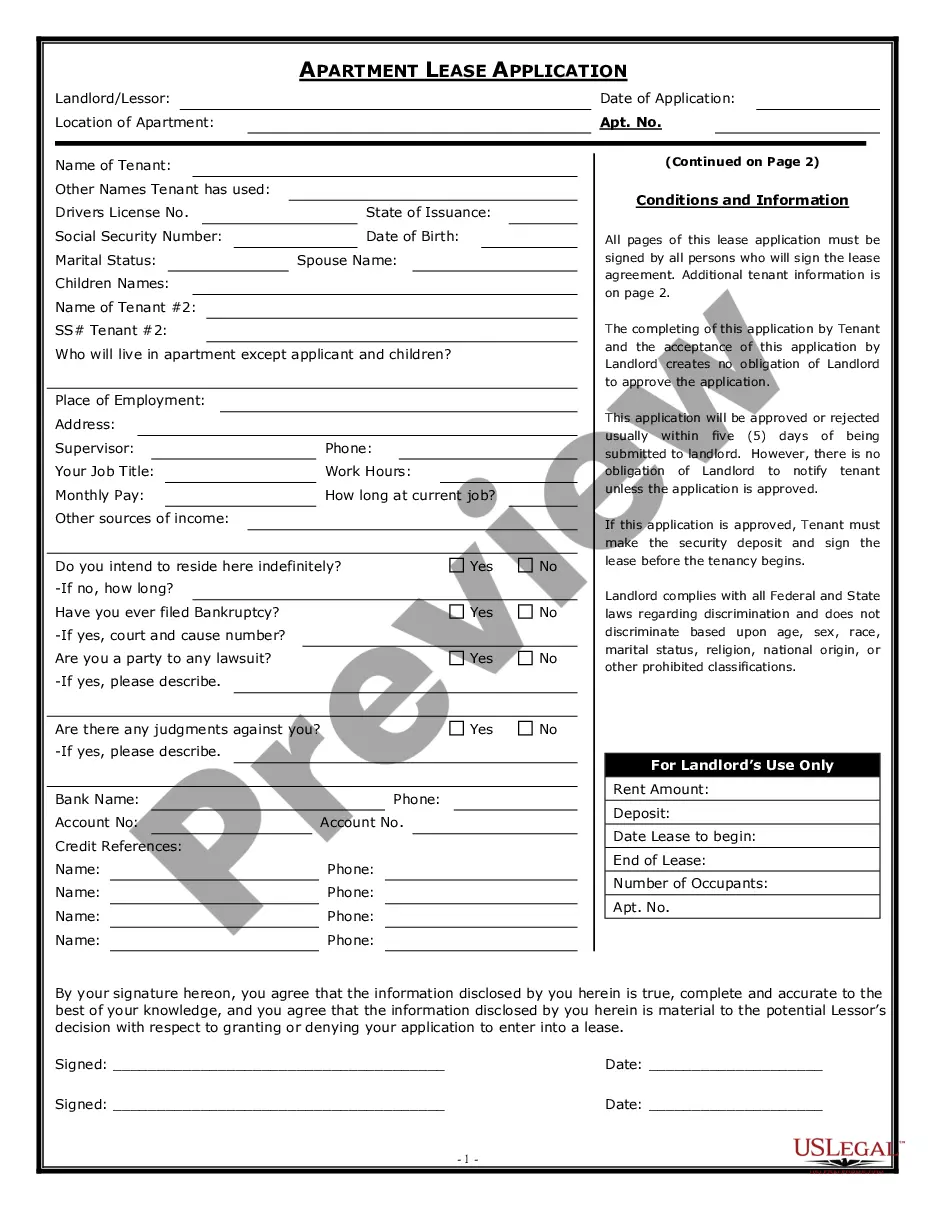

Virginia Rental Application With Cosigner

Description

How to fill out Virginia Apartment Lease Rental Application Questionnaire?

Creating legal documents from the ground up can occasionally be somewhat daunting. Certain situations may require extensive research and substantial financial investment. If you're looking for a more straightforward and economical method of preparing Virginia Rental Application With Cosigner or any other documentation without unnecessary complications, US Legal Forms is always accessible.

Our online repository of more than 85,000 current legal templates encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-specific documents meticulously crafted for you by our legal professionals.

Utilize our platform whenever you require a trustworthy and dependable service through which you can easily find and download the Virginia Rental Application With Cosigner. If you are familiar with our site and have previously set up an account, simply Log In to your account, find the template, and download it, or re-download it at any later time from the My documents section.

Not registered yet? No problem. It requires minimal time to create an account and browse the catalog. However, before proceeding to download the Virginia Rental Application With Cosigner, consider these suggestions.

US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make form completion a simple and efficient process!

- Review the form preview and descriptions to confirm you are selecting the correct document.

- Ensure the template you choose complies with the rules and laws of your state and county.

- Select the appropriate subscription plan to obtain the Virginia Rental Application With Cosigner.

- Download the file. Afterward, complete, sign, and print it.

Form popularity

FAQ

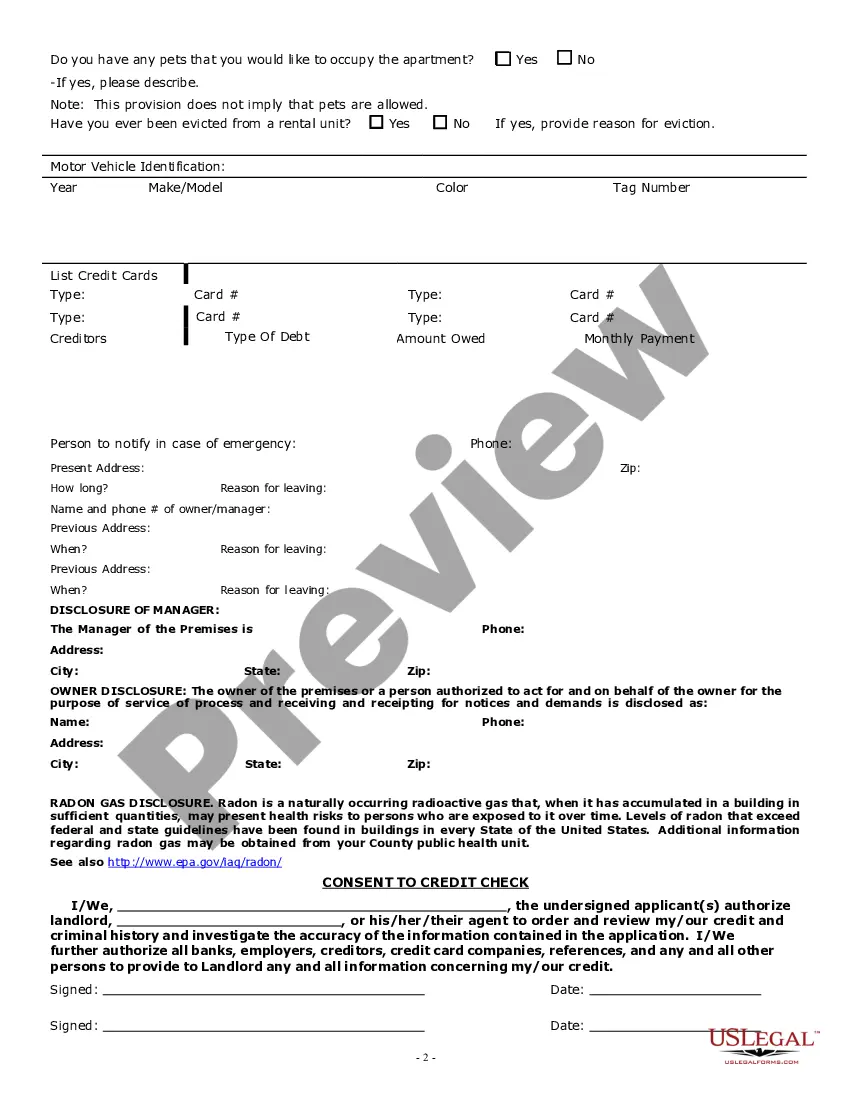

Co-signer Agreement Contract The Co-signer agrees to payment of rent and to the fulfillment of other responsibilities of the tenant to ________________________________________ under the tenancy agreement. This may include but is not limited to unpaid rent or late charges, and damages to the Leased Premises.

Your Co-Signer Agreement should include information like: who is the landlord; the name(s) of the tenant(s); when the original lease was signed; the rental property's location; the co-signer's name, driver's license and social security number; whether the co-signer will be responsible for any lease extensions or ...

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

By. A co-applicant is an additional person considered in the underwriting and approval of a loan or other type of application. Applying for a loan with a co-applicant can help to improve the chances of loan approval and also provide for more favorable loan terms.

One of the most common examples of cosigning is a parent signing an apartment lease for their child.