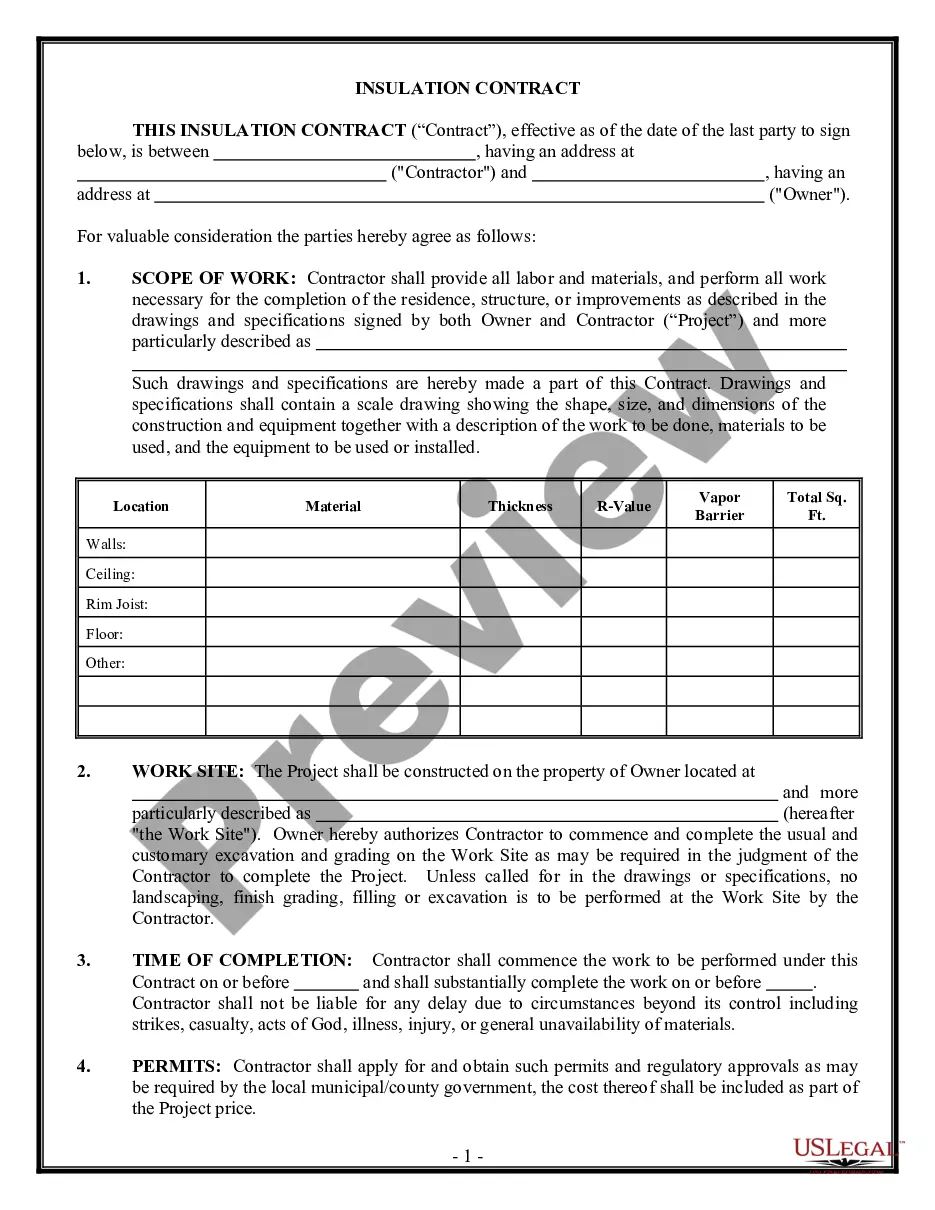

This is a sample form for use in Virginia, a Deed of Gift. It is available in Word and Rich Text formats.

Virginia Deed Of Gift Form For Property

Description

How to fill out Virginia Deed Of Gift?

It’s well-known that you cannot become a legal authority instantly, nor can you fully understand how to swiftly prepare the Virginia Deed Of Gift Form For Property without a specialized background.

Assembling legal documents is a lengthy process that necessitates specific education and expertise. So why not entrust the preparation of the Virginia Deed Of Gift Form For Property to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can find everything from court documents to templates for office communication. We recognize how vital compliance and observance of federal and state regulations are. That’s why, on our site, all forms are region-specific and current.

You can revisit your forms from the My documents section at any time. If you're an existing user, you can simply Log In, and locate and download the template from the same section.

No matter the reason for your forms—whether financial, legal, or personal—our platform has you covered. Experience US Legal Forms now!

- Locate the form you need using the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to see if the Virginia Deed Of Gift Form For Property is what you’re looking for.

- Restart your search if you require any other form.

- Sign up for a free account and choose a subscription plan to buy the form.

- Click Buy now. Once the purchase is complete, you can download the Virginia Deed Of Gift Form For Property, complete it, print it, and deliver it by mail to the necessary parties or organizations.

Form popularity

FAQ

Transferring a property title to a family member in Virginia can be done using a Virginia deed of gift form for property. This form simplifies the title transfer process and ensures that all details are legally documented. After completing the form, file it with your local land records office to finalize the transfer. Always consider legal advice to ensure a smooth transaction.

To gift a house to a family member without incurring taxes, utilize the Virginia deed of gift form for property. This form allows you to transfer ownership without the need for payment, thus avoiding capital gains tax. Ensure that the property value is below the annual exclusion limit set by the IRS. It's also wise to consult a tax professional for specific advice.

To fill out a property deed, start by obtaining a Virginia deed of gift form for property. Enter the full names of the grantor and grantee, followed by the property description. Make sure to include the parcel number and address to avoid confusion. After completing the form, both parties must sign it in front of a notary public.

Yes, you can prepare your own deed in Virginia by using the Virginia deed of gift form for property, which is readily available through various online resources, including uslegalforms. It's essential to ensure that all necessary information is included and that you follow the required legal steps for signing and recording. However, you may want to consult with a legal professional for advice to ensure everything is correctly handled.

Filing a deed in Virginia involves several steps: first, complete the Virginia deed of gift form for property, ensuring all information is accurate and complete. Next, you will need to bring it along with any applicable fees to the local circuit court for recording. After the court processes the deed, they will return a copy to you, confirming the official filing.

To transfer ownership of property in Virginia, you can complete a Virginia deed of gift form for property, specifying the new owner and the property details. After signing and notarizing the deed, you must file it with the local circuit court to legally document the ownership change. This process is vital for ensuring the new owner's rights to the property.

To create a valid gift deed in Virginia, the gift must be explicitly stated, and the Virginia deed of gift form for property must be signed by the giver. The property should be adequately described, and the deed must be notarized to ensure its legality. It's also helpful to have witnesses present during the signing, though it is not a strict requirement.

To record a deed in Virginia, you need to take the completed Virginia deed of gift form for property to the local circuit court in the county or city where the property is located. Make sure to bring the original deed along with a copy, as well as payment for any recording fees. Once filed, the court will process your document and officially record the transfer of ownership.

One significant disadvantage of a gift deed is that it may impact the donor's eligibility for government assistance programs, as the gift might be considered an asset transfer. Additionally, once a Virginia deed of gift form for property is executed, the donor relinquishes all rights to the property, which can complicate personal financial situations in the future. It may also have tax implications for both the donor and the recipient, particularly if the property appreciates in value. Thus, careful consideration is essential before proceeding with a gift deed.

The primary difference lies in the nature of the transfer. A quitclaim deed conveys whatever interest the person has in the property, without warranties, while a Virginia deed of gift form for property specifically denotes a transfer made as a gift. Essentially, a quitclaim deed may be used between parties who know each other and trust that the title is clear, whereas a gift deed is intended purely for the purpose of gifting. Understanding these differences is crucial for anyone considering property transfers in Virginia.