Gift Real Grantor Blank With A Will

Description

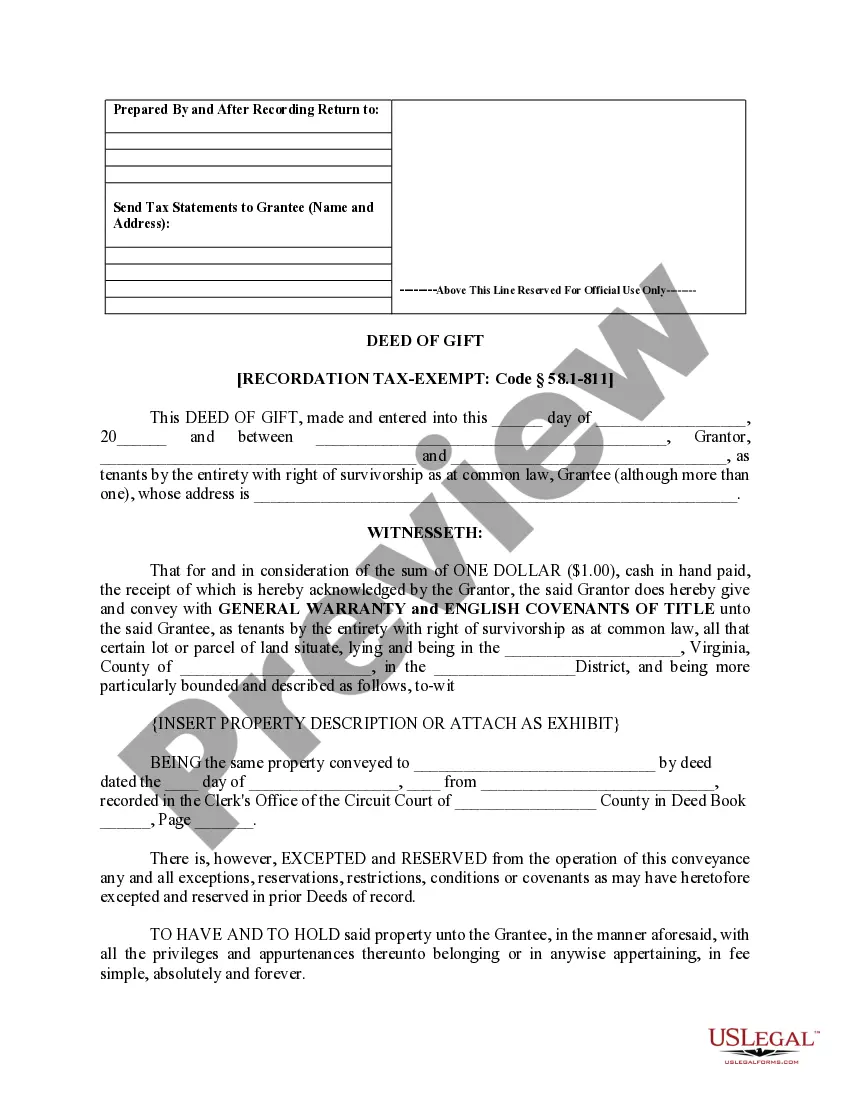

How to fill out Virginia Deed Of Gift?

- If you're an existing user, log in to your account and ensure your subscription is active. Click the Download button to save the needed template directly to your device.

- For new users, start by exploring the Preview mode and form description. Confirm the selected form aligns with your requirements and complies with your local jurisdiction.

- If necessary, utilize the Search tab to find additional templates that match your needs. Ensure you've selected the correct form before proceeding.

- Click the Buy Now button to purchase the document. Choose your preferred subscription plan and register for an account to access the complete library.

- Finally, enter your payment details via credit card or PayPal to finalize your subscription, allowing you to download the form. You can access it anytime in the My Forms section.

In conclusion, US Legal Forms provides a robust library, featuring over 85,000 fillable legal templates, ensuring you find exactly what you need. Their premium support also guarantees that your documents are accurate and legally sound.

Start your hassle-free legal documentation process today—visit US Legal Forms and get your 'Gift real grantor blank with a will' now!

Form popularity

FAQ

The term for a gift through a will is bequest. A bequest can include various types of assets, ranging from personal belongings to real estate, like in the case of a gift real grantor blank with a will. This legal term emphasizes the importance of your wishes after your demise, serving as a key component in estate planning. Utilizing a platform like US Legal Forms can streamline the creation of such documents, ensuring your gifts are legally sound.

The property transferred by a will is known as the testator's estate. When you establish a gift real grantor blank with a will, you specify which assets from your estate will go to particular individuals. This process helps in organizing your possessions and ensures that your legacy is honored. Creating a will through platforms like US Legal Forms simplifies this process and provides essential legal guidance.

The gift of real property by will is commonly referred to as a devise. When you create a gift real grantor blank with a will, you designate specific property to a beneficiary upon your passing. This legal act ensures that your real estate will be transferred according to your wishes. By using a well-structured will, you can provide clarity and prevent potential disputes over property.

Form 709 can be filed electronically depending on the software you use, although some cases may require paper submission. When strategically using a gift real grantor blank with a will, be sure to check the current e-filing options available through platforms like uslegalforms. Keeping up-to-date with these guidelines ensures you can submit your forms efficiently.

If you have made gifts that exceed the annual exclusion limit, you are required to file form 709. Filing this form is essential to report your gifts accurately and avoid potential penalties. Including a gift real grantor blank with a will helps clarify your intentions and further solidifies your compliance with tax laws.

Yes, you can file form 709 using TurboTax, which simplifies the process for many users. By incorporating a gift real grantor blank with a will, you can navigate through the instructions efficiently. TurboTax provides a straightforward way to ensure all your tax forms, including any gifts, are properly reported and filed.

Certain forms, including specific state forms and a few federal forms, are not available for electronic filing. Form 709 is sometimes among those that require paper filing, especially if amendments are needed. If you have a gift real grantor blank with a will, it is essential to review which forms can be filed electronically to streamline your tax process.

Form 709 does not need to be filed with your 1040 tax return, but it should be submitted separately if you have made gifts that exceed the annual exclusion limit. If you are utilizing a gift real grantor blank with a will, be sure to include form 709 as part of your comprehensive estate planning process. Keeping these forms organized will help ensure that you meet all necessary compliance requirements.

To document a gift for tax purposes, you need to keep clear records, including the gift amount and details about the recipient. Using a gift real grantor blank with a will helps to clarify your intent and provides a formal record. It's crucial to maintain proper documentation so that you can accurately report the gift when filing tax forms, such as form 709.

Yes, you can sign form 709 electronically, making it easier than ever to manage your tax obligations related to the gift real grantor blank with a will. Utilizing electronic signatures speeds up the filing process and ensures that your document is legally binding. This method is available through various online platforms that cater specifically to tax forms, including uslegalforms.