Gift Real Estate Forecast Next 5 Years

Description

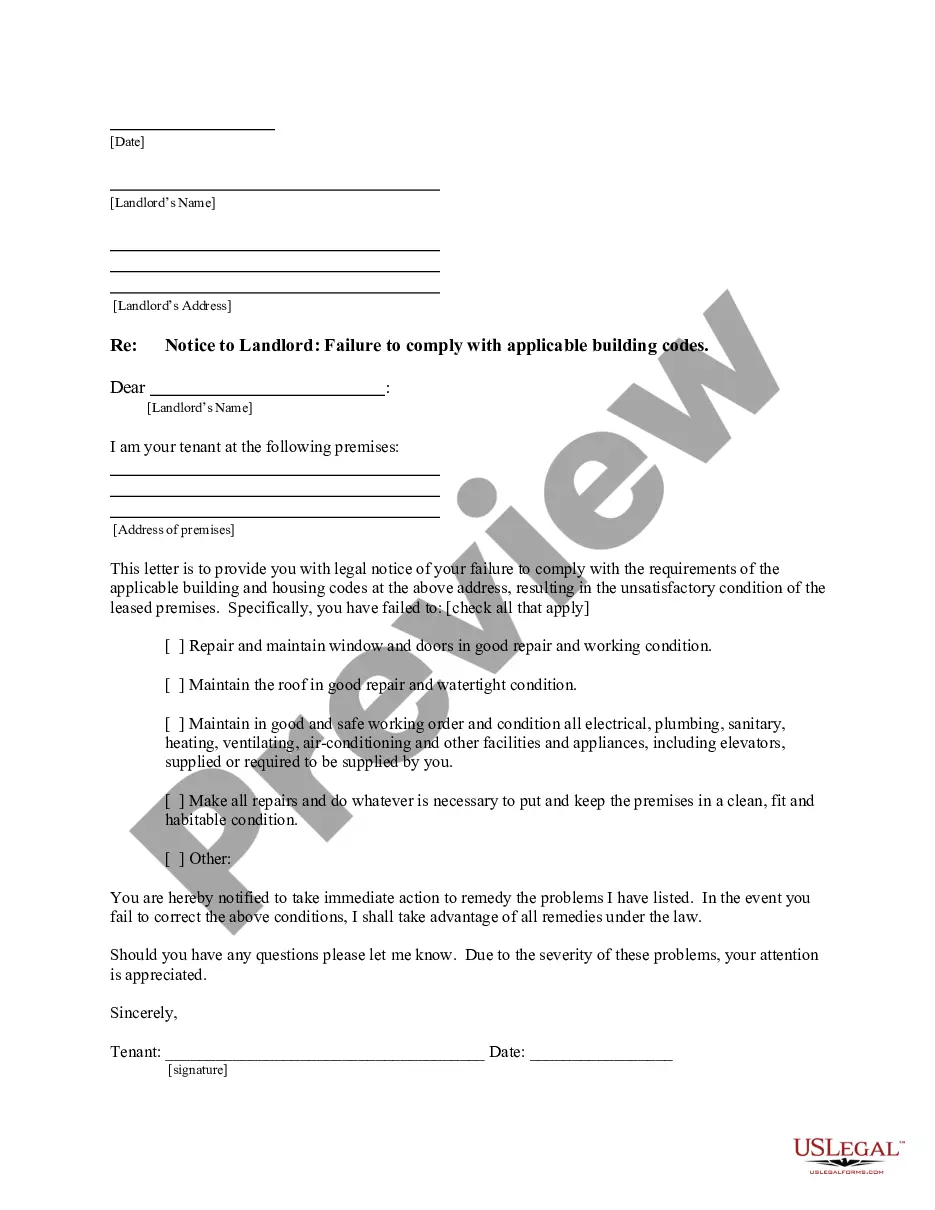

How to fill out Virginia Deed Of Gift?

It’s well-known that you cannot instantly become a legal authority, nor can you quickly comprehend how to prepare the Gift Real Estate Forecast for the next 5 years without a specialized background.

Generating legal documents is a lengthy process that demands specific education and expertise. So why not entrust the development of the Gift Real Estate Forecast for the next 5 years to the specialists.

With US Legal Forms, one of the largest collections of legal documents, you can locate everything from judicial papers to templates for internal communication.

You can regain access to your documents from the My documents section at any time. If you’re an existing user, you can simply Log In and find and download the template from the same section.

Regardless of the reason for your documents—whether financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Understand the form you require using the search bar at the top of the page.

- Review it (if this option is available) and examine the accompanying description to determine if the Gift Real Estate Forecast for the next 5 years is what you are looking for.

- Restart your search if you need a different form.

- Create a free account and choose a subscription plan to purchase the form.

- Click Buy now. Once the payment is completed, you can access the Gift Real Estate Forecast for the next 5 years, fill it out, print it, and send it or mail it to the relevant individuals or organizations.

Form popularity

FAQ

The gift real estate forecast for the next 5 years suggests that while prices may rise, a sudden spike in 2025 is uncertain. Experts predict gradual increases due to ongoing demand and limited inventory. It is wise to analyze regional trends and economic conditions to make informed decisions. Staying updated with market forecasts will help you navigate your real estate journey.

The amount you can inherit without paying inheritance tax varies by state, as some states impose their own inheritance taxes. Generally, federal law does not impose an inheritance tax. Understanding local laws and the gift real estate forecast next 5 years will help you navigate your inheritance planning.

The gift estate exemption for 2025 is expected to be higher than in previous years, but exact figures will depend on legislative decisions. It's essential to remain informed, as this exemption plays a significant role in estate planning. The gift real estate forecast next 5 years highlights the importance of strategic gifting.

The gift tax limit for 2025 is still uncertain, but projections indicate it may increase due to inflation adjustments. Monitoring these changes is crucial for effective gifting strategies. The gift real estate forecast next 5 years can provide insights that help you stay ahead.

It is likely that the annual gift tax exclusion may change in 2026, as tax laws are subject to review and adjustment. Keeping an eye on the legislative developments will help you make informed decisions. The gift real estate forecast next 5 years suggests being proactive about your financial planning.

The tax rate on gifted property varies based on the value of the gift and your total taxable gifts for the year. If your gift exceeds the annual exclusion, it may be subject to federal gift tax rates, which can range from 18% to 40%. Staying updated with the gift real estate forecast next 5 years will help you manage your taxes more effectively.

To avoid capital gains tax on gifted property, you can choose to gift property that has appreciated in value while planning the timing of the transfer. One strategy is to consult with a tax advisor to understand your options and how the gift real estate forecast next 5 years may affect your situation. Utilizing USLegalForms can simplify the legal documentation involved.

Yes, gifting $75,000 towards a down payment may trigger gift tax considerations. In 2023, the annual gift tax exclusion is $17,000 per recipient, so you could be subject to tax on the excess amount. Understanding the gift real estate forecast next 5 years will help you plan your financial decisions effectively.

To gift a property to a family member, you need to prepare a deed that transfers ownership. You should also consult with a legal professional to ensure the process complies with local laws. Additionally, consider the implications on your taxes, especially in light of the gift real estate forecast next 5 years.

The gift real estate forecast for 2025 suggests that real estate could remain a solid investment option. As demand continues to grow, property values may appreciate, making it an attractive avenue for investors. However, it's vital to consider your local market conditions and investment strategy. Utilizing resources from uslegalforms can help you navigate the complexities of real estate investment successfully.