Gift Real Estate Forecast

Description

How to fill out Virginia Deed Of Gift?

Creating legal documents from the ground up can occasionally feel a bit daunting. Certain situations may demand extensive research and significant financial investment.

If you’re in search of a more straightforward and economical method of preparing the Gift Real Estate Forecast or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can rapidly access state- and county-specific templates meticulously crafted by our legal experts.

Utilize our platform whenever you require dependable and trustworthy services through which you can swiftly find and download the Gift Real Estate Forecast. If you’re familiar with our site and have previously established an account, simply Log In to your profile, choose the form, and download it immediately or retrieve it later anytime in the My documents section.

Download the document, then complete, sign, and print it. US Legal Forms proudly holds an impeccable reputation and boasts over 25 years of expertise. Join us now and simplify the form completion process!

- Don’t have an account? No problem. It requires minimal time to create one and explore the library.

- But before proceeding to download the Gift Real Estate Forecast, keep these suggestions in mind.

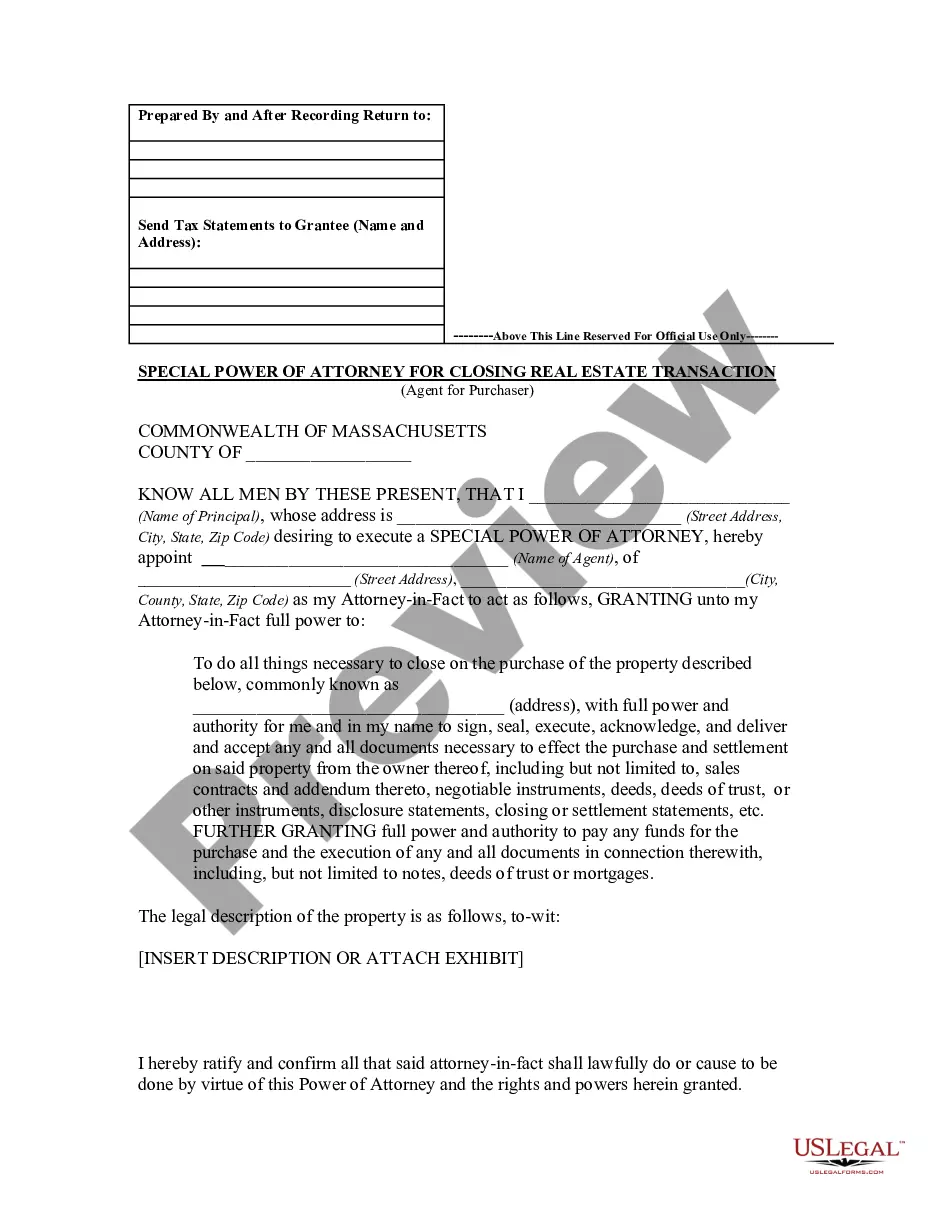

- Review the document preview and descriptions to ensure you have located the form you need.

- Verify if the form you select meets the standards of your state and county.

- Choose the most appropriate subscription option to acquire the Gift Real Estate Forecast.

Form popularity

FAQ

To legally prove something is a gift, you should document the transfer process with clear intentions from both parties. This includes a signed gift letter, any relevant correspondence, and records of the transaction. By maintaining thorough documentation, you can support your claim, ensuring alignment with the gift real estate forecast and making any legal processes smoother.

A gift offer letter typically outlines the intention to transfer property without expecting anything in return. For instance, it may include details such as the property address, the value of the gift, and a statement confirming that no repayment is expected. When you draft this letter, consider using templates available on the US Legal Forms platform, which can simplify the process and ensure you include all necessary elements for a clear gift real estate forecast.

To determine the value of gifted property, you can start by assessing recent sales of comparable properties in the area, which provides a market-based perspective. Additionally, consider hiring a professional appraiser who can evaluate the property’s condition, location, and unique features. This valuation plays a crucial role in understanding the gift real estate forecast, ensuring both parties are aware of the property's worth.

Many experts believe that the real estate market may experience a rebound in 2025, driven by economic recovery and increasing demand. Factors such as job growth, interest rates, and demographic shifts will play crucial roles in shaping the market. Keeping an eye on these trends can help refine your gift real estate forecast. To stay informed and prepared, consider using uslegalforms for the necessary legal documents and guidance in your real estate endeavors.

The 7% rule in real estate suggests that investors should aim for a return on investment of at least 7% when purchasing properties. This guideline helps you evaluate potential properties and make informed decisions. By incorporating this rule into your strategy, you can better navigate the market and enhance your overall gift real estate forecast. Understanding this rule empowers you to maximize your investments effectively.

Yes, many real estate agents choose to give closing gifts as a way to show appreciation to their clients. These gifts can range from personalized items to practical household goods. While closing gifts may not directly influence the gift real estate forecast, they can enhance the client-agent relationship, fostering trust and encouraging referrals. Therefore, a thoughtful closing gift can leave a lasting impression.

To predict real estate appreciation, you should analyze economic indicators, population growth, and local market conditions. Researching historical data can also reveal patterns that suggest future growth. By staying informed and using tools that project trends, you can create a more accurate gift real estate forecast. This knowledge equips you to make strategic decisions about property investments.

The best way to gift real estate is to consult with a legal expert to ensure all necessary steps are followed correctly. You should consider creating a gift deed that clearly outlines the transfer of ownership. Furthermore, using platforms like US Legal Forms can simplify the paperwork and ensure compliance with state regulations. A careful approach can lead to a smooth transaction that benefits both parties in the gift real estate forecast.

Buying your parents' house for $1 is possible, but it comes with potential tax consequences. The IRS views this as a gift, which may trigger gift tax considerations if the house's fair market value is significantly higher. To ensure compliance with tax laws and protect everyone’s interests, it's wise to consult with a legal expert. US Legal Forms offers the necessary documentation and advice to help you manage the process and understand the gift real estate forecast.

Yes, your parents can gift you a house, but there are important considerations. The IRS has specific rules about gift taxes that may apply, especially if the property's value exceeds a certain threshold. It is crucial to understand the implications of this gift on your taxes and estate planning. Using a resource like US Legal Forms can help you navigate the legalities involved in transferring property and provide guidance on the gift real estate forecast.