Gift Deed Virginia For Foreigners

Description

How to fill out Virginia Deed Of Gift?

- Log in to your US Legal Forms account if you're already a member. If your subscription is expired, renew it based on your selected pricing plan.

- For first-time users, start by checking the Preview mode and reading the form description to ensure it aligns with your jurisdiction's requirements.

- If necessary, use the Search tab to find another template that fits your needs.

- Purchase the document by clicking the Buy Now button, selecting a subscription plan, and creating your account.

- Complete your payment using your credit card or PayPal account for the subscription.

- Download your form to your device, ensuring easy accessibility later via the My Forms section in your profile.

In conclusion, US Legal Forms streamlines the process of obtaining legal documents such as a gift deed in Virginia. It offers a vast selection of forms and the added benefit of expert assistance to ensure your documents are correct and compliant.

Start using US Legal Forms today to manage your legal document needs with ease!

Form popularity

FAQ

Creating a gift deed in the USA generally involves drafting a clear document that specifies the property being transferred and the parties involved. It's advisable to have the deed reviewed by a legal professional to ensure it meets all state requirements. For simplicity, platforms like uslegalforms can provide templates and guidance tailored for foreigners looking to navigate the gift deed process efficiently.

While a gift deed can simplify property transfer, there are potential disadvantages, including the inability to change your mind after the transfer is complete. Furthermore, gifting property may have tax implications for both the giver and the receiver. It's important for foreigners to consult with a legal expert familiar with Virginia laws to mitigate risks associated with a gift deed.

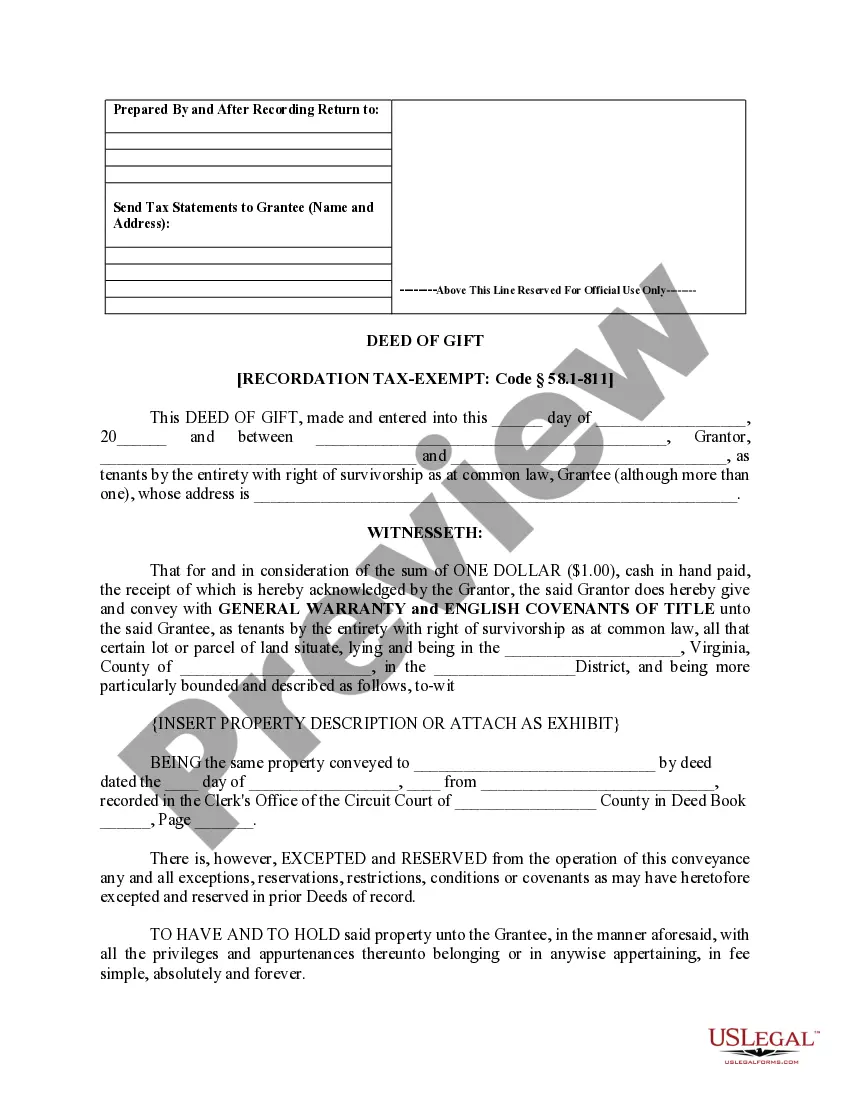

To gift a house in Virginia, you will need to prepare a gift deed, which outlines the transfer of ownership from you, the donor, to the recipient. Ensure that both parties sign the deed before a notary, and then record it at the county clerk's office to make it an official transfer. For foreigners, using a platform like uslegalforms can streamline this process and ensure proper documentation.

A deed of gift serves to transfer ownership of property from one person to another without compensation. This legal document is especially useful in situations where individuals wish to pass on their assets, such as real estate, to family members or friends. For foreigners considering this process in Virginia, understanding how a gift deed works is essential for ensuring compliance with local laws.

The primary difference lies in intention and security. A quitclaim deed simply transfers whatever interest the grantor has without any warrants, while a gift deed explicitly denotes that the transfer is a gift, ensuring that no compensation is exchanged. This becomes particularly relevant for foreigners looking at property in Virginia; a gift deed provides clearer documentation of intent and can simplify legal processes. Consider using uslegalforms to access templates and guidance tailored to your needs.

A quitclaim deed and a gift deed serve different purposes, despite some similarities. A quitclaim deed transfers ownership without any guarantees, while a gift deed specifically involves the transfer of property as a gift, often including language that indicates no payment is involved. When dealing with property transfers in Virginia, particularly for foreigners, understanding the distinctions helps you make informed decisions about your real estate transactions.

While a quitclaim deed can transfer property quickly and easily, it does come with disadvantages. One major issue is that it does not guarantee that the person transferring the deed holds clear title to the property. This means you, as a buyer, may face unexpected claims to the property. Additionally, when considering a gift deed Virginia for foreigners, it’s important to know that a quitclaim deed does not provide any warranties regarding the property’s condition or value.

In the United States, including Virginia, gifts can be subject to tax rules. Generally, a gift deed is not taxable for the recipient, but the giver may have to report the property transfer if it exceeds the annual exclusion amount. Understanding the nuances of tax liability is essential, especially for foreign nationals involved in property transfers. Consulting with USLegalForms can provide clarity and ensure compliance with relevant tax laws when using a gift deed in Virginia for foreigners.

Choosing between inheriting a house and receiving it as a gift often depends on your specific circumstances. With a gift deed in Virginia for foreigners, you can transfer property ownership while avoiding the lengthy probate process associated with inheritance. Moreover, a gift deed allows the giver to see their property enjoyed by the recipient during their lifetime. Ultimately, consider tax implications and personal relationships when making this decision.

When considering a settlement deed versus a gift deed, it's important to understand how each serves different purposes. A settlement deed typically resolves disputes or transfers property within a family or to settle a financial matter, while a gift deed specifically transfers ownership without compensation, making it a popular choice for those wishing to give property as a gift. For foreigners, a gift deed in Virginia can offer several benefits, such as simplicity in transfer and potential tax advantages. If you're navigating these options, U.S. Legal Forms can provide you with streamlined documentation and resources to ensure you make an informed decision about your property transactions.