Va Law Codes For Divorce

Description

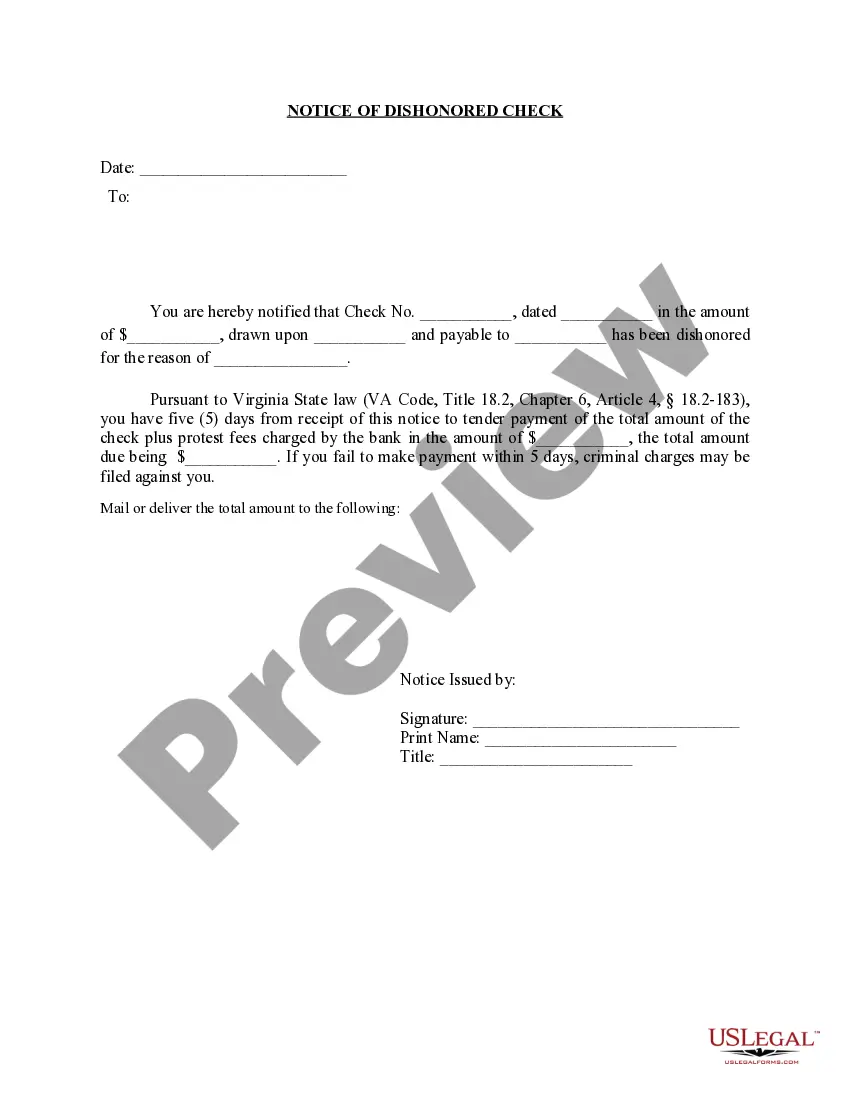

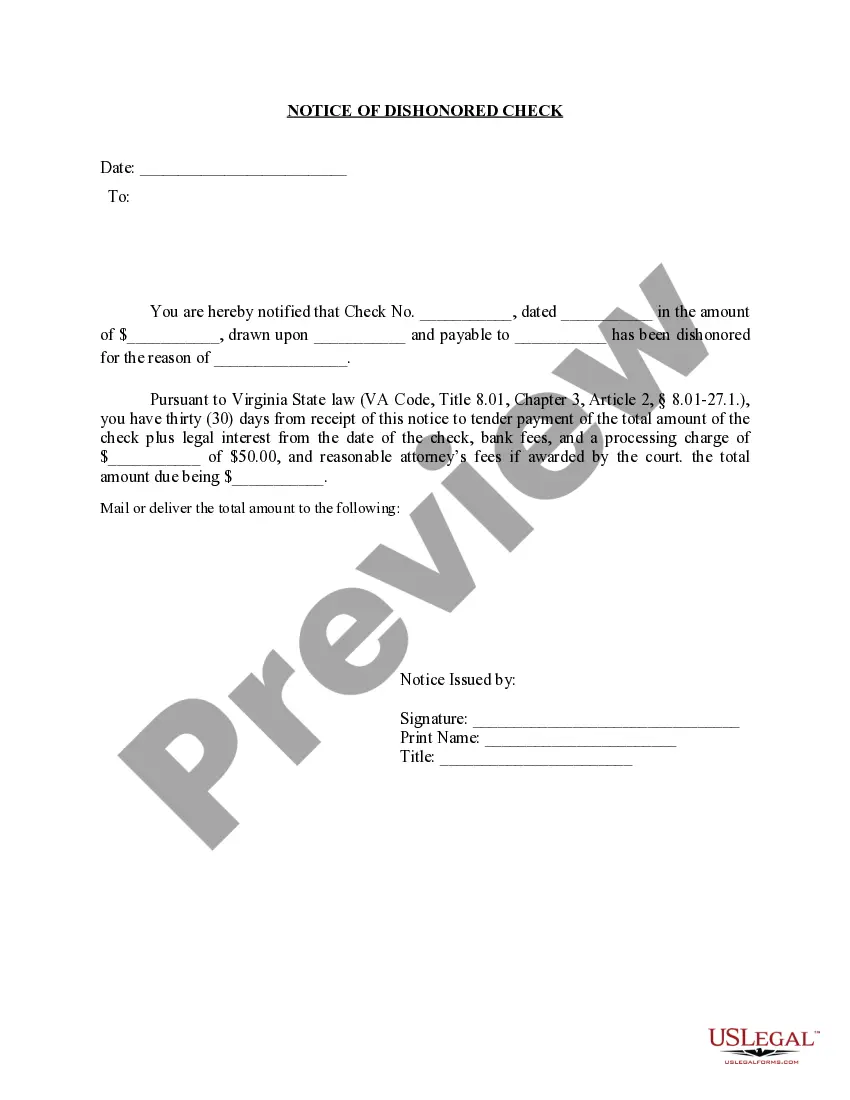

How to fill out Virginia Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

The Virginia Statutes for Dissolution of Marriage available on this site is a reusable official template created by expert attorneys in compliance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with over 85,000 authenticated, state-specific documents for any professional and personal necessity.

Complete and sign the document. Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and eSign your form. Re-download your documents anytime. Access the My documents tab in your profile to retrieve any previously downloaded forms. Subscribe to US Legal Forms to have verified legal templates for every circumstance in life at your fingertips.

- Explore the document you require and review it.

- Browse through the file you searched and preview it or examine the form description to ensure it meets your requirements. If it does not, utilize the search feature to find the appropriate one. Click Buy Now when you have located the template needed.

- Select and Log In.

- Pick the pricing plan that works for you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Virginia Statutes for Dissolution of Marriage (PDF, DOCX, RTF) and download the template onto your device.

Form popularity

FAQ

The 21-day rule in Virginia refers to the timeframe within which a defendant must respond to a divorce complaint once served. Under Virginia law, the defendant has 21 days to file an answer if served in-state, or 30 days if out of state. Promptly adhering to this rule is essential to move forward in your divorce process smoothly. For clarity on the procedures, consider exploring resources available on platforms like USLegalForms, which offer helpful guidance.

If you are an existing customer of the lender, with whom you have a savings or salary account, fixed deposits, or have taken loans in the past, you may not be required to submit documents. However, you may be required to submit relevant information via an application form online, as mentioned above.

Loan Term: Under Virginia law, your loan term cannot be more than 24 months. Your loan term also cannot be less than four months unless your total monthly payment will not exceed the greater of (i) 5.0% of your verified gross monthly income or (ii) 6.0% of your verified net monthly income.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.

Legislation has been enacted allowing payday lenders to transact business in Virginia. The legislation became effective on July 1, 2002 and allowed payday lenders licensed by the State Corporation Commission (SCC) to begin such business on that date.

Typical personal loan documentation requirements Proof of your identity. First and foremost, you have to prove to lenders that you are who you say you are. ... Proof of address. ... Proof of income. ... Recurring monthly expenses. ... Your credit score. ... Your purpose for the personal loan.

Loan Term: Under Virginia law, your loan term cannot be more than 24 months. Your loan term also cannot be less than four months unless your total monthly payment will not exceed the greater of (i) 5.0% of your verified gross monthly income or (ii) 6.0% of your verified net monthly income.

§ 6.2-303. Except as otherwise permitted by law, no contract shall be made for the payment of interest on a loan at a rate that exceeds 12 percent per year.

Personal loans can be used for just about anything. Generally, the only time you'll need to specify a purpose for your personal loan is if you're planning debt consolidation.