Increase Rent Re Withholding

Description

How to fill out Virginia Letter From Landlord To Tenant About Intent To Increase Rent And Effective Date Of Rental Increase?

Whether for business purposes or for individual matters, everyone has to handle legal situations sooner or later in their life. Filling out legal papers requires careful attention, starting with picking the right form sample. For instance, when you pick a wrong version of the Increase Rent Re Withholding, it will be turned down when you send it. It is therefore important to have a trustworthy source of legal files like US Legal Forms.

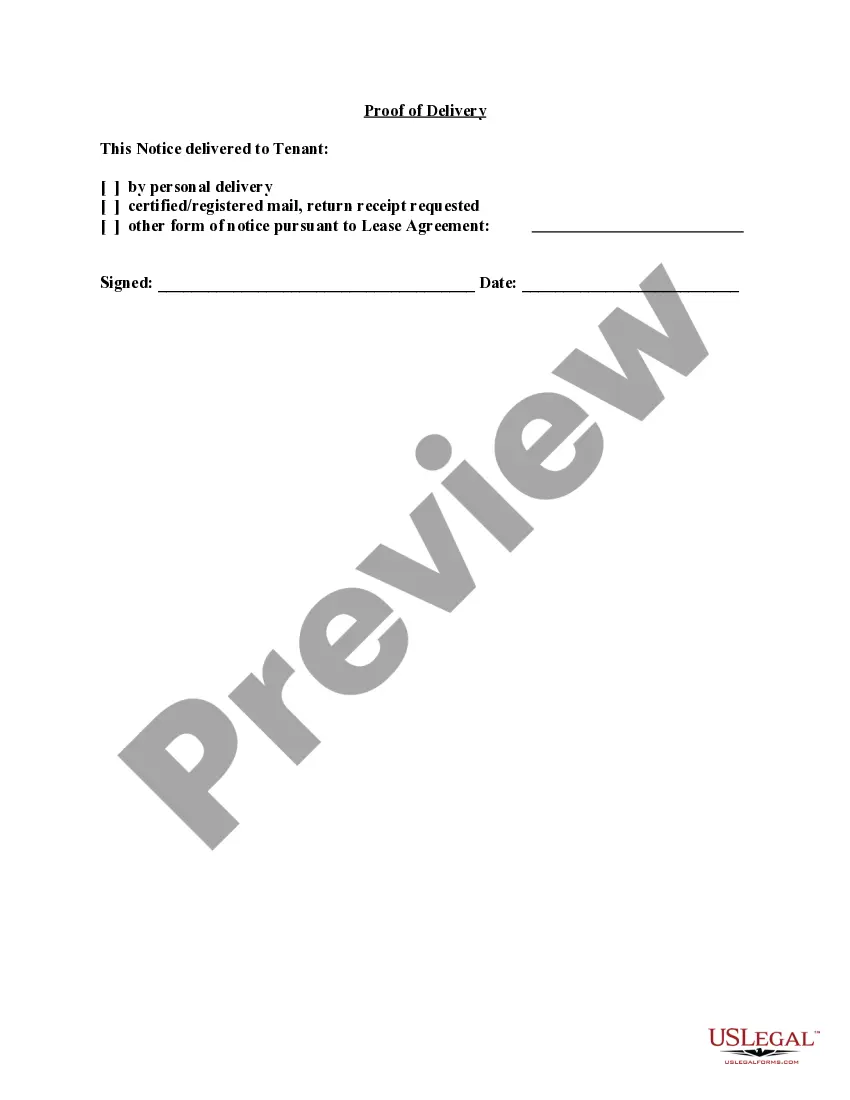

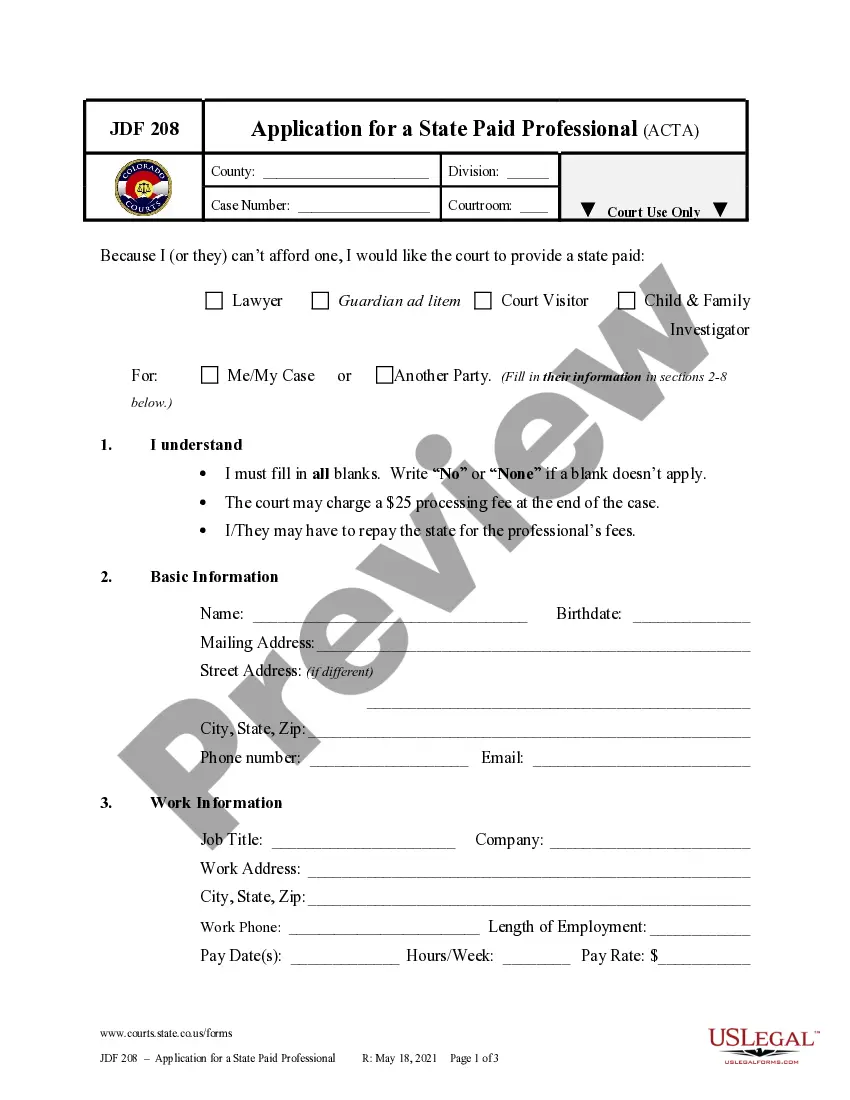

If you have to obtain a Increase Rent Re Withholding sample, stick to these simple steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Examine the form’s information to ensure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect document, return to the search function to find the Increase Rent Re Withholding sample you require.

- Get the file when it meets your needs.

- If you already have a US Legal Forms profile, simply click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Pick your transaction method: use a credit card or PayPal account.

- Choose the file format you want and download the Increase Rent Re Withholding.

- After it is downloaded, you can fill out the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time looking for the right sample across the web. Take advantage of the library’s simple navigation to find the proper template for any occasion.

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Your number of qualifying children under age 17 multiplied by $2,000 will go into the first box. The number of other dependents multiplied by $500 will go in the second box. The sum of those two numbers will go on line 3.

Hear this out loud PauseJust divide the amount you usually pay in federal taxes by the number of paychecks you receive in a year to find out how much extra should be withheld each pay period.

Simply add an additional amount on Line 4(c) for "extra withholding." That will increase your income tax withholding, reduce the amount of your paycheck and either jack up your refund or reduce any amount of tax you owe when you file your tax return.

On line 4(c), you can instruct your employer to withhold an extra amount of tax from your paycheck. Alternatively, don't factor the extra income into your W-4. Instead of having the tax come directly out of your paycheck, send estimated tax payments to the IRS yourself instead.