Trust Deed Form With A Mortgage

Description

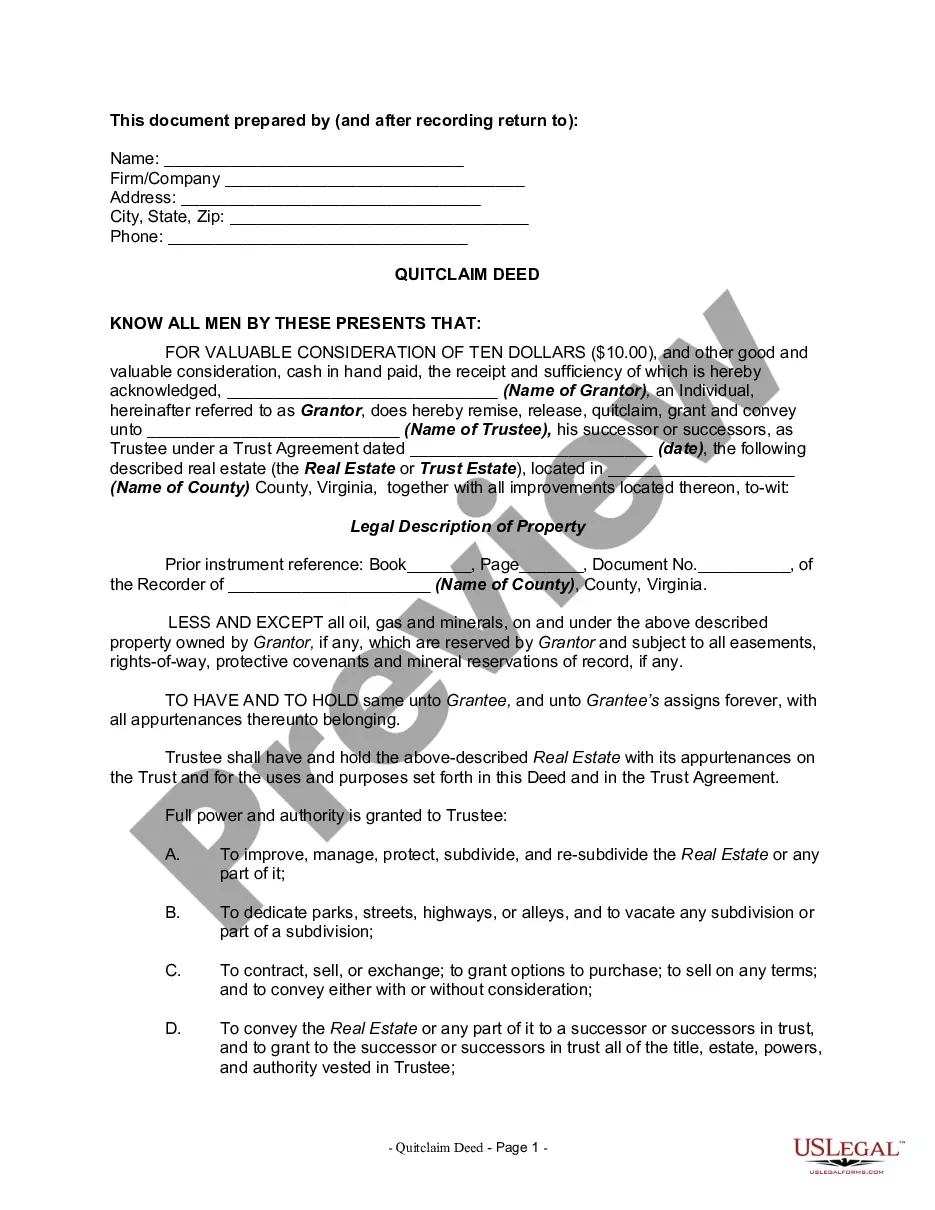

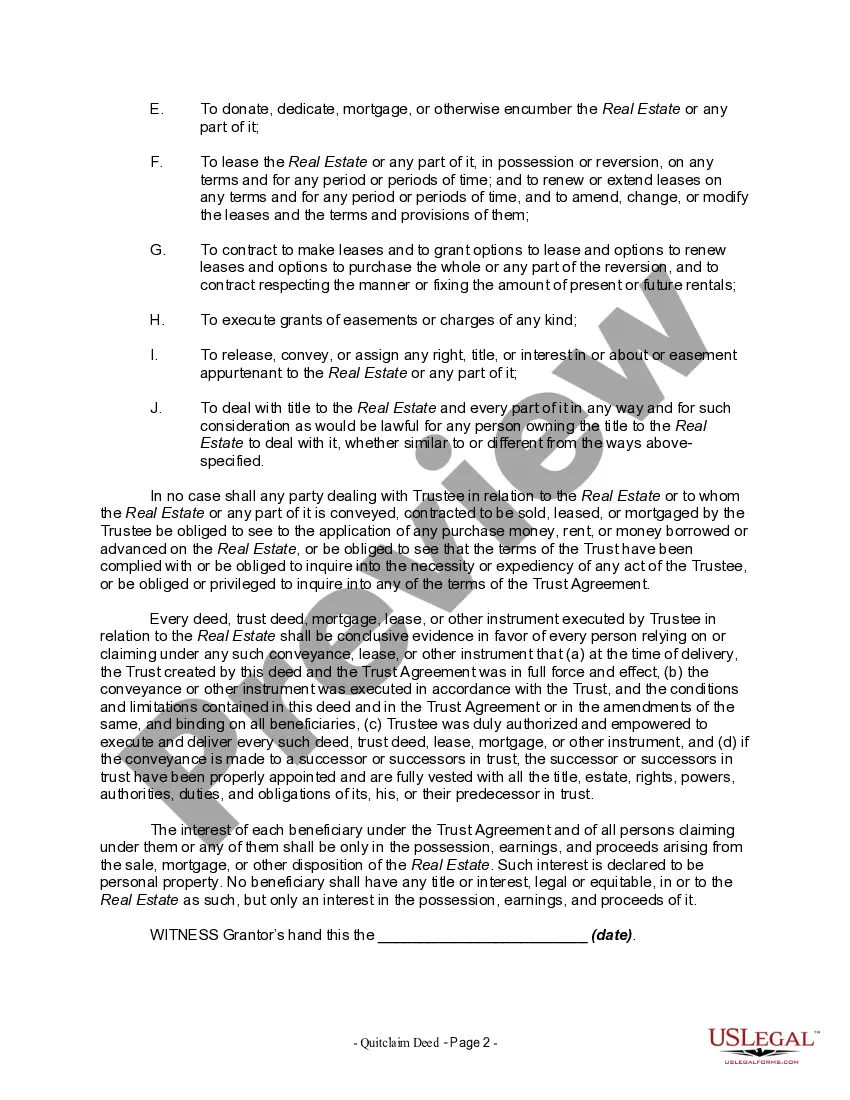

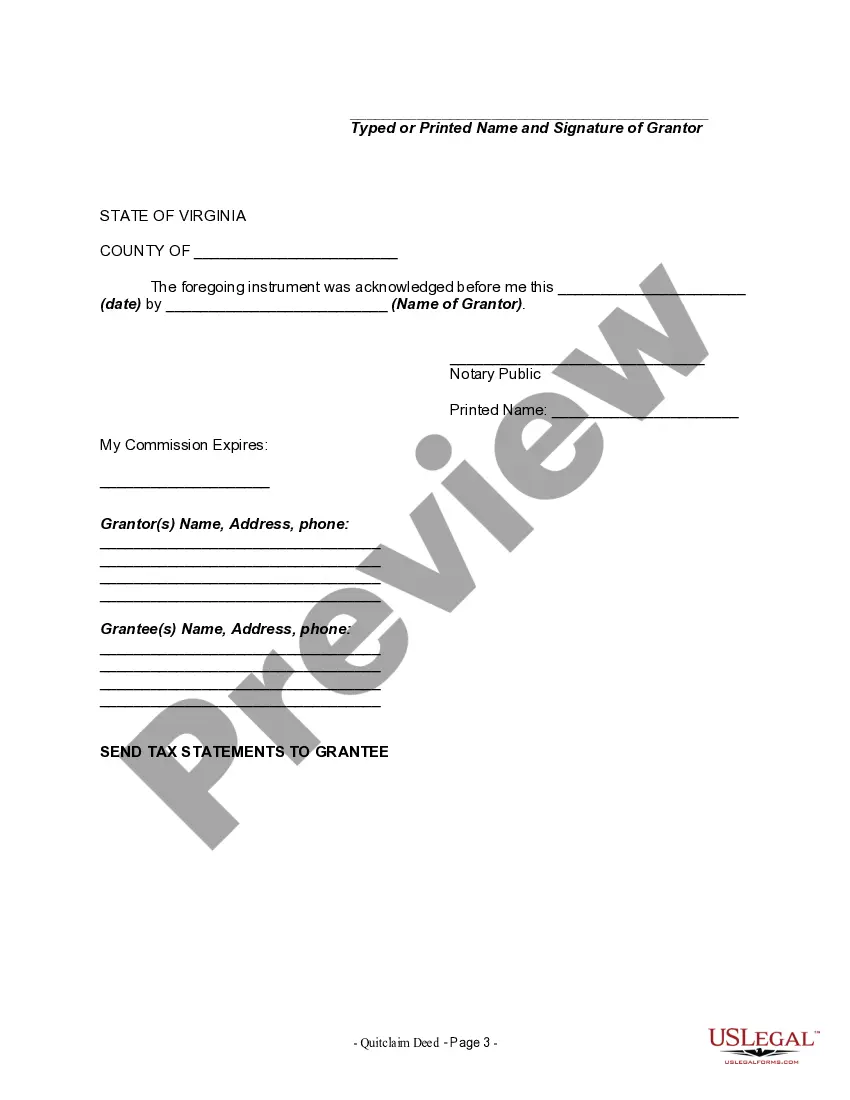

How to fill out Virginia Land Trust - Quitclaim Deed?

Individuals frequently link legal documentation with something intricate that only an expert can manage.

In a certain sense, this is accurate, as creating a Trust Deed Form With A Mortgage requires significant expertise in subject matters, including state and local laws.

Nonetheless, with US Legal Forms, everything has become simpler: pre-made legal templates for any life and business event specific to state statutes are compiled in a single online catalog and are currently accessible to all.

Select a pricing plan that fits your needs and budget. Register for an account or Log In to continue to the payment page. Complete your subscription payment via PayPal or with your credit card. Choose the format for your document and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our catalog are reusable: once obtained, they remain in your profile. You can access them whenever necessary through the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe now!

- US Legal Forms offers over 85k current documents sorted by state and area of application, making the search for Trust Deed Form With A Mortgage or any other specific template take just minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to get the form.

- New users will first need to create an account and subscribe before they can save any documents.

- Here’s a step-by-step guide on how to acquire the Trust Deed Form With A Mortgage.

- Carefully review the page content to make sure it aligns with your requirements.

- Read the form description or view it via the Preview option.

- Search for another template using the Search field in the header if the previous one does not meet your criteria.

- Click Buy Now when you discover the correct Trust Deed Form With A Mortgage.

Form popularity

FAQ

A mortgage trust is a legal entity that holds mortgages as its primary assets. This type of trust can be established using a trust deed form with a mortgage, allowing investors to earn returns through the interest payments made on these loans. Understanding mortgage trusts can be beneficial for those looking to diversify their investment portfolios. They can provide steady income and offer unique investment opportunities.

When you place assets in a trust, such as a bank account, those assets are managed according to the trust's instructions. A trust deed form with a mortgage can also affect how these assets are treated in terms of ownership and distribution. This arrangement can provide clarity and protection for your financial assets. It's essential to understand these dynamics when setting up a trust.

In California, lenders typically use a deed of trust instead of a traditional mortgage. This deed of trust form with a mortgage creates a three-party agreement between you, the lender, and the trustee. It allows for a quicker foreclosure process if needed, making it a preferred choice in the state. Knowing this can help you navigate real estate transactions effectively.

Yes, a trust deed can impact your bank accounts, especially if there are restrictions placed on your finances. However, you will usually be able to maintain a basic bank account to manage your daily expenses. Being mindful of your financial habits during this time can help you regain better control over your financial future. For managing your needs, consider using a trust deed form with a mortgage to better prepare for your financial commitments.

Yes, you can still get a mortgage after a trust deed, but it's essential to rebuild your credit first. Lenders will review your financial circumstances, including how you managed debts while under the trust deed. Showing that you have improved your financial habits increases your chances. Engaging with a trust deed form with a mortgage can help guide your next steps.

A trust deed typically lasts for four years, depending on the terms agreed upon. During this time, you must adhere to the financial obligations set forth in the agreement. After this period, as long as you comply with the requirements, the trust deed will be discharged. For those needing assistance, uslegalforms offers tools to streamline the trust deed form with a mortgage process.

A trust deed usually remains on your credit report for up to six years after it is established. This can affect your ability to secure loans but may improve over time with responsible financial behavior. Remember that the impact diminishes as time passes. Utilizing a trust deed form with a mortgage may be a viable option to consider during this period.

A trust deed is important because it offers a straightforward way to secure property financing. It clearly outlines the responsibilities of both the borrower and the lender, minimizing potential misunderstandings. When using a trust deed form with a mortgage, both parties have a clear agreement, which can help avoid disputes. By understanding its importance, you empower yourself to make better financial decisions.

Yes, you can obtain a mortgage after utilizing a trust deed but it may depend on your financial history. Lenders generally look at your credit score and payment history when considering your application. If you've managed your finances well after the trust deed form with a mortgage, you can still qualify for a new mortgage. Ensure you communicate with lenders about your past and present financial situation.

When deciding between a deed of trust and a mortgage, it's essential to understand their differences. A deed of trust often allows for a smoother and faster foreclosure process, which can be beneficial for lenders. On the other hand, the trust deed form with a mortgage gives you, as a borrower, certain advantages, including more options during financing. Consider your circumstances carefully before making your decision.