Transfer Deed When Someone Dies

Description

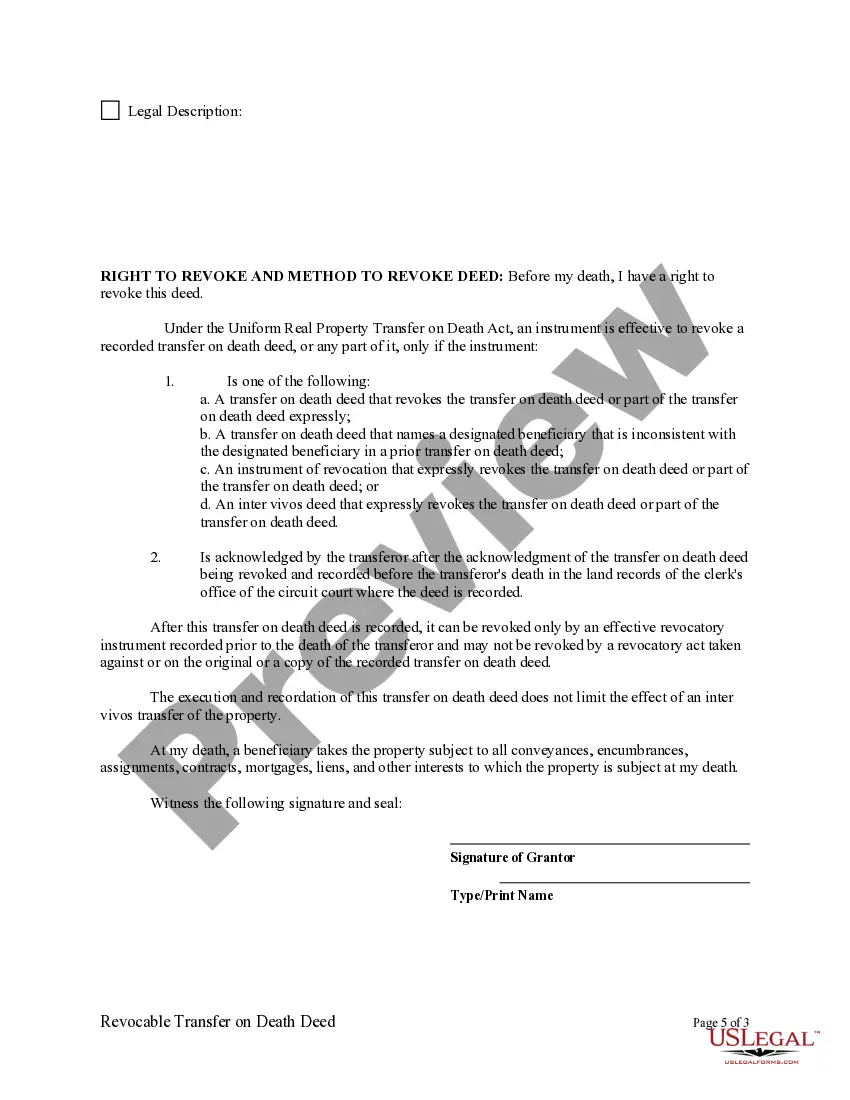

How to fill out Virginia Revocable Transfer On Death Deed From Individual To Individual?

Legal documents administration can be exasperating, even for the most astute professionals.

When you are seeking a Transfer Deed When Someone Passes Away and lack the time to search for the accurate and current version, the procedures can be daunting.

Access state- or county-specific legal and business forms.

US Legal Forms caters to all requests you may have, from personal to business documents, in one place.

If this is your initial experience with US Legal Forms, create a free account and gain unlimited access to all platform advantages. Here are the steps to follow after downloading the form you need.

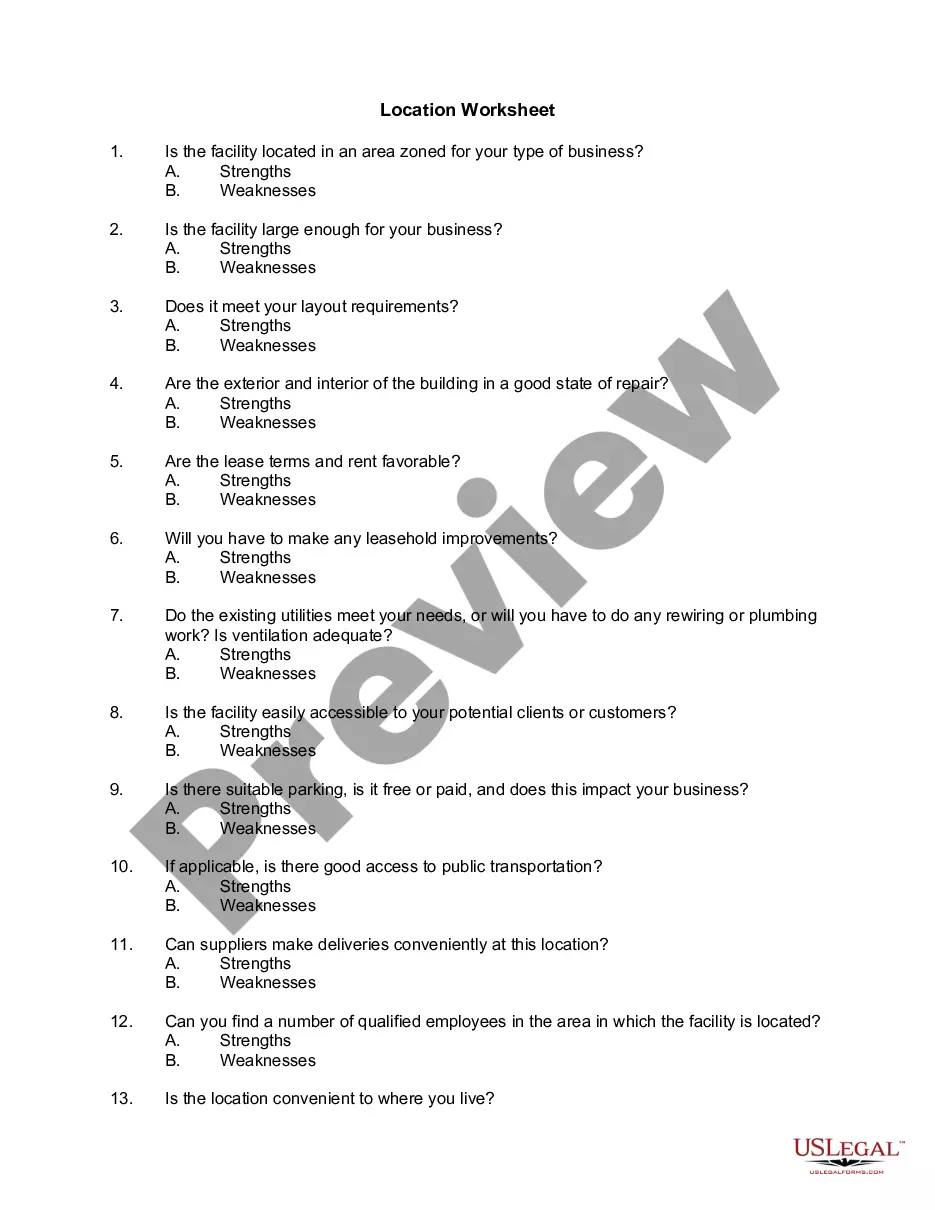

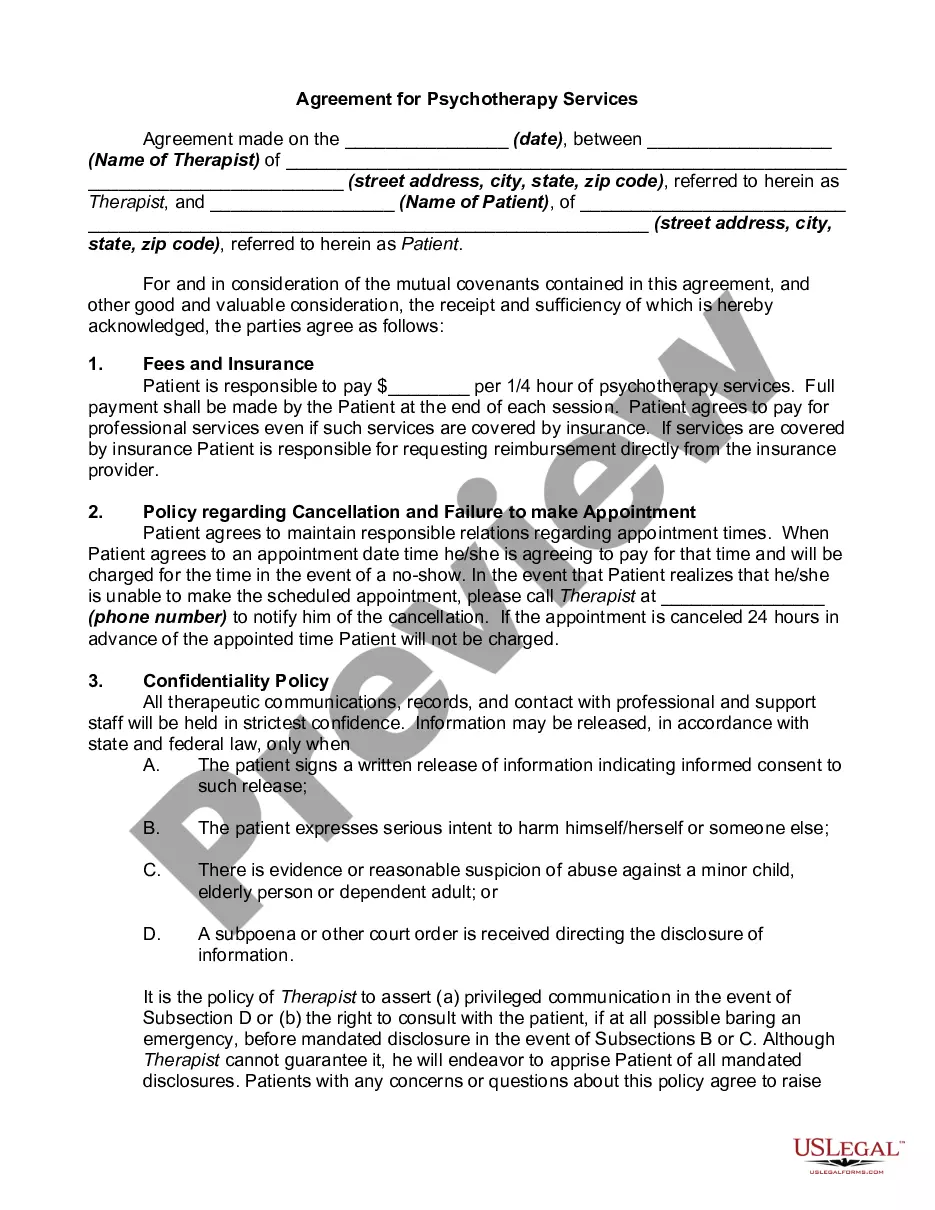

- Utilize advanced tools to complete and manage your Transfer Deed When Someone Passes Away.

- Access a valuable library of articles, guides, and resources related to your situation and needs.

- Save time and effort searching for the documents you need and use US Legal Forms' sophisticated search and Preview tool to find Transfer Deed When Someone Passes Away and download it.

- If you possess a subscription, Log Into your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you have previously saved and manage your files as per your requirements.

- A comprehensive online form repository could be transformative for anyone wishing to handle these matters effectively.

- US Legal Forms is a leading provider in digital legal documents, featuring over 85,000 state-specific legal forms accessible to you at any moment.

- With US Legal Forms, you can.

Form popularity

FAQ

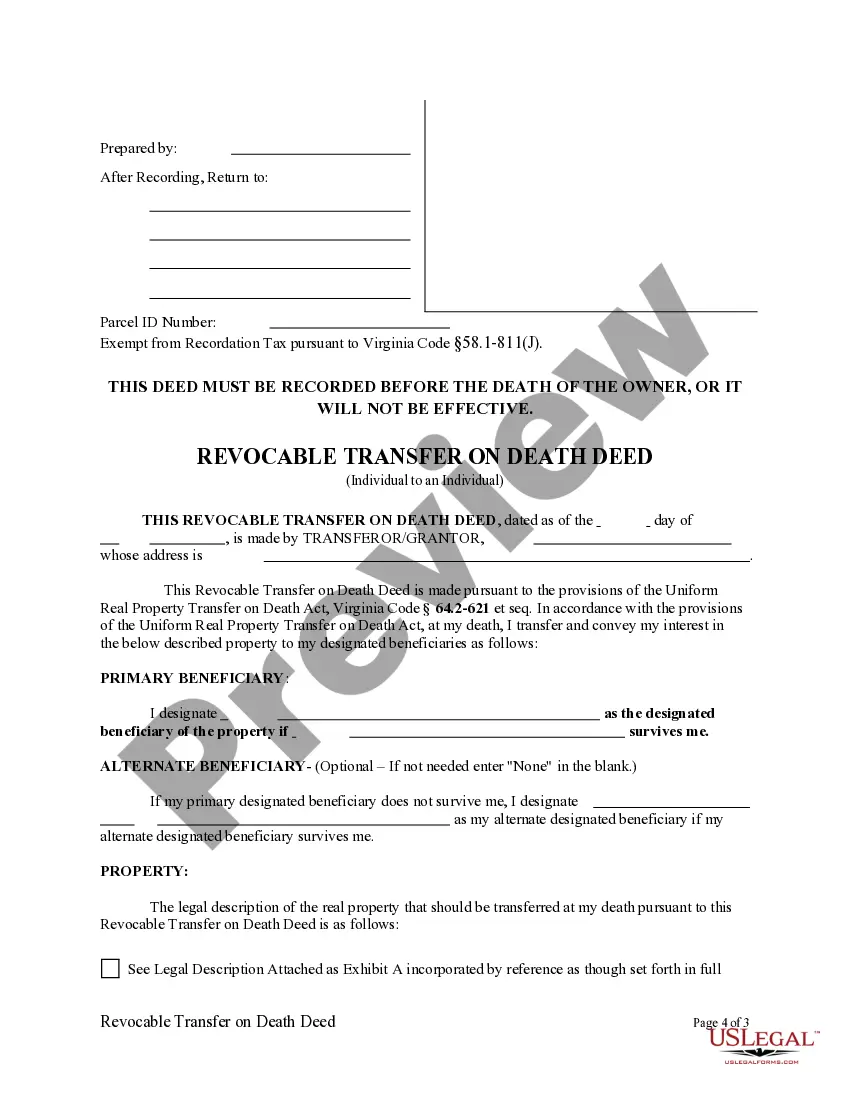

Meanwhile, our fee to prepare a Transfer on Death Deed is $195. Good to know: Since the Transfer upon Death Deed conveys property outside of Probate, it avoids incurring costs to transfer the property to your beneficiaries upon your death.

How to Minimize Capital Gains Tax on Inherited Property Sell the inherited property quickly. ... Make the inherited property your primary residence. ... Rent the inherited property. ... Qualify for a partial exclusion. ... Disclaim the inherited property. ... Deduct Selling Expenses from Capital Gains.

After one year, if the executor doesn't complete their duties, beneficiaries may demand payment (possibly with interest) by taking the executor to court.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

The deed could get complicated, and its validity contested if it is not recorded correctly or if the legal criteria are not met. If there is no provision for a contingent beneficiary, the transfer on the death deed is rendered ineffective if the named beneficiary passes away before the property owner.