Virginia Foreign Corporation Withdrawal

Description

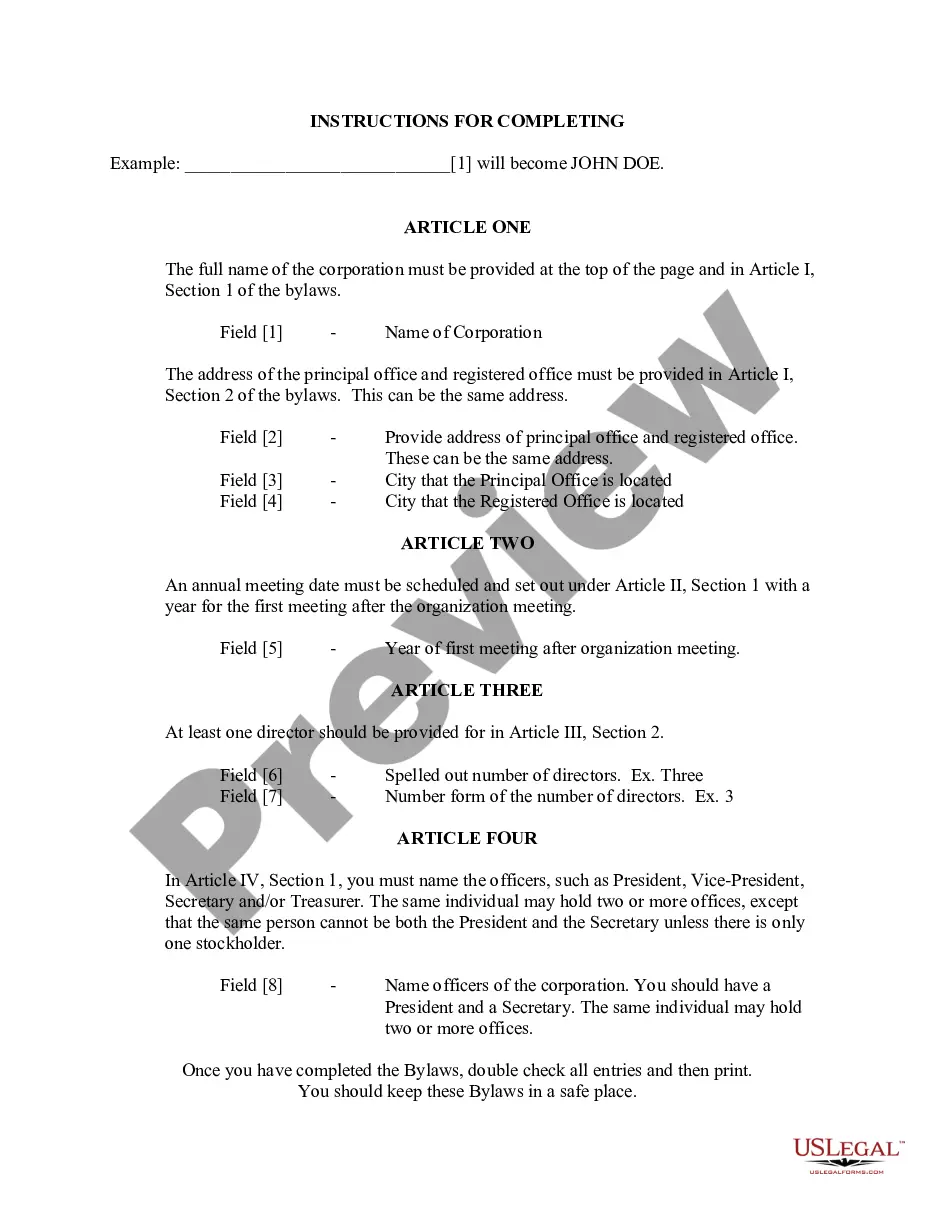

How to fill out Virginia Bylaws For Corporation?

When you need to file Virginia Foreign Corporation Withdrawal in accordance with your local state's guidelines, there can be several choices to select from.

There's no requirement to review each form to ensure it meets all the legal requirements if you are a US Legal Forms subscriber. It is a dependable resource that can assist you in obtaining a reusable and current template on any topic.

US Legal Forms is the largest online catalog containing an archive of over 85k ready-to-use documents for business and personal legal needs. All templates are confirmed to adhere to each state's laws and regulations. Hence, when downloading Virginia Foreign Corporation Withdrawal from our platform, you can be confident that you maintain a valid and current document.

Select the most fitting subscription plan, Log In to your account, or create one. Pay for a subscription (PayPal and credit card options are available). Download the template in the desired file format (PDF or DOCX). Print the document or complete it electronically in an online editor. Accessing professionally drafted official papers becomes uncomplicated with US Legal Forms. Additionally, Premium users can also take advantage of the robust integrated solutions for online PDF editing and signing. Give it a try today!

- Obtaining the required sample from our platform is exceptionally easy.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- Later, you can access the My documents tab in your profile and keep access to the Virginia Foreign Corporation Withdrawal at any time.

- If this is your first experience with our library, please follow the guidance below.

- Browse the suggested page and check it for alignment with your criteria.

- Utilize the Preview mode and read the form description if available.

- Find another sample via the Search field in the header if necessary.

- Click Buy Now once you locate the appropriate Virginia Foreign Corporation Withdrawal.

Form popularity

FAQ

Yes, many states, including Virginia, offer online services for dissolving a corporation. You can complete the necessary forms and submit them electronically, making the process efficient and straightforward. This method streamlines the Virginia foreign corporation withdrawal, so you can focus on your next steps without added hassle.

For a corporation to be voluntarily dissolved, the board must first adopt a resolution to dissolve. Following this, the proper dissolution paperwork must be filed with the state, and all debts should be settled. Each step is crucial to ensure a smooth Virginia foreign corporation withdrawal, minimizing future tax or legal issues for the business owners.

To cancel an inactive LLC in Virginia, start by reviewing your company's obligations and settling any outstanding debts. Next, you must file Articles of Cancellation with the Virginia State Corporation Commission. This step officially completes the Virginia foreign corporation withdrawal process and ensures no further liabilities arise, allowing you to close your business without future concerns.

When you dissolve your corporation, it ceases all business operations and legal existence. This process includes notifying creditors, settling debts, and filing dissolution documents with the state. Understand that the Virginia foreign corporation withdrawal will protect you from future liabilities linked to the corporation, making it critical to complete this process correctly.

Closing a corporation involves a formal process to ensure all legal and financial obligations are settled. First, the corporation must hold a board meeting to approve the closure. Afterward, you need to file the necessary paperwork with the state, which may include a Virginia foreign corporation withdrawal form, ensuring that all debts and obligations are accounted for.

To register an out-of-state business in Virginia, the corporation must file for a Certificate of Authority with the Virginia State Corporation Commission. This process requires submitting necessary documentation and paying fees. It’s essential to complete this step correctly if you plan to operate in Virginia, particularly if you might consider a Virginia foreign corporation withdrawal in the future.

In the U.S., a foreign corporation refers to a business entity incorporated in one state but doing business in another. This designation is important for understanding jurisdictional regulations and compliance. When dealing with the complexities of Virginia foreign corporation withdrawal, a clear grasp of your corporation's status can greatly influence your next steps.

A foreign corporation in Virginia is a business entity that is incorporated in another state but plans to conduct business in Virginia. These corporations must register with the Virginia State Corporation Commission and may be subject to certain taxes and regulations. If you’re thinking about Virginia foreign corporation withdrawal, it’s crucial to follow the proper procedures to dissolve your operations in the state.

A foreign corporation operates in a state outside of where it was originally incorporated within the United States. An alien corporation, however, is a company that is incorporated in another country and wishes to conduct business in the U.S. Understanding these distinctions can help you make informed decisions regarding your business, especially when considering the Virginia foreign corporation withdrawal.

Virginia recognizes several types of corporations, including domestic corporations, foreign corporations, nonprofit organizations, and professional corporations. Each type has different regulations and tax responsibilities. Understanding these classifications is essential, especially if you plan on navigating the Virginia foreign corporation withdrawal process.