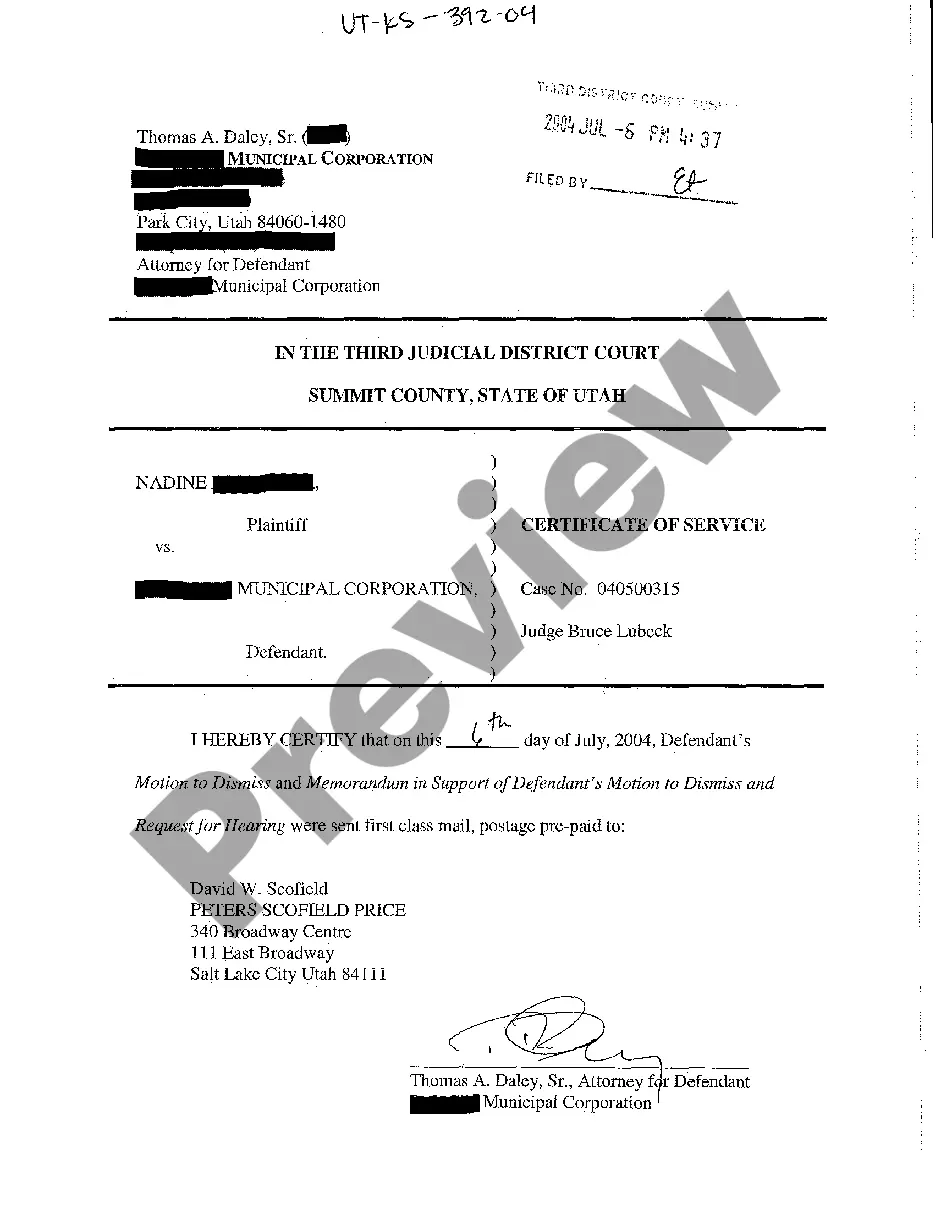

Certificate Of Service Utah Withholding Tax

Description

How to fill out Utah Certificate Of Service?

Drafting legal paperwork from scratch can often be intimidating. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re looking for a a simpler and more affordable way of preparing Certificate Of Service Utah Withholding Tax or any other forms without jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of more than 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-compliant templates carefully put together for you by our legal experts.

Use our website whenever you need a trustworthy and reliable services through which you can easily locate and download the Certificate Of Service Utah Withholding Tax. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and navigate the library. But before jumping straight to downloading Certificate Of Service Utah Withholding Tax, follow these recommendations:

- Review the document preview and descriptions to ensure that you are on the the form you are searching for.

- Make sure the template you choose complies with the regulations and laws of your state and county.

- Choose the right subscription option to buy the Certificate Of Service Utah Withholding Tax.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us now and turn document completion into something easy and streamlined!

Form popularity

FAQ

The Utah State Tax Commission has updated Publication 14, Withholding Tax Guide to reflect a reduction in the income tax withholding rate from 4.85% to 4.65%. The revised withholding rate is effective for wages paid on and after June 1, 2023.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc.

Find Your Utah Tax ID Numbers and Rates You can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms. If you're unsure, contact the agency at (801) 297-2200.

How to File and Pay. You may file your withholding returns online at tap.utah.gov*. You must include your FEIN and withholding account ID number on each return.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return. Keep all these forms with your tax records ? we may ask you to provide the documents at a later time.