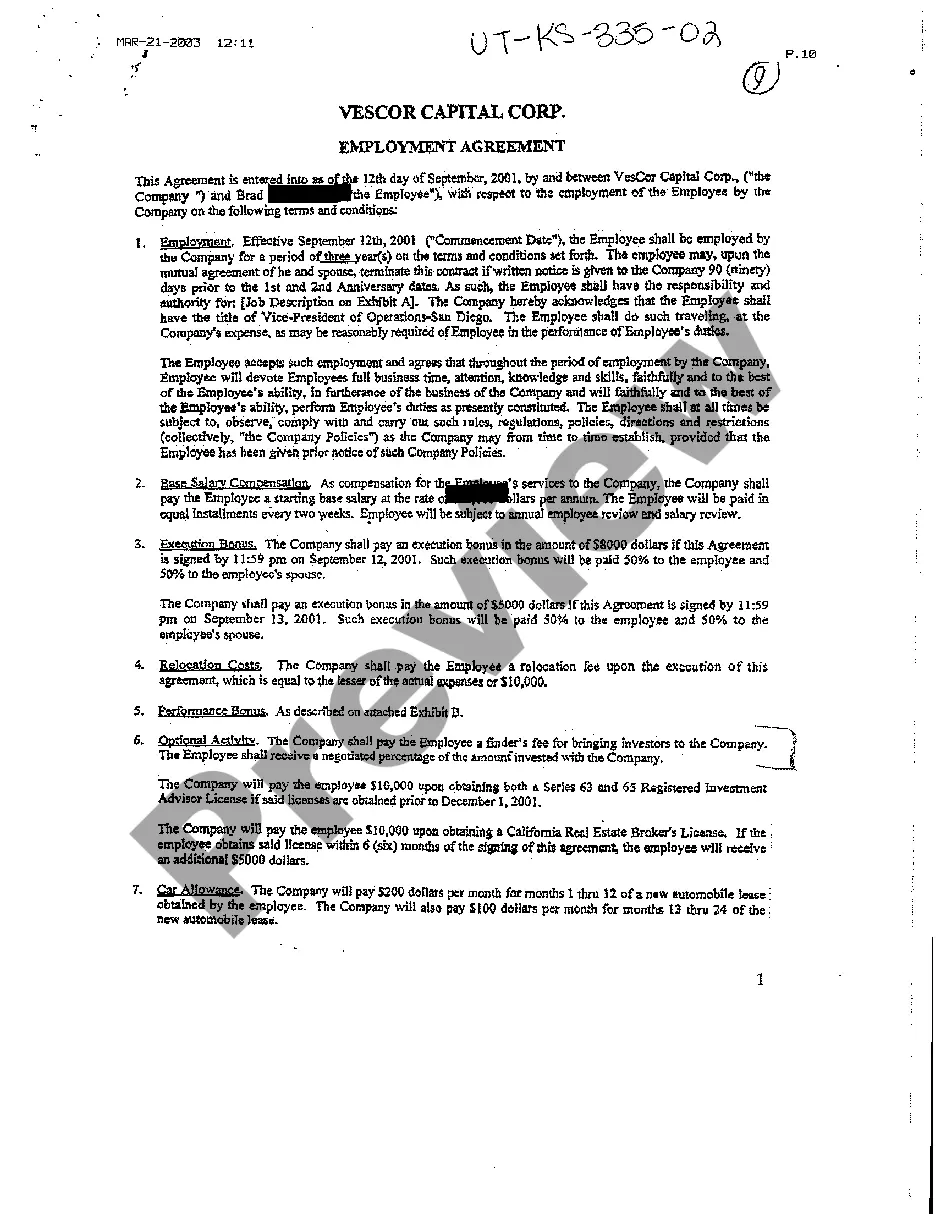

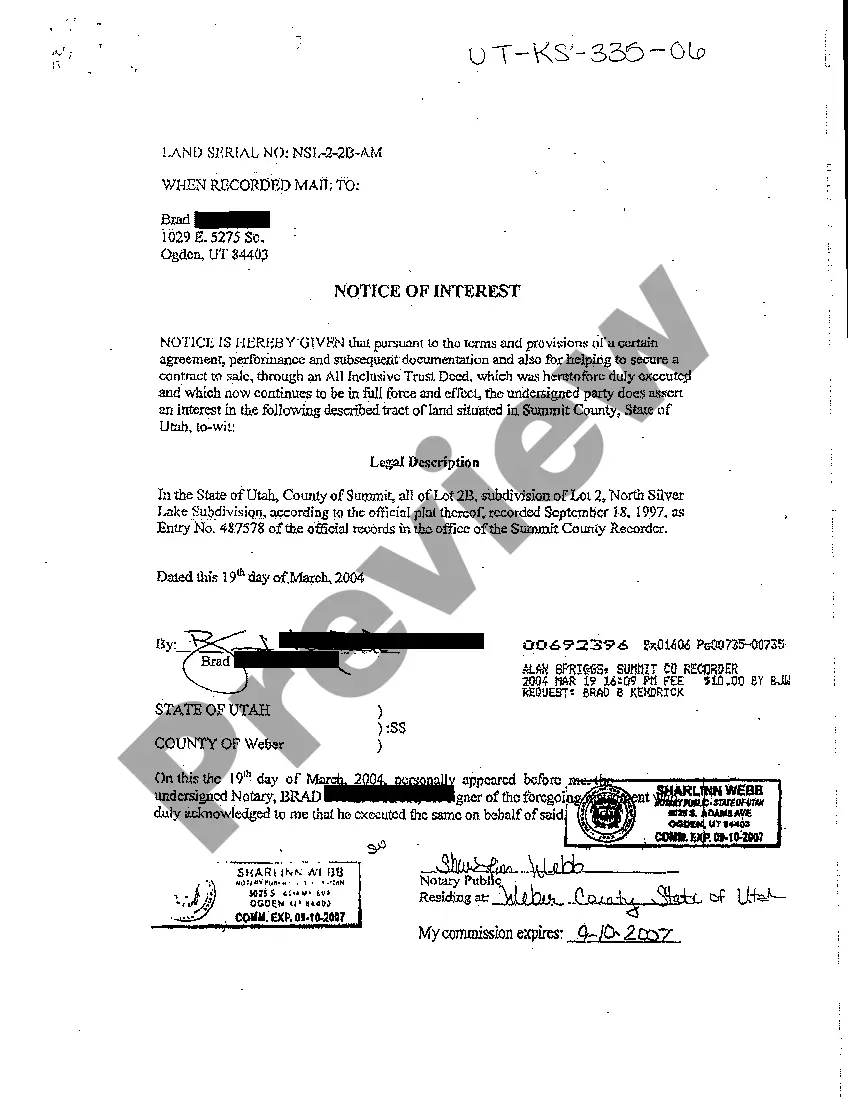

Notice Of Interest Withheld

Description

How to fill out Utah Notice Of Interest In Property By Respondent?

Whether for commercial reasons or for personal matters, everyone must confront legal issues at some point in their life.

Filling out legal paperwork requires meticulous care, beginning with selecting the proper form template.

Once downloaded, you can fill out the form using editing software or print it and fill it out by hand. With extensive US Legal Forms resources available, you won't need to waste time hunting for the right template online. Utilize the library's user-friendly navigation to find the suitable sample for any circumstance.

- Locate the form you require using the search box or catalog navigation.

- Review the description of the form to confirm it aligns with your situation, state, and area.

- Click on the preview of the form to view it.

- If it is the wrong document, return to the search tool to find the Notice Of Interest Withheld template you need.

- Obtain the file if it fulfills your requirements.

- If you own a US Legal Forms account, simply click Log in to access documents you've saved in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing plan.

- Complete the account registration form.

- Choose your payment method: you can use a credit card or PayPal.

- Select the document format you prefer and download the Notice Of Interest Withheld.

Form popularity

FAQ

If you don't want to reveal to your employer that you have a second job, or that you get income from other non-job sources, you have a few options: On line 4(c), you can instruct your employer to withhold an extra amount of tax from your paycheck. Alternatively, don't factor the extra income into your W-4.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Taxable interest is taxed just like ordinary income. Payors must file Form 1099-INT and send a copy to the recipient by January 31 each year. Make sure you understand your Form 1099-INT in order to report the figures properly. Interest income must be documented on B on Form 1040 of the tax return.