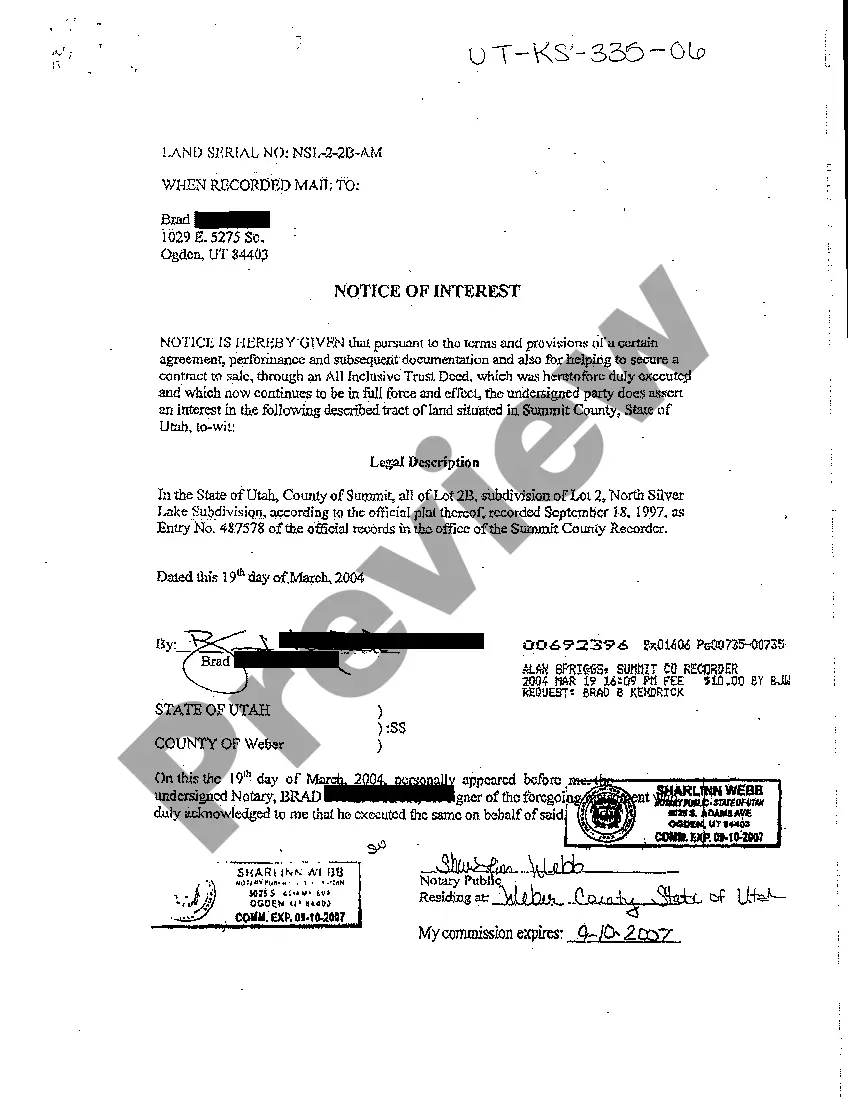

Notice Of Interest Form Utah Withholding

Description

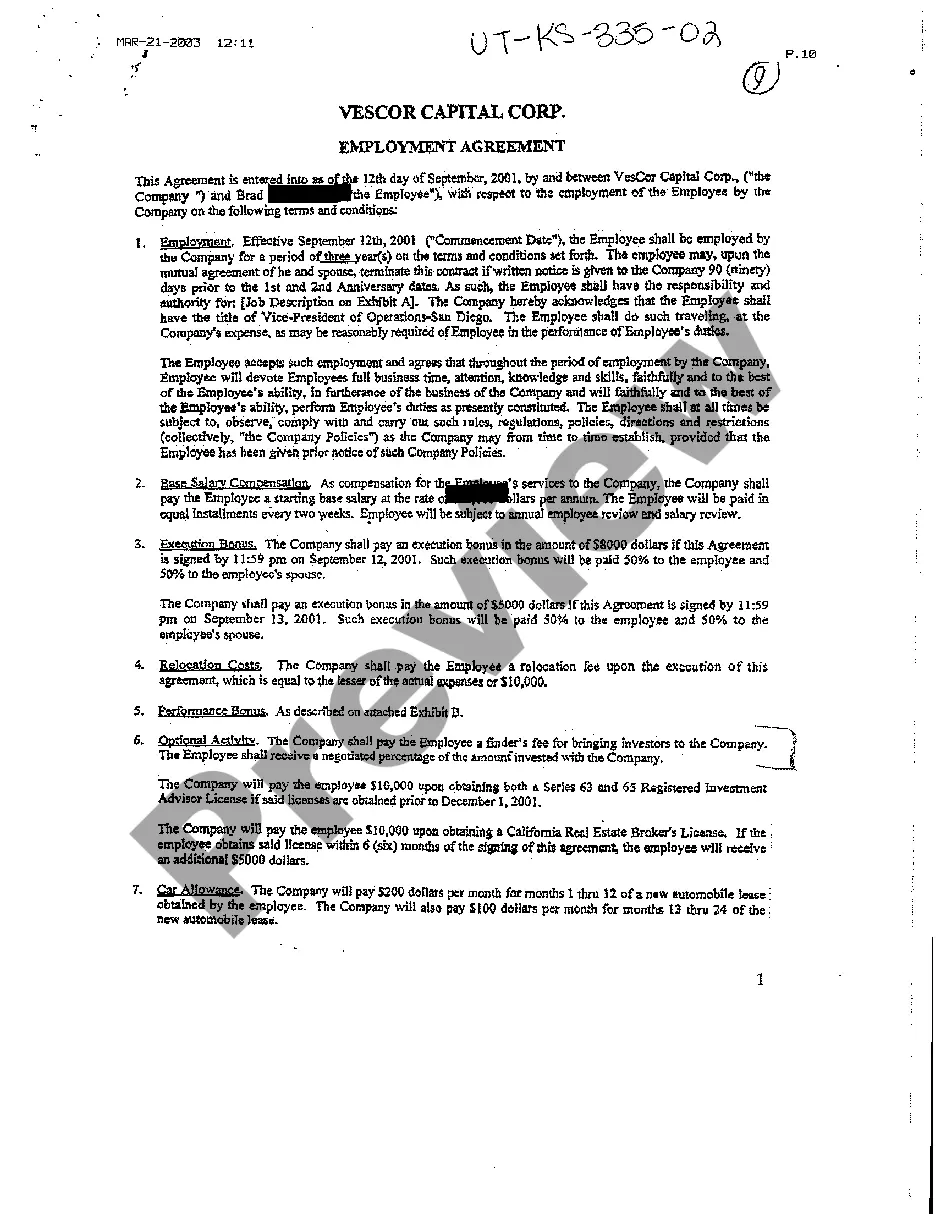

How to fill out Utah Notice Of Interest In Property By Respondent?

When you need to file Notice Of Interest Form Utah Withholding in accordance with your local state's laws, there can be various options to select from.

There's no need to verify each form to ensure it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

Acquiring properly drafted formal documents becomes simple with the US Legal Forms. Additionally, Premium subscribers can also benefit from the powerful integrated solutions for online PDF editing and signing. Give it a try today!

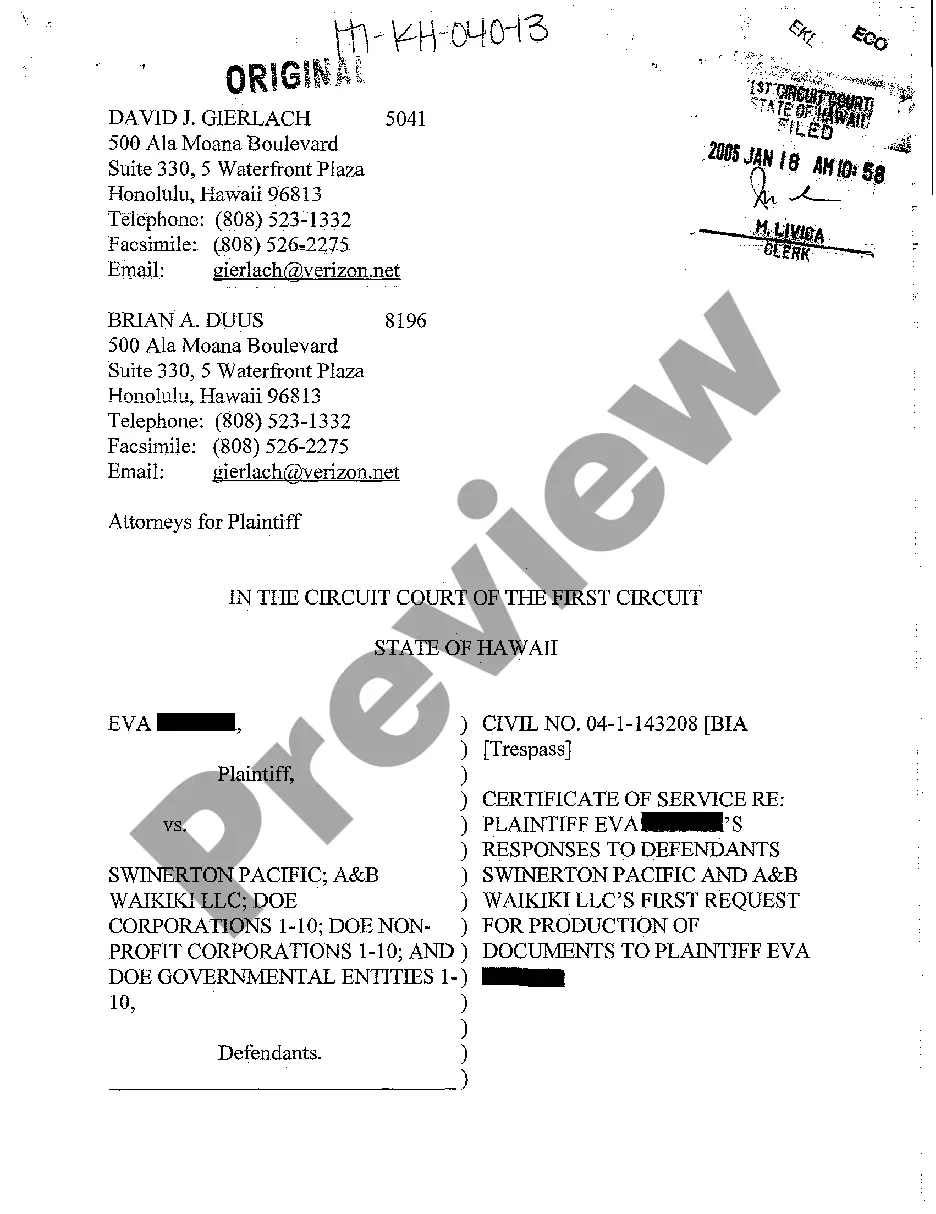

- US Legal Forms is the most extensive online repository with an archive of over 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's laws.

- Thus, when downloading Notice Of Interest Form Utah Withholding from our platform, you can be assured that you possess a valid and current document.

- Retrieving the necessary sample from our site is extremely straightforward.

- If you already have an account, simply Log In to the platform, confirm that your subscription is active, and save the chosen file.

- In the future, you can access the My documents section in your profile and keep access to the Notice Of Interest Form Utah Withholding at any time.

- If it's your first time using our library, please adhere to the instructions listed below.

- Review the suggested page and determine if it meets your needs.

Form popularity

FAQ

A good percentage to withhold for taxes generally ranges between 10% to 20%, depending on your income level and financial situation. However, each individual's needs may vary, so it’s wise to analyze your tax liability and potential refunds. Tools like the Notice of interest form utah withholding can help you determine the right percentage tailored to your circumstances.

Interest withholding refers to the amount of interest that may be deducted from your payments over time. This practice is commonly observed in various financial transactions, including tax withholdings. Understanding interest withholding is beneficial as it can affect your overall tax bill. If you're new to this concept, consult resources like the Notice of interest form utah withholding for guidance.

To fill out your tax withholding form, start by entering your personal details clearly. Next, follow the prompts for determining your allowances, accounting for dependents and additional income. Make sure to sign and date the form before submission. The Notice of interest form utah withholding provides a helpful guide to ensure you navigate this form correctly.

On your tax withholding form, include your basic information such as name, address, and Social Security number. Then, indicate your desired allowances based on your tax situation. It’s critical to provide accurate details to avoid under-withholding or over-withholding. Utilizing the Notice of interest form utah withholding can streamline this process and enhance your tax planning.

The withholding percentage you choose relies on your income, filing status, and personal circumstances. You can use the IRS withholding calculator to gain insight into the appropriate percentage. It's wise to consider your financial goals and obligations. The Notice of interest form utah withholding can assist in determining a suitable amount for your situation.

Filling out a withholding allowance form is straightforward. Start by entering your personal information, including your name and Social Security number. Next, indicate the number of allowances you wish to claim based on your situation. You can refer to the IRS guidelines or use the Notice of interest form utah withholding to optimize your deductions and ensure accuracy.

To elect Pass-Through Entity (PTE) status in Utah, you will need to file the appropriate forms and meet the state requirements. This election allows business entities to pass income directly to owners or shareholders to streamline taxation. Make sure you understand the implications of this election by consulting our resources, including the Notice of interest form Utah withholding, to clarify any uncertainties.

You should mail the Utah TC 65 to the address specified on the form or on the Utah State Tax Commission website. Ensure that you check if any payment is due with your submission, as this could affect the mailing address. If you choose to file electronically, follow the instructions available on the website. Integrating our tools might give you added confidence when dealing with the Notice of interest form Utah withholding.

To file withholding tax in Utah, first, you need to complete the relevant forms, including the Notice of interest form Utah withholding if applicable. You can file your withholding taxes electronically through the Utah Online Tax System or by mailing the forms to the appropriate tax office. Ensure you check the filing deadlines to avoid penalties and keep your tax records organized.

Yes, you need to include a copy of your federal return when you file your Utah state return. This requirement helps Utah tax officials verify your information and ensure compliance. Including this copy can also expedite the processing of your return. For more detailed guidelines, refer to the Notice of interest form Utah withholding to assist you.