Utah Withdrawal Foreign Corporation

Description

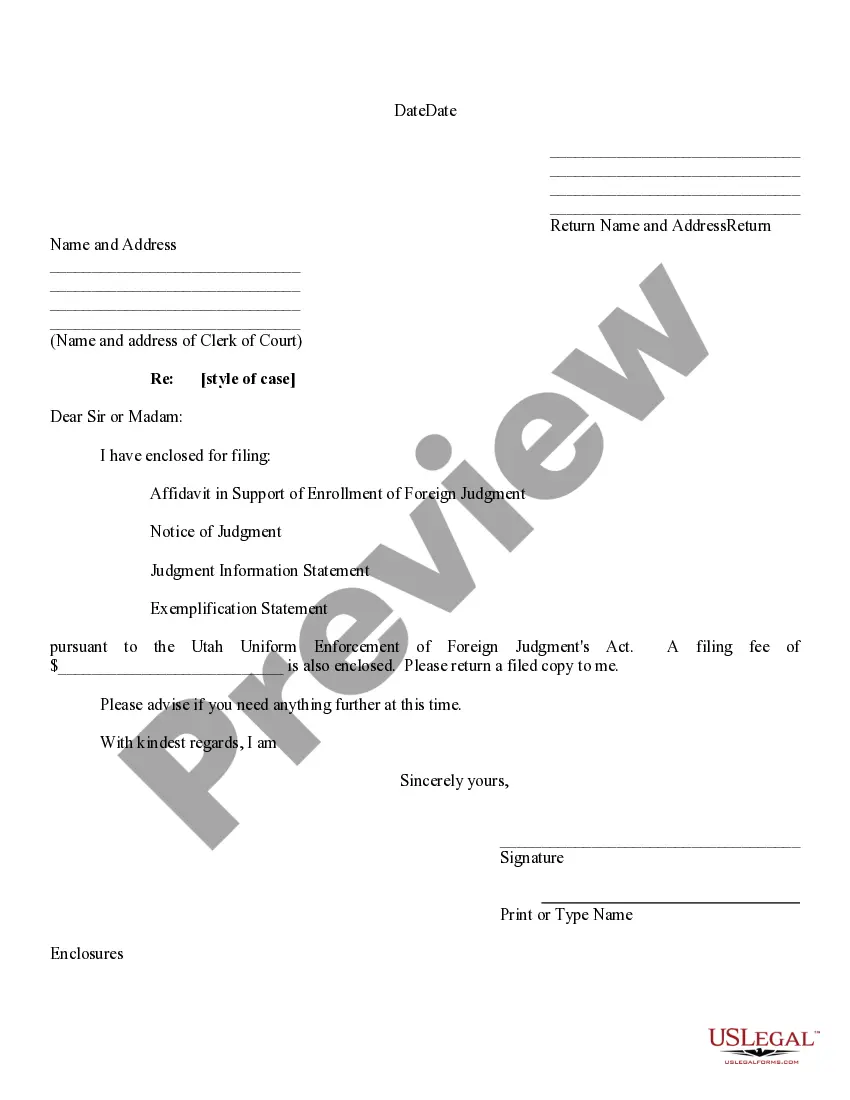

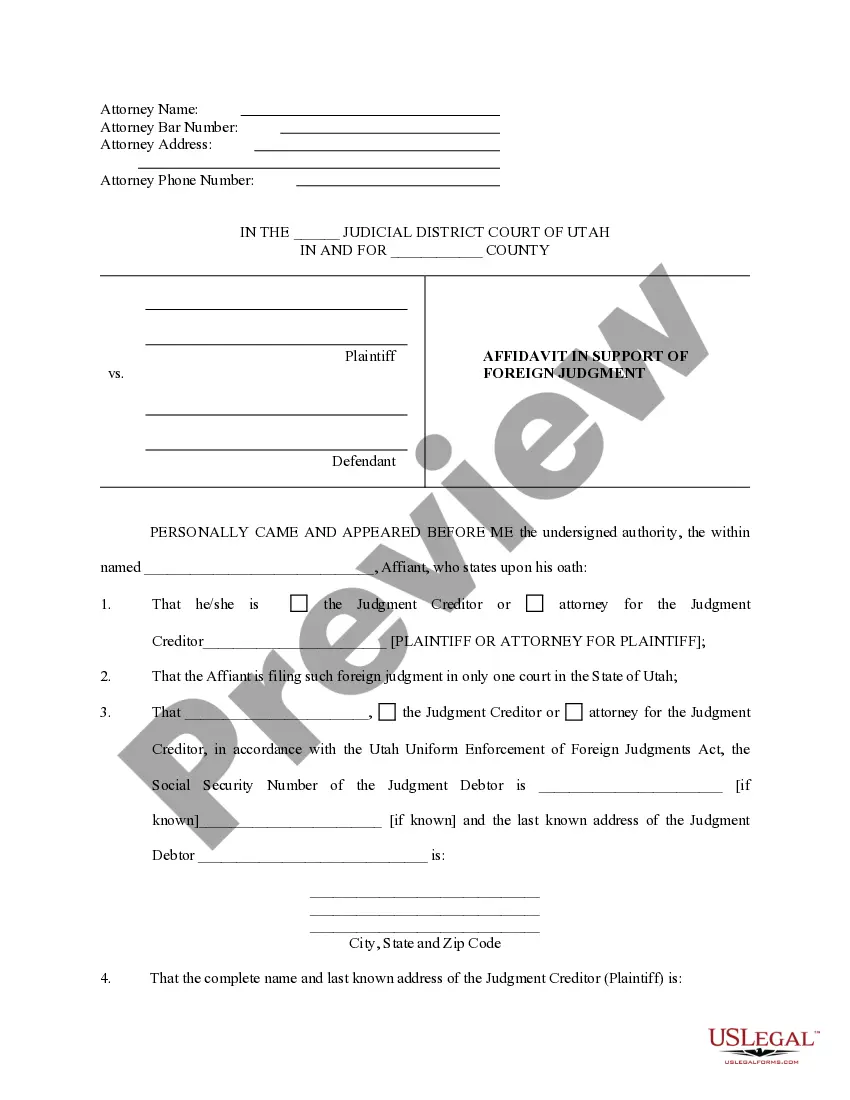

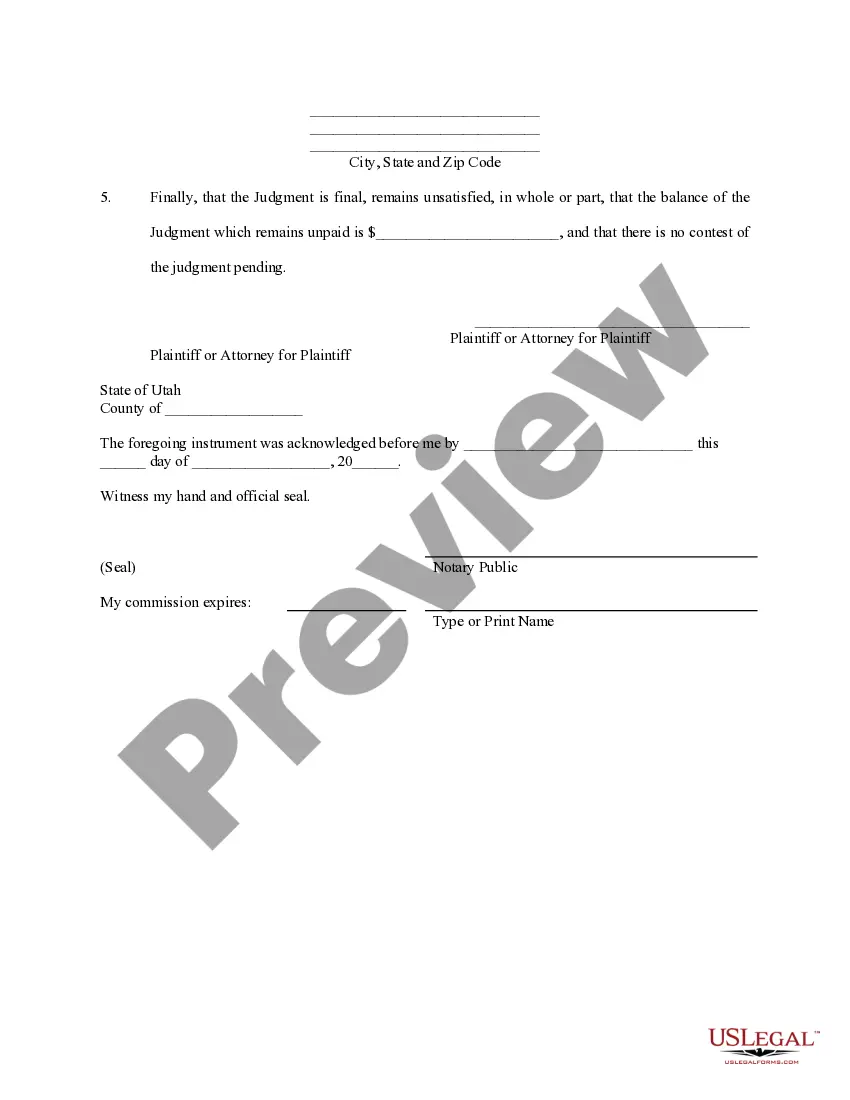

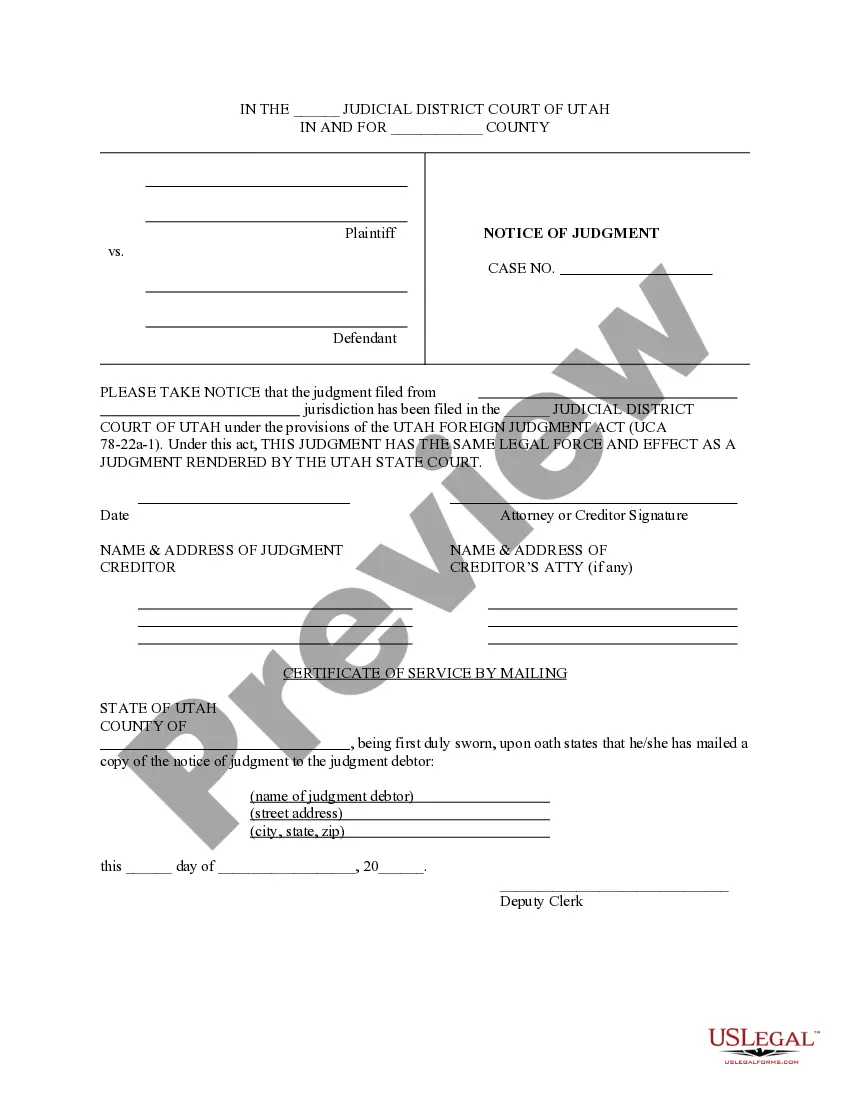

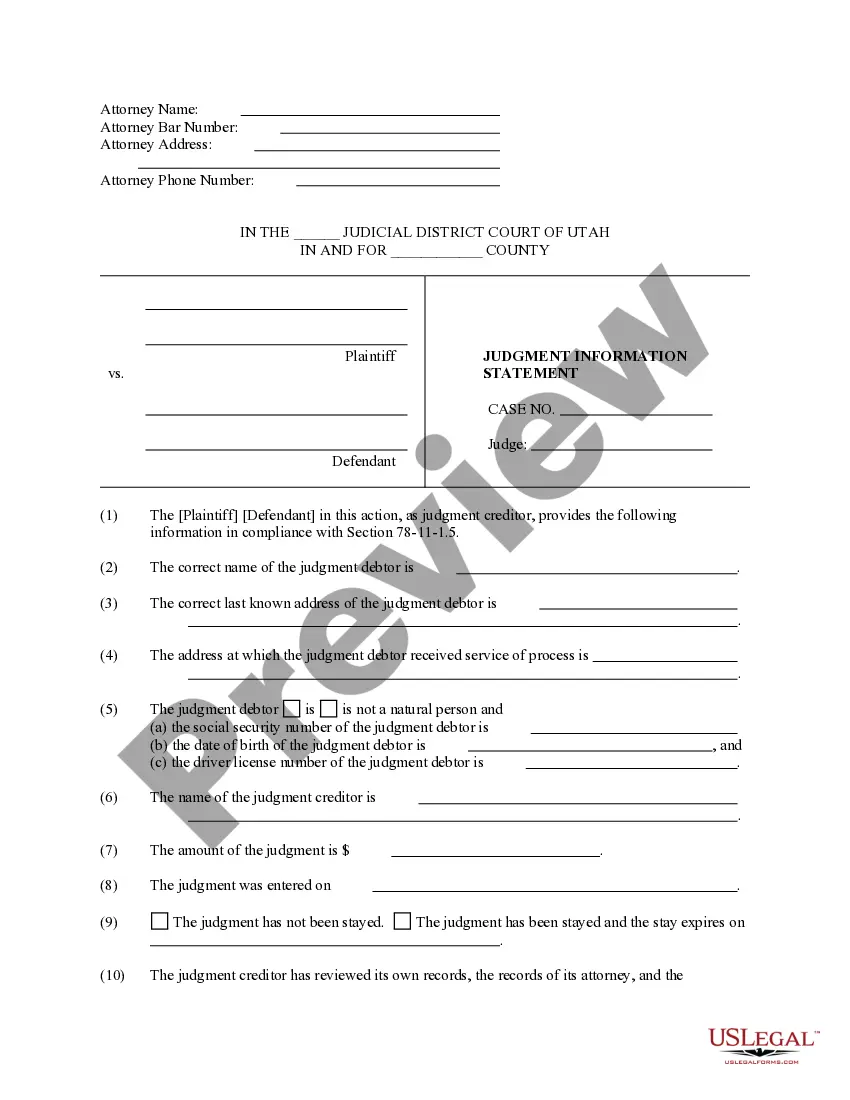

How to fill out Utah Foreign Judgment Enrollment?

Regardless of whether you deal with documents regularly or you occasionally need to submit a legal report, it is essential to find a source of information where all examples are related and current.

The first step you should take with a Utah Withdrawal Foreign Corporation is to ensure it is the most recent version, as this determines whether it can be submitted.

If you want to make your search for the most recent document examples easier, look for them on US Legal Forms.

To acquire a form without an account, follow these steps: Use the search feature to locate the form you need, check the Utah Withdrawal Foreign Corporation preview and description to confirm it is the one you want, double-check the form and click Buy Now, select a subscription plan that suits you, register for an account or Log In to your existing one, enter your credit card information or PayPal account to finalize the purchase, choose the download file format and confirm it. Say goodbye to confusion when managing legal documents. All your templates will be organized and authenticated with a US Legal Forms account.

- US Legal Forms is a database of legal documents that includes almost every sample form you could need.

- Look for the templates you need, verify their relevance immediately, and learn more about their applications.

- With US Legal Forms, you gain access to roughly 85,000 form templates across various fields.

- Find the Utah Withdrawal Foreign Corporation examples in just a few clicks and save them whenever you wish in your account.

- A US Legal Forms account enables you to access all the samples you need with ease and less hassle.

- Simply click Log In in the site header and navigate to the My documents section to have all the documents you need at your fingertips, eliminating the need to spend time searching for the best template or verifying its authenticity.

Form popularity

FAQ

Receiving a letter from the Utah State Tax Commission often means that there is an inquiry regarding your tax status or compliance. If you are operating as a foreign corporation in Utah, this letter may relate to your Utah withdrawal foreign corporation status. It is important to address any inquiries promptly to avoid potential penalties or complications. You can find assistance on how to respond or clarify your status through platforms like US Legal Forms, which provides necessary resources and guidance.

To establish a corporation in Utah, start by choosing a unique name that complies with state regulations. Next, file Articles of Incorporation with the Utah Division of Corporations, ensuring you provide accurate details about your business. Keep in mind that if you are a foreign corporation looking to operate in Utah, you must undergo the Utah withdrawal foreign corporation process. For assistance, consider using US Legal Forms to access the necessary documents and navigate the requirements easily.

Setting up an LLC in Utah generally takes about 1 to 2 weeks if you submit the application online. For mail submissions, it may take longer due to processing times. To expedite the process, ensure all paperwork is accurately completed and filed. Options for faster services are often available if you need your Utah withdrawal foreign corporation established quickly.

Yes, a foreign corporation can do business in the US, but it must comply with state-specific regulations. This usually involves registering in the state where it wishes to operate and obtaining necessary licenses and permits. Understanding these requirements is vital for successfully entering the market. If you are considering a Utah withdrawal foreign corporation, ensure you meet all local guidelines.

To register an out of state business in Utah, you need to file for a Certificate of Authority with the Utah Division of Corporations. This form requires details about your business and its existence in another state. Once approved, you can operate legally in Utah. This process is essential to avoid issues as a Utah withdrawal foreign corporation.

In Utah, LLCs are typically treated as pass-through entities for tax purposes. This means the income of the LLC is reported on the owners' personal tax returns, avoiding double taxation. However, if your LLC opts to be taxed as a corporation, different tax rules may apply. Understanding these options is crucial for your financial planning, especially for a Utah withdrawal foreign corporation.

Closing down an LLC in Utah involves a few clear steps. First, you must file a Certificate of Dissolution with the Utah Secretary of State. Next, notify any creditors, settle debts, and make any necessary distributions to members. Using a platform like uslegalforms can guide you through the process, ensuring you follow the correct procedures for a Utah withdrawal foreign corporation. This support helps you manage compliance and reduces potential pitfalls during dissolution.

To officially close an LLC, you need to start the dissolution process with the state where your business is registered. This typically involves filing the necessary paperwork, which includes a Certificate of Dissolution. Additionally, make sure to settle any outstanding debts, distribute any remaining assets, and notify the IRS and state agencies. If you're considering a Utah withdrawal foreign corporation, understanding the specific requirements for dissolution in Utah can streamline the process.