Affidavit Of Child Support Withholding Calculator

Description

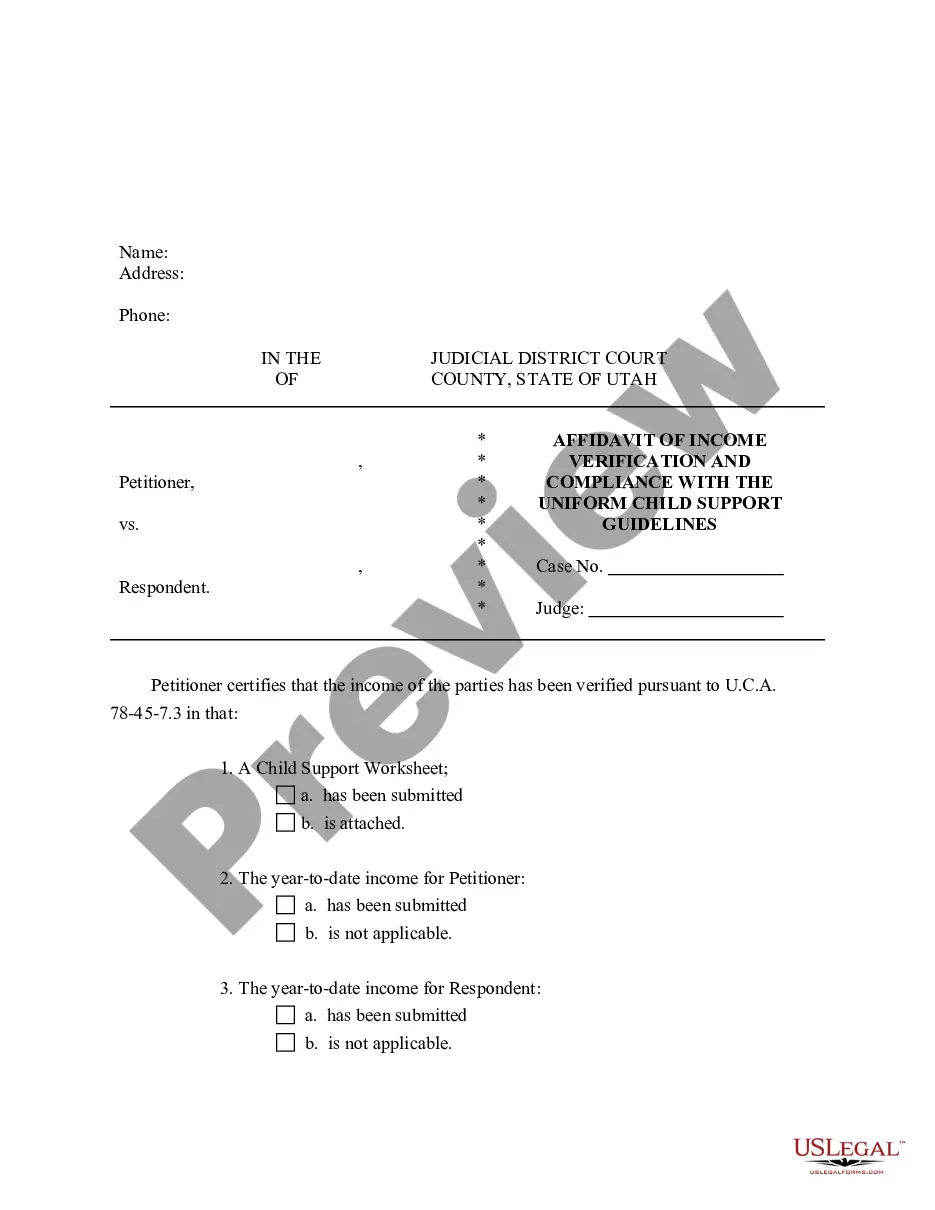

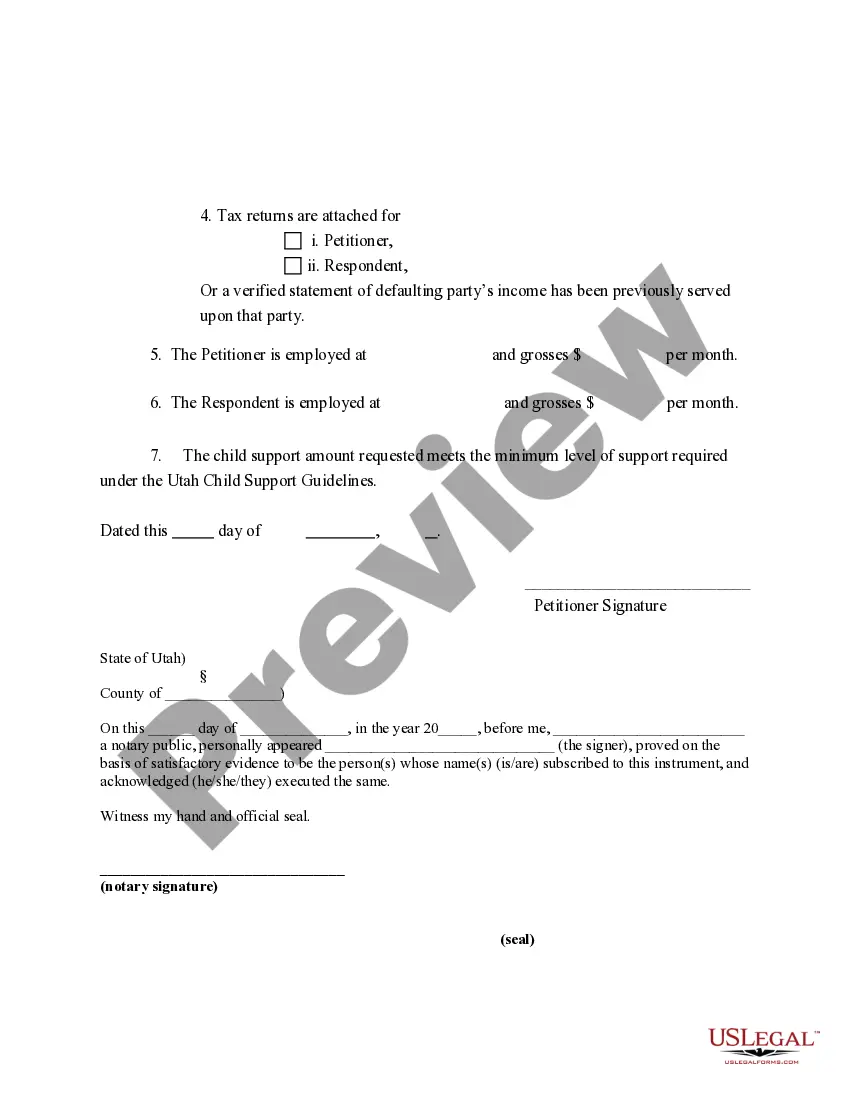

How to fill out Utah Affidavit Of Income Verification And Compliance With Child Support Guidelines?

Traversing the red tape of traditional documents and formats can be challenging, particularly for those who do not engage in it professionally.

Even locating the appropriate format for an Affidavit Of Child Support Withholding Calculator will consume considerable time, as it needs to be accurate down to the last detail.

However, you will spend much less time searching for a suitable template from a reliable source.

Follow these simple steps to obtain the correct form: Enter the document name in the search bar. Locate the right Affidavit Of Child Support Withholding Calculator from the results list. Review the sample outline or open its preview. If the template meets your requirements, click Buy Now. Choose your subscription plan. Register an account at US Legal Forms using your email and creating a password. Choose a credit card or PayPal for payment. Download the template file to your device in your preferred format. US Legal Forms can save you valuable time and effort in determining whether the online form you found is appropriate for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a website that streamlines the task of finding the correct forms online.

- US Legal Forms is a centralized repository for accessing the latest form samples, learning their usage, and downloading these samples for completion.

- It boasts a collection of over 85,000 forms applicable in various sectors.

- While seeking an Affidavit Of Child Support Withholding Calculator, you can trust in its relevance as every form is validated.

- Creating an account with US Legal Forms allows seamless access to all necessary samples.

- You can store them in your history or add them to your My documents collection.

- Access your saved forms from any device by signing in through Log In on the site.

- If you do not yet possess an account, you can always start a new search for the template you require.

Form popularity

FAQ

The South Carolina guidelines establish a basic child support obligation average between $793 to $1628. This range applies to parents of one to six children. For example, a non-custodial parent of three children earns $3,000 a month. The custodial parent of all three children earns $1,500 per month.

How are Child Support Payments Missouri Calculated? Child support is calculated using the Schedule of Basic Child Support Obligations and the parent's gross income. Gross income usually includes wages, salaries, commissions, tips, as well as retirement and pension plans.

The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent.

Typically, parents must pay child support until the child is 18. There are some exceptions, however. Support may continue until the age of 21 if the child is still in school. The support period could be shorter if the child marries, joins the military, or otherwise becomes self-supporting.

Although Missouri has a Schedule of Basic Child Support Obligations, every case is unique. Typically, a judge will follow the schedule. The minimum payment is $50 per month. For each $50 more in combined adjusted gross income, the child support payment increases.